Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10/AMENDMENT 3

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities

Exchange Act of 1934

|

ASIARIM CORP.

AKA UN MONDE INTERNATIONAL LTD.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

83-0500896

|

|

(State of other jurisdiction of

incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

5689 Condor Place

Mississauga ON

L5V 2J4 Canada

Westagate Mall

(Address of Principal

Executive Offices) (Zip Code)

1-905-962-0823

(Registrant’s

telephone number, including area code)

Securities to be

Registered Under Section 12(b) of the Act:

None

Securities to be

Registered Under Section 12(g) of the Act:

Common Stock, Par

Value $0.001

(Title of Class)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ASIARIM CORP.

INDEX TO FORM 10

Cautionary Note Regarding

Forward-Looking Statements

This registration statement

on Form 10 contains “forward-looking statements” concerning our future results, future performance, intentions, objectives,

plans, and expectations, including, without limitation, statements regarding the plans and objectives of management for future operations,

any statements concerning our proposed services, any statements regarding future economic conditions or performance, and any statements

of assumptions underlying any of the foregoing. All forward-looking statements included in this document are made as of the date hereof

and are based on information available to us as of such date. We assume no obligation to update any forward-looking statements. In some

cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,”

“plans,” “anticipates,” “intends,” “believes,” “estimates,” “potential,”

or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected

in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking

statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking

statements. Future financial condition and results of operations, as well as any forward-looking statements are subject to inherent risks

and uncertainties, including those discussed under “Risk Factors” and elsewhere in this Form 10.

Introductory Comment

We are filing this General

Form for Registration of Securities on Form 10 to register our common stock pursuant to Section 12(g) of the Exchange Act. Once this

registration statement is deemed effective, we will be subject to the requirements of Section 13(a) under the Exchange Act, which will

require us to file annual reports on Form 10-K (or any successor form), quarterly reports on Form 10-Q (or any successor form), and current

reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration

statements pursuant to Section 12(g) of the Exchange Act.

Throughout this Form 10,

unless the context otherwise requires, the terms “we,” “us,” “our,” the “Company,” “ARMC"

and “our Company” refer to Asiarim Corp., a Nevada corporation. Asiarim Corp. is a Blank Check Company under Rule 419 of the

Securities Act of 1933.

The term ‘blank

check company” means that we are a development stage company and have no specific business plan or purpose or has indicated that

is business plan is to engage in a merger or acquisition with an unidentified company, or other entity or person. A blank check company:

(i) Is a development stage company

that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an

unidentified company or companies, or other entity or person; and

(ii) Is issuing “penny stock,”

as defined in Rule 3a51-1 under the Securities Exchange Act of 1934.

Our

officers and directors reside outside the United States, investors may have limited legal recourse against them including

difficulties in enforcing judgments made against them by U.S. courts. Our officers and directors reside in Canada. There is a

reciprocal arrangement between Canada and the United States regarding recognition or enforcement of civil judgments. However, the

investor will incur additional costs to pursue a judgment in Canada and the Canadian courts may deny enforcement of the

judgment.

The following disclosures are based on

operations being located in China. As of this time, the Company has not committed to any China operations. Our officers and

directors reside in Canada and may decide that operations will be located in their place of residence.

Our operations, may or may not,

be in China. If we decide to base our operations in China, legal claims, including federal securities law claims, against China-based

Issuers may be difficult or impossible for investors to pursue in U.S. courts. Even if an investor obtains a judgment in a U.S. court,

the investor may be unable to enforce such judgment, particularly in the case of a China-based Issuer, where the related assets or persons

are typically located outside of the United States and in jurisdictions that may not recognize or enforce U.S. judgments. If an investor

is unable to bring a U.S. claim or collect on a U.S. judgment, the investor may have to rely on legal claims and remedies available in

China or other overseas jurisdictions where the China-based Issuer may maintain assets. The claims and remedies available in these jurisdictions

are often significantly different from those available in the United States and difficult to pursue.

Recent statements and regulatory actions by China’s government,

such as those related to the use of variable interest entities and data security or anti-monopoly concerns, may impact the company’s

ability to conduct its business, accept foreign investments, or list on an U.S. or other foreign exchange.

These risks are highlighted below and in Item 1A. Risk Factors.

The Company does not have a variable interest entity at this time and

may, or may not, decide to base their operations in China.

The Company is currently organized under the operating structure of

the public entity, Asiarim Corp., incorporated in the state of Nevada. ARMC may conduct operations in China and may acquire Chinese companies

as subsidiaries to carry out its plan of operation.

The Company is not currently organized under a variable interest entity

(VIE) creating a question of whether China’s Foreign Investment Law (FIL) prevents foreign ownership in our company. We will continue

to monitor the changes in FIL, and the Company may consider migrating to a VIE structure to continue receiving participation from foreign

investors.

The VIE structure consists of at least three core entities: a Chinese

company with legitimate operations (referred to as the VIE); a wholly foreign-owned enterprise established as an intermediary in China;

and an offshore shell company that lists on a U.S. or other foreign exchange.

The VIE structure enables a Chinese company to list on an overseas

stock exchange, such as OTC Markets, because direct ownership in the shares of the Chinese company is restricted by China’s laws.

To expand upon this, a Chinese company sets up an offshore shell company for overseas listing purposes that allows foreign investors to

buy into the stock. The shell company is not the Chinese operating company and does not hold the assets of the operating company.

The Chinese government could rule that the structure is against public

policy and this ruling would likely result in a material change in our contemplated operations. Furthermore, the value of our common stock

may decline or become worthless, and the shareholder could lose their entire investment.

Any failure by our VIEs or their shareholders

to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business. If

our VIEs or their shareholders fail to perform their respective obligations under the contractual arrangements, we may have to incur substantial

costs and expend additional resources to enforce such arrangements. We may also have to rely on legal remedies under PRC law, including

seeking specific performance or injunctive relief, and contractual remedies, which we cannot assure you will be sufficient or effective

under PRC law.

