Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10/AMENDMENT 7

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities

Exchange Act of 1934

|

ASIARIM CORP.

AKA UN MONDE INTERNATIONAL LTD. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

83-0500896 |

|

(State of other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

5689 Condor Place

Mississauga ON

L5V 2J4 Canada

Westagate Mall

(Address of Principal

Executive Offices) (Zip Code)

1-905-962-0823

(Registrant’s

telephone number, including area code)

Securities to be

Registered Under Section 12(b) of the Act:

None

Securities to be

Registered Under Section 12(g) of the Act:

Common Stock, Par

Value $0.001

(Title of Class)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ASIARIM CORP.

INDEX TO FORM 10

Cautionary Note Regarding

Forward-Looking Statements

This registration statement

on Form 10 contains “forward-looking statements” concerning our future results, future performance, intentions, objectives,

plans, and expectations, including, without limitation, statements regarding the plans and objectives of management for future operations,

any statements concerning our proposed services, any statements regarding future economic conditions or performance, and any statements

of assumptions underlying any of the foregoing. All forward-looking statements included in this document are made as of the date hereof

and are based on information available to us as of such date. We assume no obligation to update any forward-looking statements. In some

cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,”

“plans,” “anticipates,” “intends,” “believes,” “estimates,” “potential,”

or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected

in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking

statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking

statements. Future financial condition and results of operations, as well as any forward-looking statements are subject to inherent risks

and uncertainties, including those discussed under “Risk Factors” and elsewhere in this Form 10.

Introductory Comment

We are filing this General

Form for Registration of Securities on Form 10 to register our common stock pursuant to Section 12(g) of the Exchange Act. Once this

registration statement is deemed effective, we will be subject to the requirements of Section 13(a) under the Exchange Act, which will

require us to file annual reports on Form 10-K (or any successor form), quarterly reports on Form 10-Q (or any successor form), and current

reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration

statements pursuant to Section 12(g) of the Exchange Act.

Throughout this Form 10,

unless the context otherwise requires, the terms “we,” “us,” “our,” the “Company,” “ARMC"

and “our Company” refer to Asiarim Corp., a Nevada corporation. Asiarim Corp. is a Blank Check Company under Rule 419 of the

Securities Act of 1933.

Un Monde International Ltd. is Blank Check Company as defined by

Securities Act Rule 419(a)(2):

(2) For

purposes of this section, the term “blank check company” shall mean a company that:

(i) Is

a development stage company that has no specific business plan or purpose or has indicated that its business plan is

to engage in a merger or acquisition with an unidentified company or companies, or other entity or person; and

(ii) Is issuing

“penny stock,” as defined in Rule 3a51-1 (17 CFR 240.3a51-1) under the Securities Exchange Act of 1934 (“Exchange

Act”).

We plan to merge with or acquire a target

company in the business of educating international students, so they have the tools to contribute and thrive in an interdependent world.

Our vision incorporates the spirit of social responsibility, not only on a local community basis but also on a global scale. We will

achieve this through multilingual education and critical thinking so the student may integrate into any cultural situation.

There is no geographic limitation to the location of targets, as

these types of opportunities are not necessarily bound by geography; provided however, we expressly disclaim any intent to and we will

not pursue a business combination with a target company (either directly or through any subsidiaries) with any operations in

China, Hong Kong or Macau nor will we consummate a business combination with any such entity ever.

Our officer and director resides in Canada, investors may have

limited legal recourse against them including difficulties in enforcing judgments made against them by U.S. courts. We are organized

under the laws of the state of Nevada. As of the date of this disclosure, the director and officer of is located outside the United States.

Therefore, any judgment obtained in the United States against our officer and director, including judgments with respect to the payment

of principal, premium (if any) and interest on the notes, may not be collectible in the United States. In addition, it may not be possible

for investors to effect service of process within the United States upon our officer and director, or to enforce against him, judgments

obtained in U.S. courts predicated upon the civil liability provisions of federal or state securities laws. The laws of each jurisdiction

with respect to the collectability and enforcement of judgments obtained in U.S. courts are different and may adversely affect the

investor’s right of recovery.

Our officer and director is a Canadian citizen, has Chinese ancestry

and may have personal ties that continue in China. Notwithstanding such ties to China, we expressly disclaim any intent to and will not

consummate a business combination with a target business (either directly or through any subsidiaries) with any operations

in China, Hong Kong or Macau ever.

