UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended November

30, 2015

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-17284

MERCARI COMMUNICATIONS GROUP, LTD.

(Exact name of registrant as specified in

its charter)

| Colorado |

|

84-1085935 |

| (State or other jurisdiction |

|

(IRS Employer Identification No.) |

| of incorporation or organization) |

|

|

135 Fifth Ave., 10thFloor,

New York, NY 10010

(Address of principal executive offices)

(212) 739-7689

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes x No

¨

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files).

Yes x No

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

|

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes x No

¨

Indicate the number of shares outstanding of each of the issuer’s

classes of common stock, as of the latest practical date: As of January 14, 2016, there were 45,411,400 shares of the registrant’s

common stock issued and outstanding.

MERCARI COMMUNICATIONS GROUP, LTD.

FORM 10-Q

November 30, 2015

INDEX

INTRODUCTORY NOTE. CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING INFORMATION AND RISK FACTORS

This Quarterly Report on Form 10-Q contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 about Mercari

Communications Group, Ltd. (the “Company,” “Mercari,” “we,” “us,” and “our”)

that are subject to risks and uncertainties. Forward-looking statements include information concerning future financial performance,

business strategy, projected plans and objectives. Statements preceded by, followed by or that otherwise include the words

“anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,”

“may increase,” “may fluctuate” and similar expressions of future or conditional verbs such as “will,”

“should,” “would,” and “could” are generally forward-looking in nature and not historical facts.

Actual results may differ materially from those projected, implied, anticipated or expected in the forward-looking statements.

Readers of this Quarterly Report should not rely solely on the forward-looking statements and should consider all uncertainties

and risks throughout this report. The statements are representative only as of the date they are made. The Company undertakes no

obligation to update any forward-looking statement.

These forward-looking statements, implicitly

and explicitly, include the assumptions underlying the statements and other information with respect to the Company’s beliefs,

plans, objectives, goals, expectations, anticipations, estimates, financial condition, results of operations, future performance

and business, including management’s expectations and estimates with respect to revenues, expenses, return on equity, return

on assets, asset quality and other financial data.

Although the Company believes that the expectations

reflected in the forward-looking statements are reasonable, these statements involve risks and uncertainties that are subject to

change based on various important factors, some of which are beyond the control of the Company. The following factors, among others,

could cause the Company’s results or financial performance to differ materially from its goals, plans, objectives, intentions,

expectations and other forward-looking statements:

| · | general economic and industry conditions; |

| · | limited resources and need for additional financing; |

| · | competition for suitable private companies with which to merge; |

| · | no definitive agreements or business opportunities identified; |

| · | substantial dilution to current shareholders if a merger occurs; and |

| · | our stock is thinly traded with limited liquidity. |

All forward-looking statements are qualified

in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this Quarterly Report

on Form 10-Q to reflect events or circumstances after the date hereof. New factors emerge from time to time, and it is not possible

for us to predict which factors, if any, will arise. In addition, the Company cannot assess the impact of each factor on the Company’s

business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

MERCARI COMMUNICATIONS GROUP, LTD.

CONDENSED BALANCE SHEETS

| | |

(unaudited) | | |

| |

| | |

Nov 30, 2015 | | |

May 31, 2015 | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 603 | | |

$ | 1,099 | |

| Prepaid Expense | |

| 199 | | |

| - | |

| Total Assets | |

$ | 802 | | |

$ | 1,099 | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts Payable & Accrued Liabilities | |

$ | 700 | | |

$ | 1,917 | |

| Shareholder Advances | |

| 105,987 | | |

| 74,000 | |

| Total Liabilities | |

| 106,687 | | |

| 75,917 | |

| | |

| | | |

| | |

| Shareholders' Equity | |

| | | |

| | |

Common Stock, Par value $.00001;

Authorized 950,000,000 shares, Issued 45,411,400 shares at November 30, 2015 and May 31, 2015 | |

| 454 | | |

| 454 | |

| Paid-In Capital | |

| 158,722 | | |

| 158,722 | |

| | |

| (265,061 | ) | |

| (233,994 | ) |

| Total Shareholders' Deficit | |

| (105,885 | ) | |

| (74,818 | ) |

| | |

| | | |

| | |

| Total Liabilities and Shareholders' Deficit | |

$ | 802 | | |

$ | 1,099 | |

The accompanying notes are an integral part

of these financial statements.

MERCARI COMMUNICATIONS GROUP, LTD.

CONDENSED STATEMENTS OF OPERATIONS

| | |

(unaudited) | | |

(unaudited) | |

| | |

For the three months ended | | |

For the six months ended | |

| | |

November 30, | | |

November 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenues: | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 18,019 | | |

| 8,098 | | |

| 31,067 | | |

| 8,805 | |

| | |

| - | | |

| - | | |

| - | | |

| - | |

| Net (Loss) | |

$ | (18,019 | ) | |

$ | (8,098 | ) | |

$ | (31,067 | ) | |

$ | (8,805 | ) |

| Basic & Diluted Loss Per Share | |

| (0.0004 | ) | |

| (0.0002 | ) | |

| (0.0007 | ) | |

| (0.0002 | ) |

| Weighted Average Shares | |

| 45,411,400 | | |

| 45,411,400 | | |

| 45,411,400 | | |

| 45,411,400 | |

The accompanying notes are an integral part

of these financial statements.

