08/07/14 - TSX Venture Exchange Daily Bulletins

TSX VENTURE COMPANIES

CONFEDERATION MINERALS LTD. ("CFM")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated May 16,

2008, has been filed with and accepted by TSX Venture Exchange Inc., and

filed with and receipted by the British Columbia and Alberta Securities

Commissions on May 20, 2008, pursuant to the provisions of the applicable

Securities Acts.

The gross proceeds received by the Company for the Offering were $1,000,000

(4,000,000 common shares at $0.25 per share). The Company is classified as

a 'Mining' company.

Commence Date: At the opening July 15, 2008, the Common shares

will commence trading on the TSX Venture Exchange

Inc.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which 13,565,001 common shares are issued and

outstanding

Escrowed Shares: 6,350,001 common shares are subject to a 36 month

staged release escrow

Transfer Agent: Computershare Investor Services

Trading Symbol: CFM

CUSIP Number: 20716C 10 6

Agent: Canaccord Capital Corp.

Agent's Warrants: 320,000 Agent's Warrants. Each Agent's Warrant

entitles the Agent to purchase one common share in

the capital of the Company at a price of $0.25 per

common share for a period of 24 months from the

date of listing of the Company.

For further information, please refer to the Company's Prospectus dated May

16, 2008.

Company Contact: Kenneth R. Holmes

Company Address: Unit C - 12343 104 Avenue

Surrey, BC V3V 3H2

Company Phone Number: 604 535-8640

Company Fax Number: 604 535-8642

TSX-X

---------------------------------------------------------------------------

FREEPORT CAPITAL INC. ("F.H")

(formerly Freeport Capital Inc. ("F.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening on Tuesday, July 15, 2008,

the Company's listing will transfer to NEX, the Company's Tier

Classification will change from Tier 2 to NEX, and the Filing and Service

Office will change from Calgary to NEX.

As of July 15, 2008, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from F.P to F.H. There is no

change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated April 14, 2008, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

FRONTIER PACIFIC MINING CORPORATION ("FRP")

BULLETIN TYPE: Delist-Offer to Purchase

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

Effective at the close of business July 15, 2008, the common shares of

Frontier Pacific Mining Corporation (the "Company") will be delisted from

the TSX Venture Exchange. The delisting of the Company's shares results

from Eldorado Gold Corporation ("Eldorado") purchasing over 93% of the

Company's shares pursuant to a Formal Offer (the "Offer") to acquire all of

the Company's common shares dated May 9, 2008. Company shareholders will

receive $0.0001 in cash, 0.1220 shares of Eldorado and one Exchange Receipt

of Eldorado (the "Exchange Receipt") for every Company share held.

Subject to the terms of an Exchange Receipt indenture dated July 4, 2008,

each Exchange Receipt entitles its holder to receive an additional 0.008

Eldorado common share if, prior to July 1, 2009, a Joint Ministerial

Resolution is issued in Greece by the Joint Ministerial Council accepting

the Environmental Terms of Reference drafted by the Ministry of Environment

in respect of the Company's Perama Hill project.

For further information please refer to Eldorado's information circular,

dated May 9, 2008 and the Company's news release dated July 8, 2008.

TSX-X

---------------------------------------------------------------------------

GOLD WHEATON GOLD CORP. ("GLW")

(formerly Kadywood Capital Corp. ("KDC.H"))

BULLETIN TYPE: Graduation from NEX to TSX Venture, Symbol Change, Reverse

Takeover-Completed, Name Change, Private Placement-Brokered

BULLETIN DATE: July 14, 2008

NEX Company

Graduation from NEX to TSX Venture, Symbol Change:

The Company has met the requirements to be listed as a TSX Venture Tier 1

Company. Therefore, effective at the opening July 15, 2008, the Company's

listing will transfer from NEX to TSX Venture and the Company's Tier

classification will change from NEX to Tier 1 and the Filing and Service

Office will change from NEX to Vancouver.

Effective at the opening July 15, 2008, the trading symbol for the Company

will change from KDC.H to GLW.

