Commencement of Contract Mining Operations at Oena Diamond Mine

14 June 2022 - 3:03AM

Southstone Minerals Limited (“Southstone” or the

“Company”) (TSX.V – SML) is pleased to announce that Oryx

Mining (Pty) Ltd (“Oryx”) has commenced diamond mining operations

at Oena Diamond Mine (“Oena”), South Africa.

Oena will be operated 23 hours a day, 6 days a

week with total head feed capacity of 200 tonnes per hour to a

desanding screen which feeds to an 18-foot pan plant. Concentrate

produced from the pan plant will be transferred securely to a high

security processing facility where diamonds will be recovered using

BVX technology. Diamonds will be sold monthly at a designated

tender facility (see news release dated 19 April 2022 for detailed

terms).

Oena consists of an 8,800-hectare mining right

located along the Orange River (see Figure 1). Mining operations

will commence at Blokwerf Section with subsequent expansion to the

Sandberg Section. Since November 2018, Southstone has bulk sampled

an estimated 638,690 tonnes from Sandberg recovering 2,681 carats

(cts) (1,155 diamonds) with an average stone size of 2.32 cts and

has bulk sampled an estimated 202,760 tonnes from Blokwerf

recovering 550 cts (307 diamonds) with an average stone size of

1.79 cts.

Importantly, Sandberg mined tonnes to date

comprise only 30% of the total tonnes mined at Oena by Southstone

since 2015, yet Sandberg has produced more than 50% of the diamonds

over 10 ct and valued >USD $5,000 per ct. Table 1 lists some of

the exceptional diamonds that have been recovered from both

Sandberg and Blokwerf Sections over 10 ct and Table 3 provides

images of a select number of diamonds. The average run of mine

diamond sale price to from July 2015 to April 2022 is USD $1,612

per ct (see Table 2).

Figure 1 – Oena Mining

License: https://www.globenewswire.com/NewsRoom/AttachmentNg/e5233607-eb21-4519-be6f-46224be71081

|

Diamond |

See Photo |

Section |

Sales Weight (ct) |

USD per ct |

Total USD |

|

1 |

below |

Sandberg |

44.250 |

$5'492 |

$243'000 |

|

2 |

below |

Sandberg |

37.030 |

$5'103 |

$188'962 |

|

3 |

below |

Sandberg |

35.000 |

$15'286 |

$535'000 |

|

4 |

below |

Sandberg |

32.218 |

$1'809 |

$58'289 |

|

5 |

below |

Sandberg |

26.410 |

$12'680 |

$334'900 |

|

6 |

below |

Sandberg |

26.340 |

$5'884 |

$155'000 |

|

7 |

|

Sandberg |

22.020 |

$7'720 |

$170'000 |

|

8 |

below |

Sandberg |

20.112 |

$4'031 |

$81'084 |

|

9 |

|

Sandberg |

19.420 |

$2'034 |

$39'500 |

|

10 |

|

Sandberg |

18.730 |

$8'270 |

$154'889 |

|

11 |

below |

Blokwerf |

17.550 |

$3'971 |

$69'499 |

|

12 |

|

Sandberg |

16.922 |

$3'137 |

$53'100 |

|

13 |

|

Sandberg |

15.250 |

$5'016 |

$76'499 |

|

14 |

|

Sandberg |

14.800 |

$2'910 |

$42'900 |

|

15 |

|

Sandberg |

13.200 |

$2'121 |

$27'999 |

|

16 |

|

Sandberg |

10.651 |

$5'330 |

$56'780 |

|

17 |

below |

Sandberg |

10.510 |

$8'712 |

$91'560 |

Table 1 – Sandberg and Blokwerf selection of

diamonds recovered over 10 cts

Sandberg represents a target of 4.50 million (M)

to 5.75M cubic meters (approximately 11M tonnes) and Blokwerf

represents a target of 6.25M to 7.25M cubic meters (approximately

18M tonnes) of basal and suspended gravel has been identified for

continued exploration and bulk sampling. (see news release dated 1

December 2014).

|

|

Total ct sold |

Total Number of Diamonds |

Average Diamond Size ct |

Average USD per ct |

Approx. Total Sales(USD) |

|

July 2015 to April 2022 |

7,967 |

3,958 |

2.01 |

1,612 |

$12,850,000 |

Table 2 – Oena Diamond Mine production from July

2015 to April 2022

|

Diamond |

SizeDateValue |

Photo |

|

1 |

44.25 carat - $5,492 per carat ($243,000)Sandberg20 March 2020 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/ebdde413-a42a-4520-a5d0-39553169f62d |

|

2 |

37.03 carat - $5,103 per carat ($188,962)Sandberg24 February

2020 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/361769b1-5a62-4cc6-84b1-48b2bff21ee7 |

|

3 |

35.00 carat - $15,286 per carat ($535,000)Sandberg28 November

2019 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/59c511a8-c19a-4674-b3e8-acd95046f77f |