MERCARI COMMUNICATIONS GROUP, LTD.

CONDENSED STATEMENTS OF CASH FLOWS

| | |

(unaudited) |

|

| | |

For the six months ended November 30, |

|

| | |

2015 | | |

2014 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net Loss | |

$ | (31,067 | ) | |

$ | (8,805 | ) |

| Increase (Decrease) in Accounts Payable | |

| (1,217 | ) | |

| 6,314 | |

| Increase in Prepaid Expense | |

| (199 | ) | |

| - | |

| Net Cash Used in operating activities | |

| (32,483 | ) | |

| (2,491 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Net cash provided by investing activities | |

| - | | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Payments on shareholder loans | |

| - | | |

| - | |

| Proceeds from shareholder advance | |

| 31,987 | | |

| 5,500 | |

| Proceeds from notes payable | |

| - | | |

| - | |

| Proceeds from sale of stock | |

| - | | |

| - | |

| Cash contributed by shareholders | |

| - | | |

| - | |

| Net Cash Provided by financing activities | |

| 31,987 | | |

| 5,500 | |

| | |

| | | |

| | |

| Net (Decrease) Increase in Cash and Cash Equivalents | |

| (496 | ) | |

| 3,009 | |

| Cash and Cash Equivalents at Beginning of Period | |

| 1,099 | | |

| 1,503 | |

| Cash and Cash Equivalents at End of Period | |

$ | 603 | | |

$ | 4,512 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE

OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the year for: | |

| | | |

| | |

| Interest | |

$ | - | | |

$ | - | |

| Franchise and income taxes | |

$ | - | | |

$ | - | |

The accompanying notes are an integral part

of these financial statements.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

This summary of accounting policies for

Mercari Communications Group, Ltd. (the “Company”) is presented to assist in understanding the Company’s financial

statements. The accounting policies conform to generally accepted accounting principles and have been consistently applied in the

preparation of the financial statements.

Interim Reporting

The unaudited financial statements as of

November 30, 2015 and for the six months then ended reflect, in the opinion of management, all adjustments (which include only

normal recurring adjustments) necessary to fairly state the financial position and results of operations for the six months. Operating

results for interim periods are not necessarily indicative of the results which can be expected for full years.

Nature of Operations and Going Concern

The accompanying financial statements have

been prepared on the basis of accounting principles applicable to a “going concern”, which assume that the Company

will continue in operation for at least one year and will be able to realize its assets and discharge its liabilities in the normal

course of operations.

Several conditions and events cast doubt

about the Company’s ability to continue as a “going concern.” The Company has incurred net losses of approximately

$265,061 from inception to November 30, 2015, has no revenues and requires additional financing

in order to finance its business activities on an ongoing basis. The Company’s future capital requirements will depend on

numerous factors including, but not limited to, continued progress in finding a merger candidate and the pursuit of business opportunities.

The Company is actively pursuing alternative financing and has had discussions with various third parties, although no firm commitments

have been obtained. In the interim, shareholders of the Company have been contributing capital to the Company to meet its ordinary

and normal operating expenses. Management believes that actions presently being taken to revise the Company’s operating and

financial requirements provide them with the opportunity to continue as a “going concern”.

These financial statements do not reflect

adjustments that would be necessary if the Company were unable to continue as a “going concern”. While management believes

that the actions already taken or planned, will mitigate the adverse conditions and events which raise doubt about the validity

of the “going concern” assumption used in preparing these financial statements, there can be no assurance that these

actions will be successful. If the Company were unable to continue as a “going concern,” then substantial adjustments

would be necessary to the carrying values of assets, the reported amounts of its liabilities, the reported revenues and expenses,

and the balance sheet classifications used.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (Continued)

Organization and Basis of Presentation

The Company was incorporated under the laws

of the State of Colorado on December 30, 1987. From 1988 until early in 1990, the Company was engaged in the business of providing

educational products, counseling, seminar programs, and publications such as newsletters to adults aged 30 to 50. The Company financed

its business with private offerings of securities, obtaining shareholder loans, and with an underwritten initial public offering

of securities registered with the Securities and Exchange Commission (“SEC”). The Company’s business failed in

early 1990. The Company ceased all operating activities during the period from June 1, 1990 to November 30, 2001 and was considered

dormant. During this period that the Company was dormant, it did not file required reports with the SEC under the Securities Exchange

Act of 1934, as amended (“Exchange Act”). From November 30, 2001 to March 1, 2004, the Company was in the

development stage. On August 3, 2004, the shareholders of the Company approved a plan of quasi-reorganization which called for

a restatement of accounts to eliminate the accumulated deficit and related capital accounts on the Company’s balance sheet.

The quasi-reorganization was effective March 1, 2004. Since March 1, 2004, the Company is in the development stage, and

has not commenced planned principal operations.

Nature of Business

The Company has no products or services

as of November 30, 2015. The Company is seeking merger or acquisition candidates. The Company intends to acquire interests in various

business opportunities, which in the opinion of management will provide a profit to the Company.

Cash and Cash Equivalents

For purposes of the statement of cash flows,

the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents

to the extent the funds are not being held for investment purposes.

