TSX VENTURE COMPANIES:

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 5, 2010

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the Alberta Securities Commission on

May 5, 2010, against the following Companies for failing to file the

documents indicated within the required time period:

---------------------------------------------------------------------------

Period

Ending

Symbol Company Failure to File (Y/M/D)

---------------------------------------------------------------------------

("GPL") General Mining annual audited financial statements 09/12/31

Properties Ltd. annual management's discussion & analysis 09/12/31

certification of annual filings 09/12/31

---------------------------------------------------------------------------

("WCE") Western Canada annual audited financial statements 09/12/31

Energy Ltd. annual management's discussion & analysis 09/12/31

certification of annual filings 09/12/31

---------------------------------------------------------------------------

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements. Members

are prohibited from trading in the securities of the company during the

period of the suspension or until further notice.

TSX-X

----------------------------------------------------------------------------

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 5, 2010

TSX Venture Tier 2 Company

A Cease Trade Order has been issued by the Alberta Securities Commission on

May 5, 2010, against the following Company for failing to file the documents

indicated within the required time period:

----------------------------------------------------------------------------

Period

Ending

Symbol Company Failure to File (Y/M/D)

----------------------------------------------------------------------------

("ZGG") Z-Gold annual audited financial statements 09/12/31

Exploration Inc. annual management's discussion & analysis 09/12/31

certification of annual filings 09/12/31

----------------------------------------------------------------------------

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements. Members

are prohibited from trading in the securities of the company during the

period of the suspension or until further notice.

TSX-X

----------------------------------------------------------------------------

ARIUS3D CORP. ("LZR")

BULLETIN TYPE: Private Placement-Brokered, Convertible Debenture/s

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced March 3, 2010:

Convertible Debenture $350,000

Conversion Price: Convertible into shares at a price of $0.18 per

share until December 31, 2014

Maturity date: December 31, 2014

Warrants: 1,944,600 warrants, each warrant is exercisable

into a common share at the price of $0.18 until

December 31, 2014

Interest rate: 8% per annum

Number of Placees: 11 placees

Agent's Fee: $24,500 and 136,122 broker warrants payable to BMO Nesbitt

Burns Inc. Each broker warrant is exercisable into one common share at a

price of $0.18 per share until December 31, 2014.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the warrants,

if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

AURA SILVER RESOURCES INC. ("AUU")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced March 22, 2010:

Number of Shares: 4,275,000 shares

Purchase Price: $0.20 per share

Warrants: 4,275,000 share purchase warrants to purchase

4,275,000 shares

Warrant Exercise Price: $0.25 for a two year period

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

James M. Franklin Y 100,000

Agent's Fee: An aggregate of $68,400 and 427,500 agent

compensation options payable to Union Securities

Ltd., Jennings Capital Inc., Dundee Securities

Corp., Raymond James Ltd., and BMO Nesbitt Burns

Inc. Each agent compensation option is exercisable

into one common share and one common share

purchase warrant at a price of $0.20 per option

for a two year period.

Each warrant is exercisable into one common share

at a price of $0.25 per share for a two year

period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the warrants,

if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

BOXXER GOLD CORP. ("BXX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced January 27, February 9, February

23, and April 19, 2010:

Number of Shares: 11,000,000 Units

(Each Unit consists of one common share and

one-half of one share purchase warrant.)

Purchase Price: $0.10 per Unit

Warrants: 5,500,000 share purchase warrants to purchase

5,500,000 shares

Warrant Exercise Price: $0.12 for a six-month period

$0.15 for the subsequent six-month period

Number of Placees: 49 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

David Yancie Y 650,000

Elmer Stewart Y 270,000

William Kilbourne Y 200,000

Brian Harder Y 133,000

Colin Christensen Y 100,000

Alan Woodroffe P 200,000

Simon Schillaci P 160,000

Finder's Fee: $35,040 and 363,000 Finder's Warrants payable to

Union Securities Ltd.

$6,000 and 75,000 Finder's Warrants payable to

William McCarty

Each Finder's Warrant is exercisable for one Unit

at a price of $0.10 for a period of 12 months from

the closing date.