|

4 and 8 |

Sandberg – parcel of 16 stones32.218 carat - $1,807 per carat

($58,289)20.112 carat - $4,031 per carat ($81,084)4.75 carat 2.2

carat5.15 Carat 2.0 carat4.0

Carat 2.05 carat3.4

carat 1.25 Carat4.0

carat 0.95 carat3.15

carat 1.0 carat2.8

carat 0.75 carat23

November 2020 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/b45d4a5a-8b75-4a36-a469-9f18309f55df |

|

5 |

26.41 carat -$12,680 per carat ($334,900)Sandberg – parcel of 3

stones3.85 carat3.25 carat24 January 2019 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/9322f4ce-7c70-452b-908e-5309ff4c068b |

|

6 |

26.34 carat - $5,884 per carat ($155,000)Sandberg18 September

2020 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/10c82bf0-c63a-4c0b-984b-dbc6007c77b6 |

|

11 |

17.55 carat- $3,971 per carat ($69,499)Blokwerf22 February

2019 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/383f8269-3d95-4604-9aed-4b6a595735a7 |

|

17 |

10.51 carat -$8,712 per carat ($91,560)Sandberg23 January 2021 |

https://www.globenewswire.com/NewsRoom/AttachmentNg/230116f8-3b69-4c19-b2fd-3d91d5495967 |

Table 3 – Oena Diamond Mine diamond photos of

select diamonds from Sandberg and Blokwerf production

The technical disclosure in this news release

has been approved by Terry L. Tucker, P.Geo., Executive Chairman of

the Company and a Qualified Person as defined by National

Instrument 43-101 of the Canadian Securities Administrators.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SOUTHSTONE MINERALS LIMITEDTerry L. Tucker,

P.Geo.Executive Chairman

info@southstoneminerals.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking

StatementCertain information set forth in this news

release contains “forward-looking statements” and “forward-looking

information” under applicable securities laws. Except for

statements of historical fact, certain information contained herein

constitutes forward-looking statements, which include management’s

assessment of future plans and operations and are based on current

internal expectations, estimates, projections, assumptions and

beliefs, which may prove to be incorrect. Some of the

forward-looking statements may be identified by words such as

“forecasts”, estimates”, “expects” “anticipates”, “believes”,

“projects”, “plans”, “outlook”, “capacity” and similar expressions.

These statements are not guarantees of future performance and undue

reliance should not be placed on them.

Such forward-looking statements necessarily

involve known and unknown risks and uncertainties, which may cause

the Company’s actual performance and financial results in future

periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking

statements. These risks and uncertainties include, but are not

limited to statements with respect to the estimation of mineral

resources; the realization of mineral resource estimates;

anticipated future production, capital and operating costs; cash

flows and mine life; potential size of a mineralized zone;

potential expansion of mineralization; potential types of mining

operations; permitting timelines; government regulation of

exploration and mining operations; risks that the presence of

diamond deposits mentioned nearby the Company’s property are not

indicative of the diamond mineralization on the Company’s property,

the supply and demand for, deliveries of and the level and

volatility of prices of rough diamonds, risks that the actual

revenues will be less than projected; risks that the target

production for the existing mining contracts will be less than

projected or expected; risks that production will not commence as

projected due to delay or inability to receive governmental

approval of the Company’s acquisition or the timely completion of

an NI43-101 report; technical problems; inability of management to

secure sales or third party purchase contracts; currency and

interest rate fluctuations; COVID-19; foreign exchange fluctuations

and foreign operations; various events which could disrupt

operations, including labor stoppages and severe weather

conditions; and management’s ability to anticipate and manage the

foregoing factors and risks.

The forward-looking statements and information

contained in this news release are based on certain assumptions

regarding, among other things, future prices for coal and diamonds;

future currency and exchange rates; the Company’s ability to

generate sufficient cash flow from operations and access capital

markets to meet its future obligations; coal consumption levels;

and the Company’s ability to retain qualified staff and equipment

in a cost-efficient manner to meet its demand. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The reader is

cautioned not to place undue reliance on forward-looking

statements. The Company does not undertake to update any of the

forward-looking statements contained in this news release unless

required by law. The statements as to the Company’s capacity to

achieve revenue are no assurance that it will achieve these levels

of revenue.

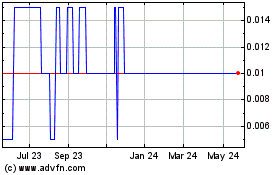

Southstone Minerals (TSXV:SML)

Historical Stock Chart

From Mar 2025 to Apr 2025

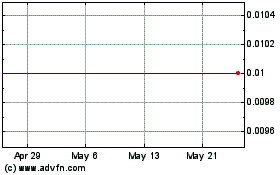

Southstone Minerals (TSXV:SML)

Historical Stock Chart

From Apr 2024 to Apr 2025