Pervasiveness of Estimates

The preparation of financial statements

in conformity with generally accepted accounting principles required management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income Taxes

The Company accounts

for income taxes under the provisions of ASC 740-10 & 740-30 (formerly SFAS No.109, “Accounting for Income Taxes”).

ASC 740 requires recognition of deferred income tax assets and liabilities for the expected future income tax consequences, based

on enacted tax laws, of temporary differences between the financial reporting and tax bases of assets and liabilities.

Loss per Share

Basic loss per share has been computed by

dividing the loss for the period applicable to the common shareholders by the weighted average number of common shares during the

years. There are no outstanding common stock equivalents for November 30, 2015 and 2014 and are thus not considered.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (Continued)

Concentration of Credit Risk

The Company has no significant off-balance-sheet

concentrations of credit risk such as foreign exchange contracts, options contracts or other foreign hedging arrangements.

Fair Value of Financial Instruments

The carrying value

of cash and accrued expenses, if applicable, approximate their fair values based on the short-term maturity of these instruments.

The carrying amounts of debt were also estimated to approximate fair value.

The Company utilizes the methods of fair

value measurement as described in ASC 820 to value its financial assets and liabilities. As defined in ASC 820, fair value is based

on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. In order to increase consistency and comparability in fair value measurements, ASC 820 establishes a fair

value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three broad levels, which are

described below:

Level 1: Quoted prices (unadjusted) in

active markets that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest

priority to Level 1 inputs.

Level 2: Observable prices that are based

on inputs not quoted on active markets, but corroborated by market data.

Level 3: Unobservable inputs are used when

little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs.

New Accounting Pronouncements

In August 2014, the FASB issued Accounting

Standards Update “ASU” 2014-15 on “Presentation of Financial Statements Going Concern (Subtopic 205-40) –

Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” (the “Update”). Currently,

there is no guidance in U.S. GAAP about management’s responsibility to evaluate whether there is substantial doubt about

an entity’s ability to continue as a going concern or to provide related footnote disclosures. The amendments in the Update

provide that guidance. In doing so, the amendments are intended to reduce diversity in the timing and content of footnote disclosures.

The amendments require management to assess an entity’s ability to continue as a going concern by incorporating and expanding

upon certain principles that are currently in U.S. auditing standards. Specifically, the amendments (1) provide a definition of

the term substantial doubt, (2) require an evaluation every reporting period including interim periods, (3) provide principles

for considering the mitigating effect of management’s plans, (4) require certain disclosures when substantial doubt is alleviated

as a result of consideration of management’s plans, (5) require an express statement and other disclosures when substantial

doubt is not alleviated, and (6) require an assessment for a period of one year after the date that the financial statements are

issued (or available to be issued).

The amendments in this Update are effective

for public and nonpublic entities for annual periods ending after December 15, 2016. Early adoption is permitted.

The Company has reviewed all other recently issued but not yet

effective accounting pronouncements and have determined that these new accounting pronouncements are either not applicable or would

not have a material impact on the results of operations or changes in the financial position.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 2 - COMMITMENTS

As of November 30, 2015 all activities of

the Company are conducted on a rent free basis at the corporate offices of Algodon Wines & Luxury Development Group, Inc. or

“AWLD”, the majority shareholder of the Company. Currently, there are no outstanding debts owed by the Company for

the use of these facilities.

NOTE 3 - COMMON STOCK TRANSACTIONS

On August 3, 2004, the Company authorized

a 900 to 1 reverse stock split of the Company’s common stock. On May 29, 2008, the Company authorized a 3.5 to 1 reverse

stock split of the Company’s common stock. All references to the Company’s common stock in the financial statements

have been restated to reflect the reverse stock splits.

On December 17, 2001, the Board of

Directors approved the cancellation of 64,524 shares of common stock. During the year ended May 31, 2003, these shares were

cancelled.

On December 17, 2001, the Board of

Directors authorized the sale of 240,945 restricted common shares at par value to three directors of the Company. The directors

paid $7,590 in cash consideration for those shares. During the year ended May 31, 2003, these shares were issued.

On January 19, 2007, the Company issued

two promissory notes for $10,000 each to two nonaffiliated lenders. The notes were payable by the Company only at the time, and

in the event, the Company became current in reporting obligations under the Exchange Act, as amended. At the time when the notes

became payable, the Company agreed to issue and deliver to each of the two lenders 285,714 shares of the Company’s unregistered

common stock. On March 9, 2007, the Company issued 571,428 shares of stock as payment for the notes payable.

On June 18, 2007, the Company sold 142,857

shares of its common stock to Kanouff, LLC (“KLLC”), a Colorado limited liability company, for $5,000 in cash, and

sold 142,857 shares of its common stock to Underwood Family Partners, Ltd. (the “Partnership”), a Colorado limited

partnership, for $5,000 in cash. John P. Kanouff, a former officer and director of the Company, is the sole owner and member of

KLLC; and L. Michael Underwood, a former officer and director of the Company, is the general partner of the Partnership. The Company

sold such shares to KLLC and the Partnership in order to obtain working capital. The Registrant relied upon Section 4(2) of the

Securities Act of 1933 as providing the exemption from registration under such Act for such transactions.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 3 - COMMON STOCK TRANSACTIONS (continued)

On November 27, 2007, the Company sold

214,286 shares of its common stock to Kanouff, LLC for $7,500 in cash and sold 214,286 shares of its common stock to Underwood

Family Partners, Ltd. for $7,500 in cash. The Company sold such shares to KLLC and the Partnership in order to obtain working capital.