In addition, if any third parties claim any

interest in such shareholders' equity interests in our VIEs, our ability to exercise shareholders' rights or foreclose the share pledge

according to the contractual arrangements may be impaired. If these or other disputes between the shareholders of our VIEs and third parties

were to impair our control over our VIEs, our ability to consolidate the financial results of our VIEs would be affected, which would

in turn result in a material adverse effect on our business, operations and financial condition.

We may lose the ability to use and enjoy assets

held by our VIEs that are critical to the operation of our business if our VIEs declare bankruptcy or become subject to a dissolution

or liquidation proceeding. Our VIEs will hold certain assets that may be critical to the operation of our business. If the shareholders

of our VIEs breach the contractual arrangements and voluntarily liquidate our VIEs, or if our VIEs declare bankruptcy and all or part

of its assets become subject to liens or rights of third-party creditors or are otherwise disposed of without our consent, we may be unable

to continue some or all of our business activities. This could materially and adversely affect our business, financial condition and results

of operations. In addition, if any of our VIEs undergoes an involuntary liquidation proceeding, third-party creditors may claim rights

to some or all of its assets, thereby hindering our ability to operate our business, which could materially or adversely affect our business,

financial condition and results of operations.

The Chinese government could rule in the future, that the structure

is against public policy and this ruling would likely result in a material change in our contemplated operations. Furthermore, the value

of our common stock may decline or become worthless, and the shareholder could lose their entire investment.

The Chinese government may intervene or influence our operations

at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could

result in a material change in our operations and/or the value of our common stock.

We will continue to monitor the changes in

FIL, and ARMC may consider migrating to a VIE structure to continue receiving participation from foreign investors.

If and when, the majority of our contemplated operations are to be

in China, the Chinese government could rule that the structure is against public policy and this ruling would likely result in a material

change in our contemplated operations. Furthermore, the value of our common stock may decline or become worthless, and the shareholder

could lose their entire investment.

China may be subject to considerable

degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to

China, including regulatory, liquidity and enforcement risks.

Regulatory cycles are not uncommon

in China. Policy and regulatory scrutiny should be seen as ongoing risks when it comes to investing in China. The revised Chinese regulations

have not ruled on for our industry. We are not currently engaged in a VIE structure, however that could change moving forward.

We are subject to differing and sometimes

conflicting laws and regulations in the various China jurisdictions where we provide our services. Considerable uncertainties still exist

with respect to the interpretation and implementation of existing laws and regulations governing our contemplated business activities.

As we implement our business plan and expand into new cities or countries or as we add new products and services to our platform, we may

become subject to additional laws and regulations that we are not subject to now. Existing or new laws and regulations could expose us

to substantial liability, including significant expenses necessary to comply with such laws and regulations, and could dampen our growth,

which could adversely affect our business and results of operations.

China’s legal system is substantially different from the legal

system in the United States and may raise risks and uncertainties concerning the intent, effect, and enforcement of its laws, rules, and

regulations, including those that restrict the inflow and outflow of foreign capital or provide the Chinese government with significant

authority to exert influence on a China-based Issuer’s ability to conduct business or raise capital. This lack of certainty may

result in the inconsistent and unpredictable interpretation and enforcement of laws, rules, and regulations, which may change quickly.

China-based Issuers face risks related to evolving laws and regulations, which could impede their ability to obtain or maintain permits

or licenses required to conduct business in China. In the absence of required permits or licenses, governmental authorities may impose

material sanctions or penalties on the company. Such actions could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

A more detailed discussion on

the risks of investing in Chinese companies can be found in Item A. Risk Factors

If and when, our contemplated operations are to be in China, we

may be governed by the China Securities Regulatory Commission (CSRC), Cyber Administration of China (CAC) and The Ministry of Education

of the People’s Republic of China.

CAC oversees data security and recently

revised its laws to include operators that possess personal information for over one million individuals would be subject to cybersecurity

review when listing of foreign exchanges. Personal information is defined in Article76(5) of Cybersecurity Law as various information

which is recorded in electronic or any other form and used alone or in combination with other information to recognize the identity of

a natural person, including but not limited to name, date of birth, ID number, personal biological identification information, address

and telephone number of natural persons.

As we have not implemented our business

plan, ARMC does not meet the criteria to trigger the CAC revised rule. However, we may, upon executing our business model, be subject

to CAC rules and regulations. Our operations could be suspended if the CAC finds we are in violation of data security laws.

The CRSC oversees China's nationwide

centralized securities supervisory system, with the power to regulate and supervise securities issuers, as well as to investigate, and

impose penalties for illegal activities related to securities and futures.

ARMC will be subject to CRSC

rules and regulations. As such, we will be required to submit information about our business to CRSC for approval and will be subject

to continued compliance. At this time, we have not submitted applications for permission to conduct our business, however we will submit

all requested information to CRSC once our business plan has been implemented.

The CRSC oversees China's

nationwide centralized securities supervisory system, with the power to regulate and supervise securities issuers, as well as to investigate,

and impose penalties for illegal activities related to securities and futures.

ARMC will be subject to CRSC

rules and regulations and has not received approval at this time. As such, we will be required to submit information about our business

to CRSC for approval and will be subject to continued compliance. In addition, if we decide to implement a VIE structure, the CRSC could

deny us permission as an issuer to foreign investors if it is ruled that VIE’s are illegal.

The value of our stock could

decline or become worthless. The CRSC and SEC are working together to ensure compliance and protection of foreign investor rules. ARMC

could be delisted as a result of not complying with these rules.

If, in the future, we become

noncompliant with CRSC rules, our business operations could be suspended and our stock could be worthless. In addition, the CRSC

could deny us permission as an issuer to foreign investors if it is ruled that VIE’s are illegal.

The Ministry of Education of

People’s Republic of China (“MEPRC”) is the agency of the State Council that oversee education throughout the country.

ARMC will be subject to MEPRC regulation.

Laws in China regulating the

system of education include the Regulation on Academic Degrees, the Compulsory Education Law, the Teachers Law, the Education Law, the

Law on Vocational Education, and the Law on Higher Education. MEPRC will also continue to review the VIE structure and may rule that this

structure is illegal in the future.

