Wescan Goldfields Inc. announces second quarter results

26 August 2011 - 3:07AM

PR Newswire (Canada)

SASKATOON, Aug. 25, 2011 /CNW/ -- Stock Symbol: WGF: TSX-V

SASKATOON, Aug. 25, 2011 /CNW/ - Wescan Goldfields Inc. ("Wescan"

or the "Company") reports that the unaudited results of Wescan's

operations for the quarter ended June 30, 2011 will be filed today

on SEDAR and may be viewed at www.sedar.com once posted. A summary

of key financial and operating results for the quarter is as

follows: Highlights • Commenced drill

programs on the Company's Jojay and Jasper gold properties

• Initiated airborne geophysical

survey at Munro Lake gold property

• Issued and outstanding shares of

112,452,121 at June 30, 2011 Overview of activities During the

first half of 2011, Wescan focused on reviewing historical drill,

geological and geotechnical data in order to plan the 2011

exploration activities on its portfolio of gold and coal

properties. Based on this review, the Company undertook the

raising of sufficient capital during the first quarter in order to

finance a significant portion of the planned 2011 exploration

programs. Following the completion of a $1.6 million

financing on February 24, 2011, Wescan announced certain

exploration programs for the year. The programs commenced in

June of 2011 on the Company's portfolio of gold properties in the

La Ronge Gold Belt in northern Saskatchewan. The Company's

large parcel of coal permits has also been reviewed and the Company

intends to focus future coal exploration programs on certain areas

of high potential. Quarterly Results For the quarter ended June 30,

2011 the Company recorded a net loss of $734,615 ($0.01 per share)

compared to a net loss of $303,910 ($0.00 per share) for the same

period in 2010. The difference between the quarter ended June

30, 2011 and 2010 is primarily the result of the impairment of

certain coal evaluation and exploration assets. Year to Date

Results For the six months ended June 30, 2011, the Company

recorded a net loss of $837,136 ($0.01 per share) compared to a net

loss of $477,414 ($0.01 per share) for the same period in

2010. The difference from 2011 to 2010 is primarily the

result of the impairment of certain coal exploration and evaluation

assets. Selected financial highlights include:

