Maersk Buys Swedish Customs Specialist for $279 Million

06 July 2020 - 6:12PM

Dow Jones News

By Dominic Chopping

AP Moeller-Maersk AS on Monday announced the 2.6 billion Swedish

kronor ($279 million) acquisition of Swedish trade-and-customs

specialist KGH Customs Services AB.

The Danish shipping company has agreed to buy KGH from

Bridgepoint Development Capital as it looks to boost its

capabilities as an integrated container logistics company, offering

end-to-end supply chain services.

"There are no end-to-end solutions without customs clearance,"

said Maersk's Ocean & Logistics Chief Executive Vincent

Clerc.

"With KGH, we will not only be able to strengthen our

capabilities within customs services and related consultancy, but

also reach more of our customers in Europe through a larger

geographical footprint and digital solutions."

KGH is based in Gothenburg, Sweden, and reported recurring

earnings before interest, tax, depreciation and amortization of

SEK160 million in 2019 on revenue of SEK890 million. It has 775

employees and a yearly business of 1.98 million customs

clearances.

Following the acquisition, Maersk said annual Ebitda synergies

from the combination are expected to amount to approximately SEK50

million-SEK75 million.

Closing of the acquisition is subject to customary regulatory

approvals and until then Maersk and KGH will remain two separate

companies, conducting their business as usual.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

July 06, 2020 03:57 ET (07:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

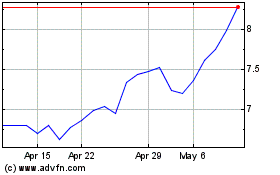

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

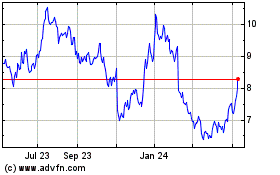

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about AP Moller Maersk AS (PK) (OTCMarkets): 0 recent articles

More AP Moller Maersk AS (PK) News Articles