Our curriculum, teachers, and

facilities will be subject to inspection and require approval by MEPRC to operate. If, in the future, we become noncompliant with MEPRC

rules, our business operations could be suspended.

The CRSC, CAC and MEPRC are working

to ensure compliance and protection of foreign investors. ARMC could be delisted as a result of not complying with any one of these regulatory

agencies and could completely hinder our ability to offer or continue to offer securities to investors and cause the value of such

securities to significantly decline or be worthless.

If and when, our contemplated operations are to be in China, ARMC

may be required to comply with CRSC, CAC and MERPC rules and regulations. Our operations may be required to receive permission from these

entities to conduct business. As of this time, we have not received the requisite permissions from CAC, CSRC and the MEPRC.

ARMC may conduct operations

in China and may acquire Chinese companies as subsidiaries to carry out its plan of operation. Daily operations in PRC include curriculum

training, selling our program, hiring labor forces, and R&D. Cash associated with these activities will circulate in PRC in the form

of local currency. Activities such as raising capital to support PRC operations, hiring employees, paying for working capital, and paying

out dividends will involve cross-border payments. As of this date, we have not made transfers, dividends, or distributions and have not

implemented a cross border payment a cross border payment system.

If we acquire a Chinese business,

we will be subject to cross-border payments must comply with the relevant regulation of the China State Administration of Foreign Exchange

(SAFE).

Companies based in China

have utilized SWIFT and the Clearing House Interbank Payments System, which has widely been used to transfer cash between entities, across

borders, and to for from US investors

At this time, we do not have a plan in place for cross border payments

as we have not acquired a company based in China. If we acquire a Chinese business, we will be

subject to cross-border payments must comply with the relevant regulation of the China State Administration of Foreign Exchange (SAFE).

If we acquire a company based

in China our ability to transfer cash between entities, across borders, and to US investors may be restricted or prohibited if SAFE determines

our business does not meet its criteria.

PRC adopts a partial foreign

exchange administration. As such, foreign currency is forbidden to circulate within the territory. It allows exchange and payment

on current accounts such as trading while implementing certain controls on capital accounts such as investment. We may face obstacles

even if transactions are legal and reasonable after proper registration. So far, ARMC has not yet to establish a VIE nor has determined

the structure.

If we adopt a VIE structure,

ARMC will comply with US laws, PRC laws and regulations. ARMC will also work out financial plans to establish cash flow to parent company,

subsidiaries level and VIE level regarding daily operation and dividends pay out. However, there is no guarantee that cash will be distributed

from businesses, including subsidiaries and/or consolidated VIEs, to the parent company. There is also no guarantee we will have

the ability to settle amounts owed under the VIE agreements. If this occurs our business would be greatly affected and our stock could

decline or become worthless. In addition, the investor could lose all of their investment.

Trading in our securities may be prohibited under the Holding Foreign

Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate the auditor of a company that we may target

for a business combination, as a result an exchange may determine to delist our securities.

(a) Business Development

The Company was organized under the laws of the State of Nevada on

June 15, 2007, under its current name. The Company was a development stage company with the goal

of acquire private corporations that are involved in education and management services offering private, distinguished, specialized,

and internationalized education to international students in schools.

Prior to 2012, the Company engaged

in the computer electronics business as it completed the acquisition of Commodore.

Business operations for Asiarim Corp. and its subsidiaries were abandoned

by former management and a custodianship action, as described in the subsequent paragraph, was commenced in 2016. The Company filed its

last 10Q in 2011, this financial report included liabilities and debts. As of the date of this filing, these liabilities and debts have

been addressed and the legal opinion for debt write off is attached as an Exhibit.

On May 5, 2016, the Eighth District

Court of Clark County, Nevada granted the Application for Appointment of Custodian as a result of the absence of a functioning board of

directors and the revocation of the Company’s charter. The order appointed Bryan Glass (“Mr. Glass”, the “Custodian”)

custodian with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock, and authorize

new classes of stock.

The court awarded custodianship to Mr. Glass based on the absence of

a functioning board of directors, revocation of the company’s charter, and abandonment of the business. At this time, Ms. Glass

was appointed sole officer and director.

The Company was severely delinquent in filing annual reports for the

Company’s charter. The last annual report was filed on September 30, 2010 in on Form 10-K. In addition, the company was subject

to Exchange Act reporting requirements including filing 10Q’s and 10Ks. The Company filed its last 10Q for quarter ending June 30,

2011, and was out of compliance with Exchange Act reporting. Mr. Glass attempted to contact the Company’s officers and directors

through letters, emails, and phone calls, with no success.

Mr. Glass was a shareholder in the Company and applied to the Court

for an Order appointing Brian Glass as the Custodian. This application was for the purpose of reinstating ARMC’s corporate charter

to do business and restoring value to the Company for the benefit of the stockholders.

Mr. Glass performed the following actions in its capacity as custodian:

|

|

•

|

Funded any expenses of the company including paying off outstanding liabilities

|

|

|

•

|

Brought the Company back into compliance with the Nevada Secretary of State, resident agent, transfer agent

|

|

|

•

|

Appointed officers and directors and held a shareholders meeting

|

The Custodian paid the following expenses

on behalf of the company:

Nevada Secretary of State for reinstatement of the Company, $3,925

Transfer agent, Island Stock Transfer, $9,100

Amended and Restated Articles of Incorporation for the Company, $175.

Upon appointment as the Custodian of ARMC

and under its duties stipulated by the Nevada court, Mr. Glass took initiative to organize the business of the issuer. As Custodian, the

duties were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Nevada

Secretary of State. Mr. Glass also had authority to enter into contracts and find a suitable merger candidate. Mr. Glass was compensated

for its role as custodian in the amount of 40,000,000 shares of Restricted Common Stock. SCC did not receive any additional compensation,

in the form of cash or stock, for custodian services. The custodianship was discharged on November 9, 2016.

