Maersk Warns of Lower Earnings From Coronavirus Impact -- 2nd Update

21 February 2020 - 6:25AM

Dow Jones News

By Costas Paris and Dominic Chopping

A.P. Moeller-Maersk A/S is facing a weak year as the coronavirus

outbreak takes a toll on shipping volumes and freight rates after

broader market conditions sent the Danish shipping giant to an

unexpected fourth-quarter loss.

The world's biggest container ship operator, said Thursday it

has canceled dozens of sailings out of China since late January as

factories there were closed for an extra week after the Lunar New

Year and struggled to resume production.

Maersk Chief Executive Soren Skou said in an interview that

quarantines and travel restrictions aimed at containing the spread

of the virus have had "a huge impact" on China's export volumes.

"But it's also hurting import volumes with not enough truck drivers

to move things around," he said.

Maersk has dropped more than 50 sailings from China ports since

late January, part of the larger retrenchment of shipping services

in and out of a country that is an anchor of global trade.

In the quarter ending in December, Maersk swung to an unexpected

net loss of $72 million from a profit of $46 million in the

year-earlier period. A FactSet analyst poll had expected a net

profit of $343 million. The company said that the results were hurt

by implementing a new international accounting standard for leases

and 2019 figures aren't comparable with last year.

Maersk, which is seen as a barometer of global trade, reported a

revenue fall of 5.6% to $9.67 billion, missing expectations of

$9.94 billion, as its shipping unit lowered capacity to adjust to

market conditions.

It said the outlook for 2020 is subject to significant

uncertainties and affected by the coronavirus, which has

significantly lowered visibility on what to expect in the short

term.

"As factories in China are closed for longer than usual in

connection with the Chinese New Year and as a result of the

Covid-19, we expect a weak start to the year," the company

said.

Maersk's stock was down 3.9% to 8,228 Danish kroner in trading

Thursday on the Copenhagen Stock Exchange.

For the full year, Maersk's earnings before interest, taxes,

depreciation and amortization rose to $5.71 billion, meeting the

company's own guidance of between $5.4 billion and $5.8 billion,

but it expects to report a lower figure this year of around $5.5

billion.

The company's main Maersk Line shipping unit saw revenue fall as

volumes dropped 1.8% while freight rates slipped 0.4%. Maersk said

it continued to cut its cost base at the unit while lower fuel

prices also helped offset some of the weakness.

Volumes were hit in both East-West and North-South routes, amid

continued slower growth in the U.S. following the front-loading of

orders in the same quarter last year ahead of anticipated tariffs.

The company pointed to lower demand in Europe, continued weak

demand in Latin America, and softer market conditions in West and

Central Asia and Australia.

The Maersk loss followed Hapag-Lloyd AG's release of earnings

earlier this week that showed the German carrier's Ebitda rose 40%

in the fourth quarter from the year before to $526 million.

Hapag-Lloyd said its revenue and average freight rates both

deteriorated in the final three months of 2019, however.

Shipping data group Alphaliner said in a report this week that

carriers had pulled a total of 1.67 million containers of capacity

from China services since the start of the Lunar New Year holiday.

Container lines have lost a total of $1.5 billion in business since

then, the report said.

"As the trade war between the U.S. and China began to show signs

of thawing, coronavirus came out of nowhere and has created huge

uncertainty and a bearish outlook for the liner business in the

short-term," said Jonathan Roach, a container analyst on Braemar

ACM Shipbroking.

Shipping executives and analysts expect global supply chains to

be disrupted well into the second quarter as emerging economies in

Asia heavily depend on China for manufactured goods.

Maersk declared an unchanged full-year dividend of 150 Danish

kroner ($21.68).

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 20, 2020 14:10 ET (19:10 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

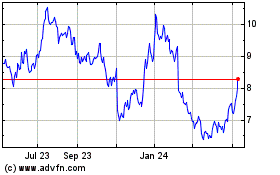

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

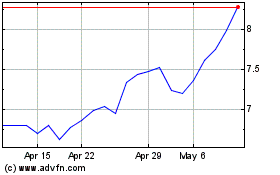

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025