2nd UPDATE: Allianz 3Q Net Profit More Than Doubles; Shares Up

10 November 2009 - 12:42AM

Dow Jones News

Allianz SE (ALV.XE), Europe's largest primary insurer by market

capitalization, Monday said third-quarter net profit more than

doubled on lower asset write-downs, and as improvements in

life/health insurance and financial services more than offset lower

contributions from property/casualty insurance.

The figures reflect Allianz's improved earnings power in its

core operations following the sale of loss-making Dresdner

Bank.

Allianz shares were among the top gainers in the German

blue-chip index as most of the earnings figures topped consensus

forecasts.

At 1230 GMT, the stock was up EUR4.64, or 5.9%, at EUR83.90,

outperforming the Stoxx Europe 600 insurance index, which was up

2.8%.

UniCredit analyst Andreas Weese said net profit and operating

profit were ahead of consensus following a better-than-forecast

contribution from life/health insurance and financial services,

while the contribution from property/casualty insurance was in

line. Weese, who rates the share at buy, described the capital

position good.

JPMorgan analyst Michael Huttner said the company's "margins

were OK" and said the figures showed signs of "a little bit of

growth" in life/health insurance and asset management. He said that

the company's statement that it is not in need of capital and that

no acquisitions are planned do give the share a lift compared with

competitors French Axa SA (AXA) and Zurich Financial Services AG

(ZURN.VX).

"The capital statement helps - though a capital hike wasn't

expected - and there's no deal risk," Huttner said.

Earlier Monday, Axa said it planned to launch a EUR2 billion

rights issue to swell its war chest for potential acquisitions,

including the possible purchase of AXA Asia Pacific Holdings Ltd.'s

(AXA.AU) Asian assets.

Merck Finck analyst Konrad Becker also said the figures topped

his forecast, though he would have liked to see some full-year

guidance.

Still, the company refrained from giving concrete earnings

targets for 2009 or beyond.

Chief Financial Officer Oliver Baete, who took up his post on

Sept. 1, said a full year earnings forecast for 2009 or for 2010

wouldn't be reliable in the current, still highly volatile, market

environment.

But, Allianz is well capitalized and prepared for delivering

solid earnings even in the "challenging market environment with

structurally lower returns" ahead, due to its high-quality

investment portfolio and conservative risk management approach,

Baete said.

Allianz, which accrued a dividend equivalent of EUR1.4 billion

for the first nine months, plans to stick to a dividend payout

ratio of 40% of net profit, Baete said.

Third-quarter net profit rose to EUR1.32 billion from EUR545

million in the year-earlier quarter, roughly in line with the

EUR1.33 billion average forecast in a Dow Jones Newswires poll of

15 analysts.

The year-earlier figure was restated to reflect continuing

operations only, after Allianz sold Dresdner Bank to Commerzbank AG

(CBK.XE) for around EUR5.1 billion in the first quarter. A year

ago, Allianz made a EUR2.02 billion loss when it still owned

Dresdner Bank.

Operating profit rose 23% to EUR1.93 billion from EUR1.56

billion, beating a forecast of EUR1.84 billion. Life/health

insurance and financial services benefited from improvements in

capital markets, the gradual economic recovery and the narrowing of

credit spreads - which supported good-margin revenue growth from

investment products with underlying guarantees.

Meanwhile, property/casualty contributed 18% less to operating

profit than in the year-ago quarter, which the company attributed

to negative effects from the recession on business in Germany,

France, Italy and credit insurance, and to an unusually high number

of weather-related claims in those countries.

Higher claims costs pushed the combined ratio up to 96.9% from

96.5% a year ago, meaning Allianz spent 96.9 cents on claims and

other costs for each euro of premium income. For the full year,

Allianz targets a combined ratio of between 97% and 98%. JPMorgan's

Huttner said a combined ratio better than 97.5% could be difficult

to reach in 2009, as it would require a fourth quarter figure of

some 95%.

Allianz said property/casualty business is working on improving

productivity, that first signs of improvement will be seen in 2010,

but the full impact will only be noticeable over the next three

years.

The investment result, and notably lower net write-downs on

investments, made a substantially better contribution to earnings

than a year ago. In the quarter, net write-downs on investments

were EUR46 million compared with EUR921 million in the third

quarter of 2008. Net realized disposal gains were EUR322 million

compared with EUR517 million a year ago.

-By Ulrike Dauer, Dow Jones Newswires; +49 69 29725 500;

ulrike.dauer@dowjones.com

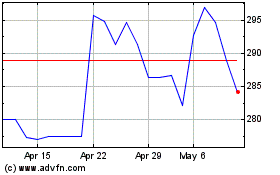

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

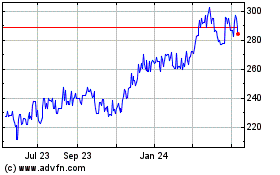

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024