TSX-X

----------------------------------------------------------------------------

COGITORE RESOURCES INC. ("WOO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced April 8, 2010:

Number of Shares: 2,000,000 flow-through shares

Purchase Price: $0.35 per share

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

C. David A. Comba Y 20,000

Tony Brisson Y 28,580

Jonathan Goodman Y 142,900

Stephen Lidsky Y 19,640

Gerald Riverin Y 57,140

David Goodman Y/P 428,884

Daniel Goodman Y 28,571

Finder's Fee: An aggregate of $26,760 in cash payable to RPL

Capital Ltd., GFI Investment Counsel Ltd., CIBC

World Markets Inc. and Raymond James Ltd.

For further details, please refer to the Company's news release dated April

30, 2010.

TSX-X

----------------------------------------------------------------------------

CORAL GOLD RESOURCES LTD. ("CLH")

BULLETIN TYPE: Private Placement-Brokered, Amendment

BULLETIN DATE: May 6, 2010

TSX Venture Tier 1 Company

Further to the bulletin dated April 16, 2010, TSX Venture Exchange has been

advised of the following amendment to the Brokered Private Placement

announced March 23, 2010 and April 5, 2010:

Agents' Fees: $214,060 cash and 389,200 warrants payable to

Canaccord nFinancial Ltd.

$2,376 cash payable to Paul Hickey

$2,343 cash and 4,260 warrants payable to Leede

Financial Markets Inc.

$11,000 cash payable to David Snow

$6,082 cash and 11,058 warrants payable to Jim

MacDonald

$5,999.99 cash and 10,909 warrants payable to Nick

Barham

There are NO Agents' Fees for:

- Haywood Securities Inc. of $2,376 cash and 4,320 warrants; or

- Carson Seabolt of $3,300 cash and 6,000 warrants.

TSX-X

----------------------------------------------------------------------------

CROWN POINT VENTURES LTD. ("CWV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced April 26, 2010:

First Tranche:

Number of Shares: 4,289,334 shares

Purchase Price: $0.75 per share

Warrants: 2,144,667 Series A share purchase warrants to

purchase 2,144,667 shares and 2,144,667 Series B

share purchase warrants exercisable at $1.50 per

share for three years from the closing date

Warrant Exercise Price: $1.00 for a two year period for Series A warrants

Number of Placees: 49 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Theresa Sheehan P 150,000

John T. Eymann P 250,000

Eymann Investments Corp.

(John T. Eymann) P 200,000

William Ellis P 75,000

Samantha Sharpe P 33,000

Finders' Fees: $74,250 cash and (i)132,000 Finder's Options

payable to PI Financial Corp.

(ii)112,620 units payable to Cormel Capital Sarl

(Blaise Yerly)

$25,305.03 cash and -41,987 Finder's Options

payable to Dundee Securities Corp.

(i)Finder's Options are exercisable at $0.75 per

unit and units are under the same terms as those

to be issued pursuant to the private placement.

(ii) Finder's Fee Units are under the same terms

as those to be issued pursuant to the private

placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

----------------------------------------------------------------------------

DECADE RESOURCES LTD. ("DEC")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Further to the bulletin dated May 3, 2010, TSX Venture Exchange has been

advised of the following amendment to the Non-Brokered Private Placement

announced March 24, April 1 and April 7, 2010:

Finders' Fees: $17,500 cash payable to Limited Market Dealer Inc.

$21,000 cash payable to Secutor Capital Management

Corporation

$38,045 cash payable to 0857796 B.C. Ltd. (Norman

Schemedding)

$23,940 cash payable to Kyle Stevenson

$6,300 cash payable to Raymond James Ltd.

$8,575 cash payable to Woodstone Capital Inc.

$7,175 cash payable to Canaccord Financial Ltd.

$26,250 cash payable to Otis Brandon Munday

$7,700 cash payable to Northern Securities Inc.

$5,250 cash payable to RBC Dominion Securities

$1,750 cash payable to Leede Financial Markets Inc

TSX-X

----------------------------------------------------------------------------

DIA BRAS EXPLORATION INC. ("DIB.RT")

BULLETIN TYPE: Rights Expiry-Delist

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Effective at the opening, May 10, 2010, the Rights of the Company will trade

for cash. The Rights expire May 13, 2010 and will therefore be delisted at

the close of business May 13, 2010.

