UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For the fiscal year ended October 31, 2015 |

| |

|

| |

OR |

| |

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 000-53051

Advanced Biomedical Technologies Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

Empire State Building

350 Fifth Ave, 59th Floor

New York, NY 10118

(Address of principal executive offices, including zip code.)

(718) 766-7898

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| |

|

|

|

|

|

| |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

There was no active public trading market as of the last business day of the Company’s year-end.

The aggregate market value of common stock held by non-affiliates of the registrant, computed by reference to the price at which the common equity was last sold being $0.14 on April 30, 2015 which is the last trading day of the second quarter, was approximately $2,648,300 as of April 30, 2015 (the last business day of the registrant’s most recently completed second quarter), assuming solely for the purpose of this calculation that all directors, officers and more than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

As of February 16, 2016, there are 66,874,850 shares of common stock outstanding.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

Investors are cautioned that certain statements contained in this document, as well as some statements in periodic press releases and some oral statements of Advanced Biomedical Technologies Inc. (“ABMT”) officials during presentations about ABMT, are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” or similar expressions. In addition, any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future ABMT actions, which may be provided by management, are also forward-looking statements as defined by the Act. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about ABMT, economic and market factors and the industries in which ABMT does business, among other things. These statements are not guaranties of future performance and we have no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in the forward-looking statements, and Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K.

Organizational History

Advanced Biomedical Technologies, Inc. has one direct wholly owned subsidiary, Masterise Holdings Ltd., a limited liability company organized under the laws of British Virgin Islands (“Masterise”). Masterise, owns seventy percent (70%) of the issued and outstanding equity or voting interests in Shenzhen Changhua, a company formed under the laws of the People’s Republic of China. (ABMT, Masterise, and Shenzhen Changhua are collectively referred to throughout this document as “We, “Us,” “Our” (and similar pronouns), “ABMT” and the “Company”).

We were incorporated in the State of Nevada on September 12, 2006. We maintain our statutory registered agent’s office at The Corporation Trust Company of Nevada, 311 S Division Street, Carson City, Nevada 89703, and our business office is located at 350 Fifth Avenue, 59th Floor, New York, NY 10118. We have not been subject to any bankruptcy, receivership, or similar proceeding, or any material reclassification or consolidation.

Our primary business is carried out by Masterise through Shenzhen Changhua, as set forth in the following diagram:

Shenzhen Changhua does not have any subsidiary.

Organizational History of Masterise and Shenzhen Changhua

Masterise is a wholly owned subsidiary of Advanced Biomedical Technologies, Inc.

Masterise is a limited liability company which was organized under the laws of British Virgin Islands (“BVI”) on May 31, 2007, and owns 70% of the capital stock of Shenzhen Changhua.

Shenzhen Changhua is a limited liability company which was organized under the laws of PRC on September 25, 2002.

Since their founding, Shenzhen Changhua has been involved in the development of self-reinforced, absorbable degradable screws, rods and binding wires for fixation on human fractured bones. The Company is currently involved in conducting clinical trials on its products and intends to raise additional capital to produce and market its products commercially pending approval of its products by the China Food and Drug Administration (“CFDA”), formally the State Food and Drug Administration (“SFDA”) of the PRC.

Primary Products

Our primary products include Absorbable PA Osteosynthesis Devices made of a proprietary polyamide material. These advanced materials are used in surgical screws, binding wires, rods and related medical devices for the treatment of orthopedic trauma, sports-related medical treatment, cartilage repair, and related treatments, and reconstructive dental procedures. Our devices are Self-Reinforced, Bio-absorbable, Brady-degradable internal fixation devices. At this time, ABMT is the sole patent holder of PA technologies in China, as well as the only company currently engaged in clinical trials and marketing submission for PA devices in the PRC. Our PA Screws have completed clinical trials and are pending approval by the China Food and Drug Administration of China (“CFDA”); and our PA Binding Wires are under clinical trials; and our PA Mini-Screws are under animal test.

Product Characteristics:

The theory of Brady-degradable PA absorbable material is based on water dissolution, that is, the material is broken down by body fluids in a predictable and carefully engineered fashion. As a bone fracture heals, the supporting implant is designed to degrade from the outer to the inner layers, inducing new bone generation in the gap left by the degrading material. Eventually, new bone is formed to occupy all of the space left by the degraded implant.

Brady-degradable PA absorbable materials consist of enhanced fiber and high molecular polymers. It has high tensile, bending, and shear strengths, and is particularly suitable for patients with severe conditions, high tensile, bending, and shear strengths, and is particularly suitable for patients with severe conditions, such as fractures with light osteoporosis, severe soft tissue injury or bad blood supply, and so forth. This innovative material provides several benefits:

1. Reduces costs on all patient medical care,

2. Helps avoid the necessity for secondary surgery,

3. Enhances the performance of components constructed from these materials,

4. Improves the biological activity of components employing these materials,

5. Effectively controls the degeneration speed of the temporary support component.

The Company has developed six proprietary re-absorbable polymer fixation implant product lines, including screws, pins, tacks, rods and binding wires, which provide an alternative to metal implants and overcome the limitations of first generation re-absorbable fixation devices. The Company’s product range will ultimately cover the full gamut of components featuring self-reinforced, re-absorbable, biodegradable PA macromolecule polymer materials for implantation, including human orthopedic and dental applications, as well as veterinary applications.

Industry Development

The fracture fixation industry has developed through three generations of materials science:

The first generation internal-fracture fixation material:

The first generation internal-fracture-fixer components are usually made of stainless steel, titanium and alloy. Due to their high intensity, low costs and easy machining character, these components have achieved huge success in fracture treatment and remain the most widely used internal-fracture-fixer material. However, their prominent flaws are the huge difference between metal’s elasticity co-efficient, easily causing second-time bone fracture. The metallic ion can also cause tissue inflammation, and the need of a secondary surgery to have them taken out. These flaws stimulated the development of the degradable macromolecule material.

The second generation fracture fixation material:

The second generation bone-fracture-fixed components are made of degradable macromolecule material, such as PLLA, PGA and PDS, etc. The disadvantage of these components is rapid self-degeneration in early stages after the initial implant. For example, the strength of SR-PLLA decreases to 10-20Mpa after 4 weeks of implantation. Therefore, the second generation bone-fracture-fixed components can be only used to treat substantial spongiosa bone fractures.

The third generation fracture fixation material:

The third generation fracture fixation material, biodegradable fracture fixation components are currently under research by developed countries. There are many technical challenges to research in the third generation fracture fixation material field; for example, the materials must have a high degree of bio-compatibility and mechanical compatibility. They also must be of high biological activity, self-absorbable, and degeneration controllable.