Reverse Takeover-Completed:

The TSX Venture Exchange has accepted for filing the Company's Reverse

Takeover ('RTO'), which includes the following transactions:

FNX Acquisition:

Gold Wheaton Gold Corp. (the "Company") has a letter agreement with FNX

Mining Company Inc. ("FNX"), dated June 12, 2008, to acquire the right to

purchase 50% of the contained gold equivalent ounces in ore mined and

shipped from the FNX Operations, being: (i) PM and 700 Deposits at the

McCreedy West Mine; (ii) the Levack Footwall Deposit, Rob's Zone and 1900

Zone at the Levack Mine; and (iii) the 2000 and North Deposits at the

Podolsky Mine. Aggregate consideration payable by the Company to FNX is:

- $175 million cash;

- 350 million shares; and

- A vendor take back note of $50 million, payable six months from closing.

Redcorp Transaction:

The Company has a letter of intent dated June 12, 2008 with Redcorp

Ventures Ltd., to acquire 100% of the gold production from Redcorp's

Tulsequah Chief Project for the life of the mine in consideration of:

- US$90 million cash on completion of construction and commissioning of the

Tulsequah Chief Mine.

The Company is classified as a 'junior natural resource - mining' company.

Escrowed: 361,138,000 common shares

Escrow Term: 18 months

Company Contact: Gordon Keep

Company Address: Suite 3123 - 595 Burrard Street

Vancouver, BC V7X 1J1

Company Phone Number: 604 609-6110

Company Fax Number: 604 609-6145

Company Email Address: mcoghill@endeavourfinancial.com

Name Change:

Pursuant to a resolution passed by Directors July 7, 2008, the Company has

changed its name as follows. There is no consolidation of capital.

Effective at the opening July 15, 2008, the common shares of Gold Wheaton

Gold Corp. will commence trading on TSX Venture Exchange, and the common

shares of Kadywood Capital Corp. will be delisted.

Capitalization: Unlimited common shares with no par value of

which 928,356,668 common shares are issued and

outstanding

Unlimited preferred shares with no par value of

which

Nil preferred shares are issued and outstanding

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: GLW (new)

CUSIP Number: 38075N 10 9 (new)

Private Placement-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced June 12, 2008 and June 19, 2008:

Number of Shares: 520,000,000 shares

Purchase Price: $0.50 per share

Warrants: 260,000,000 share purchase warrants to purchase

260,000,000 shares

Warrant Exercise Price: $1.00 for a five year period

Number of Placees: 821 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Terry MacGibbon Y 2,000,000

Jeff Durno Y 40,000

Fiore Financial Corp. (Frank Giustra) Y 6,000,000

Julie Rennie Y 91,000

Radcliffe Foundation (Frank Giustra) Y 6,000,000

Trisec Securities Inc. (Francesco Acquilini) Y 5,000,000

David A. Cohen Y 2,000,000

GBK Investments Inc. (Gordon B. Keep) Y 100,000

Gordon B. Keep Y 253,380

The Kinder Dream Foundation (Gordon B. Keep) Y 100,000

Fernwood Foundation (Ian Telfer) Y 1,262,000

Ian Telfer Y 2,000,000

Agents' Fees: $3,445,000 payable to Paradigm Capital Inc.

$3,445,000 payable to Canaccord Capital

Corporation

$3,445,000 payable to GMP Securities L.P.

$1,950,000 payable to BMO Nesbitt Burns Inc.

$650,000 payable to Brant Securities Limited

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

ISACSOFT INC. ("ISF")

BULLETIN TYPE: Delist

BULLETIN DATE: July 14, 2008

TSX Venture Tier 1 Company

Further to the news release dated July 10, 2008, the common shares of

ISACSOFT Inc. will be delisted from TSX Venture Exchange effective at the

close of business on July 14, 2008. The delisting of the Company's shares

results from the completion of a going-private transaction, as described in

the Company's Management Proxy Circular dated May 27, 2008.

ISACSOFT INC. (" ISF ")

TYPE DE BULLETIN : Retrait de la cote

DATE DU BULLETIN : Le 14 juillet 2008

Societe du groupe 1 de TSX croissance

Suite au communique de presse emis le 10 juillet 2008, les actions

ordinaires de ISACSOFT Inc. seront retirees de la cote de Bourse de

croissance TSX a la fermeture des affaires le 14 juillet 2008. Le retrait

de la cote des actions de la societe survient suite a une transaction de

privatisation, telle que divulguee dans la circulaire de sollicitation de

procurations par la direction datee du 27 mai 2008.

TSX-X

---------------------------------------------------------------------------

MONT BLANC RESOURCES INC. ("MTN")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated June 10, 2008, the Exchange

has been advised that the Cease Trade Order issued by the British Columbia

Securities Commission on June 10, 2008 has been revoked.

