Route1 Reports 2014 First Quarter Financial Results

30 May 2014 - 3:00AM

Marketwired Canada

Route1 Inc. (TSX VENTURE:ROI), a leading provider of secure access technologies

for the mobile workspace that protects businesses and government agencies and

whose customers include the U.S. Department of Defense, the Department of

Homeland Security, the Department of Energy and the Government of Canada, today

announced its financial results for the first quarter ended March 31, 2014.

For Q1 2014, total revenue increased to $1.8 million from $1.1 million in 2013.

Gross profit also increased during the first quarter of 2014 to $1.4 million or

80% of revenue compared to gross profit of $0.9 million or 82% of revenue in Q1

2013.

Total Revenue Mar 31 Mar 31

in 000s of CAD dollars 2014 2013

----------------------------------------

Devices 461 30

Services 1,281 1,027

Other 14 0

----------------------------------------

Total Revenue 1,756 1,057

----------------------------------------

The increase in revenue and gross profit year over year is attributable to the

previously announced sale of 7,000 MobiKEY Fusion devices to a component of the

U.S. Department of Homeland Security, 4,000 of which were delivered in the

quarter and the purchase of the MobiKEY application software service by a second

component of the United States Department of Defense.

Route1's Q1 2014 total comprehensive net income was $0.4 million compared to a

net loss of $0.1 million during the same period of 2013.

Earnings before interest, tax, depreciation, and amortization (Adjusted EBITDA)

during the first quarter of 2014 amounted to $564,000 compared to $9,000 in Q1

2013.

Adjusted EBITDA Mar 31 Dec 31 Sept 30 June 30 Mar 31

in 000s of CAD dollars 2014 2013 2013 2013 2013

---------------------------------------------

Revenue 1,756 1,525 1,485 1,366 1,057

Adjusted EBITDA 564 48 22 (7) 9

Amortization 95 70 69 72 50

Operating profit (loss) before

stock based compensation 469 (22) (47) (79) (41)

---------------------------------------------

During the first quarter of 2014, Route1 used cash flow in operating activities

of $0.4 million. As at March 31, 2014, the Company had no bank debt and a cash

balance of $332,288.

Balance Sheet Extracts Mar 31 Dec 31 Mar 31

in 000s of CAD dollars 2014 2013 2013

------------------------------------

Cash 332 700 1,826

Total current assets 3,057 1,588 2,996

Total current liabilities 2,629 1,715 2,824

Net working capital 428 (127) 172

Total assets 3,778 2,387 3,567

Bank debt 0 0 0

Total liabilities 2,770 1,854 2,971

------------------------------------

Paid, Active Subscribers

As at March 31, 2014, Route1 had 14,240 paying, active subscribers. During Q1

2014 Route1's average revenue per subscriber was $312, an increase of $67 per

subscriber or 27%, from the same period in 2013.

Revenue from Subscribers Mar 31 Dec 31 Sep 30 Jun 30 Mar 31

in 000s of CAD dollars 2014 2013 2013 2013 2013

---------------------------------------------

Closing number of subscribers 14,240 14,602 14,642 14,784 13,989

Average number of subscribers 14,198 14,600 14,697 15,159 13,853

Revenue per subscriber $312 $301 $310 $306 $245

Subscriber Revenue $1,108 $1,100 $1,139 $1,158 $853

---------------------------------------------

The decrease in MobiKEY subscribers, between Q1 2014 and Q4 2013, is primarily

attributable to the loss of its European Government client's remaining users.

The loss of the account was first announced by Route1 on November 20, 2012 and

is due to budget cutbacks.

Business and Market Commentary

-- Route1 renewed its two largest accounts, both with the U.S. government,

between March 15, 2014 and April 30, 2014.

-- Route1 will realize revenue growth in "Revenue from Subscribers" and per

subscriber in Q2 2014 compared to Q1 2014 as a result of a stronger U.S.

dollar exchange rate at the time of renewing U.S. based accounts in late

Q1 and early Q2 2014.

-- Leveraging U.S. government reciprocity rules and the installed

accredited infrastructure, Route1 has a growing number of pilots with

new U.S. DoD prospect clients.

-- Route1 is actively working to have the MobiKEY technology added to the

U.S. Defense Information Systems Agency (DISA) Approved Products List.

-- Continued business development focus on the Canadian Federal Government

and selective commercial enterprise opportunities.

-- The macro digital security environment is changing in a way that should

benefit Route1 as board and corporate executives of potential Enterprise

clients now face increased scrutiny over the loss of client or employee

data and their own intellectual property. We are in the midst of a sea

change with respect corporate accountability, specifically the C-Suite,

as evidenced by:

-- The departure of Target's CEO and CIO over the last 120 days after a

very public data breach affecting over 70 million customers was

announced in Q4 2013;

-- The U.S. District Court of New Jersey's affirmation on April 7, 2014

that the Federal Trade Commission could proceed with its USD $6.5

million lawsuit against Wyndham Worldwide Corp. after the company

experienced a data breach stemming from inadequate security

methodology, setting a precedent for federal litigation against

major organizations that fail to protect sensitive information; and

-- More than 60% of Internet services were affected by the Heartbleed

Bug that drew worldwide attention in April 2014. It is expected that

organizations will search for alternatives to browser-based mobile

access solutions and look to implement easy-to-use multifactor

authentication technologies.

-- Route1 will be releasing MobiKEY 4.4 releasing - audio support - in

early June 2014.

ABOUT ROUTE1, INC.

Route1 enables the mobile workspace without compromising on security. Its

flagship technology MobiKEY uniquely combines secure mobile access, with high

assurance identity validation and plug-and-play usability. Remote and mobile

workers are able to securely and cost effectively access their workspace from

any device without exposing the organization to the risk of data spillage or

malware propagation. MobiKEY customers include Fortune 500 enterprises as well

as the U.S. Department of Defense, the Department of Homeland Security, the

Department of Energy and the Government of Canada. Headquartered in Toronto,

Canada, Route1 is listed on the TSX Venture Exchange.

For more information, visit our website at: www.route1.com.

This news release, required by applicable Canadian laws, does not constitute an

offer to sell or a solicitation of an offer to buy any of the securities in the

United States. The securities have not been and will not be registered under the

United States Securities Act of 1933, as amended (the "U.S. Securities Act") or

any state securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

(C) Route1 Inc., 2014. All rights reserved. Route1, the Route1 and shield design

Logo, SECURING THE DIGITAL WORLD, Mobi, MobiSecure, MobiLINK, Route1 MobiKEY,

Route1 MobiVDI, MobiKEY, MobiKEY IBAD, DEFIMNET, MobiNET, Route1 MobiNET,

TruOFFICE, TruFLASH, TruOFFICE VDI, MobiKEY Fusion, MobiNET Aggregation Gateway,

MobiNET Switching Array, MobiNET Secure Gateway, EnterpriseLIVE, EnterpriseLIVE

Virtualization Orchestrator, MobiNET Agent, MobiKEY Classic and MobiKEY Classic

2, are either registered trademarks or trademarks of Route1 Inc. in the United

States and/or Canada. All other trademarks and trade names are the property of

their respective owners.

The DEFIMNET and MobiNET platforms, and the MobiKEY, MobiKEY Classic, MobiKEY

Classic 2 and MobiKEY Fusion devices are protected by copyright, international

treaties, and various patents, including Route1's U.S. Patents 7,814,216 and

7,739,726, Canadian Patent 2,578,053, and other patents pending. The MobiKEY

Classic 2 is also protected by U.S. Patents 6,748,541 and 6,763,399, and

European Patent 1001329 of Aladdin Knowledge Systems Ltd. and used under

license. Other patents are registered or pending in various countries around the

world.

Other product and company names mentioned herein may be trademarks of their

respective companies.

FOR FURTHER INFORMATION PLEASE CONTACT:

Tony Busseri

CEO

+1 416 814-2635

tony.busseri@route1.com

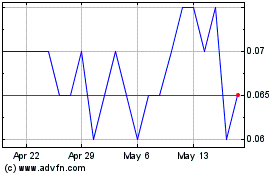

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2024 to May 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From May 2023 to May 2024