TRADE DATES

May 10, 2010 - TO SETTLE - May 11, 2010

May 11, 2010 - TO SETTLE - May 12, 2010

May 12, 2010 - TO SETTLE - May 13, 2010

May 13, 2010 - TO SETTLE - May 13, 2010

The above is in compliance with Trading Rule C.2.18 - Expiry Date:

Trading in the rights shall be for cash for the three trading days preceding

the expiry date and also on expiry date. On the expiry date, trading shall

cease at 12 o'clock noon E.T. and no transactions shall take place

thereafter except with permission of the Exchange.

TSX-X

----------------------------------------------------------------------------

FIELDEX EXPLORATION INC. ("FLX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

an Acquisition Agreement dated March 19, 2010, whereby the Company has an

option to acquire a 100% interest Michikamats Property located in the

province of Newfoundland and Labrador, which consists of 635 mining claims.

Pursuant to the Agreement, the Company is required to issue a total of

4,000,000 shares to the Vendors and make a cash payment of $160,000 during

the first year of the agreement.

The Vendors will retain a 2.0% Net Smelter Return, half of which (1%) may be

repurchased for the sum of $1,000,000.

For more information, please refer to the Company's press release dated

April 6, 2010.

EXPLORATION FIELDEX INC. ("FLX")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 6 mai 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention d'acquisition datee du 19 mars 2010, selon laquelle la societe a

l'option d'acquerir un interet de 100 % dans la propriete de Michikamats,

laquelle etant composee de 635 claims miniers situes dans la province de

Terre-Neuve-et-Labrador.

En vertu de l'entente, la societe doit payer emettre un total de 4 000 000

d'actions aux vendeurs et effectuer un paiement en especes de 160 000 $

durant la premiere annee de l'entente.

Les vendeurs conserveront une royaute ("NSR") de 2 %, duquel la moitie (1

%) est rachetable en contrepartie d'un paiement de 1 000 000 $.

Pour plus d'information, veuillez vous referer au communique de presse de la

societe date du 6 avril 2010.

TSX-X

----------------------------------------------------------------------------

_

FISSION ENERGY CORP. ("FIS")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced March 9 and March 29, 2010:

Number of Shares: 8,384,000 non-flow-through shares

2,635,000 flow-through shares

Purchase Price: $0.80 per non-flow-through share

$0.95 per flow-through share

Warrants: 4,192,000 share purchase warrants to purchase

4,192,000 shares

Warrant Exercise Price: $1.00 for a two year period

Number of Placees: 84 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Tara Cannon P 15,000

Justin Ginetz P 15,000

Kerry Staunton P 15,000

Olav Langelaar P 15,000

James Nagy P 40,000

Richard Cohen P 25,000

Robert Klassen P 40,000

Agents' Fees: $58,297.32 cash and (i)69,314 warrants payable to

Cormark Securities Inc.

$242,905.50 cash and (i)288,810 warrants payable

to Dundee Securities Corporation

$38,864.88 cash and (i)46,210 warrants payable to

Fort House Inc.

$72,871.65 cash and (i)86,643 warrants payable to

Raymond James Ltd.

$72,871.65 cash and (i)86,643 warrants payable to

Salman Partners Inc.

(i)Warrants are exercisable at $1.00 per share for

two years

Finders' Fees: $58,176 cash and (i)72,720 warrants payable to

(i)Global Resource Investments Ltd.

$7,680 cash and (i)9,600 warrants payable to

National Bank Financial Inc.

(i)Warrants are exercisable at $1.00 per share for

two years

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

FOCCINI INTERNATIONAL INC. ("FOI")

BULLETIN TYPE: Delist

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Effective at the close of business Thursday, May 6, 2010, the common shares

will be delisted from TSX Venture Exchange at the request of the Company.

The Company is expected to commence trading on CNSX on or about Friday May

7, 2010.

TSX-X

----------------------------------------------------------------------------

GOLD SUMMIT CORPORATION ("GSM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced February 10, 2010 and April 8, 2010:

Number of Shares: 1,688,700 non flow-through shares

150,000 flow-through shares

Purchase Price: $0.125 per non flow-through share

$0.14 per flow-through share

Warrants: 1,838,700 share purchase warrants to purchase

1,838,700 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ralph W. Kettell Y 600,000

Anthony P. Taylor Y 280,000

Agent's Fee: $23,209 and 183,870 broker warrants payable to

Nottingham Consulting Ltd. Each broker warrant is

exercisable into one common share at a price of

$0.125 per common share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the warrants,

if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

HAWK URANIUM INC. ("HUI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

purchase and assumption agreement (the "Agreement") dated April 28, 2010,

between Hawk Uranium Inc. (the "Company") and Canadian Orebodies Inc. - a

TSX Venture-listed company (the "Vendor"). Pursuant to the Agreement, the

Company shall acquire a 100% interest in the Vendor's eight 100% owned

properties and all of the Vendor's interest in seven 50% joint venture

properties with MacDonald Mines Exploration Ltd. and Temex Resources Corp.