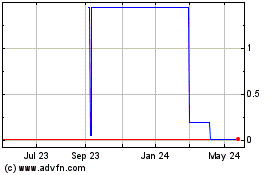

Our Company is currently listed as Pink

Current on the OTC Markets platform. Our stock quote is currently quoted on OTC Markets. The market for our stock is uncertain at this

time and there is a limited market for our common stock

Our securities could be particularly illiquid

due to being listed on this market and it could impede a potential merger, acquisition, reverse merger or business combination pursuant

to which the company could become an operating company

The filing of this registration statement

and continued compliance with financial reporting requirements will allow ARMC to be listed as a Pink Current company on the OTC Markets

platform. In addition, we are actively pursuing a viable merger candidate which will allow us continued Pink Current status.

(a) Business Development

The Company was organized under the laws of the State of Nevada on

June 15, 2007, under its current name. The Company was a development stage company with the goal

of acquire private corporations that are involved in education and management services offering private, distinguished, specialized,

and internationalized education to international students in schools.

Prior to 2012, the Company engaged

in the computer electronics business as it completed the acquisition of Commodore.

Business operations for Asiarim Corp. and its subsidiaries were abandoned

by former management and a custodianship action, as described in the subsequent paragraph, was commenced in 2016. The Company filed its

last 10Q in 2011, this financial report included liabilities and debts. As of the date of this filing, these liabilities and debts have

been addressed and the legal opinion for debt write off is attached as an Exhibit.

On May 5, 2016, the Eighth District

Court of Clark County, Nevada granted the Application for Appointment of Custodian as a result of the absence of a functioning board of

directors and the revocation of the Company’s charter. The order appointed Bryan Glass (“Mr. Glass”, the “Custodian”)

custodian with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock, and authorize

new classes of stock.

The court awarded custodianship to Mr. Glass based on the absence of

a functioning board of directors, revocation of the company’s charter, and abandonment of the business. At this time, Ms. Glass

was appointed sole officer and director.

The Company was severely delinquent in filing annual reports for the

Company’s charter. The last annual report was filed on September 30, 2010 in on Form 10-K. In addition, the company was subject

to Exchange Act reporting requirements including filing 10Q’s and 10Ks. The Company filed its last 10Q for quarter ending June 30,

2011, and was out of compliance with Exchange Act reporting. Mr. Glass attempted to contact the Company’s officers and directors

through letters, emails, and phone calls, with no success.

Mr. Glass was a shareholder in the Company and applied to the Court

for an Order appointing Brian Glass as the Custodian. This application was for the purpose of reinstating ARMC’s corporate charter

to do business and restoring value to the Company for the benefit of the stockholders.

Mr. Glass performed the following actions in its capacity as custodian:

| |

• |

Funded any expenses of the company including paying off outstanding liabilities |

| |

• |

Brought the Company back into compliance with the Nevada Secretary of State, resident agent, transfer agent |

| |

• |

Appointed officers and directors and held a shareholders meeting |

The Custodian paid the following expenses

on behalf of the company:

Nevada Secretary of State for reinstatement of the Company, $3,925

Transfer agent, Island Stock Transfer, $9,100

Amended and Restated Articles of Incorporation for the Company, $175.

Upon appointment as the Custodian of ARMC

and under its duties stipulated by the Nevada court, Mr. Glass took initiative to organize the business of the issuer. As Custodian, the

duties were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Nevada

Secretary of State. Mr. Glass also had authority to enter into contracts and find a suitable merger candidate. Mr. Glass was compensated

for its role as custodian in the amount of 40,000,000 shares of Restricted Common Stock. SCC did not receive any additional compensation,

in the form of cash or stock, for custodian services. The custodianship was discharged on November 9, 2016.

On January 30, 2019, Mr. Glass entered into

a Stock Purchase Agreement with Asia Gateway Capital Ltd.*, whereby Asia Gateway Capital Ltd. purchased 40,000,000 shares of Restricted

Common Stock. These shares represent the controlling block of stock. Mr. Glass resigned his position of sole officer and director

and appointed Ci Zhang as CEO and Director of the Company. Mr. Glass also appointed ChangJun Xue as CFO, Treasurer and Director and Bing

Qing Xie as Secretary and Director.

*Asia Gateway Capital Ltd. is controlled

by Jamie Liu.

We are currently a shell company, as defined

in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2.

(b) Business of Issuer

Asiarim Corp. is a developmental stage company,

incorporated under the laws of the State of Nevada on June 15, 2007. Our plan of business has not been implemented but will incorporate

the acquisition of private corporations involved in education and management services offering private, distinguished, specialized, and

internationalized education to international students in schools.