__________________________________________________________________

| | | As at | | | As at | December | |Condensed Consolidated | June

30, | 31, | |Balance Sheets | 2011 | 2010 |

|___________________________|_____________|__________| |Current

assets | $ | $ | | | 1,553,628| 517,599|

|___________________________|_____________|__________| |Capital and

other assets | 6,561,457| 7,077,897|

|___________________________|_____________|__________| |Current

liabilities | 202,939| 145,786|

|___________________________|_____________|__________| |Long-term

liabilities | 163,853| 75,520|

|___________________________|_____________|__________| |Future

income tax liability| 58,248| 163,336|

|___________________________|_____________|__________|

|Shareholders' equity | 7,690,045| 7,210,854|

|___________________________|_____________|__________| | |

|____________________________________________________| |Condensed |

| | | | |Consolidated |Three Months| | | | |Statements of| |Three

Months |Six Months| Six Months | |Loss and | Ended June | Ended

June |Ended June|Ended June 30,| |Comprehensive| 30, | 30, | 30, |

| |Loss | 2011 | 2010 | 2011 | 2010 |

|_____________|____________|_____________|__________|______________|

|Interest and | $ | $ | $ |$ 19,821| |other income | 13,699| 9,934|

24,233| |

|_____________|____________|_____________|__________|______________|

|Operating | 166,054| 313,844| 279,109| 497,235| |expenses | | | |

|

|_____________|____________|_____________|__________|______________|

|Loss before | (152,355)| (303,910)| (254,876)| (477,414)| |other

items | | | | |

|_____________|____________|_____________|__________|______________|

|Impairment of| (700,265)| -| (700,265)| -| |exploration | | | | |

|and | | | | | |evaluation | | | | | |assets | | | | |

|_____________|____________|_____________|__________|______________|

|Flow-through | 12,917| -| 12,917| -| |share premium| | | | |

|recovery | | | | |

|_____________|____________|_____________|__________|______________|

|Deferred | 105,088| -| 105,088| -| |income tax | | | | | |recovery

| | | | |

|_____________|____________|_____________|__________|______________|

|Net and | (734,615)| (303,910)| (837,136)| (477,414)|

|comprehensive| | | | | |loss for the | | | | | |period | | | | |

|_____________|____________|_____________|__________|______________|

|Net and | (0.01)| (0.00)| (0.01)| (0.01)| |comprehensive| | | | |

|loss per | | | | | |share | | | | |

|_____________|____________|_____________|__________|______________|

____________________________________________________________________

| | Six Months | Six Months | |Condensed Consolidated Statements

|Ended June 30, |Ended June 30, | |of Cash Flows | 2011 | 2010 |

|__________________________________|________________|________________|

|Cash flows from operating |$ (219,987)|$ (522,561)| |activities |

| |

|__________________________________|________________|________________|

|Cash flows from investing | (220,801)| (62,471)| |activities | | |

|__________________________________|________________|________________|

|Cash flows from financing | 1,416,293| 442,619| |activities | | |

|__________________________________|________________|________________|

|Increase (decrease) in cash and | 975,505| (142,413)| |cash

equivalents | | |

|__________________________________|________________|________________|

|Cash and cash equivalents - | 499,115| 289,605| |beginning of

period | | |

|__________________________________|________________|________________|

|Cash and cash equivalents - end of| 1,474,620| 147,192| |period |

| |

|__________________________________|________________|________________|

Outlook With the significant escalation in the price of gold, the

Company believes the timing is right to focus exploration efforts

on the properties with known gold mineralization. This focus

on gold properties will include exploration work on the Jojay,

Jasper and Munro Lake properties. The Company's success in

raising additional flow-through financing during the first quarter

of 2011 has allowed it to begin exploration programs on this

portfolio of gold properties in the La Ronge Gold Belt in northern

Saskatchewan. The Company also remains committed to its coal

holdings near Hudson Bay, Saskatchewan and has determined

additional exploration and evaluation work is warranted based on

the review conducted. The Company will also continue to

evaluate the potential for the acquisition of other mineral

properties that fit its strategic direction. Management is

confident the Company will have sufficient access to financial

markets to continue its planned exploration activities in 2011.

Caution Regarding Forward-looking Information This press release

contains forward-looking statements within the meaning of certain

securities laws, including the "safe harbour" provisions of

Canadian Securities legislation and the United States Private

Securities Litigation Reform Act of 1995. The words "may," "could,"

"should," "would," "suspect," "outlook," "believe," "plan,"

"anticipate," "estimate," "expect," "intend," and words and

expressions of similar import are intended to identify

forward-looking statements, and, in particular, statements

regarding Wescan's future operations, future exploration and

development activities or other development plans contain

forward-looking statements. Forward-looking statements in this

press release include, but are not limited to, the ability to raise

funds to pursue exploration activities, the use of such funds, and

the acquisition and exploration of additional properties. These

forward-looking statements are based on Wescan's current beliefs as

well as assumptions made by and information currently available to

it and involve inherent risks and uncertainties, both general and

specific. Risks exist that forward-looking statements will not be

achieved due to a number of factors including, but not limited to,

developments in world gold and coal markets, risks relating to

fluctuations in the Canadian dollar and other currencies relative

to the US dollar, changes in exploration, development or mining

plans due to exploration results and changing budget priorities of

Wescan, the effects of competition in the markets in which Wescan

operates, the impact of changes in the laws and regulations

regulating mining exploration and development, judicial or

regulatory judgments and legal proceedings and operational risks

and the additional risks described in Wescan's most recently filed

annual and interim MD&A, news releases and technical reports.

Wescan's anticipation of and success in managing the foregoing

risks could cause actual results to differ materially from what is

anticipated in such forward-looking statements. Although management

considers the assumptions contained in forward-looking statements

to be reasonable based on information currently available to it,

those assumptions may prove to be incorrect. When making decisions

with respect to Wescan, investors and others should not place undue

reliance on these statements and should carefully consider the

foregoing factors and other uncertainties and potential events.

Unless required by applicable securities law, Wescan does not

undertake to update any forward-looking statement that may be made.

"Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release." To view this news release in HTML

formatting, please use the following URL:

http://www.newswire.ca/en/releases/archive/August2011/25/c6263.html

p align="center" Mr. Darren S. Anderson, Presidentbr/ orbr/ Mr.

Harvey J. Bay, Chief Financial Officerbr/ 300 - 224 4supth/sup

Avenue Southbr/ Saskatoon, SK S7K 5M5br/ PH: (306) 664-2422br/ FAX:

(306) 667-3557 /p

Copyright

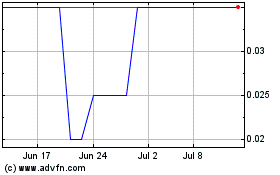

Wescan Goldfields (TSXV:WGF)

Historical Stock Chart

From Oct 2024 to Nov 2024

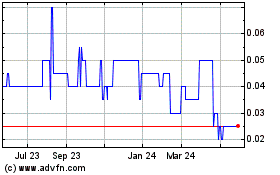

Wescan Goldfields (TSXV:WGF)

Historical Stock Chart

From Nov 2023 to Nov 2024