(collectively, the "Properties"). The Properties consist of approximately

444 100%-owned claim units comprising approximately 7,104 hectares, and

approximately 891 50%-owned claim units comprising approximately 14,256

hectares, all which are located in the James Bay Lowlands "Ring of Fire", in

Ontario. The 100%-owned properties would remain subject to a 10% net profits

interest in favour of Orebodies, and the 50%-owned properties remain subject

to a 5% net profits interest.

As consideration, the Company will issue the Vendor an aggregate of

5,000,000 shares and 4,000,000 share purchase warrants. Each warrant is

exercisable into one common share at a price of $0.15 per share for a four

year period. The Vendor shall also have the right to appoint one individual

to the Company's board of directors.

In connection with this transaction, the Company will issue an aggregate of

450,000 finder's shares to Sarmat Resources Inc. and Badger Resources Inc.

For further information, please refer to the Company's press releases dated

April 13, 2010 and April 29, 2010.

TSX-X

----------------------------------------------------------------------------

MERCARI AQUISITION CORP. ("MV.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Reference is made to our bulletin dated May 5, 2010, with respect to the

listing of the Company's common shares.

We have received confirmation that the closing has occurred. Therefore, the

common shares of the Company which were listed at the close of business

yesterday, May 5, 2010, commenced trading at the opening of business on

Thursday, May 6, 2010.

The Company has completed its public offering of securities prior to the

opening of market on May 6, 2010. The gross proceeds received by the Company

for the Offering were $250,000 (2,500,000 common shares at $0.10 per share).

TSX-X

----------------------------------------------------------------------------

NIBLACK MINERAL DEVELOPMENT INC. ("NIB")

BULLETIN TYPE: Warrant Price Amendment

BULLETIN DATE: May 6, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has consented to the reduction in the exercise price of

the following warrants:

Private Placement:

# of Warrants: 3,933,700

Expiry Date of Warrants: December 11, 2014

Forced Exercise Provision:If the closing price for the Company's shares is

greater than $0.5625 for a period of 10

consecutive trading days (the 'Premium Trading

Days'), then the warrant holders will have 30 days

to exercise their warrants. The reduced exercise

period will commence 7 calendar days after the

tenth Premium Trading Day.

Original Exercise

Price of Warrants: $0.65

New Exercise Price

of Warrants: $0.45

These warrants were issued pursuant to a private placement of 4,597,000

Units, each Unit consisting of one common share and one share purchase

warrant, which was accepted for filing by the Exchange effective December 9,

2009.

TSX-X

----------------------------------------------------------------------------

NORAVENA CAPITAL CORPORATION ("NRV.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated March 29, 2010 has been

filed with and accepted by TSX Venture Exchange and the Ontario, British

Columbia and Alberta Securities Commissions effective March 31, 2010,

pursuant to the provisions of the respective Securities Acts. The Common

Shares of the Company will be listed on TSX Venture Exchange on the

effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$300,000 (1,500,000 common shares at $0.20 per share).

Commence Date: At the opening Friday, May 7, 2010, the Common

shares will commence trading on TSX Venture

Exchange.

Corporate Jurisdiction: Canada

Capitalization: Unlimited common shares with no par value of which

6,500,010 common shares are issued and outstanding

Escrowed Shares: 5,000,010 common shares

Transfer Agent: Olympia Transfer Services Inc.

Trading Symbol: NRV.P

CUSIP Number: 655455 10 3

Agent: Union Securities Limited

Agent's Options: 150,000 non-transferable stock options. One option

to purchase one share at $0.20 per share for up to

24 months.

For further information, please refer to the Company's Prospectus dated

March 29, 2010.

Company Contact: James P. Boyle, President

Company Address: 25 Adelaide Street East,

Suite 1900

Toronto, Ontario, M5C 3A1

Company Phone Number: (416) 867-8800 x201

Company Fax Number: (416) 867-8833

TSX-X

----------------------------------------------------------------------------

PETROGLOBE INC. ("PGB")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated May 5, 2010, effective at

6:45 a.m. PST, May 6, 2010 trading in the shares of the Company will remain

halted pending the dissemination of a comprehensive news release and

satisfaction of all applicable requirements of the TSX Venture Exchange.