The Company changed its name in Nevada, the

state of domicile, to Un Monde International Ltd.

At present financial revenue has not yet been realized. The Company

hopes to raise capital in order to fund the acquisitions.

All statements involving our business plan are forward looking statements

and have not been implemented as of this filing.

The Company is moving in a new direction,

statements made relating to our business plan are forward looking statements and we have no history of performance and have not implemented

our business plan. Current management does not have any experience in acquisition of

international educational companies but is actively looking for a suitable person to incorporate into the management team.

We feel that our contemplated business

plan addresses the need for additional development in the education industry.

Our contemplated business is within the

industry of educating international students, so they have the tools to contribute and thrive in an interdependent world. Our vision

incorporates the spirit of social responsibility, not only on a local community basis but also on a global scale. We will achieve this

through multilingual education and critical thinking so the student may integrate into any cultural situation.

The impact of social distancing requirements

due to Covid-19 has accelerated already robust global growth in online education, a trend many expect to continue even after Covid-19

restrictions are lifted.

As governments attempt to reduce the cost

of studying abroad, providing such opportunities in a cost-effective way has become the focus for leading educational institutions.

In a post-Covid world, online education is far and away now the ideal solution.

International education is generally

taken to include

| · | Traditional curriculum (math, sciences, languages) |

| · | Knowledge of other world regions & cultures; |

| · | Familiarity with international and global issues; |

| · | Skills in working effectively within global or cross-cultural environments, and using information from different sources around the

world; |

| · | Ability to communicate in multiple languages; and |

| · | Dispositions towards respect and concern for other cultures and peoples. |

The Company intends to implement its business

plan upon raising capital. Subject to available capital, the Company intends to invest in:

Development

| · | Formal and informal education curriculum |

| o | Training, exchange programs, cross-cultural communication |

Implementation

| · | Promoting international understanding/international-mindedness and/or global awareness/understanding |

| · | Being active in global engagement/global or world citizenship |

| · | Increasing intercultural understanding and respect for difference |

| · | Encouraging tolerance and commitment to peace |

The analysis will be undertaken by or under

the supervision of our management. As of the date of this filing, we have not entered into definitive agreements. In our continued efforts

to analyze potential business plan, we intend to consider the following factors:

| · | Potential for growth, indicated by anticipated market expansion or new technology; |

| · | Competitive position as compared to other schools of similar size and experience within the education segment as well as within the

industry as a whole; |

| · | Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional assistance

and other required items; |

| | · | Capital

requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional

securities or convertible debt, through joint ventures or similar arrangements or from other sources; |

| · | The extent to which the business opportunity can be advanced in the marketplace; and |

| · | Other relevant factors |

In applying the foregoing criteria, management

will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available

data. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity

to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial capabilities

for identifying and completing our business plan.

We are unable to predict when we will, if

ever, identify and implement our business plan. We anticipate that proposed business plan would be made available to us through personal

contacts of our directors, officers and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of

the financial community and others who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee or

to otherwise compensate the persons who introduce the Company to business opportunities in which we participate.

There is no geographic limitation to the location of targets, as

these types of opportunities are not necessarily bound by geography; provided however, we expressly disclaim any intent to and we will

not pursue a business combination with a target company (either directly or through any subsidiaries) with any operations in

China, Hong Kong or Macau nor will we consummate a business combination with any such entity ever.

We expect that our due diligence will encompass,

among other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well

as a review of financial and other information, which is made available to the Company. This due diligence review will be conducted either

by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash

payments for services or expenses related to any analysis.

We may incur time and costs required to select

and evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty.

Any costs incurred with respect to the indemnification and evaluation of a prospective international education program that is not ultimately

completed may result in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s

fees and other related expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific

business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments

will require substantial management time and attention and substantial cost for accountants, attorneys, consultants, and others. Costs

may be incurred in the investigation process, which may not be recoverable. Furthermore, even if an agreement is reached for the participation

in a specific business opportunity, the failure to consummate that transaction may result in a loss to the Company of the related costs

incurred.

Competition

Our

company expects to compete with many countries in the international education industry. In addition, there are several competitors that

are larger and more profitable than ARMC. We expect that the quantity and composition of our competitive environment will continue to

evolve as the industry matures. Additionally, increased competition is possible to the extent that new geographies enter the marketplace

as a result of continued enactment of regulatory and legislative changes. We believe that diligently establishing and expanding our funding

sources will establish us in an already established industry. Additionally, we expect that establishing our product offerings on new platforms

are factors that mitigate the risk associated with operating in a developing competitive environment. Additionally, the contemporaneous

growth of the industry as a whole will result in new students entering the international education marketplace, thereby further mitigating

the impact of competition on our future operations and results.