Product Development

After careful deliberation, we selected the biodegradable screw as our first product to market. In order to replace the widely-used metal components, the new materials must meet multiple bio-consistency and mechanical-consistency requirements. Furthermore, they must also exhibit specific properties with respect to bio-activities, degradability, and controllable degradation speed. Although many macromolecule materials are degradable inside human body, relatively few provide the physical characters required for fracture fixation.

Development began with selection of macromolecule materials that exhibited the desired physical characters, leading, ultimately, to our selection of polyamide. In order to achieve the desired mechanical performance and degrading speed, various chemical and physical techniques were employed to modify the bio-degradable polyamide so as to synthesize the required new bio-degradable material. This phase of our research also entailed the selection of monomer class, polymerization conditions, the mensuration of polymer molecular weight, hydrophile capability, crystal capability, the mensuration and controlled degrading speed of the polymer, the mensuration and control of the mechanical performance of the polymer, and numerous other critical considerations.

Our next challenge was to identify a suitable bio-active inorganic material, and to optimize the compound and associated production conditions. It was critical that we could predict and control the bio-activities of the implanted fixture material, and to this end we used high grade and mature phosphate type bio-active materials, taking into account the preparation characteristics of the compound material, and the surface character requirements of the finished products. We also improved current technical parameters by modifying the surface character, thereby achieving critical control over the desired grain size and surface activities.

The third technological hurdle involved the actual preparation and utilization of the engineered compound in conjunction with a bio-active material. Hydronium bombardment of the surface, with spread and cover techniques, was employed during this critical step in the process. This had the effect of creating a well-knit bio-active membrane on the degradable polymer’s surface, and embedding a bio-active core inside the degradable polymer stick, so as to form the bio-active degradable compound material.

The final step entailed strengthening and shaping the processed compound by using directional extrusion and molding. Degradable acantha inoculators, fixation screws, orthopedics stuffing, enlace strings, and anti-conglutination membrane can all be manufactured, as needed, using this same technique.

Our company has studied and researched Polyamide, changing its chemical and physical properties to meet the above requirements. As a result of our research we have:

| 1. |

Increased mechanical strength to 170Mpa. |

| 2. |

Increased biological activities to accelerate bone cell substitution. |

| 3. |

Extended the degeneration period during the implant. While the PA is degenerating layer by layer, the bone cells grow and take its place. |

Product Analysis

Our Company is researching and currently developing the capability of manufacturing several different kinds of human implant products including Artificial Lumbar Disc, Mini-Screws, Suture Anchors, reconstructive dental devices and other PA products. Currently the company has two production lines certified by the GMP regulations.

Our Company is constantly analyzing the market needs to develop suitable products. One of the company’s products is currently pending CFDA approval and two products are under clinical tests.

Overview of PA Devices and Market in the US, China and Worldwide

Fractures are among the most common orthopaedic problems. There are estimated 1.5 million fracture cases each year in the United States alone (Riggs and Melton 1995), and the average citizen in a developed country can expect to sustain two fractures over the course of their lifetime. Fractures occur at an annual rate of 2.4 per 100 population. Men are more likely to experience fractures (2.8 per 100 population) than women (2.0 per 100). In 1998, over 10.7 million fractures were seen by physicians in office-based practice (this included visits for follow-up care). Of these, approximately 8.6 million visits for fracture care (79.6%) were made to orthopaedic surgeons. When a fracture was referred to another physician, approximately 90.6% were referred to orthopaedic surgeons. (Data Source: National Ambulatory Medical Care Survey & American Academy of Orthopaedic).

Hip fracture rates are increasing throughout urban Asia. A landmark study from Beijing 2002–2006 indicates the hip fracture incidence in those aged over 50 years to be 229/100,000 per year in women and 129/100,000 per year in men. This study found the rates of age-specific hip fractures in those aged over 50 years increased by 58% in women and by 49% in men. The same study also compared hip fractures that occurred from 2002-2006 with those that had occurred previously from 1990-1992, and it was found that the adjusted age-specific rates of hip fracture over age 50 years increased 2.76-fold in women and 1.61-fold in men. The increasing rate of hip fractures is serious since they are associated with increased mortality. In Mainland China, 1.8 million new osteoporotic vertebral fractures occurred in 2006. Since the number of people aged older than 60 years is expected to approach 438 million by 2050, it can be projected that the number of Chinese in this age group with osteoporotic vertebral fractures could reach 36.7 million and 48.5 million in 2020 and 2050, respectively. (Data Source: International Osteoporosis Foundation).

The demand for medical device equipment has rapidly increased during the last decade. Total market sales have increased more than 15% each year. The figures show that about 4 million bone bolts/screws are needed each year. Between 2005 and 2009, the total world-wide sales of clinical equipment and materials are over USD 2 trillion, and more than 50% of the sales are related to bio-materials.

China’s Market for PA Devices

China’s market for PA devices depends on 3 major conditions:

- patients

- advanced technology level

- performance and price of the materials.

In the first 50 years of the 21st century, China will have a growing aging population, while the total population in China will continually increase. New and improved medical technologies will be rapidly developed and utilized throughout hospitals in China, and material optimization and product pricing is expected to directly stimulate increased sales.

Competitive Analysis

Our Company is the only patent holder of PA technologies in China, as well as the only company carrying out Clinical Trials on PA products in China. At this time there are no similar products in this market (bio-degradable internal fixation devices that degrade without acids or other non-naturally occurring substances). Moreover, due to the nature of the regulatory environment, and the requirements and logistics of mounting a clinical trial, it would take any new competitor a minimum of three years to catch up to our lead in this area alone. Factoring in our established relationships with key customers, distributors, and regulators, as well as our ready-to-run production facilities, and our actual advantage is considerable longer than the 3 year regulatory advantage. This represents an invaluable window in which to firmly entrench our company as the preferred purveyor of self-reinforced, absorbable biodegradable PA components in the Chinese health care environment.

To reiterate, our company and product line offer several critical competitive advantages, specifically:

|

· |

There are no similar patent registrations in China. |

|

· |

Our initial product, the PA Screw, has completed 100% of the required clinical trials, with a 100% success rate, and now await the formality of CFDA approval. |

|

· |

We are the only company qualified and permitted to conduct clinical trials of other PA products by China’s CFDA. |

|

· |

We have a timing advantage over other companies in China, which would have to go through the preclinical testing before they could even apply for a permit to conduct actual clinical trials. |

|

· |

Under existing regulation structure, it will take at least 3 years for any competitor’s clinical trials to be completed, and total of 7 or more years to reach the point where we are now. |

Specific Competition

Competition in the medical implant device industry is intense both in China and in global markets. In orthopedics, ABMT’s principal competitors are the numerous companies that sell metal implants. ABMT competes with the manufacturers and marketers of metal implants by emphasizing the ease of implantation of the Company’s Self-Reinforced, Bio-absorbable, Brady-degradable implants, the cost effectiveness of such products, and the elimination of risks associated with the necessity of performing removal surgeries frequently required with less modern products.

