Maersk to Eliminate Hundreds of Jobs

30 November 2019 - 2:18AM

Dow Jones News

By Costas Paris

Denmark's A.P. Moller-Maersk A/S will cut hundreds of jobs to

cut costs as the shipping giant prepares for significantly higher

fuel costs next year and plans to invest more heavily in inland

logistics services.

"We have announced internally the need to save cost in our head

office functions and that it will also lead to reductions both in

and outside Denmark," a Maersk spokesman said. "We do not yet know

the exact extent or how many are affected, but this is something we

are currently discussing."

People with knowledge of the matter said around 200 jobs will be

cut at the company's headquarters in Copenhagen and at Hamburg Süd,

the German container operator that Maersk bought in 2017.

The cuts come as Maersk is seeking to expand its business, which

is largely focused on ocean container transport, to do more

end-to-end logistics, particularly inland supply services such as

warehousing and customs clearance.

"Maersk needs to build up our non-ocean services and this will

affect ocean services," one person familiar with the plan said.

This person said there are overlaps in jobs at the information

technology department following the merger with Hamburg Süd, which

originally saw its workforce cut by 200 people to around 900 after

Maersk's takeover.

Maersk Chief Executive Søren Skou said this month that he plans

to invest hundreds of millions of dollars in expanding inland

logistics services next year.

Maersk, the world's biggest container ship operator by capacity

according to data analyst Alphaliner, employs around 75,000 people

in more than 120 countries. It has around 70,000 customers in its

core ocean transport business, including a broad range of U.S.

companies such as car makers and retailers.

The parent company this month reported a net profit of $520

million in the third quarter, up 30% from $396 million a year

earlier.

But the Maersk Line operation faces strong headwinds in shipping

markets. Analysts have sharply reduced forecasts for growth this

year in container markets as big retailers and manufacturers that

ship goods internationally facing weakening global economic

conditions and rising trade barriers.

Maersk and other ocean carriers also face an average increase of

25% in their fuel bills when vessels will have to start using

cleaner fuels as part of a regulatory mandate to cut sulfur

emissions.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

November 29, 2019 10:03 ET (15:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

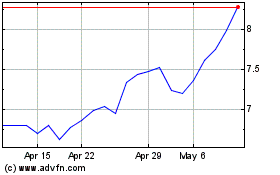

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

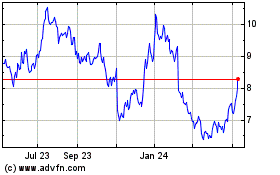

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025