The Registrant relied upon Section 4(2) of the Securities Act of 1933 as providing the exemption from registration under such Act

for such transactions.

In connection with the 3.5 to 1 reverse

stock split approved on May 29, 2008, an additional 5,729 shares of common stock were issued due to rounding provisions included

in the terms of the reverse stock split. On June 4, 2008, the Company cancelled 5,729 of its outstanding shares of common stock.

These shares were surrendered for cancellation by the then majority shareholders of the Company in order to offset shares issued

by the Company in rounding up transactions in connection with the 3.5 to 1 reverse stock split approved on May 29, 2008.

On November 9, 2009, pursuant to the Stock

Purchase Agreement described under Note 5, Mercari offered and sold 43,822,001 shares of its common stock to AWLD. The offer and

sale by the Company of the common stock to AWLD was exempt from registration under the Securities Act of 1933, as amended (the

"Securities Act"), pursuant to Section 4(2) thereof. The Company made this determination based on the representations

of AWLD which included, in pertinent part, that AWLD was an "accredited investor" within the meaning of Rule 501 of Regulation

D promulgated under the Securities Act, that AWLD was acquiring the common stock for investment purposes for its own account and

not as nominee or agent, and not with a view to the resale or distribution thereof, and that AWLD understood that the common stock

may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

NOTE 4 - RELATED PARTY TRANSACTIONS

There are no current related party transactions

other than discussed in the Company’s annual report on Form 10-K for the year ended May 31, 2015 and other previous filings

as filed with the SEC.

For the six months ended November 30, 2015,

the Company received additional shareholder advances totaling $31,987 from AWLD, the Company’s parent, bringing the total

advance balance to $105,987. This total advance carries no interest and is intended to be converted to equity in the future.

MERCARI COMMUNICATIONS GROUP, LTD.

NOTES TO CONDENSED UNAUDITED FINANCIAL

STATEMENTS

NOTE 5 – STOCK PURCHASE AGREEMENT

On November 9, 2009, we entered into and

closed the Stock Purchase Agreement with AWLD, KLLC, and the Partnership. Immediately prior to closing, KLLC and the Partnership

were the majority shareholders of the Company, and the Stock Purchase resulted in a change in control of the Company. AWLD is headquartered

in New York, NY, and is a virtually integrated company that creates, develops, markets, sells and manages private equity investment

opportunities, formerly in the biotechnology industry and currently in non-leveraged global real estate assets located in Argentina.

In connection with the Stock Purchase, AWLD purchased, and the Company sold, an aggregate of 43,822,001 shares of common stock

for a purchase price of $43,822, or $0.001 per share. In addition, AWLD purchased 200 shares of common stock from KLLC and 200

shares of common stock from the Partnership for a purchase price of $180,000 payable to each selling shareholder, of which $105,000

was paid at closing and $75,000 was previously paid in connection with a letter of intent and related amendments. Immediately following

the closing of the Stock Purchase Agreement, there were 45,411,400 shares of common stock issued and outstanding. Immediately following

the closing of the Stock Purchase Agreement, AWLD owned an aggregate of 43,822,401 shares of the Company’s common stock out

of the total of 45,411,400 shares of common stock issued and outstanding at the closing, or approximately 96.5% of the Company’s

issued and outstanding shares.

The Stock Purchase Agreement contained post-closing

covenants whereby Mercari and AWLD agreed to utilize their commercially reasonable efforts to cause Mercari to (i) remain a Section

12(g) reporting company in compliance with and current in its reporting requirements under the Exchange Act; and (ii) cause all

of the assets and business or equity interest of AWLD, its subsidiaries and affiliated companies to be transferred to Mercari and,

in connection with such transactions, cause Mercari’s stock to be distributed by AWLD to AWLD’s stockholders and the

holders of equity interests in the affiliated companies (“Reorganization Transaction”). In connection with and contemporaneously

with the Reorganization Transaction, it is anticipated that Mercari and/or AWLD will seek to obtain at least $10 million in gross

proceeds from a financing (the “Financing”). If the gross proceeds from the Financing exceed $15 million at the time

of the last closing of such financing, Mercari will issue additional shares of common stock to AWLD at a purchase price of $.001

per share as follows: (i) 18,164,560 additional shares if the amount of the Financing is at least $15 million and less than $20

million; or (ii) 34,058,550 additional shares if the amount of the Financing is $20 million or more. After consummation of the

Financing, Mercari will seek to register for resale all of the shares issued in the Financing and shares of common stock issued

by Mercari from and after December 1, 2001 and prior to the date of the Stock Purchase Agreement. Mercari will use its commercially

reasonable efforts to file the registration statement within 60 days after consummation of the Reorganization Transaction (“Filing

Date”) and to have the registration statement become effective within 180 days after the Filing Date. If the SEC requires

Mercari to reduce the number of shares included under such registration statement, any such reduction will first be made from the

shares issued in the Financing. The post-closing obligations of AWLD and Mercari discussed herein are contingent upon AWLD’s

good faith determination that, after taking commercially reasonable efforts, the transactions are feasible. Such determination

shall take into account all relevant material factors, including without limitation, then-current economic, financial and market

conditions.