TSX-X

----------------------------------------------------------------------------

REC MINERALS CORP. ("REC")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

Letter Agreement (the "Agreement"), dated April 29, 2010, between REC

Minerals Corp. (the "Company"), and an arm's-length party (the "Vendor"),

whereby the Company may acquire a 100% undivided interest in two (2) mineral

claims (the "Property"), located in northwestern British Columbia.

Under the terms of the Agreement, the Company can earn a 100% interest in

the Property by making aggregate cash payments of CDN$70,000, issuing

775,000 common shares and incurring CDN$500,000 in exploration expenditures

over a three (3) year period.

For further details, please refer to the Company's news release dated May 4,

2010.

TSX-X

----------------------------------------------------------------------------

SANDSTORM RESOURCES LTD. ("SSL")

BULLETIN TYPE: Plan of Arrangement, Declaration of Dividend

BULLETIN DATE: May 6, 2010

TSX Venture Tier 1 Company

Plan of Arrangement:

TSX Venture Exchange has approved the Company's proposed Plan of Arrangement

under section 289 of the Business Corporations Act (British Columbia). The

Plan of Arrangement was approved by a special resolution passed by the

Company's shareholders at a meeting held on April 30, 2010. The Exchange has

been advised that the Plan of Arrangement and transactions involved

therewith will close and be given effect at 12:01AM (PDT) on May 13, 2010.

The Plan of Arrangement, which is fully described in the Company's

Information Circular, dated March 26, 2010, effectively involves a

restructuring of the Company's business and assets in order to separate its

precious metals business from its base metal and energy interests.

Shareholders will continue to hold their Sandstorm Resources Ltd. shares and

will receive one Sandstorm Metals & Energy Ltd. share for every 35 Sandstorm

Resources Ltd. shares held at 12:01AM (PDT) on May 13, 2010.

A separate Bulletin will be issued for the listing of Sandstorm Metals &

Energy Ltd. to commence at the opening on May 13, 2010.

Declaration of Dividend:

The Plan of Arrangement results in the following entitlement:

Entitlement per Share: 1/35th of one common share of Sandstorm Metals &

Energy Ltd.

Payable Date: May 17, 2010

Record Date: May 12, 2010

Ex-Plan of

Arrangement Date: May 10, 2010

TSX-X

----------------------------------------------------------------------------

SILVER FIELDS RESOURCES INC. ("SF")

BULLETIN TYPE: Consolidation

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders April 23, 2010, the

Company has consolidated its capital on a 10 old for 1 new basis and has

subsequently increased its authorized capital. The name of the Company has

not been changed.

Effective at the opening May 7, 2010, the shares of Silver Fields Resources

Inc. will commence trading on TSX Venture Exchange on a consolidated basis.

The Company is classified as a 'Mineral Exploration/Development' company.

Post - Consolidation

Capitalization: unlimited shares with no par value of which

10,840,149 shares are issued and outstanding

Escrow nil shares are subject to escrow

Transfer Agent: CIBC Mellon Trust Company

Trading Symbol: SF (UNCHANGED)

CUSIP Number: 82771N 20 3 (new)

TSX-X

----------------------------------------------------------------------------

SKYLINE GOLD CORPORATION ("SK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced April 12, 2010 and April 27, 2010:

Number of Shares: 4,993,334 shares

Purchase Price: $0.12 per share

Warrants: 4,993,334 share purchase warrants to purchase

2,496,667 shares

Warrant Exercise Price: $0.15 for a one year period

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Manas Dichow Y 500,000

Finders' Fees: $18,354 payable to CIBC Wood Gundy

$1,680 payable to Ian Gordon

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. (Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

TAMERLANE VENTURES INC. ("TAM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced March 8, 2010:

Number of Shares: 542,553 flow-through shares

Purchase Price: $0.30 per flow-through share

Warrants: 271,276 share purchase warrants to purchase

271,276 shares

Warrant Exercise Price: $0.45 for an eighteen month period

Number of Placees: 3 placees

Agent's fee: $9,765.95 and 43,403 Agent's options payable to

Kingsdale Capital Markets Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

----------------------------------------------------------------------------

UNITED URANIUM CORP. ("UUC")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver to

Calgary.