On January 30, 2019, Mr. Glass entered into

a Stock Purchase Agreement with Asia Gateway Capital Ltd.*, whereby Asia Gateway Capital Ltd. purchased 40,000,000 shares of Restricted

Common Stock. These shares represent the controlling block of stock. Mr. Glass resigned his position of sole officer and director and

appointed Ci Zhang as as CEO, Treasurer, Secretary, and Director of the Company. Mr. Glass also appointed ChangJun Xue and Bing Qing

Xie as Directors.

*Asia Gateway Capital Ltd. is controlled

by Jamie Liu.

We are currently a shell company, as defined

in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2.

(b) Business of Issuer

Asiarim Corp. is a developmental stage company,

incorporated under the laws of the State of Nevada on June 15, 2007. Our plan of business has not been implemented but will incorporate

the acquisition of private corporations involved in education and management services offering private, distinguished, specialized, and

internationalized education to international students in schools.

The Company changed its name in Nevada, the

state of domicile, to Un Monde International Ltd.

At present financial revenue has not yet been realized. The Company

hopes to raise capital in order to fund the acquisitions.

All statements involving our business plan are forward looking statements

and have not been implemented as of this filing.

The

Company is moving in a new direction, statements made relating to our business plan are forward looking statements and we have no history

of performance. Current management does not have any experience in acquisition of international educational companies but is actively

looking for a suitable person to incorporate into the management team.

We feel that our business plan addresses the

need for additional development in the education industry.

We are in the business of acquiring private

corporations in the business of educating international students, so they have the tools to contribute and thrive in an interdependent

world. Our vision incorporates the spirit of social responsibility, not only on a local community basis but also on a global scale. We

will achieve this through multilingual education and critical thinking so the student may integrate into any cultural situation.

The impact of social distancing requirements

due to Covid-19 has accelerated already robust global growth in online education, a trend many expect to continue even after Covid-19

restrictions are lifted.

As governments in China attempt to reduce

the cost of studying abroad, providing such opportunities in a cost-effective way has become the focus for leading educational institutions.

In a post-Covid world, online education is far and away now the ideal solution.

International education is generally

taken to include

|

|

·

|

Traditional curriculum (math, sciences, languages)

|

|

|

·

|

Knowledge of other world regions & cultures;

|

|

|

·

|

Familiarity with international and global issues;

|

|

|

·

|

Skills in working effectively within global or cross-cultural environments, and using information from different sources around the

world;

|

|

|

·

|

Ability to communicate in multiple languages; and

|

|

|

·

|

Dispositions towards respect and concern for other cultures and peoples.

|

The Company intends to implement its business

plan upon raising capital. Subject to available capital, the Company intends to invest in:

Development

|

|

·

|

Formal and informal education curriculum

|

|

|

o

|

Training, exchange programs, cross-cultural communication

|

Implementation

|

|

·

|

Promoting international understanding/international-mindedness and/or global awareness/understanding

|

|

|

·

|

Being active in global engagement/global or world citizenship

|

|

|

·

|

Increasing intercultural understanding and respect for difference

|

|

|

·

|

Encouraging tolerance and commitment to peace

|

The analysis will be undertaken by or under

the supervision of our management. As of the date of this filing, we have not entered into definitive agreements. In our continued efforts

to analyze potential business plan, we intend to consider the following factors:

|

|

·

|

Potential for growth, indicated by anticipated market expansion or new technology;

|

|

|

·

|

Competitive position as compared to other schools of similar size and experience within the education segment as well as within the

industry as a whole;

|

|

|

·

|

Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional assistance

and other required items;

|

|

|

·

|

Capital

requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional

securities or convertible debt, through joint ventures or similar arrangements or from other sources;

|

|

|

·

|

The extent to which the business opportunity can be advanced in the marketplace; and

|

|

|

·

|

Other relevant factors

|

In applying the foregoing criteria, management

will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available

data. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity

to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial capabilities

for identifying and completing our business plan.

We are unable to predict when we will, if

ever, identify and implement our business plan. We anticipate that proposed business plan would be made available to us through personal

contacts of our directors, officers and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of

the financial community and others who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee or

to otherwise compensate the persons who introduce the Company to business opportunities in which we participate.

As of the time of this filing, the Company

has not implemented its business plan.

We expect that our due diligence will encompass,

among other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well

as a review of financial and other information, which is made available to the Company. This due diligence review will be conducted either

by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash

payments for services or expenses related to any analysis.

We may incur time and costs required to select

and evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty.

Any costs incurred with respect to the indemnification and evaluation of a prospective international education program that is not ultimately

completed may result in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s

fees and other related expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific

business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments

will require substantial management time and attention and substantial cost for accountants, attorneys, consultants, and others. Costs

may be incurred in the investigation process, which may not be recoverable. Furthermore, even if an agreement is reached for the participation

in a specific business opportunity, the failure to consummate that transaction may result in a loss to the Company of the related costs

incurred.

Competition

Our

company expects to compete with many countries in the international education industry. In addition, there are several competitors that

are larger and more profitable than ARMC. We expect that the quantity and composition of our competitive environment will continue to

evolve as the industry matures. Additionally, increased competition is possible to the extent that new geographies enter the marketplace

as a result of continued enactment of regulatory and legislative changes. We believe that diligently establishing and expanding our funding

sources will establish us in an already established industry. Additionally, we expect that establishing our product offerings on new platforms

are factors that mitigate the risk associated with operating in a developing competitive environment. Additionally, the contemporaneous

growth of the industry as a whole will result in new students entering the international education marketplace, thereby further mitigating

the impact of competition on our future operations and results.

Compliance with education standards

and guidelines will increase development costs and the cost of operating our business. In turn, we may not be able to meet the competitive

price point for our education curriculum dictated by the market and our competitors.

Again,

these are forward looking statements and not an indication of past performance. There is no guarantee that we will be able to implement

our business plan and have no merger candidates as of the time of this filing.