Upon closing of the Stock Purchase Agreement,

Mercari experienced a change in control and a change in all the members of the Board of Directors and executive officers.

NOTE 6 – SUBSEQUENT EVENTS

The

Company adopted ASC 855, and has evaluated all events occurring after November 30, 2015, the date of the most recent balance sheet,

for possible adjustment to the financial statements or disclosures through January 14, 2016, which is the date on which the financial

statements were issued.

Item 2. Management's Discussion and Analysis of

Financial Condition and Results of Operations.

General

This discussion should be read in conjunction

with Management's Discussion and Analysis of Financial Condition and Results of Operations in the Company's annual report on Form

10-K for the year ended May 31, 2015.

Results of Operations

The Company is a development stage business,

which intends to acquire a United States or foreign based business which is privately owned and wishes to become a publicly owned

business. The Company was inactive and did not file reports required under the Securities Exchange Act of 1934 (“Exchange

Act”) from 1990 through 2000, and has not conducted any material business operations since 1990. The Company was reactivated

in 2001 and is now current in its state and United States internal revenue filing obligations and the Company has filed all reports

required to be filed by it with the SEC under the Exchange Act, during the past seven years. The Company is now actively seeking

one or more acquisition candidates.

During each of the years since the Company

was reactivated, the Company has had no revenue and has had losses approximately equal to the expenditures made to reactivate and

meet filing and reporting obligations. We do not expect any revenue unless and until a business acquisition transaction is completed.

Our expenses have been paid from capital contributions and advances from the directors of the Company.

Liquidity and Capital Resources

The Company requires working capital principally

to fund its current activities. There are no commitments from banks or other lending sources for lines of credit or similar short-term

borrowing, but the Company has been able to obtain additional capital required from its officers, directors and principal shareholders

or other related entities.

In order to complete any acquisition, the

Company may be required to supplement its available cash and other liquid assets with proceeds from borrowings, the sale of additional

securities, including the private placement of restricted stock and/or a public offering, or other sources. There can be no assurance

that any such required additional funding will be available or favorable to the Company.

The Company’s business plan requires

substantial funding from a public or private offering of its common stock in connection with a business acquisition, for which

the Company has no commitments. The Company may actively pursue other financing or funding opportunities at such time as a business

acquisition opportunity becomes available.

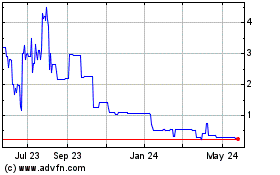

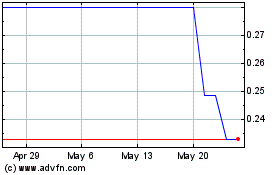

During February of 2008, shares of the common

stock of the Company were cleared for quotation on the OTC Bulletin Board and the Pink Sheets under the symbol of “MCAR.”

Off Balance Sheet Arrangements

We have no off balance sheet financing or

similar arrangements and we do not expect to initiate any such arrangement.

Item 3. Quantitative and Qualitative Disclosures

About Market Risk.

As a smaller reporting company, the Company

is not required to provide the information required by this Item.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

We maintain disclosure controls and procedures

that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized

and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that

such information is accumulated and communicated to management, including the Chief Executive Officer and Chief Financial Officer,

as appropriate, to allow timely decisions regarding required disclosure. Management necessarily applies its judgment in assessing

the costs and benefits of such controls and procedures, which, by their nature, can provide only reasonable assurance regarding

management’s control objectives.

Our management, with the participation of

our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures

(as defined in Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based on this evaluation,

our Chief Executive Officer and Chief Financial Officer have concluded that the design and operation of our disclosure controls

and procedures were effective as of such date to provide assurance that information required to be disclosed by us in the reports

that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified

in the rules and forms of the Securities and Exchange Commission, and that such information is accumulated and communicated to

management as appropriate to allow timely decisions regarding disclosure.

Changes in Internal Control over Financial Reporting

There have been

no changes in internal controls over financial reporting during the Company’s last fiscal quarter (the quarter ended November

30, 2015) that have materially affected, or are reasonably likely to materially affect, the Company’s internal controls

over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

There is no pending litigation to which

the Company is presently a party or to which the Company’s property is subject and management is not aware of any litigation

which may arise in the future.

Item 1A. Risk Factors

As a smaller reporting company, the Company

is not required to provide the information required by this Item.

Item 2. Unregistered Sales of Equity Securities

and Use of Proceeds

During the quarter

ended November 30, 2015, we did not have any sales of securities in transactions that were not registered under the Securities

Act of 1933, as amended, that have not been previously reported in a Form 8-K.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

N/A.

Item 5. Other Information

None.

