Southstone Minerals Limited (“Southstone” or the

“Company””) (TSX.V – SML) announces that it entered into a

share purchase agreement (the “

Agreement”) with

five arm’s length parties, collectively the

“

Sellers”, setting out the terms of an acquisition

(the “

Acquisition”) of the remaining 90% interest

of the issued and outstanding shares of Padstone Pte. Ltd.

(“

Padstone") a private Singaporean company.

Southstone is currently a passive shareholder of Padstone, holding

a minority 10% interest.

Padstone, via a wholly owned subsidiary, has

applied for two alluvial and kimberlite diamond exploration permits

in the Republic of Guinea, collectively the “Soromaya

Project” or the “Permits”. The Soromaya

Project is both an alluvial and kimberlite diamond exploration

project and covers an area of 198.54 square kilometers and located

northwest of the diamond mining town of Banankoro, approximately

574 kilometers east of the capital, Conakry. The Company can

provide no assurance as to when, or if, the Permits, will be

granted.

In consideration for the Acquisition, the

Sellers will be issued, on a pro-rata basis, an aggregate of

15,500,000 common shares of Southstone (the “Consideration

Shares”), with a deemed value of CAD$0.01, and will be

paid a deferred pro-rata cash payment in the amount of USD$100,000,

payable within 24 months from the closing date of the Acquisition.

Southstone has also agreed to reimburse up to a maximum amount of

USD$100,000 in interest-free Padstone shareholder loans, the

proceeds of which were used to fund working capital and general

corporate purposes. Repayment of the loans is due within 18 months

from the closing date of the Acquisition. There is no factual

financial information of Padstone to report at this time.

The Agreement with the Sellers will be executed

on the 10 January 2024 and closing of the Acquisition is subject to

(i) the two Permits being granted for a period of not less than

three years, (ii) a title opinion on the Soromaya Project and

corporate legal opinion for Padstone, and (iii) completion of an

independent National Instrument 43-101 Report (the

“Report”) on the Soromaya Project, as well as any

other conditions that may required by the TSX Venture Exchange.

Only upon granting of the Permits can the Report be completed and

therefore there are a number of significant milestones required to

ultimately close this Acquisition.

The Company has been informed by the Canadian

Investment Regulatory Organization (“CIRO”) and the TSV Venture

Exchange that trading of the Company must be halted and will remain

halted pending receipt and review of acceptable documentation

regarding the Fundamental Acquisition pursuant to Section 5.6(d) of

Exchange Policy 5.3.

Southstone currently holds a minority 10%

interest in Padstone; however, in the event that the Acquisition is

not concluded by 31 March 2024 (the “Long-stop

Date”), this 10% interest returns to Padstone’s treasury.

Accordingly, Southstone deems Padstone to be arm’s length on the

following basis: (i) no officers or directors hold office in the

other company; (ii) the Company is a passive shareholder and has no

control over the direction or management of Padstone; and (iii) the

Company’s minority 10% interest is diminimus, it provides no voting

control over any matter, and is at risk of being returned to

Padstone treasury.

The Company also confirms that the non-brokered

private placement, as announced on 6 November 2023, has been

extended, which private placement consists of up to 10M units at a

price of C$0.05 per unit for gross proceeds up to C$500,000 (the

"Private Placement").

Each unit of the Private Placement shall consist

of one common share in the capital of the Company and one-half of a

share purchase warrant, with each whole warrant entitling the

holder to purchase one additional common share at a price of C$0.10

per share at any time within two years from the date of issuance.

The warrants shall also be subject to an accelerated exercise

clause in the event the Company's share price exceeds C$0.15 for 10

consecutive trading days.

Proceeds from the Private Placement are

anticipated to be used on exploration of the Visirivier and Kabies

Sections of the Oena Mining License which have had little

exploration or mining activity to date as well as for general

working capital purposes.

The Company may pay finders fee's in either

cash, shares, share purchase warrants or a combination thereof, as

permitted by regulators, on a portion or all the Private Placement.

Closing of the Private Placement is expected to occur on or before

31 March 2024 or closing of the Acquisition. All securities issued

under the Private Placement will be subject to a hold period of

four months from the date of issuance.

Upon closing of the Acquisition, the issuance of

the Consideration Shares on a pro-rata basis, along with the

Private Placement will not result in any person who was previously

not an insider, becoming an insider of Southstone.

As consideration for introduction and assistance

with completing the Acquisition, Southstone has agreed to issue a

finder’s fee of 1,500,000 common shares, with a deemed value of

CAD$0.01, to an arm’s length third party, Mr. Scott Griffin. The

issuance of the Consideration Shares and the finders’ fees shares

are both subject to the approval of the TSX Venture Exchange and

will be subject to a customary prescribed hold period.

Upon closing of the Acquisition, Southstone

intends to appoint a new independent director and a new Chief

Financial Officer, each of whom shall be arm's length to Padstone

and its shareholders. No rights have been granted to Padstone or to

its shareholders as it relates to board nominees to the Southstone

board of directors.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SOUTHSTONE MINERALS LIMITEDTerry L. Tucker,

P.Geo.Executive ChairmanFor

additional information, please contact Terry L. Tucker at

info@southstoneminerals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. Capitalized terms used herein that have

not been defined have the same meanings ascribed in the policies of

the TSX.V.

Forward-Looking StatementThis news release of

Company contains statements that constitute “forward-looking

statements.” Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

Southstone’s actual results, performance or achievements, or

developments in the industry to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements.

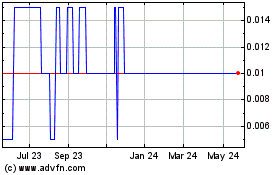

Southstone Minerals (TSXV:SML)

Historical Stock Chart

From Mar 2025 to Apr 2025

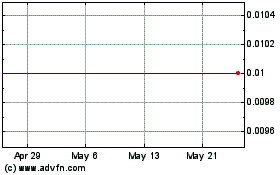

Southstone Minerals (TSXV:SML)

Historical Stock Chart

From Apr 2024 to Apr 2025