Effect of Existing or Probable Governmental

Regulations on the Business

Upon effectiveness of this Form 10, we will

be subject to the Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, we will be required to file with the SEC annual

reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent

accounting oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also (1)

requires steps be taken to enhance the direct responsibility of senior members of management for financial reporting and for the quality

of financial disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to public view, possible

conflicts of interest affecting securities analysts; (3) creates guidelines for audit committee members’ appointment, and compensation

and oversight of the work of public companies’ auditors; (4) prohibits certain insider trading during pension fund blackout periods;

and (5) establishes a federal crime of securities fraud, among other provisions.

We will also be subject to Section 14(a) of

the Exchange Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with

the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders

at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information

outlined in Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days

prior to the date that definitive copies of this information are provided to our stockholders.

Employees

As of March 31, 2021, we had one officer,

three directors and no employees. We anticipate that we will begin to fill out our management team as and when we raise capital to begin

implementing our business plan. In the interim, we will utilize independent consultants to assist with accounting and administrative matters.

We currently have no employment agreements and believe our consulting relationships are satisfactory. We plan to continue to hire independent

consultants from time to time on an as-needed basis.

Risks Relating to Our Business

Our

business plan involves a number of very significant risks. Our future business, operating results and financial condition could be seriously

harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these

risks. You should invest in our common stock only if you can afford to lose your entire investment.

Our officers and directors reside

outside the United States, investors may have limited legal recourse against them including difficulties in enforcing judgments made

against them by U.S. courts. Our officers and directors reside in Canada. There is a reciprocal arrangement between Canada and the United

States regarding recognition or enforcement of civil judgments. However, the investor will incur additional costs to pursue a judgment

in Canada and the Canadian courts may deny enforcement of the judgment.

The following disclosures are based

on operations being located in China. As of this time, the Company has not committed to China operations. Our officers and directors

reside in Canada and may decide that operations will be located in their place of residence.

ARMC may implement a VIE structure in the future if our operations

are located in China. If the PRC government determines that the contractual arrangements constituting part of our VIE structure does

not comply with PRC regulations, or if these regulations change or are interpreted differently in the future, our shares may decline

in value or be worthless if we are unable to assert our contractual control rights over the assets of our PRC subsidiaries that may conduct

all or substantially all of our operations.

Our Auditor is U.S based and registered with the PCAOB so

Our Company is Subject to PCAOB Inspections

The Holding Foreign Companies Accountable Act (“HFCAA”)

became law in December 2020 and prohibits foreign companies from listing their securities on U.S.

exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive years.

The HFCAA requires the SEC to identify registrants that have retained

a registered public accounting firm to issue an audit report where that registered public accounting firm has a branch

or office that:

|

|

·

|

Is located in a foreign jurisdiction; and

|

|

|

·

|

The PCAOB has determined that it is unable to inspect or investigate completely because of a position taken by an authority

in the foreign jurisdiction

|

|

|

·

|

As reflected on the PCAOB's website, the PCAOB is currently unable to inspect or investigate accounting firms due to a position

of the local authority in two jurisdictions: China and Hong Kong

|

If our

PCAOB auditor is unable to inspect the issuer's public accounting firm for three consecutive years,

the issuer's securities are banned from trade on a national exchange or through other methods. The United States Senate passed

the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would decrease the number of non-inspection years from

three years to two years. As a result, our securities could be delisted rendering our stock worthless.

Merger & Acquisition Approval

is Required

Under the PRC Anti-monopoly Law, merger & acquisitions that

meet certain turnover thresholds must notify the State Administration for Market Regulation (SAMR) for merger control clearance and may

not be implemented without SAMR’s approval.

ARMC may merge with, or acquire, a target company to commence its

business operations. If our target business meets the threshold for review by SAMR, we will be required to submit an application for

approval.

The SAMR utilizes a substantive test for

merger review. The substantive test takes into consideration the:

|

|

•

|

Market

shares and market control power of the business operators concerned

|

|

|

•

|

Concentration levels of relevant

markets

|

|

|

•

|

Impact

of the concentration on market entry, technological development, consumers and other relevant

operators

|

|

|

•

|

Impact

of the concentration on national economic development

|

|

|

•

|

Foreign investment

|

If the merger or acquisition does not meet the SAMR criteria, our

application will be denied.

Such action could significantly limit or completely hinder our

ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Our business is subject to numerous

legal and regulatory risks that could have an adverse impact on our contemplated business.

We are subject to differing and sometimes

conflicting laws and regulations in the various China jurisdictions where we provide our services. As the carbon neutrality and air purification

is still at a relatively early stage of development, new laws and regulations may be adopted from time to time to address new issues

that come to the authorities' attention. In addition, considerable uncertainties still exist with respect to the interpretation and implementation

of existing laws and regulations governing our contemplated business activities. A large number of proposals are before various national,

regional, and local legislative bodies and regulatory entities regarding issues related to our industry or our business model. As we

implement our business plan and expand into new cities or countries or as we add new products and services to our platform, we may become

subject to additional laws and regulations that we are not subject to now. Existing or new laws and regulations could expose us to substantial

liability, including significant expenses necessary to comply with such laws and regulations, and could dampen our growth, which could

adversely affect our business and results of operations.

Risks Related to Access to Information

and Regulatory Oversight

PRC Securities Law state that no overseas securities regulator

can directly conduct investigations or evidence collection activities within the PRC and no entity or individual in China may provide

documents and information relating to securities business activities to overseas regulators without Chinese government approval. The

SEC, U.S. Department of Justice, and other U.S. authorities face substantial challenges in bringing and enforcing actions against China-based

Issuers and their officers and directors. As a result, investors in China-based Issuers may not benefit from a regulatory environment

that fosters effective enforcement of U.S. federal securities laws.

The Chinese government’s significant oversight and discretion

over the conduct of the business of any China-based company that we may target, could hinder, or influence our operations at any time.

If the Chinese government were to intervene in the target of a potential business combination it could result in a material change in

our operations. If it were determined that the target is not compliant with Chinese law, we would be prevented from moving forward with

our business plan. Such actions could significantly limit or completely hinder our ability to offer or continue to offer securities to

investors and cause the value our securities to significantly decline or be worthless.