Compliance with education standards

and guidelines will increase development costs and the cost of operating our business. In turn, we may not be able to meet the competitive

price point for our education curriculum dictated by the market and our competitors.

Again,

these are forward looking statements and not an indication of past performance. There is no guarantee that we will be able to implement

our business plan and have no merger candidates as of the time of this filing.

Effect of Existing or Probable Governmental

Regulations on the Business

Upon effectiveness of this Form 10, we will

be subject to the Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, we will be required to file with the SEC annual

reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent

accounting oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also (1)

requires steps be taken to enhance the direct responsibility of senior members of management for financial reporting and for the quality

of financial disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to public view, possible

conflicts of interest affecting securities analysts; (3) creates guidelines for audit committee members’ appointment, and compensation

and oversight of the work of public companies’ auditors; (4) prohibits certain insider trading during pension fund blackout periods;

and (5) establishes a federal crime of securities fraud, among other provisions.

We will also be subject to Section 14(a) of

the Exchange Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with

the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders

at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information

outlined in Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days

prior to the date that definitive copies of this information are provided to our stockholders.

Employees

As of March 31, 2021, we had one officer,

three directors and no employees. We anticipate that we will begin to fill out our management team as and when we raise capital to begin

implementing our business plan. In the interim, we will utilize independent consultants to assist with accounting and administrative matters.

We currently have no employment agreements and believe our consulting relationships are satisfactory. We plan to continue to hire independent

consultants from time to time on an as-needed basis.

Risks Relating to Our Contemplated

Business Plan

Our contemplated business plan involves

a number of very significant risks. Our future business, operating results and financial condition

could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment

due to any of these risks. You should invest in our common stock only if you can afford to lose your entire investment.

Our officer and director resides in Canada

and the investor will incur additional costs to pursue a judgment in Canada and the Canadian courts may deny enforcement of the judgment.

Our

future business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following

risks. You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can

afford to lose your entire investment.

China companies and operations

There is no geographic limitation to the location of targets, as

these types of opportunities are not necessarily bound by geography; provided however, we expressly disclaim any intent to and we will

not pursue a business combination with a target company (either directly or through any subsidiaries) with any operations in

China, Hong Kong or Macau nor will we consummate a business combination with any such entity ever.

Enforcement of Civil Liabilities

We are organized under the laws of the

state of Nevada. As of the date of this disclosure, the director and officer of is located outside the United States. Therefore, any

judgment obtained in the United States against our officer and director, including judgments with respect to the payment of principal,

premium (if any) and interest on the notes, may not be collectible in the United States. In addition, it may not be possible for investors

to effect service of process within the United States upon our officer and director, or to enforce against, judgments obtained in U.S. courts

predicated upon the civil liability provisions of federal or state securities laws. The laws of this jurisdiction with respect to the

collectability and enforcement of judgments obtained in U.S. courts are different and may adversely affect the investor’s

right of recovery.

Canada and its provinces are

not party to any convention or bilateral treaty with the United States providing for the reciprocal recognition and enforcement of judgments.

As a result, a judgment obtained in a U.S. federal or state court against our officer and director located in the province of Ontario

will not automatically be recognized or enforced by the courts of this province. There is substantial doubt whether an original action

predicated solely upon civil liability under United States federal securities legislation could be brought successfully in the province

of Ontario, and furthermore, that if a court of this province concluded that it had jurisdiction over such an action, it might exercise

its discretion to decline to assume jurisdiction based on consideration of the most appropriate or convenient forum for that action to

be heard.

A court of competent jurisdiction

in the Province of Ontario (“Ontario Court”) would give a judgment based upon a final and conclusive in personam judgment

of a court exercising jurisdiction in a U.S. Court for a sum certain, obtained against a guarantor (or its directors or officers)

with respect to a claim arising out of the guarantee provided by such guarantor (a “U.S. Judgment”), without reconsideration

of the merits, provided that:

(a) the

U.S. Court had jurisdiction over the guarantor as recognized under the laws of the Province of Ontario and the federal laws of Canada

applicable therein for purposes of enforcement of foreign judgments;

(b) an

action to enforce the U.S. Judgment must be commenced in the Ontario Court within any applicable limitation period;