Effective at the opening on Tuesday, July 15, 2008, trading will be

reinstated in the securities of the Company.

TSX-X

---------------------------------------------------------------------------

OTIS CAPITAL CORP. ("OOO")

(formerly Otis capital Corp. ("OOO.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol,

Private Placement-Non-Brokered

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Information Circular dated July 8, 2008. As a

result, at the opening on July 15, 2008, the Company will no longer be

considered a Capital Pool Company. The Qualifying Transaction includes the

following:

Blue Hill Property Acquisition:

The Exchange has accepted an agreement in principal, dated April 15, 2008,

among the Company, Mr. Mitchell L. Bernardi (a resident of Spokane,

Washington, USA), Dr. John R. Carden (a resident of Liberty Lake,

Washington, USA) and Winboom Enterprises Limited (beneficially owned by Mr.

Jayang Jhaveri) (a resident of Hong Kong, PRC) (collectively, the

"Vendors"). Pursuant to the Agreement, the Company will acquire the option

to acquire an undivided 100% interest in the Blue Hill Creek Property,

located in Cassia County, Idaho.

Aggregate Compensation payable by the Company to the Vendors is:

- US$40,000 cash to Mitchell L. Bernardi and John R. Carden (collectively

"B&C"); (paid)

- US$40,000 to B&C on Exchange acceptance to B&C;

- 1,500,000 shares on Exchange acceptance, for a 10% interest;

- 750,000 Shares to the Vendors 6-months from the execution of the Blue

Hill Agreement ("Execution") for a 20% interest;

- US$50,000 to B&C and 750,000 Shares to the Vendors, one year from

Execution for a 30% interest;

- 750,000 Shares to the Vendors 18 months from Execution, for a 40%

interest;

- US$60,000 to B&C and 750,000 Shares to the Vendors, two years from

Execution for a 50% interest;

- 750,000 Shares to the Vendors 30 months from Execution for a 60%

interest;

- US$70,000 to B&C and 750,000 Shares three years from Execution for a 70%

interest;

- US $80,000 to B&C four years from Execution for an 85% interest; and

- US $100,000 to B&C five years from Execution for a 100% interest.

Kilgore property Acquisition:

The Exchange has accepted an agreement in principle dated June 4th, 2008

between the Company and Bayswater Uranium Corporation ("Bayswater").

Pursuant to the Agreement, the Company can earn up to a 75% joint venture

interest in the Kilgore Gold Project, Clark County, Idaho, and two

additional gold properties, Hai and Gold Bug located in Lemhi Counties,

Idaho (the "Properties).

Aggregate consideration payable by the Company to Bayswater to earn an

initial 50% interest in the property is:

- US$200,000 in cash over two years;

- 2,500,000 common shares over five years; and

- US$3M exploration expenditures over 5 years.

Aggregate consideration payable by the Company to Bayswater to increase its

interest in the property to 75% is:

- 1,000,000 common shares; and

- Completion of an independent pre-feasibility study.

Capitalization: unlimited shares with no par value of which

11,079,000 shares are issued and outstanding

Escrow: 3,155,500 shares

Symbol: OOO same symbol as CPC but with .P removed

The Company is classified as a "junior natural resource - mining" company.

Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced:

Number of Shares: 3,765,000 shares

Purchase Price: $0.50 per share

Warrants: 3,765,000 share purchase warrants to purchase

3,765,000 shares

Warrant Exercise Price: $0.70 for a one year period

$0.90 in the second year

Number of Placees: 82 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Ken King P 100,000

Robert Sali P 200,000

Finder's Fee: $33,775 payable to Mihalis Belantis

$7,000 payable to Sherman Dahl

$41,650 payable to Doug Bachman

$7,000 payable to J. Kevin Arius

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

SEA DRAGON ENERGY INC. ("SDX")

BULLETIN TYPE: New Listing-IPO-Shares, Halt

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated July 3,

2008, has been filed with and accepted by TSX Venture Exchange (the

"Exchange"), and filed with and receipted by the Alberta Securities

Commission, the Ontario Securities Commission and the British Columbia

Securities Commission (through the Multilateral Instrument 11-102 Passport

System) on July 8, 2008, pursuant to the provisions of the Alberta, British

Columbia, and Ontario Securities Acts.

The gross proceeds received by the Company for the Offering were

$35,000,000.40 (58,333,334 common shares at $0.60). The Company is

classified as an "oil and gas exploration" company.