TSX-X

----------------------------------------------------------------------------

VESTA CAPITAL CORP. ("VES")

(formerly: Vesta Capital Corp. ("VES.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Private

Placement-Brokered, Reinstated for Trading

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

Trading in the common shares of the Company has been halted since September

22, 2009, pending completion of its Qualifying Transaction.

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated March 30, 2010. As a

result, at the opening Friday, May 7, 2010, the Company will no longer be

considered a Capital Pool Company and the trading in the shares of the

Company will be reinstated. The Qualifying Transaction includes the

following:

The Company has completed its previously announced acquisition of United

Hydrocarbon Corporation ("UHC") and its 65% membership interest in Excelaron

LLC on April 23, 2010. The transaction was completed by way of an

amalgamation of UHC with 2240853 Ontario Inc., a wholly-owned subsidiary of

the Company. The Company has issued an aggregate of 113,999,722 common

shares to existing shareholders of UHC and purchasers under the private

placement described below.

Private placement- Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement completed by UHC immediately prior to the closing

of the Qualifying Transaction announced on April 1, 2010. The UHC securities

issued in the private placement were exchanged into the following securities

of the Company:

Number of Shares: 59,850,000 shares

Purchase Price: $0.15 per share

Warrants: 29,925,000 share purchase warrants to purchase

29,925,000 shares

Warrant Exercise Price: $0.40 for a two-year period

Number of Placees: 98 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

Harold Wolkin Y,P 665,000

Alexander Mackay P 133,000

Angela Gougeon P 66,500

Ya-Hsren (Yas) Lee P 166,250

Lee & Lee Wang Hui Chuan P 79,800

Timothy J. Hart P 166,250

Agent's Fee: Agent Cash Options

Fraser Mackenzie Limited $188,751 848,256

Salman Partners Inc. $71,739 418,947

Hampton Securities Limited $178,459.50 952,547

Jones Gable and Company Limited $10,000 50,000

All Group Financial Services $22,750 113,750

Canaccord Financial Ltd. $38,500 192,500

Bolder Investment Partners $36,800 184,000

BMO Nesbitt Burns $5,000 0

Each Agent Option is exercisable into one common

share at $0.20 per share for 24 months from the

date of closing.

Note that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

The Exchange has been advised that the above transactions have been

completed, as announced in a press release dated May 3, 2010.

Capitalization: Unlimited number of shares with no par value of

which 120,302,722 shares are issued and

outstanding

Escrow: 54,947,222 common shares

Symbol: VES (same symbol as CPC but with .P removed)

The Company is classified as an "Oil and Gas Exploration/Development"

company.

Company Contact: Dr. Arthur Halleran, CEO

Company Address: Brookfield Place, Suite 1800

181 Bay Street

Toronto, ON M5J 2T9

Company Phone number: (403) 667-4941

Email address: art@unitedhunter.ca

TSX-X

________________________________

VICTORIA GOLD CORP. ("VIT")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: May 6, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

Share Purchase Agreement (the "Agreement"), dated March 5, 2010, between

Victoria Gold Corp. (the "Company"), StrataGold Corporation and Tassawini

Gold (Barbados) Corporation ("TG Barbados") - two wholly-owned subsidiaries

of the Company, and Takara Resources Inc. - a TSX Venture listed company

("Takara"), whereby the Company has agreed to sell to Takara all of the

issued and outstanding shares of StrataGold Guyana Inc. ("SG Guyana") - a

wholly-owned subsidiary of TG Barbados that holds all of the interests in

the Company's Guyanese gold assets.

As consideration for SG Guyana, TG Barbados will receive 21,858,355 common

shares of Takara. In the event that Takara obtains a positive economic

assessment on the assets acquired, or alternatively, enters into an

arrangement for project funding, an additional 4,000,000 common shares will

be issued to TG Barbados.

For further information, please refer to the Company's news release dated

April 27, 2010.

TSX-X

----------------------------------------------------------------------------

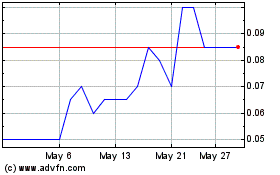

Wescan Energy (TSXV:WCE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wescan Energy (TSXV:WCE)

Historical Stock Chart

From Nov 2023 to Nov 2024