Item 6. Exhibits

Please see the exhibit index following the signature page of

this report.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

MERCARI COMMUNICATIONS GROUP, LTD |

| |

|

|

|

|

| |

|

|

|

|

| DATE: January 14, 2016 |

|

By: |

/s/ Scott L. Mathis |

|

| |

|

|

|

Scott L. Mathis, Chief Executive Officer |

| |

|

|

|

|

|

| |

|

|

|

|

| DATE: January 14, 2016 |

|

By: |

/s/ Maria I. Echevarria |

|

| |

|

|

|

Maria I. Echevarria, Chief Financial Officer |

| |

|

|

|

|

|

EXHIBIT INDEX

The following is a complete list of exhibits filed as part of

this Form 10-Q. Exhibit numbers correspond to the numbers in the Exhibit Table of Item 601 of Regulation S-K.

| Exhibit |

|

|

| Number |

|

Description of Exhibit |

| |

|

|

| 3.1 |

|

Articles of Incorporation.(1) |

| |

|

|

| 3.2 |

|

Articles of Amendment to Articles of Incorporation.(2) |

| |

|

|

| 3.3 |

|

Bylaws of the Registrant (as amended).(3) |

| |

|

|

| 3.4 |

|

Plan of Recapitalization adopted August 4, 2004.(4) |

| |

|

|

| 10.1 |

|

Stock Purchase Agreement by and between Diversified Private Equity Corporation, Mercari Communications Group, Ltd., Kanouff, LLC and Underwood Family Partners, LTD., dated as of November 9, 2009.(5) |

| |

|

|

| 31.1 |

|

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended(6) |

| |

|

|

| 31.2 |

|

Certification of Chief Financial Officer pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended(6) |

| |

|

|

| 32.1 |

|

Certification of Chief Executive Officer pursuant to 18 U. S. C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002(7) |

| |

|

|

| 32.2 |

|

Certification of Chief Financial Officer pursuant to 18 U. S. C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002(7) |

| |

|

|

| 101.INS |

|

XBRL Instance Document |

| |

|

|

| 101.SCH |

|

XBRL Taxonomy Extension Schema |

| |

|

|

| 101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase |

| |

|

|

| 101.LAB |

|

XBRL Taxonomy Extension Label Linkbase |

| |

|

|

| 101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase |

| |

|

|

| 101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase |

| |

|

|

| |

|

|

| (1) |

|

Incorporated by reference from Exhibit 3.1 to the Company’s Annual Report on Form 10-K filed on March 7, 2007. |

| |

|

|

| (2) |

|

Incorporated by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on June 3, 2008. |

| |

|

|

| (3) |

|

Incorporated by reference from Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on June 3, 2008. |

| |

|

|

| (4) |

|

Incorporated by reference from Exhibit 3.3 to the Company’s Annual Report on Form 10-K filed on March 7, 2007. |

| |

|

|

| (5) |

|

Incorporated by reference from Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on November 10, 2009. |

| |

|

|

| (6) |

|

Filed herewith. |

| |

|

|

| (7) |

|

Furnished, not filed herewith. |

| |

|

|

EXHIBIT 31.1

CERTIFICATION

I, Scott L. Mathis, certify that:

1. I

have reviewed this 10-Q of Mercari Communications Group, Ltd.

2. Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report.

3. Based

on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented

in this report.

4. The

registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange

Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

| (a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

| (b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

| (c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

| (d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or its reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

5. The

registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent functions):

| (a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

| (b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| /s/ Scott L. Mathis |

| Scott L. Mathis. |

| Title: Chief Executive Officer (Principal Executive Officer) |

| Date: January 14, 2016 |

EXHIBIT 31.2

CERTIFICATION

I, Maria I. Echevarria, certify that:

1. I

have reviewed this 10-Q of Mercari Communications Group, Ltd.

2. Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report.

3. Based

on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented

in this report.

4. The

registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange

Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

| (a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

|

| (b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

| (c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

| (d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or its reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

5. The

registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent functions):

| (a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

| (b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| /s/ Maria I. Echevarria |

| Maria I. Echevarria |

| Title: Chief Financial Officer (Principal Financial Officer) |

| Date: January 14, 2016 |

EXHIBIT 32

CERTIFICATION

Pursuant to 18 U.S.C. Section 1350, as

Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In connection with the Quarterly Report of Mercari

Communications Group, Ltd. (the “Company”) on Form 10-Q for the period ended November 30, 2015, as filed with the

Securities and Exchange Commission on the date hereof (the “Report”), Scott L. Mathis, as Chief Executive Officer

and principal executive officer and Maria I. Echevarria, as Chief Executive Officer and principal financial officer of the

Company hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of

2002, to the best the undersigned’s knowledge and belief, that:

| (1) |

the Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| |

|

| (2) |

the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| /s/ Scott L. Mathis |

| Scott L. Mathis |

| Title: Chief Executive Officer (Principal Executive Officer) |

| Date: January 14, 2016 |

| /s/ Maria I. Echevarria |

| Maria I. Echevarria |

| Title: Chief Financial Officer (Principal Financial Officer) |

| Date: January 14, 2016 |

This certification accompanies this Report pursuant to Section

906 of the Sarbanes-Oxley Act of 2002 and shall not be deemed filed by the Company for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended.

v3.3.1.900

| X |

- DefinitionIf the value is true, then the document is an amendment to previously-filed/accepted document.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal period of the document report. For a first quarter 2006 quarterly report, which may also provide financial information from prior periods, the first fiscal quarter should be given as the fiscal period focus. Values: FY, Q1, Q2, Q3, Q4, H1, H2, M9, T1, T2, T3, M8, CY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in CCYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe end date of the period reflected on the cover page if a periodic report. For all other reports and registration statements containing historical data, it is the date up through which that historical data is presented. If there is no historical data in the report, use the filing date. The format of the date is CCYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word "Other".