Commence Date: At the opening Tuesday, July 15, 2008, the common shares

will commence trading on TSX Venture Exchange. Trading in the common shares

will be immediately halted upon commencement of trading pending

confirmation of the closing of the IPO.

The closing of the public offering is expected to occur before the market

opens on Tuesday, July 15, 2008. Upon receipt of closing confirmation, a

further bulletin will be issued to resume trading in the Company's shares.

Corporate Jurisdiction: Canada

Capitalization: Unlimited common shares with no par value of which

123,080,834 shares are issued and outstanding

Escrowed Shares: 12,710,998 shares

Transfer Agent: Equity Transfer and Trust Company

Trading Symbol: SDX

CUSIP Number: 811375 10 4

Agents: Salman Partners Inc.

Thomas Weisel Partners Canada Inc.

Fraser Mackenzie Limited

Agents' Over-allotment option: The Company granted an Over-Allotment option

entitling the Agents to sell an additional 15% of the IPO common shares

(7,500,000 to 10,000,000 common shares) at a price of $0.60 per common

share which option will expire 30 days from closing of the offering.

Agents' Commission: 6% of the gross proceeds raised pursuant to the

offering.

Agents' Options 3,500,000 non-transferable share purchase options.

One option to purchase one share at $0.60 per share for a period of 18

months from closing of the offering.

For further information, please refer to the Company's Prospectus dated

July 3, 2008.

Company Contact: David M Thompson, President and CEO

Company Address: 700, 205 - 5th Avenue SW

Calgary, Alberta

T2P 2V7

Company Phone Number: (403) 705 3403

Company Fax Number: (403) 264 1262

TSX-X

---------------------------------------------------------------------------

SPORTSCENE GROUP INC. ("SPS.A")

BULLETIN TYPE: Declaration of Dividend

BULLETIN DATE: July 14, 2008

TSX Venture Tier 1 Company

The Issuer has declared the following dividend:

Dividend per Class A Share: $0.30

Payable Date: August 14, 2008

Record Date: July 24, 2008

Ex-Dividend Date: July 22, 2008

TSX-X

---------------------------------------------------------------------------

TRANSGLOBE INTERNET AND TELECOM CO., LTD. ("TTI")

BULLETIN TYPE: Sustaining Fees - Halt

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

Effective at the opening, July 14, 2008, trading in the shares of the

Company were halted for failure to pay their 2008 TSX Venture annual

sustaining fee.

TSX-X

---------------------------------------------------------------------------

VENDOME CAPITAL CORP. ("VCC.H")

(formerly Vendome Capital Corp. ("VCC.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening on Tuesday, July 15, 2008,

the Company's listing will transfer to NEX, the Company's Tier

Classification will change from Tier 2 to NEX, and the Filing and Service

Office will change from Toronto to NEX.

As of July 15, 2008, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from VCC.P to VCC.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated April 1, 2008, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

WESTMINSTER RESOURCES LTD. ("WMR")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: July 14, 2008

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated June 24,

2008, has been filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the B.C and Alberta Securities Commissions on June

27, 2008, pursuant to the provisions of the B.C and Alberta Securities

Acts.

The gross proceeds received by the Company for the Offering were $2,000,000

(8,000,000 common shares at $0.25 per share). The Company is classified as

a 'Mineral Exploration' company.

Commence Date: At the opening July 15, 2008, the Common shares

will commence trading on TSX Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which

22,607,000 common shares are issued and

outstanding

Escrowed Shares: 9,070,000 common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: WMR

CUSIP Number: 960755 10 6

Agent: Canaccord Capital Corp.

Agent's Warrants: 800,000 non-transferable share purchase warrants.

One warrant to purchase one share at $0.25 per

share up to July 15, 2010.

For further information, please refer to the Company's Prospectus dated

June 24, 2008.

Company Contact: Glen Indra

Company Address: 488-625 Howe Street

Vancouver, B.C., V6C 2T6

Company Phone Number: 604-608-0400

Company Fax Number: 604-608-0344

TSX-X

---------------------------------------------------------------------------

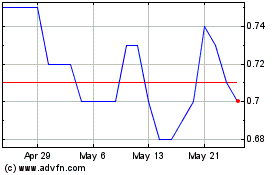

Thiogenesis Therapeutics (TSXV:TTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Thiogenesis Therapeutics (TSXV:TTI)

Historical Stock Chart

From Feb 2024 to Feb 2025