Within the resorbable implant market, ABMT is competing with other manufacturers of resorbable internal fixation devices primarily on the basis of the physiological strength of ABMT’s polymers and the length of the strength retention time demonstrated by ABMT’s formulations. In order to replace the widely-used metal components, the new materials must meet numerous bioconsistency and mechanical-consistency requirements. Furthermore, they must also exhibit specific properties with respect to bio-activities, degradability, and controllable degradation speed. Although many macromolecule materials are degradable inside human body, relatively few provide the physical characters required for fracture fixation.

Our primary competition will be the generation-one and generation-two counterparts, which, despite their functional inferiority, enjoy the benefit of familiarity and an established manufacturing and marketing base. This competition comes from a number of entrenched players worldwide, including Acumed, Biomet, Inc., Conmed Corp., Encore Orthopedics, Exactech, Inc., Johnson & Johnson, DePuy, Inc., Medtronic Sofamor Danek, Inc., Orthofix International N.V., Smith and Nephew Plc, Stryker Corp., Synthes, Inion, Ltd. and others. Although many of these competitors have substantially greater resources upon which to draw, we are confident that the technological superiority of the more forward-looking product will ultimately equalize the playing field by orthopaedic innovation.

For the past 20 years, titanium has been the most widely used, and the most expensive material for fixing fractures (in both elective and emergency surgery). Although metal exhibits the desired strength and rigidity to allow the healing process to begin, there are a number of issues associated with using permanent titanium systems. Biodegradable plating systems deliver many of the benefits of their metal counterparts, without the disadvantages.

There are a number of marketers and manufacturers of PLA and PLLA--the first generation of Self-degradable, absorbable, orthopedic internal fixation devices in China. (Note: Titanium screws cost as much as $2200.)

| Competing products and prices in China (screw) |

| Producer |

Origin |

Brand |

Price (USD/PC)

|

| Arthrex |

Germany/USA

|

Arthrex |

$ 554.74 |

|

Conmed

|

USA |

Linvatec |

$ 554.74 |

|

Bionx

|

Finland |

Biofix |

$ 554.74 |

|

Gunze

|

Japan |

Grandfix |

$ 416.06 |

|

Takiron

|

Japan |

Fixsorb |

$ 408.76 |

|

Dikang

|

China |

PDLLA |

$ 321.17 |

|

ABMT

|

China |

ABMT |

$ 300.00 |

Other foreign companies that produce PLA, PLLA or titanium, stainless products, but have less marketing in China are:

· DePuy (Johnson & Johnson)

· Medtronic

· Stryker

· Zimmer

· Smith & Nephew

· Biomet

· Conmed

· Inion

Product advantage and Market Opportunity:

| - |

There are no similar patent registrations in China. |

| - |

We are the only company qualified and permitted to take clinical trials by China CFDA. |

| - |

We have a timing advantage over other companies in China which would have to go through the preclinical testing for the CFDA permit on Clinical Trials. |

| - |

Under existing regulation by CFDA, it will take at least 3-5 years to complete clinical trials for a new product similar to the Company’s PA Screw, which has finished all required clinical trials. |

Product Comparisons

Among many other advantages, a main advantage of ABMT’s proprietary PA technology is the elimination of the need for secondary surgery to remove an implantation device. Implant removal belongs to the most common elective orthopaedic procedures in industrial countries. In children, implant removal may be necessary to remove implants early to avoid disturbances to the growing skeleton, to prevent their bony immuring making later removal technically difficult or impossible, and to allow for planned reconstructive surgery after skeletal maturation (e.g., in case of hip dysplasia). In adults, pain, soft tissue irritation, the resumption of strenuous activities or contact sports after fracture healing, and the patient’s demand are typical indications for implant removal in clinical practice. However, implant removal requires a second surgical procedure in scarred tissue, and poses a risk for nerve damage and re-fractures. (cite: Hanson et al. BMC Musculoskeletal Disorders 2008)

| PHYSICAL COMPARISON |

| |

Metal |

PLLA |

ABMT’s PA devices |

| Strength |

Excellent |

Weak |

Superior to PLLA |

| Unit Cost |

High |

Low |

Lowest |

| Processability |

Good |

Good |

Good |

| Modulus of Elasticity |

Low: may cause infection,

may cause second

fracture

|

Moderate to Quite Fragile |

Excellent |

| Self-Reinforced |

No |

Yes, but degradation

starts too quickly

|

Yes |

| Self-Resorbable |

No1 |

Yes, but initial degradation

too fast in first few

weeks. Initial strength

down to 10~20Mpa in 4

weeks (close to osteoporosis)

|

Yes: unchanged during

first 12 weeks, hardness

remains 70% min

through week 20.

|

| Stretchability |

Strong |

50~60 Mpa |

170 Mpa (min) |

| Bone Healing |

Bone mineral density decrease averages 18% |

Bone mineral density decrease averages 7-10% |

Bone mineral density decrease less than 5% |

| Implant Failure Rate |

High to Medium |

Medium to Low |

Very Low |

| Need for Repeat Surgery |

As Required2 |

Only if failure (second fracture) |

No |

1 Titanium and aluminum has been traced in serum and hair of 16 of 46 patients after receiving titanium implants. (cite: Kasai Y, Iida R, Uchida A: Metal concentrations in the serum and hair of patients with titanium alloy spinal implants.)

2 Implant removal belongs to the most common elective orthopaedic procedures in the industrial countries. In a frequently cited Finnish study, implant removal contributed to almost 30% of all planned orthopaedic operations, and 15% of all operations. (cite: Bostman O, Pihlajamaki H: Routine implant removal after fracture surgery: a potentially reducible consumer of hospital resources in trauma units.)

