UPDATE: KGHM's Canada Investment Positive But Has Some Risks

05 May 2010 - 9:08PM

Dow Jones News

An agreement between Polish copper miner KGHM Polska Miedz

(KGH.WA) and Canada's Abacus Mining & Exploration Corp. (AME.V)

to jointly explore a copper and gold field project in western

Canada is a positive move but not without potential risks, analysts

said Wednesday.

The deal, signed Tuesday, will see KGHM pay $37 million for 51%

of the joint venture. Abacus will contribute its rights to the

Afton Ajax field, located in the Canadian province of British

Columbia, into the business.

KGHM has the option to buy a further 29% in the joint venture

for up to $35 million. If it exercises that option, it will be

required to organize financing of $535 million for the joint

venture's investment in the field, proportionally to its holdings

in the venture.

"The field's parameters are really fantastic, especially in

terms of unit production costs," Michal Marczak, equity analyst

with BRE Bank brokerage, said in a research note. He said he

expects KGHM's investment to be paid back after only four

years.

But he said the decision to sell such an attractive field at a

relatively low price raised questions.

"The answer (as to why Abacus is selling) probably lies in risk

factors which still remain unknown," he added.

According to estimates, the Afton Ajax field is expected to

produce 50,000 metric tons of copper and 100,000 troy ounces of

gold a year. The field is expected to produce for 23 years starting

in 2013, KGHM said.

Pawel Puchalski, equity analyst with BZ WBK brokerage, said the

deal is supportive to KGHM's valuation, but that numerous risks

exist. These include possible delays in project startup, escalating

costs of investment and lower output.

The project will help KGHM in its strategic long-term goal of

producing 700,000 tons of copper annually, the company's chief

executive Herbert Wirth said Wednesday. In 2009, KGHM produced

501,000 tons of copper.

Under that strategy, KGHM plans to spend PLN13.7 billion on

investment by 2014. Of this, PLN5.7 billion is to be spend on

capital investment.

Copper production costs at Afton Ajax are estimated at

$2,000/ton, Wirth said, significantly lower than KGHM's average

costs of $3,580/ton in 2009.

The company operates three mines in Poland--Lubin, Rudna and

Polkowice-Sierszowice. It also has an Ore Enrichment Plants

division, which prepares concentrate for smelters and refineries in

Legnica and Glogow; a Tailings Management division, responsible for

the storage and management of tailings, and a Cedynia copper wire

rod plant in Orsk.

At 1013 GMT KGHM shares traded down 1.4% at 103.50 zlotys

($33.50) at the Warsaw Stock Exchange, against a 0.5% slide in the

blue-chip WIG20 index.

-By Malgorzata Halaba, Dow Jones Newswires; +4822 447-2432;

malgorzata.halaba@dowjones.com

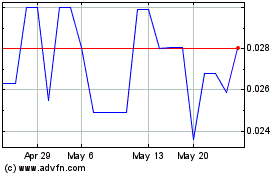

Abacus Mining and Explor... (PK) (USOTC:ABCFF)

Historical Stock Chart

From May 2024 to Jun 2024

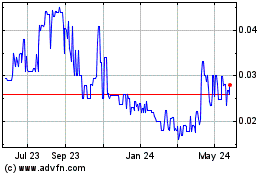

Abacus Mining and Explor... (PK) (USOTC:ABCFF)

Historical Stock Chart

From Jun 2023 to Jun 2024