Risks Related to the Regulatory Environment

China’s legal system is substantially different from the

legal system in the United States and may raise risks and uncertainties concerning the intent, effect, and enforcement of its laws, rules,

and regulations, including those that restrict the inflow and outflow of foreign capital or provide the Chinese government with significant

authority to exert influence on a China-based Issuer’s ability to conduct business or raise capital.

Regarding China based issuers, the Chinese government has made

recent statements indicating the intent to exert more oversight and control over offerings that are conducted overseas and relating to

foreign investment.

This lack of certainty may

result in the inconsistent and unpredictable interpretation and enforcement of laws, rules, and regulations, which may change quickly.

China-based Issuers face risks related to evolving laws and regulations, which could impede their ability to obtain or maintain permits

or licenses required to conduct business in China. In the absence of required permits or licenses, governmental authorities may impose

material sanctions or penalties on the company. Such actions could significantly limit or completely hinder our ability to offer or

continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Limitations on Shareholder Rights and

Recourse

Legal claims, including federal securities

law claims, against China-based Issuers may be difficult or impossible for investors to pursue in U.S. courts. Even if an investor obtains

a judgment in a U.S. court, the investor may be unable to enforce such judgment, particularly in the case of a China-based Issuer, where

the related assets or persons are typically located outside of the United States and in jurisdictions that may not recognize or enforce

U.S. judgments. If an investor is unable to bring a U.S. claim or collect on a U.S. judgment, the investor may have to rely on legal

claims and remedies available in China or other overseas jurisdictions where the China-based Issuer may maintain assets. The claims and

remedies available in these jurisdictions are often significantly different from those available in the United States and difficult to

pursue.

We are not currently required to comply with regulations and policies

of the Cyberspace Administration of China (CAC) because we have not commenced our business in China.

CAC regulates the collection of personal information, which is

recorded electronically, or in any other form, to recognize the identity of a natural person. In light of greater oversight regarding

the collection of personal information we will be subject to cybersecurity review upon execution of our contemplated business plan.

Our potential business combination, international education and

management services, will have operations in China and will be subject to cybersecurity review. We face uncertainties as to whether such

clearance can be timely obtained, or at all, and we may incur additional time delays to complete any anticipated acquisitions.

In light of greater oversight by CAC for companies seeking to list

on a foreign exchange, target business combinations could be impacted. If CAC determines our target business does not meet its requirements,

our ability to implement our business plan will be greatly affected.

If CAC determines that we have violated any portion of PRC laws and

regulation, our ability to obtain or maintain permits or licenses required to conduct business in China may be affected. In the absence

of required permits or licenses, governmental authorities may impose material sanctions or penalties on the company. Such actions could

significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our

securities to significantly decline or be worthless.

If CAC determines that we have violated any portion of PRC laws

and regulation, our ability to obtain or maintain permits or licenses required to conduct business in China may be affected. In the absence

of required permits or licenses, governmental authorities may impose material sanctions or penalties on the company. Such actions could

significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of such

securities to significantly decline or be worthless.

Resale limitations of Rule 144(i) on your shares

According to the Rule 144(i), Rule 144 is not available for the resale

of securities initially issued by either a reporting or non-reporting shell company. Moreover, Rule 144(i)(1)(ii) states that Rule 144

is not available to securities initially issued by an issuer that has been “at any time previously” a reporting or non-reporting

shell company. Rule 144(i)(1)(ii) prohibits shareholders from utilizing Rule 144 to sell their shares in a company that at any time in

its existence was a shell company. However, according to Rule 144(i)(2), an issuer can “cure” its shell status.

To “cure” a company’s current or former shell company

status, the conditions of Rule 144(i)(2) must be satisfied regardless of the time that has elapsed since the public company ceased to

be a shell company and regardless of when the shares were issued. The availability of Rule 144 for resales of shares issued while the

company is a shell company or thereafter may be restricted even after the expiration of the one-year period since it filed its Form 10

information if the company is not current on all of its periodic reports required to be filed within the SEC during the 12 months before

the date of the shareholder’s sale. Thus, the company must file all 10-Qs and 10-K for the preceding 12 months and since the filing

of the Form 10, or Rule 144 is not available for the resale of securities.

We have extremely limited assets, have

incurred operating losses, and have no current source of revenue

We have had minimal assets. We do not expect

to generate revenues until we begin to implement our business plan. However, we can provide no assurance that we will produce any material

revenues for our stockholders, or that our business will operate on a profitable basis.

We will, likely, sustain operating expenses

without corresponding revenues, at least until the consummation of our business plan. This may result in our incurring a net operating

loss that will increase unless we consummate a business plan with a profitable business or internally develop our business. We cannot

assure you that we can identify a suitable business combination or successfully internally develop our business, or that any such business

will be profitable at the time of its acquisition by the Company or ever.

Our capital resources may not be sufficient

to meet our capital requirements, and in the absence of additional resources we may have to curtail or cease business operations

We have historically generated negative cash

flow and losses from operations and could experience negative cash flow and losses from operations in the future. Our independent auditors

have included an explanatory paragraph in their report on our financial statements for the fiscal years ended December 31, 2020, and

2019 expressing doubt regarding our ability to continue as a going concern. We currently only have a minimal amount of cash available,

which will not be sufficient to fund our anticipated future operating needs. The Company will need to raise substantial sums to implement

its business plan. There can be no assurance that the Company will be successful in raising funds. To the extent that the Company is

unable to raise funds, we will be required to reduce our planned operations or cease any operations.

We may encounter substantial competition

in our business and our failure to compete effectively may adversely affect our ability to generate revenue

International education is an emerging industry.

We believe that existing and new competitors will continue to improve in cost control and performance of their curriculum. We have global

competitors and we will be required to continue to invest in product development and productivity improvements to compete effectively

in our markets. Our competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than

ours, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations

and financial condition.

Our major competitors may be better able than

we to successfully endure downturns in our industrial sector. In periods of reduced demand for our product, we can either choose to maintain

market share by reducing our selling prices to meet competition or maintain selling prices, which would likely sacrifice market share.