Towards the end of the last century, spinal and orthopedic implants evolved towards progressively stronger and stiffer devices, as it was presumed that increased construct rigidity would optimize the biological milieu and provide more rapid and robust healing and arthrodesis. For the past 20 years, titanium has been the most widely used, and the most expensive material for fixing fractures (in both elective and emergency surgery). More than 1,000 tons (2.2 million pounds) of titanium devices of every description and function are implanted in patients worldwide each year. Although metal exhibits the desired strength and rigidity to allow the healing process to begin, there are a number of issues associated with using permanent titanium systems. Biodegradable systems deliver many of the benefits of their metal counterparts, without the disadvantages:

| |

METAL |

ABMT’s PA devices |

| Cranial Growth |

· Growth restriction

· Intracranial implant migration

|

· Stimulation of growth leading to better bone healing |

| Accumulation of Metal in tissues |

Yes |

No |

| Adverse Effect |

· Many necessitate removal operation either for mechanical strength of the overall structure

· majority of implant failures occur at the bone-screw interface with screw pullout being the most common mechanistic cause of construct failure

· should the bone fail to heal, these micromotions will persist and cause the metallic screw to oscillate within the far softer surrounding bone interface

|

None |

| Stiffness for optimal healing |

· Too stiff

· Stress shielding can result in bone atrophy and degradation

|

· Optimal stiffness/flexibility characteristics to achieve surgical fixation, while conforming to the softer, more pliable bone of the patient |

| Other Effects |

· Implant palpability

· Temperature sensitivity

· Occasionally visibility

· Could cause trauma in the event of mechanical failure

· Imaging and radiotherapy interference

· Potential for cross contamination

|

· No long-term palpability

· No temperature sensitivity

· Predictable degradation

· Reduced patient trauma

· No imaging and radiotherapy interference

· No second surgery required

|

| Cost of product |

Cost to hospital: $400-$2200 |

Cost to hospital: $300 |

Intellectual Property

The Company has been granted one patent for its material by the State Intellectual Property Office of the P.R.C. Patent no. ZL971190739, PRC. This patent also protects the use and manufacturing process of the material.

Chinese Patent

| Title: High molecular human body embedding article and its preparing process product and use |

| Application Number: |

97119073 |

Application Date: |

1997.10.22 |

| Publication Number: |

1214939 |

Publication Date: |

1999.04.28 |

| Approval Pub. Date: |

|

Granted Pub. Date: |

2002.08.14 |

| International Classification: |

A61F2/02,A61L27/00,C08L33/00 |

| Applicant(s) Name: |

Liu Jianyu |

| Address: |

518111 |

| Inventor(s) Name: |

|

| Attorney & Agent: |

Li Zhi Ning |

Abstract

The present invention discloses a macromolecular implant for human body and its preparation process, and relates to the products made up by using said macromolecular implant and their application. Said invented product is made up by using resin fibre through hot-pressing treatment according to the formula provided by said invention, and its strength is high, tenacity is good and its shape can be processed according to the requirement in the period of bone union after implantation, and said implant can be made into the fixation block, eurymeric block, fastening piece and suture for reduction of fracture, and can be started to be degraded from twenty-fourth week after implantation, and can be completely absorbed by human body after 1.5-2 years, and its cost is low.

Employees

As of October 31, 2015, we had 24 employees, with 11 employees in R&D, Clinical and Regulatory, 5 employees in Manufacturing, 3 employees in Sales & Marketing, 4 employees in General and Administration, and 1 employee in Accounting. The Company intends to offer more engineer positions in future.

We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. None of our employees are represented by a labor union, and our employee relations have been good.

The company’s facilities are located at Block A, Longcheng Tefa Industrial park, Longgang, Shenzhen, China.

Availability of new qualified employees

Shenzhen is located in the southern part of the Guangdong Province, on the eastern shore of the Pearl River Delta. Neighboring the Pearl River Delta and Hong Kong, Shenzhen’s location gives it a geographical advantage for economic development.

Shenzhen’s well-built market economy and diversified culture of migration have helped to create the best-developed and most dynamic market economy in China. Shenzhen is China’s first special economic zone. After more than 30 years of development, Shenzhen has grown into a powerful city boasting the highest per capita GDP in China’s mainland. Its comprehensive economic capacity ranks among the top of the country’s big cities. The combined value of imports and exports has remained No.1 for 20 years in China’s foreign trade.

Since 1997, China has accelerated the development of higher education and increased enrollment in regular universities and colleges. Between 2003 and 2015 the number of students completing undergraduate and graduate courses in China more than tripled, from 2.12 million to 7.49 million graduates.

Guangdong has entered a transition period from an elite education to a popularized higher education. There are 120 universities and colleges offering higher education in Guangdong province with over 519,000 students graduated in 2015. Combined with graduates from other parts of China, there are over 800,000 job-seeking graduates in total in Guangdong in 2015. 94.80% of the graduates from Guangdong have successfully found their first employment, and more than 80% of these employments are based in Pearl River Delta.

Insurance

While we are carrying out the Clinical Trials, we do not have any Product Liability Insurance coverage for the use of our proposed products. We intend to obtain Product Liability Insurance coverage for commercial sale of our products in due course.

Government Regulations

Our primary target market is the medical community of the People’s Republic of China (PRC). Medical devices manufactured by the Company in China are subject to regulation by the China Food and Drug Administration (“CFDA”), formally the State Food and Drug Administration (“SFDA”) of the PRC. The manufacturing facilities are also required to meet China’s Good Manufacturing Practices (“GMP”) standards.

The Company’s production facilities are fully compliant with GMP requirements. The Company’s CFDA Application for its PA Screw is under the CFDA Review Process.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

There are no unresolved comments from the SEC.

None.

| ITEM 3. |

LEGAL PROCEEDINGS |

We are not involved in any pending or imminent litigations or current legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

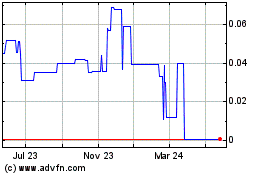

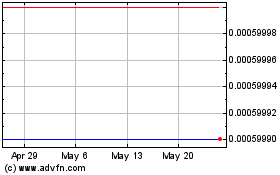

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his securities in our company. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops.

Our company’s securities are traded on the world’s largest electronic interdealer quotation system “OTCQB” operated by the OTC Markets Group under the symbol “ABMT”.

| Fiscal Quarter |

|

High Bid |

|

|

Low Bid |

|

| 2015 |

|

|

|

|

|

|

|

|

| Fourth Quarter 08-01-15 to 10-31-15 |

|

$ |

0.20 |

|

|

$ |

0.14 |

|

| Third Quarter 05-01-15 to 07-31-15 |

|

$ |

0.15 |

|

|

$ |

0.14 |

|

| Second Quarter 02-01-15 to 04-30-15 |

|

$ |

0.20 |

|

|

$ |

0.14 |

|

| First Quarter 11-01-14 to 01-31-15 |

|

$ |

0.43 |

|

|

$ |

0.20 |

|

| Fiscal Quarter |

|

High Bid |

|

|

Low Bid |

|

| 2014 |

|

|

|

|

|

|

| Fourth Quarter 08-01-14 to 10-31-14 |

|

$ |

0.51 |

|

|

$ |

0.43 |

|

| Third Quarter 05-01-14 to 07-31-14 |

|

$ |

1.00 |

|

|

$ |

0.51 |

|

| Second Quarter 02-01-14 to 04-30-14 |

|

$ |

0.65 |

|

|

$ |

0.60 |

|

| First Quarter 11-01-13 to 01-31-14 |

|

$ |

0.95 |

|

|

$ |

0.65 |

|

Shareholders

At October 31, 2015, we had 40 shareholders of record of our common stock, including shares held by brokerage clearing houses, depositories or otherwise in unregistered form. We have no outstanding options or warrants, or other securities convertible into, common equity.