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12b

-Subsection 1

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: (1) Large Accelerated Filer, (2) Accelerated Filer, (3) Non-accelerated Filer, (4) Smaller Reporting Company (Non-accelerated) or (5) Smaller Reporting Accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12b

-Subsection 1

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.3.1.900

CONDENSED BALANCE SHEETS - USD ($)

|

Nov. 30, 2015 |

May. 31, 2015 |

| Current Assets |

|

|

| Cash |

$ 603

|

$ 1,099

|

| Prepaid Expense |

199

|

0

|

| Total Assets |

802

|

1,099

|

| Current Liabilities |

|

|

| Accounts Payable & Accrued Liabilities |

700

|

1,917

|

| Shareholder Advances |

105,987

|

74,000

|

| Total Liabilities |

106,687

|

75,917

|

| Shareholders' Equity |

|

|

| Common Stock, Par value $.00001; Authorized 950,000,000 shares, Issued 45,411,400 shares at November 30, 2015 and May 31, 2015 |

454

|

454

|

| Paid-In Capital |

158,722

|

158,722

|

| Accumulated Deficit |

(265,061)

|

(233,994)

|

| Total Shareholders' Deficit |

(105,885)

|

(74,818)

|

| Total Liabilities and Shareholders' Deficit |

$ 802

|

$ 1,099

|

| X |

- DefinitionSum of the carrying values as of the balance sheet date of obligations incurred through that date and due within one year (or the operating cycle, if longer), including liabilities incurred (and for which invoices have typically been received) and payable to vendors for goods and services received, taxes, interest, rent and utilities, accrued salaries and bonuses, payroll taxes and fringe benefits. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19,20)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

| Name: |

us-gaap_AccountsPayableAndAccruedLiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionExcess of issue price over par or stated value of the entity's capital stock and amounts received from other transactions involving the entity's stock or stockholders. Includes adjustments to additional paid in capital. Some examples of such adjustments include recording the issuance of debt with a beneficial conversion feature and certain tax consequences of equity instruments awarded to employees. Use this element for the aggregate amount of additional paid-in capital associated with common and preferred stock. For additional paid-in capital associated with only common stock, use the element additional paid in capital, common stock. For additional paid-in capital associated with only preferred stock, use the element additional paid in capital, preferred stock. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.30(a)(1))

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 02

-Paragraph 31

-Article 5

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are expected to be realized in cash, sold, or consumed within one year (or the normal operating cycle, if longer). Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.9)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 3

-URI http://asc.fasb.org/extlink&oid=28358313&loc=d3e6801-107765

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 1

-URI http://asc.fasb.org/extlink&oid=28358313&loc=d3e6676-107765

| Name: |

us-gaap_AssetsCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

us-gaap_AssetsCurrentAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of currency on hand as well as demand deposits with banks or financial institutions. Includes other kinds of accounts that have the general characteristics of demand deposits. Also includes short-term, highly liquid investments that are both readily convertible to known amounts of cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. Excludes cash and cash equivalents within disposal group and discontinued operation. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Glossary Cash

-URI http://asc.fasb.org/extlink&oid=6506951

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 1

-Subparagraph (a)

-URI http://asc.fasb.org/extlink&oid=28358313&loc=d3e6676-107765

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 230

-SubTopic 10

-Section 45

-Paragraph 4

-URI http://asc.fasb.org/extlink&oid=56944662&loc=d3e3044-108585

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Glossary Cash Equivalents

-URI http://asc.fasb.org/extlink&oid=6507016

Reference 5: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.1)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

| Name: |

us-gaap_CashAndCashEquivalentsAtCarryingValue |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionAggregate par or stated value of issued nonredeemable common stock (or common stock redeemable solely at the option of the issuer). This item includes treasury stock repurchased by the entity. Note: elements for number of nonredeemable common shares, par value and other disclosure concepts are in another section within stockholders' equity. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.29)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 02

-Paragraph 30

-Article 5

| Name: |

us-gaap_CommonStockValue |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmounts due to recorded owners or owners with a beneficial interest of more than 10 percent of the voting interests or officers of the company. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 850

-SubTopic 10

-Section 50

-Paragraph 1

-Subparagraph (d)

-URI http://asc.fasb.org/extlink&oid=6457730&loc=d3e39549-107864

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 235

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08.(k)(1))

-URI http://asc.fasb.org/extlink&oid=26873400&loc=d3e23780-122690

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19(a))

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 04

-Paragraph 12

-Subparagraph a(1)

-Article 6

| Name: |

us-gaap_DueToOfficersOrStockholdersCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of liabilities and equity items, including the portion of equity attributable to noncontrolling interests, if any. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.32)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 03