Sales and overall profitability would be reduced in either case. In addition, we cannot assure you that additional competitors will not

enter our existing markets, or that we will be able to compete successfully against existing or new competition.

Effect

of Environmental Laws

We

believe we are in compliance with all applicable environmental laws, in all material respects. We do not expect future compliance with

environmental laws to have a material adverse effect on our business.

We may not be able to obtain regulatory

approvals for our product

Our business is subject to laws and regulations governing development

of curriculum, accreditation, and other matters. The Company believes acquisition of already accredited private corporations will mitigate

this risk.

All operating plans have been made in consideration of existing scholastic

regulations. Regulations that most affect operations are related to curriculums of the private corporations we acquire.

We face a number of risks associated

with our business plan, including the possibility that we may incur substantial debt or convertible debt, which could adversely affect

our financial condition

We intend to use reasonable efforts to complete

our business plan. The risks commonly encountered in implementing our business plan is insufficient revenues to offset increased expenses

associated with finding a merger candidate. Failure to raise sufficient capital to carry out our business plan. Additionally, we have

no operations at this time so our expenses are likely to increase and it is possible that we may incur substantial debt or convertible

debt in order to complete our business plan, which can adversely affect our financial condition. Incurring a substantial amount of debt

or convertible debt may require us to use a significant portion of our cash flow to pay principal and interest on the debt, which will

reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may negatively

impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing costs, and impact

the terms, conditions, and restrictions contained in possible future debt agreements, including the addition of more restrictive covenants;

impact our flexibility in planning for and reacting to changes in our business as covenants and restrictions contained in possible future

debt arrangements may require that we meet certain financial tests and place restrictions on the incurrence of additional indebtedness

and place us at a disadvantage compared to similar companies in our industry that have less debt.

Our future success is highly dependent

on the ability of management to locate and attract suitable business opportunities and our stockholders will not know what business we

will enter into until we consummate a transaction with the approval of our then existing directors and officers

At this time, we have no operations and future

implementation of our business plan is highly speculative, there is a consequent risk of loss of an investment in the Company. The success

of our plan of operations will depend to a great extent on the operations, financial condition and management of future business and internal

development. While management intends to seek businesses opportunities with entities having established operating histories, we cannot

provide any assurance that we will be successful in locating opportunities meeting that criterion. In the event we complete a business

plan, the success of our operations will be dependent upon management, its financial position and numerous other factors beyond our control.

There can be no assurance that we will

successfully consummate a business plan or internally develop a successful business

We are a blank check company and can give

no assurance that we will successfully identify and evaluate suitable business opportunities or that we will successfully implement our

business plan. We cannot guarantee that we will be able to negotiate contracts on favorable terms. No assurances can be given that we

will successfully identify and evaluate suitable business opportunities, that we will conclude a business plan or that we will be able

to develop a successful business. Our management and affiliates will play an integral role in establishing the terms for any future business.

We will incur increased costs as a result

of becoming a reporting company, and given our limited capital resources, such additional costs may have an adverse impact on our profitability.

Following the effectiveness of this Form 10,

we will be an SEC reporting company. The Company currently has no business and no revenue. However, the rules and regulations under the

Exchange Act require a public company to provide periodic reports with interactive data files which will require the Company to engage

legal, accounting and auditing services, and XBRL and EDGAR service providers. The engagement of such services can be costly, and the

Company is likely to incur losses, which may adversely affect the Company’s ability to continue as a going concern. In addition,

the Sarbanes-Oxley Act of 2002, as well as a variety of related rules implemented by the SEC, have required changes in corporate governance

practices and generally increased the disclosure requirements of public companies. For example, as a result of becoming a reporting company,

we will be required to file periodic and current reports and other information with the SEC and we must adopt policies regarding disclosure

controls and procedures and regularly evaluate those controls and process.

The additional costs we will incur in connection

with becoming a reporting company will serve to further stretch our limited capital resources. The expenses incurred for filing periodic

reports and implementing disclosure controls and procedures may be as high as $70,000 USD annually. In other words, due to our limited

resources, we may have to allocate resources away from other productive uses in order to pay any expenses we incur in order to comply

with our obligations as an SEC reporting company. Further, there is no guarantee that we will have sufficient resources to meet our reporting

and filing obligations with the SEC as they come due.

The time and cost of preparing a private

company to become a public reporting company may preclude us from entering into an acquisition or merger with the most attractive private

companies and others

From time to time the Company may come across

target merger companies. These companies may fail to comply with SEC reporting requirements may delay or preclude acquisitions. Sections

13 and 15(d) of the Exchange Act require reporting companies to provide certain information about significant acquisitions, including

certified financial statements for the company acquired, covering one or two years, depending on the relative size of the acquisition.

The time and additional costs that may be incurred by some target entities to prepare these statements may significantly delay or essentially

preclude consummation of an acquisition. Otherwise, suitable acquisition prospects that do not have or are unable to obtain the required

audited statements may be inappropriate for acquisition so long as the reporting requirements of the Exchange Act are applicable.

A Business may result in a change of

control and a change of management.

In conjunction with completion of a business

acquisition, it is anticipated that we may issue an amount of our authorized but unissued common or preferred stock which represents the

majority of the voting power and equity of our capital stock, which would result in stockholders of a target company obtaining a controlling

interest in us. As a condition of the business combination agreement, our current stockholders may agree to sell or transfer all or a

portion of our common stock as to provide the target company with all or majority control. The resulting change in control may result

in removal of our present officers and directors and a corresponding reduction in or elimination of their participation in any future

affairs.

We depend on our officers and the loss of their services would

have an adverse effect on our business

We have officers and directors of the Company that are critical to

our chances for business success. We are dependent on their services to operate our business and the loss of these persons, or any of

them would have an adverse impact on our future operations until such time as he or she could be replaced, if he could be replaced. We

do not have employment contracts or employment agreements with our officers, and we do not carry key man life insurance on their lives.