Dividend Policy

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

We have no equity compensation plans and accordingly we have no shares authorized for issuance under an equity compensation plan.

| ITEM 6. |

SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this annual report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Overview

The following discussion is an overview of the important factors that management focuses on in evaluating our businesses, financial condition and operating performance and should be read in conjunction with the financial statements included in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward looking statements as a result of any number of factors, including those set forth in this Annual Report on Form 10-K, and elsewhere in our other public filings. Factors that may cause actual results, our performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements include without limitation:

|

1. |

The company’s lack of funds in new R&D, especially in clinical testing; |

|

2. |

The company’s lack of funds in new equipment and the utilization of the production process after CFDA approval; |

|

3. |

The company may need to seek funding through such vehicles as convertible notes and warrants, private placements, and/or convertible debentures; |

|

4. |

The company needs funding for marketing and network build-up; |

|

5. |

The company plans to seek approval for clinical testing and marketing on a worldwide basis, including US FDA approval for testing and marketing in the United States of America, and there is no guaranty that we will obtain any such approval; |

|

6. |

While the company currently holds a patent originating in China, the patent does not protect our intellectual property in the United States, and the company is unsure of the validity of the patent in other countries. However, specific trade secrets are involved in the manufacturing of our product to help protect our technologies, and reverse engineering is unlikely for our types of products and technologies. Additionally, all machinery used to manufacture our products is protected by Chinese patents. |

The Company is subject to a number of risks similar to other companies in the medical device industry. These risks include rapid technological change, uncertainty of market acceptance of our products, uncertainty of regulatory approval, competition from substitute products from larger companies, the need to obtain additional financing, compliance with government regulations, protection of proprietary technology, product liability, and the dependence on key individuals.

All written and oral forward-looking statements made in connection with this Form 10-K that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

Our Business

We are engaged in the business of designing, developing, manufacturing and the planned future marketing of self-reinforced, re-absorbable biodegradable internal fixation devices. Our polyamide materials are protected by Patent no. ZL971190739, PRC, issued by the State Intellectual Property Office of the P.R.C., is used in producing screws, binding wires, rods and related products. These products are used in a variety of applications, which include orthopedic trauma, sports related medical treatment, or cartilage injuries, and reconstructive dental procedures. Our products are biodegradable internal fixation devices which are made of a very unique material called Polyamide (“PA”). Our PA products, such as screws, rods, and binding wires consist of enhanced fibers and high molecular polymers, which are designed to facilitate quick healing of complex fractures in many areas of the human skeletal system. Our products offer a number of significant advantages over existing metal implants and the first generation of degradable implants (i.e. PLLA) for patients, surgeons and other customers including:

|

1. |

A notably reduced need for a secondary surgery to remove implant due to post-operative complications, therefore avoiding unnecessary risk and expense on all patient care; |

|

2. |

Enhancing the performance of the materials by manufacturing them to be easily fitted to each patient, forming an exact fit; |

|

3. |

Improving the biological activity of materials. Clinical trial results have shown that as PA implants degrade, they promote a progressive shift of load to the new bone creating micro-motion and thereby avoiding bone atrophy due to ’stress shielding’; |

|

4. |

Reducing the chance of post-operative infection; |

|

5. |

Effectively controlling the degeneration speed, so that there will be no complications in treating repeat injuries; |

|

6. |

Ease of post-operative care i.e. no distortion during x-ray imaging; |

|

7. |

Simple and cost-effective to manufacture. |

Our products are designed to replace the traditional internal fixation device made of stainless steel and titanium and overcome the limitations of previous generations of products such as PLA and PLLA. Our laboratory statistics show that our PA products have a higher mechanical strength, last longer in degradation ratio and are more evenly absorbed form outer layer inwards as compared with similar materials such as PLA and PLLA. Thus PA allows increased restoration time for bone healing and re-growth. The Company’s PA Degradable and Absorbable Screw (“PA Screw”) and Degradable and Absorbable Binding Wire (“PA Binding Wire) are currently being tested in human trials under permit from the China Food and Drug Administration (“CFDA”). As of October 31, 2015, the Company completed 83 successful PA Screw trial cases, and 57 successful PA Binding Wire. Upon the completion of these trials the Company has already exceeded China CFDA’s requirement on PA Screw trial. The Company’s CFDA Application for its PA Screw is in the CFDA Review Process.

CFDA Application Process for PA Screws

The Company first submitted its application for PA Screws to the CFDA, formally SFDA, in 2008. The application has been withheld by the CFDA pending additional clinical trial cases. This is due to the amended CFDA regulations, which unlike previous regulations require the applicant to specify the position on the body where the clinical trial is carried out. Our amended CFDA application has specified the ankle fracture as the body part of our clinical trial. This is because bones around this part carry most of the body weight. As of October 31, 2011, we have completed all additional clinical trials required by the CFDA with 100 percent success rate. As of October 31, 2015, the company’s CFDA Application is under the CFDA Review Process.

In March 2013, The State Food and Drug Administration of the PRC (“SFDA”), China’s medical device market regulatory agency, underwent a reorganization that saw much of China’s food and drug regulatory powers consolidated into the agency, elevating it back to a ministerial-level agency directly under the State Council. The new name for the agency is China State Food and Drug Administration (“CFDA”). The name change meant the CFDA reports directly to China’s State Council and has broader authority to oversee medical device as well as food and drug sectors. This reorganization leads to a more streamlined and efficient registration process for medical devices in China. Since the reorganization, the CFDA has issued series of circulars and guidelines to help applicants. Following the CFDA guidelines, the Company has improved its GMP facilities, updated its Technical Documentation System to cover key areas such as Clinical Trial, Manufacturing Process, R&D, Monitoring and Quality Control. Due to the uniqueness of our material, there are no established CFDA Product Standards that we can follow during our application process for our PA Screws. To establish our own Product Standards, the Company has been carrying out extra tests. The Company has submitted its Product Standards and supplementary reports to the CFDA in 2014. We expected the CFDA approval for our PA Screws to be granted in 2016.

The Company’s production lines are fully operational. We have been producing products for further researches, testing and product quality control improvements. Following the CFDA final approval, the company will be earning revenues in the same quarter that its application is approved. However, we are not able to anticipate the timeline of the CFDA Review Process.