-Paragraph 25

-Article 7

| Name: |

us-gaap_LiabilitiesAndStockholdersEquity |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionTotal obligations incurred as part of normal operations that are expected to be paid during the following twelve months or within one business cycle, if longer. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.21)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

| Name: |

us-gaap_LiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

us-gaap_LiabilitiesCurrentAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of asset related to consideration paid in advance for costs that provide economic benefits within a future period of one year or the normal operating cycle, if longer. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 2

-URI http://asc.fasb.org/extlink&oid=28358313&loc=d3e6787-107765

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 340

-SubTopic 10

-Section 05

-Paragraph 5

-URI http://asc.fasb.org/extlink&oid=51662447&loc=d3e5879-108316

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Glossary Current Assets

-URI http://asc.fasb.org/extlink&oid=6509628

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section 45

-Paragraph 1

-Subparagraph (g)

-URI http://asc.fasb.org/extlink&oid=28358313&loc=d3e6676-107765

| Name: |

us-gaap_PrepaidExpenseCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe cumulative amount of the reporting entity's undistributed earnings or deficit. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.31(a)(3))

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 04

-Article 3

| Name: |

us-gaap_RetainedEarningsAccumulatedDeficit |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionTotal of all stockholders' equity (deficit) items, net of receivables from officers, directors, owners, and affiliates of the entity which are attributable to the parent. The amount of the economic entity's stockholders' equity attributable to the parent excludes the amount of stockholders' equity which is allocable to that ownership interest in subsidiary equity which is not attributable to the parent (noncontrolling interest, minority interest). This excludes temporary equity and is sometimes called permanent equity. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 310

-SubTopic 10

-Section S99

-Paragraph 2

-Subparagraph (SAB TOPIC 4.E)

-URI http://asc.fasb.org/extlink&oid=27010918&loc=d3e74512-122707

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.29-31)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Staff Accounting Bulletin (SAB)

-Number Topic 4

-Section E

| Name: |

us-gaap_StockholdersEquity |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

us-gaap_StockholdersEquityAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.3.1.900

CONDENSED BALANCE SHEETS [Parenthetical] - $ / shares

|

Nov. 30, 2015 |

May. 31, 2015 |

| Common stock, par value |

$ 0.00001

|

$ 0.00001

|

| Common stock, authorized shares |

950,000,000

|

950,000,000

|

| Common stock, issued shares |

45,411,400

|

45,411,400

|

| X |

- DefinitionFace amount or stated value per share of common stock. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.29)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 02

-Paragraph 30

-Article 5

| Name: |

us-gaap_CommonStockParOrStatedValuePerShare |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

num:perShareItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionThe maximum number of common shares permitted to be issued by an entity's charter and bylaws. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.29)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 02

-Paragraph 30

-Article 5

| Name: |

us-gaap_CommonStockSharesAuthorized |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionTotal number of common shares of an entity that have been sold or granted to shareholders (includes common shares that were issued, repurchased and remain in the treasury). These shares represent capital invested by the firm's shareholders and owners, and may be all or only a portion of the number of shares authorized. Shares issued include shares outstanding and shares held in the treasury. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.29)

-URI http://asc.fasb.org/extlink&oid=6877327&loc=d3e13212-122682

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-X (SX)

-Number 210

-Section 02

-Paragraph 30

-Article 5

| Name: |

us-gaap_CommonStockSharesIssued |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

v3.3.1.900

CONDENSED STATEMENTS OF OPERATIONS - USD ($)

|

3 Months Ended |

6 Months Ended |

Nov. 30, 2015 |

Nov. 30, 2014 |

Nov. 30, 2015 |

Nov. 30, 2014 |

| Revenues: |

$ 0

|

$ 0

|

$ 0

|

$ 0

|

| Expenses: |

|

|

|

|

| General and administrative |

18,019

|

8,098

|

31,067

|

8,805

|

| Net (Loss) |

$ (18,019)

|

$ (8,098)

|

$ (31,067)

|

$ (8,805)

|

| Basic & Diluted Loss Per Share |

$ (0.0004)

|

$ (0.0002)

|

$ (0.0007)

|

$ (0.0002)

|

| Weighted Average Shares |

45,411,400

|

45,411,400

|

45,411,400

|

45,411,400

|

| X |

- DefinitionThe amount of net income or loss for the period per each share in instances when basic and diluted earnings per share are the same amount and reported as a single line item on the face of the financial statements. Basic earnings per share is the amount of net income or loss for the period per each share of common stock or unit outstanding during the reporting period. Diluted earnings per share includes the amount of net income or loss for the period available to each share of common stock or common unit outstanding during the reporting period and to each share or unit that would have been outstanding assuming the issuance of common shares or units for all dilutive potential common shares or units outstanding during the reporting period.

| Name: |

us-gaap_EarningsPerShareBasicAndDiluted |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

num:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate total of expenses of managing and administering the affairs of an entity, including affiliates of the reporting entity, which are not directly or indirectly associated with the manufacture, sale or creation of a product or product line. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher FASB

-Name Accounting Standards Codification

-Topic 225

-SubTopic 10

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03.4)

-URI http://asc.fasb.org/extlink&oid=26872669&loc=d3e20235-122688

| Name: |

us-gaap_GeneralAndAdministrativeExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |