Signature Resources Ltd. (TSXV: SGU, OTCQB: SGGTF, FSE 3S3)

("Signature" or the "Company") is pleased to announce that it has

closed on a non-brokered charity flow through private placement for

9,090,909 shares at a price of CAD$0.156 per share for gross

proceeds of approximately CAD$1.42 million (the “Offering”). It is

important to highlight that the pricing for the Offering was

consummated in early February which represented a premium of over

40% to Signature’s share price at that time. Proceeds will be used

for flow through exploration at Lingman Lake Gold Project where

~2,500 metres of drilling has commenced. The shares issued in the

Offering will qualify as “flow-through shares” (within the meaning

of the Income Tax Act (Canada)).

Highlights:

-

Crescat Capital LLP (“Crescat”) is a Denver based hedge

fund that has experience investing in gold exploration

companies.

-

As a result of this investment, Crescat will retain a right

to participate in any future financing on a pro-rata basis of their

ownership in Signature.

-

Signature’s approved and fully funded exploration budget of

~2,500 metres with 13 holes testing multiple sub-vertical parallel

zones has commenced.

-

Drilling is designed with the intent of conducting step out

drill holes and is planned to expand the known mineralization to

the west and down dip using the Company’s 100% owned diamond drill

rig.

“We are very pleased that Crescat Capital has

decided to join Signature Resources on this exciting journey as a

valued shareholder. We look forward to building on this newly

formed relationship as we test both the extent of the historic

resource but also the vast regional district potential that we see

at the Lingman Lake Gold Project. We appreciate the kind and

supportive commentary made by Crescat Capital during their recent

webcast1.”

Robert Vallis, P.Eng.,MBA – President, CEO, and

Director

The use of proceeds will be focused on flow

through eligible exploration efforts at the Lingman Lake Gold

Project in Ontario.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale is unlawful.

These securities have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, or any state

securities laws, and may not be offered or sold in the United

States or to U.S. persons unless registered or exempt

therefrom.

About Signature The Lingman

Lake gold property consists of 1,066 crown claims, four free hold

full patented claims and 14 mineral rights patented claims totaling

1,084 total claims, approximately 20,124 hectares or 202 square

kms. The property hosts an historical estimate of 234,684 oz of

gold* (1,063,904 tonnes grading 6.86 g/t with 2.73 gpt cut-off) and

includes what has historically been referred to as the Lingman Lake

Gold Mine, an underground substructure consisting of a 126.5-meter

shaft, and 3-levels at 46-meters, 84-meters and 122-meters

depths.

*This historical resource estimate is based on

prior data and reports obtained and prepared by previous operators,

and information provided by governmental authorities. A Qualified

Person has not done sufficient work to verify the classification of

the mineral resource estimates in accordance with current CIM

categories. The Company is not treating the historical estimate as

a current NI 43-101 mineral resource estimate. Establishing a

current mineral resource estimate on the Lingman Lake deposit will

require further evaluation, which the Company and its consultants

intend to complete in due course. Additional information regarding

historical resource estimates is available in the technical report

entitled, "Technical Report on the Lingman Lake Gold Property"

dated January 31, 2020, prepared by John M. Siriunas, P.Eng. and

Walter Hanych, P.Geo., available on the Company's SEDAR profile at

www.sedar.com.

To find out more about Signature Resources

Limited, visit our website at www.signatureresources.ca, or

contact:

Jonathan HeldChief Financial Officer

416-270-9566

Cautionary Notes

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This news release contains forward-looking

statements which are not statements of historical fact.

Forward-looking statements include estimates and statements that

describe the Company’s future plans, objectives or goals, including

words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “believes”, “anticipates”, “expects”,

“estimates”, “may”, “could”, “would”, “will”, or “plan”. Since

forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Although these statements are

based on information currently available to the Company, the

Company provides no assurance that actual results will meet

management’s expectations. Risks, uncertainties and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward looking information in this news release

includes, but is not limited to, use of any private placement

proceeds raised, final acceptance of regulatory filings by the

TSX-V, the Company’s objectives, goals or future plans, statements,

exploration results, potential mineralization, the estimation of

mineral resources, exploration and mine development plans, timing

of the commencement of operations and estimates of market

conditions and risks associated with infectious diseases, including

COVID-19. Factors that could cause actual results to differ

materially from such forward-looking information include, but are

not limited to changes in general economic and financial market

conditions, failure to identify mineral resources, failure to

convert estimated mineral resources to reserves, the inability to

complete a feasibility study which recommends a production

decision, the preliminary nature of metallurgical test results,

delays in obtaining or failures to obtain required governmental,

environmental or other project approvals, political risks,

inability to fulfill the duty to accommodate First Nations and

other indigenous peoples, uncertainties relating to the

availability and costs of financing needed in the future, changes

in equity markets, inflation, changes in exchange rates,

fluctuations in commodity prices, delays in the development of

projects, capital and operating costs varying significantly from

estimates and the other risks involved in the mineral exploration

and development industry, and those risks set out in the Company’s

public documents filed on SEDAR. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

_______________________

1 Note that the Lingman Lake Gold Project was historically in

pre-development and never entered commercial production during the

1940’s.

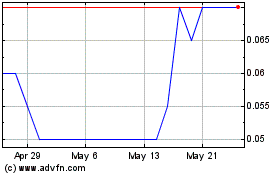

Signature Resources (TSXV:SGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Signature Resources (TSXV:SGU)

Historical Stock Chart

From Dec 2023 to Dec 2024