Clinical Trials on Other Products

Currently, we have been conducting clinical trials for PA Binding Wires at the 6 state level hospitals authorized by the CFDA in cities throughout China, including Nanchang, Changsha, Luoyang, Nanning and Tianjin. We have successfully completed all 60 clinical human trial cases required by the CFDA, and we have completed 42 comparison cases. CFDA regulations require each successful clinical trial case to be accompanied by a trial case that uses a different product for comparison reasons. We intended to start CFDA Application Process for our PA Binding Wires when we complete the remaining 18 comparison cases.

The Company has setup a joint research project with Sichuan University. The Company has completed the design and production of testing mini-screws using its patented PA material. This project is currently under way.

However, there can be no assurance that the company will be able to obtain any further clearances or approvals, if required, to market its products for their intended uses on a timely basis, if at all. Moreover, regulatory approvals, if granted, may include significant limitations on the indicated uses for which a product may be marketed. Delays in the receipt of or the failure to obtain such clearances or approvals, the need for additional clearances or approvals, the loss of previously received clearances or approvals, unfavorable limitations or conditions of approval, or the failure to comply with existing or future regulatory requirements could have a material adverse effect on the Company’s business, financial condition and results of operations.

Government Regulation

Medical implant devices/products manufactured or marketed by the company in China are subject to extensive regulations by the CFDA. Pursuant to the related laws and acts, as amended, and the regulations promulgated there under (the “CFDA Regulations”), the CFDA regulates the clinical testing, manufacture, labeling, distribution and promotion of medical devices. The CFDA also has the authority to request repair, replacement, or refund of the cost of any device manufactured or distributed by the Company.

Under the CFDA Regulations, medical devices are classified into three classes (class I, II or III), the basis of the controls deemed necessary by the CFDA to reasonably assure their safety and efficacy. Under the CFDA’s regulations, class I devices are subject to general controls [for example, labeling and adherence to Good Manufacturing Practices (“GMP”) requirements] and class II devices are subject to general and special controls. Generally, class III devices are those, which must receive premarket approval by the CFDA to ensure their safety and efficacy (for example, life-sustaining, life-supporting and certain implantable devices, or new devices which have not been found substantially equivalent to legally marketed class I or class II devices). The Company is classified as a manufacturer of class III medical devices. Current CFDA enforcement policy prohibits the marketing of approved medical devices for unapproved uses.

Before a new device can be introduced into the market in China, the manufacturer generally must obtain CFDA marketing clearance through clinical trials. Since the company is classified as a manufacturer of Class III medical devices, the company must carry out all clinical trials in pre-selected CFDA approved hospitals.

Manufacturers of medical devices for marketing in China are required to adhere to GMP requirements. Enforcement of GMP requirements has increased significantly in the last several years and the CFDA has publicly stated that compliance will be more strictly scrutinized. From time to time the CFDA has made changes to the GMP and other requirements that increase the cost of compliance. Changes in existing laws or requirements or adoption of new laws or requirements could have a material adverse effect on the company’s business, financial condition and results of operations. There can be no assurance that the company will not incur significant costs to comply with applicable laws and requirements in the future or that applicable laws and requirements will not have a material adverse effect upon the company’s business, financial condition and results of operations.

Regulations regarding the development, manufacturing and sale of the company’s products are subject to change. The company cannot predict the impact, if any, that such changes might have on its business, financial condition and results of operations.

Results of Operations

The “Results of Operations” discussed in this section merely reflect the information and results of Masterise and Shenzhen Changhua for the years ended October 31, 2015 and 2014.

Revenues

The Company is in its development stage and does not have any revenue. The management team is continuously looking for fundraising possibilities for product improvement, machinery upgrades, facility expansions, continuous research and development, and sales and marketing preparation.

Our facility is located in Shenzhen, China, which is built to meet the GMP standards. Our facility covers about 865 square meters, which includes the combined facilities of offices, laboratories, and workshops. There is one production line for the PA Screw and another production line for the PA Binding Wire. The annual production capabilities of each production line are 100,000 pieces for PA Screw, and 240,000 packs for the PA Binding Wires. Both production lines, at their maximum production capacities are capable of generating approximately $30,000,000 in annual revenue.

| Estimate current production lines in full capacity |

|

|

Output Quantity (Max.) |

|

Price at

ex-factory

(US$) |

|

|

Total

Turnover

(US$) |

|

| PA Screw |

100,000 |

(piece) |

|

|

180 |

|

|

|

18,000,000 |

|

| PA Binding Wire |

240,000 |

(pack) |

|

|

50 |

|

|

|

12,000,000 |

|

|

|

|

Total: |

|

|

|

30,000,000 |

|

The Company will market its products through a hybrid sales force comprised of a managed network of independent regional distributors/sales agents (80%) and direct sales representatives (20%) in China.

There are two ways the company will generate revenue, 1) through our nationwide and regional distributors and 2) through our direct sales channels.

Funding Needs

The Company estimates that it will need to raise minimum $750,000 over the next 12 months to bring its current products to market, and begin earning revenues. This amount may increase if we decide to start clinical trials on new products. Once we receive the CFDA permit for our PA Screw, our revenue will cover our expenditures. Otherwise, we will continue to rely on external investments and shareholder’s loans to meet our cash needs. While the Company has no outside sources of funding, the Company’s shareholders have committed to advance the Company funds as needed. There is a Letter of Continuing Financial Support signed between the Company and two of its major shareholders and related party, Titan Technology Development Ltd, Ms. Hui Wang and Mr. Chi Fung Yu.

China’s Marketing Analysis and Sales Strategy

We have established long term relationships with many hospitals and national distributors in China. Ms. Hui Wang, the Company’s CEO, has over 20 years sales experience in medical distribution. She will be in charge of our sales programs. Professor LIU, Shangli, our chief medical advisor for Greater China, is one of the highest ranked orthopedic doctors in China as well as being highly renowned in the rest of the world. He will assist the Company in nationwide product promotion and joint projects with associated academic institutions and medical schools.

During product development and clinical trial stages we developed close relationships with many major national hospitals. We expect these relationships to boost our revenue generation following CFDA final approval. In order to better serve our customers, including hospitals, distributors, patients and the general public, the Company will set up Regional Service Offices to provide technical support, product information, and customer aid service.