Because we are significantly smaller than the some of our competitors,

we may lack the resources needed to capture market share

The international education industry is highly competitive, and our

business plan has not been implemented and we are smaller in size than some of our competitors. We are at a disadvantage as a blank check

company, we do not have an established business. Many of our competitors have an already established their business, more established

market presence, and substantially greater financial, marketing, and other resources than do we. New competitors may emerge and may develop

new or innovative products that compete with our anticipated future production. No assurance can be given that we will be able to compete

successfully within the international education industry.

Our ability to use our net operating loss carry-forwards and

certain other tax attributes may be limited

We have incurred losses during our history. To the extent that we

continue to generate taxable losses, unused losses will carry forward to offset future taxable income, if any, until such unused losses

expire. Under Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change,”

generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability

to use its pre-change net operating loss carry-forwards, or NOLs, and other pre-change tax attributes (such as research tax credits)

to offset its post-change income may be limited. We may experience ownership changes in the future because of subsequent shifts in our

stock ownership. As a result, if we earn net taxable income, our ability to use our pre-change net operating loss carryforwards to offset

U.S. federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In

addition, at the state level, there may be periods during which the use of NOLs is suspended or otherwise limited, which could accelerate

or permanently increase state taxes owed.

Our ability to hire and retain key personnel

will be an important factor in the success of our business and a failure to hire and retain key personnel may result in our inability

to manage and implement our business plan

Our management has limited experience in the

educational industry and we may not be able to attract and retain the necessary qualified personnel. If we are unable to retain or to

hire qualified personnel as required, we may not be able to adequately manage and implement our business plan.

Legal disputes could have an impact on our Company

We plan to engage in business matters that are common to the business

world that can result in disputations of a legal nature. In the event the Company is ever sued or finds it necessary to bring suit

against others, there is the potential that the results of any such litigation could have an adverse impact on the Company.

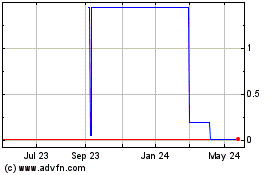

Our common stock is quoted on the OTC MARKETS. An investment

in our common stock is risky and there can be no assurance that the price for our stock will not decrease substantially in the future

Our common stock is quoted on the OTC Markets. The market for our stock

has been volatile and has been characterized by large swings in the trading price that do not appear to be directly related to our business

or financial condition. As a result, an investment in our common stock is risky and there can be no assurance that the price for our stock

will not decrease substantially in the future.

Our stock trades below $5.00 per share and is subject to special

sales practice requirements that could have an adverse impact on any trading market that may develop for our stock

If our stock trades below $5.00 per share and is subject to special

sales practice requirements applicable to "penny stocks" which are imposed on broker-dealers who sell low-priced securities

of this type. These rules may be anticipated to affect the ability of broker-dealers to sell our stock, which may in turn be anticipated

to have an adverse impact on the market price for our stock if and when an active trading market should develop.

Our officers, directors and principal stockholders own a large

percentage of our issued and outstanding shares and other stockholders have little or no ability to elect directors or influence corporate

matters

As of July 6, 2021, our officers, directors, and principal stockholders

were deemed to be the beneficial owners of approximately of our 52.6% issued and outstanding shares of common stock. As a result, such

persons can determine the outcome of any actions taken by us that require stockholder approval. For example, they will be able to elect

all of our directors and control the policies and practices of the Company.

Risks Related to Our Shareholders and Shares

of Common Stock

There is presently no public market

for our securities

Our common stock is not currently trading

on any market, and a robust and active trading market may never develop. Because of our current status as a “shell company,”

Rule 144 is not currently available. Future sales of our common stock by existing stockholders pursuant to an effective registration

statement or upon the availability of Rule 144 could adversely affect the market price of our common stock. A shareholder who decides

to sell some, or all, of their shares in a private transaction may be unable to locate persons who are willing to purchase the shares,

given the restrictions. Also, because of the various risk factors described above, the price of the publicly traded common stock may

be highly volatile and not provide the true market price of our common stock.

Our stock is not traded, so you may

be unable to sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares

Even if our stock becomes trading, it is likely

that our common stock will be thinly traded, meaning that the number of persons interested in purchasing our common shares at or near

bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including

the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend

to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares

until such time as we became more seasoned and viable. Consequently, there may be periods of several days or more when trading activity

in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that

will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more

active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained. Due

to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you need

money or otherwise desire to liquidate your shares.

Our common stock is be considered a

“penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell

A common stock is a “penny stock”

if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on

a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less than

$5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5

million.

The principal result or effect of being designated

a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny

stock” regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed

and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s

account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such

stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information

concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information,

that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be

reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth

the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement

from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment

objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell

their shares to third parties or to otherwise dispose of them in the market or otherwise.

We may issue more shares in an acquisition

or merger, which will result in substantial dilution

Our Articles of Incorporation, as amended, authorize the Company to

issue an aggregate of 90,000,000 shares of common stock of which 77,698,333 shares are currently

outstanding and 10,000,000 shares of Preferred Stock are authorized, of which 0 shares are outstanding. Any acquisition or merger effected

by the Company may result in the issuance of additional securities without stockholder approval and may result in substantial dilution

in the percentage of our common stock held by our then existing stockholders. Moreover, shares of our common stock issued in any such

merger or acquisition transaction may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional

reduction in the percentage of common stock held by our then existing stockholders. In an acquisition type transaction, our Board of

Directors has the power to issue any, or all, of such authorized but unissued shares without stockholder approval. To the extent that

additional shares of common stock are issued in connection with a business combination or otherwise, dilution to the interests of our

stockholders will occur and the rights of the holders of common stock might be materially adversely affected.

Obtaining additional capital though

the sale of common stock will result in dilution of stockholder interests

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock. Additionally, the existing conversion rights may hinder future equity

offerings, and the exercise of those conversion rights may have an adverse effect on the value of our stock. If any such conversion rights

are exercised at a price below the then current market price of our shares, then the market price of our stock could decrease upon the

sale of such additional securities. Further, if any such conversion rights are exercised at a price below the price at which any stockholder