China’s market for PA devices depends on 3 major conditions:

- Patients

- Advanced technology level

- Performance and price of the materials

The demand for internal fixation medical devices has rapidly increased during the last decade. According to China Health Care Year Book 2013, the total revenue of Chinese orthopaedic hospitals in 2013 was US$1.28 billion with over 11.5 million patients. From 2009 to 2013, the market size of China’s orthopaedic devices has grown from US$1.1 billion to US$1.92 billion, and it is estimated to reach US$2.55 billion in 2015, to overtake Japan as the second largest market in the world. The market size for trauma treatment implant devices such as our PA Screw and PA Wire was US$626.3 million or 32.6% of the total market value in 2013, and it is estimated to grow to US$1.164 billion in 2019. New and improved medical technology will continue to rapidly grow throughout hospitals in China, and material optimization and product pricing is expected to directly stimulate increased sales.

The Company has advantages and more opportunities over others competitors due to:

- No other similar patent registrations in China.

- We are the only company qualified and permitted to perform PA clinical trials by the CFDA

- We have a timing advantage over other companies in China, which would have to go through the preclinical testing for the CFDA permit on clinical trials.

- Under new regulations by the CFDA, it will take at least 5-10 years for clinical trials.

- Our patented material will enables us to rapidly diversify our product line according to market trend and demand.

Number of Hospitals in China in year 2015 Statistic and Census report by the National Health and Family Planning Commission of the People’s Republic of China.

| Statistic and Census report by National Health and Family Planning Commission of the People’s Republic of China |

| |

| (September 2015) |

| |

|

|

|

| |

September 2015 |

September 2014 |

Increase /

(Decrease) |

| Total No. of Hospitals |

26,904 |

25,304 |

1,600 |

| Public Hospital |

13,304 |

13,341 |

(37) |

| Private Hospital |

13,600 |

11,963 |

1,637 |

| Hospital Rating |

|

|

|

| AAA |

2,032 |

1,875 |

157 |

| AA |

7,080 |

6,764 |

316 |

| A |

7,464 |

6,774 |

690 |

In general, technological advancements and the marketing potential within Asia are the biggest factors in driving significant growth within the global orthopedic devices market. Another major factor that positively influences this market is the growing number of aging baby boomers with active lifestyles. This sector represents a large portion of the total population.

Research and Development

Research and development costs related to both present and future products are expensed as incurred. Total expenditure on research and development charged to general and administrative expenses for the years ended October 31, 2015 and 2014 was $60,202 and $47,700.

We expect research and development expenses to grow as we continue to invest in basic research, clinical trials, product development and in our intellectual property.

Pre-Market Research

The Company has been conducting Pre-Market Research while its PA Screw Application is under CFDA review. The research is intended to estimate the potential market success of the company’s products that can be expected. The research also looks beyond the Company’s initial market - China, and covers international markets. Based on the results of our Pre-Market Research and the positive feedbacks, we have received from trade shows and industrial conferences, it is the Company’s intention to apply for additional international regulatory approvals in due course.

Finance Costs

As of October 31, 2015 and 2014, the Company owed $562,187 and $459,131 respectively to a stockholder – Titan Technology Development Limited, which is unsecured and repayable on demand. Interest is charged at 7% per annum on the amount owed.

As of October 31, 2015 and 2014, the Company owed $27,229 and $0 respectively to Shenzhen Hygeian Medical Device Co., Ltd., which is unsecured and repayable on demand. Interest is charged at 7% per annum on the amount owed.

As of October 31, 2015 and 2014, the Company owed $1,807,103 and $1,618,333 to Chi Fung Yu, $1,660,763 and $1,370,405 to Tie Jun Chen, $33,133 and $0 to Que Feng (related parties), which are unsecured and repayable on demand. Interest is charged at 7% per annum on the amount owed.

Total interest expenses on advances from a stockholder accrued for the year ended October 31, 2015 and October 31, 2014 are $31,615 and $26,081 for Titan Technology Development Limited.

Total interest expenses on advances from following company accrued for the year ended October 31, 2015 and October 31, 2014 are $144 and $0 for Shenzhen Hygeian Medical Device Co., Ltd.

Total interest expenses on advances from following related parties accrued for the year ended October 31, 2015 and October 31, 2014 are $99,978 and $87,351 for Chi Fung Yu; $87,089 and $67,961 for Tie Jun Chen; $1,495 and $0 for Que Feng.

As of October 31, 2015 and October 31, 2014, the Company owed the following amounts respectively to two directors for advances made - $417,966 and $382,280 to Hui Wang, $21,897 and $20,230 to Chi Ming Yu. These advances were made on an unsecured basis, repayable on demand and interest free.

Imputed interest on the amounts owed to two directors for the year ended October 31, 2015 and 2014 respectively is $21,164 and $20,079 for Hui Wang; $0 and $0 for Chi Ming Yu.

Income Tax

ABMT was incorporated in the United States and has incurred net operating loss for income tax purposes for 2015 and 2014. ABMT has net operating loss carry forwards for income taxes amounting to approximately $1,612,970 and $1,512,723 as of October 31, 2015 and 2014 respectively which may be available to reduce future years’ taxable income. These carry forwards, will expire, if not utilized, commencing in 2029. Management believes that the realization of the benefits from these losses appears uncertain due to the Company’s limited operating history and continuing losses. Accordingly, a full, deferred tax asset valuation allowance has been provided and no deferred tax asset valuation allowance has been provided and no deferred tax asset benefit has been recorded. The valuation allowance at October 31, 2015 and 2014 was $548,410 and $514,326 respectively. The net change in the valuation allowance for 2014 was an increase of $34,084.

Masterise was incorporated in the BVI and under current law of the BVI, is not subject to tax on income.

Shenzhen Changhua was incorporated in the PRC and is subject to PRC income tax which is computed according to the relevant laws and regulations in the PRC. The income tax rate has been 25%. No income tax expense has been provided by Shenzhen Changhua as it is waiting for CFDA approval and it has incurred losses.

Net Loss

As reflected in the accompanying audited consolidated financial statements, the Company has an accumulated deficit of $6,262,961 at October 31, 2015 that includes a net loss of $862,854 for the year ended October 31, 2015. We are in Clinical Trial phase and do not have a CFDA permit to produce, market or sell in China.

We therefore do not have any revenue from inception to October 31, 2015 but have to incur operating expenses for the upkeep of the Company and the clinical trials.

Liquidity and Capital Resources

We had a working capital deficit of $4,568,106 at October 31, 2015 compared to a working capital deficit of $3,863,028 as of October 31, 2014. Our working capital deficit increased as a result of the fact that we are in clinical trial phase, the company has put all resources to complete the clinical trials. We do not have a CFDA permit to produce, market or sell in China. We had no revenues during the year and that our sole source of financing came in the form of a loan from our related parties and stockholders.

Cash Flows

Net Cash Used in Operating Activities

Net cash used in operating activities was $820,393 in the year ended October 31, 2015. This amount was attributable primarily to the net loss after adjustment for non-cash items, such as depreciation and imputed interest on advances from directors.

Net Cash Used in Investing Activities

We recorded $16,412 net cash used in investing activities in the year ended October 31, 2015. This amount reflected purchases of property and equipment, primarily for research and development to our facilities.

Net Cash Provided by Financing Activities

Net cash provided by financing activities in the year ended October 31, 2015 was $801,975, which represented advances from related parties.

Operating Capital and Capital Expenditure Requirements

Our ability to continue as a going concern and support the commercialization of current products is dependent upon our ability to obtain additional financing in the near term. We anticipate that such funding will be in the form of equity financing from sales of our common stock. However, there is no assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our business plan should we decide to proceed. We anticipate continuing to rely on advances from our related parties and stockholders in order to continue to fund our business operations.

We believe that our existing cash, cash equivalents at October 31, 2015, will be insufficient to meet our cash needs. The management is actively pursuing additional funding and strategic partners, which will enable the Company to implement our business plan, business strategy, to continue research and development, clinical trials or further development that may arise.

Debt Conversion

On November 13, 2015, the Company entered into a debt conversion agreement with Titan Technology Development Ltd., pursuant to which the Company and Titan agreed to convert $500,000 of the accrued interest of the outstanding debt owed by the Company to Titan into shares of the Company’s Common Stock at a conversion price of $0.05 per share. Pursuant to the terms of the Debt Conversion Agreement, on November 13, 2015, $500,000 of the accrued interest of TTD’s outstanding loan was converted into 10,000,000 shares of Company Common Stock.

Going Concern

As reflected in the accompanying consolidated financial statements, the Company has an accumulated deficit of $6,262,961 as of October 31, 2015 that includes a net loss of $862,854 for the year ended October 31, 2015. The Company’s total current liabilities exceed its total current assets by $4,568,106 and the Company used cash in operations of $820,393.

These factors raise substantial doubt about our ability to continue as a going concern. In view of the matters described above, recoverability of a major portion of the recorded asset amounts shown in the accompanying balance sheet is dependent upon continued operations of the Company, which in turn is dependent up the Company’s ability to raise additional capital, obtain financing and succeed in its future operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management has taken steps to revise its operating and financial requirements, which it believes are sufficient to provide the Company with the ability to continue as a going concern. The Company is now pursuing additional funding and potential merger or acquisition candidates, which would enhance stockholders’ investment. Management believes that the above actions will allow the Company to continue operations through the next fiscal year.

As of October 31, 2015, loans from the Company’s stockholder, two directors, three related parties and a non-related third party totaling $3,968,091 were provided to us for use as working capital. Management believes that such financing will allow us to continue operations through the next fiscal year. The Company is also actively pursuing a number of private placements funding which would ensure continued operations.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our investors.

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including but not limited to those related to income taxes and impairment of long-lived assets. We base our estimates on historical experience and on various other assumptions and factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Based on our ongoing review, we plan to adjust to our judgments and estimates where facts and circumstances dictate. Actual results could differ from our estimates.

We believe the following critical accounting policies are important to the portrayal of our financial condition and results and require our management’s most difficult, subjective or complex judgments, often because of the need to make estimates about the effect of matters that are inherently uncertain.

|

1. |

Property and equipment |

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for additions, major renewals and betterments are capitalized and expenditures for maintenance and repairs are charged to expense as incurred.

Depreciation is provided on a straight-line basis, less estimated residual value over the assets estimated useful lives. The estimated useful lives of the assets are 5 years.

In accordance with FASB Codification Topic 360 (ASC Topic 360), “Accounting for the impairment or disposal of Long-Lived Assets”, long-lived assets and certain identifiable intangible assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For purposes of evaluating the recoverability of long-lived assets, the recoverability test is performed using undiscounted net cash flows related to the long-lived assets. The Company reviews long-lived assets to determine that carrying values are not impaired.

Long-lived assets, such as property, plant and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the book value of the asset may not be recoverable. Impairment of the carrying value of long-lived assets would be indicated if the best estimate of future undiscounted cash flows expected to be generated by the asset grouping is less than its carrying value. If an impairment is indicated, any loss is measured as the difference between estimated fair value and carrying value and is recognized in operating income. For the year ended October 31, 2015 and 2014, the company has not recognized any impairment charges.

|

3. |

Fair value of financial instruments |

FASB Codification Topic 825 (ASC Topic 825), “Disclosure About Fair Value of Financial Instruments,” requires certain disclosures regarding the fair value of financial instruments. The carrying amounts of other receivables and prepaid expenses, other payables and accrued expenses, due to a stockholder, directors and related parties approximate their fair values because of the short-term nature of the instruments. The management of the Company is of the opinion that the Company is not exposed to significant interest or credit risks arising from these financial statements.

Government grants are recognized when there is reasonable assurance that the Company complies with any conditions attached to them and the grants will be received.

The Company accounts for income taxes under the FASB Codification Topic 740-10-25 (“ASC 740-10-25”). Under ASC 740-10-25, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under ASC 740-10-25, the effect on deferred tax assets and liabilities of a change in tax rates is recognized as income in the period included the enactment date.

|

6. |

Research and Development |

Research and development costs related to both present and future products are expensed as incurred.

|

7. |

Foreign currency translation |

The financial statements of the Company’s subsidiary denominated in currencies other than US $ are translated into US $ using the closing rate method. The balance sheet items are translated into US $ using the exchange rates at the respective balance sheet dates. The capital and various reserves are translated at historical exchange rates prevailing at the time of the transactions while income and expenses items are translated at the average exchange rate for the year. All exchange differences are recorded within equity.

Recent Accounting Pronouncements

In August 2014, FASB issued Accounting Standards Update (ASU) No. 2014-15 Preparation of Financial Statements – Going Concern (Subtopic 205-40), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. Under generally accepted accounting principles (GAAP), continuation of a reporting entity as a going concern is presumed as the basis for preparing financial statements unless and until the entity’s liquidation becomes imminent. Preparation of financial statements under this presumption is commonly referred to as the going concern basis of accounting. If and when an entity’s liquidation becomes imminent, financial statements should be prepared under the liquidation basis of accounting in accordance with Subtopic 205-30, Presentation of Financial Statements—Liquidation Basis of Accounting. Even when an entity’s liquidation is not imminent, there may be conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern. In those situations, financial statements should continue to be prepared under the going concern basis of accounting, but the amendments in this Update should be followed to determine whether to disclose information about the relevant conditions and events. The amendments in this Accounting Standards Update are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early application is permitted. The Company will evaluate the going concern considerations in this ASU, however, at the current period, management does not believe that it has met conditions which would subject these financial statements for additional disclosure.

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

ADVANCED BIOMEDICAL TECHNOLOGIES, INC.