(c) the

Ontario Court has discretion to stay or decline to hear an action on the U.S. Judgment if the U.S. Judgment is under appeal

or there is another subsisting judgment in any jurisdiction relating to the same cause of action as the U.S. Judgment;

(d) the

Ontario Court will render judgment only in Canadian dollars; and

(e) an

action in the Ontario Court on the U.S. Judgment may be affected by bankruptcy, insolvency or other similar laws affecting the enforcement

of creditors’ rights generally; and

subject

to the following defenses:

(f) the

U.S. Judgment was obtained by fraud or in a manner contrary to the principles of natural justice;

(g) the

U.S. Judgment is for a claim which under the laws of the Province of Ontario and the federal laws of Canada applicable therein would

be characterized as based on a foreign revenue, expropriatory, penal or other public law, which would include awards of damages made

under civil liability provisions of United States federal securities legislation, or other laws, to the extent that the same would be

classified by Ontario Courts as being of a penal nature (for example, penal or similar awards made by a court in a regulatory prosecution

or proceeding);

(h) the

U.S. Judgment is contrary to Ontario public policy or to an order made by the Attorney General of Canada under the Foreign

Extraterritorial Measures Act (Canada) or by the Competition Tribunal under the Competition Act (Canada) in

respect of certain judgments referred to in these statutes; and

(i) the

U.S. Judgment has been satisfied or is void or voidable under the laws of the applicable state or the federal laws of the United

States.

Resale limitations of Rule 144(i) on your shares

According to the Rule 144(i), Rule 144 is not available for the resale

of securities initially issued by either a reporting or non-reporting shell company. Moreover, Rule 144(i)(1)(ii) states that Rule 144

is not available to securities initially issued by an issuer that has been “at any time previously” a reporting or non-reporting

shell company. Rule 144(i)(1)(ii) prohibits shareholders from utilizing Rule 144 to sell their shares in a company that at any time in

its existence was a shell company. However, according to Rule 144(i)(2), an issuer can “cure” its shell status.

To “cure” a company’s current or former shell company

status, the conditions of Rule 144(i)(2) must be satisfied regardless of the time that has elapsed since the public company ceased to

be a shell company and regardless of when the shares were issued. The availability of Rule 144 for resales of shares issued while the

company is a shell company or thereafter may be restricted even after the expiration of the one-year period since it filed its Form 10

information if the company is not current on all of its periodic reports required to be filed within the SEC during the 12 months before

the date of the shareholder’s sale. Thus, the company must file all 10-Qs and 10-K for the preceding 12 months and since the filing

of the Form 10, or Rule 144 is not available for the resale of securities.

We have extremely limited assets, have

incurred operating losses, and have no current source of revenue

We have had minimal assets. We do not

expect to generate revenues until we begin to implement a business plan. We can provide no assurance that we will produce any material

revenues for our stockholders, or that our contemplated business will operate on a profitable basis.

We will, likely, sustain operating expenses

without corresponding revenues, at least until the consummation of a business plan. This may result in our incurring a net operating

loss that will increase unless we consummate a business plan with a profitable business or internally develop our business. We cannot

assure you that we can identify a suitable business combination or successfully internally develop our business, or that any such business

will be profitable at the time of its acquisition by the Company or ever.

Our capital resources may not be sufficient

to meet our capital requirements, and in the absence of additional resources we may have to curtail or cease business operations

We have historically generated negative cash

flow and losses from operations and could experience negative cash flow and losses from operations in the future. Our independent

auditors have included an explanatory paragraph in their report on our financial statements for the fiscal years ended December 31, 2021,

and 2020 expressing doubt regarding our ability to continue as a going concern. We currently only have a minimal amount of cash available,

which will not be sufficient to fund our anticipated future operating needs. The Company will need to raise substantial sums to implement

its business plan. There can be no assurance that the Company will be successful in raising funds. To the extent that the Company is

unable to raise funds, we will be required to reduce our planned operations or cease any operations.

We may encounter substantial competition

in our contemplated business and our failure to compete effectively may adversely affect our ability to generate revenue

We believe that existing and new competitors

will continue to improve in cost control and performance in whatever business we acquire. We may have global competitors and we will

be required to continue to invest in product development and productivity improvements to compete effectively in our markets. Our

competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than ours, which may adversely

affect our marketing strategies and could have a material adverse effect on contemplated business, results of operations and financial

condition.

Effect of Environmental Laws

We are not governed by environmental laws

at this time. However, our belief that that we will be compliance with all applicable environmental laws, in all material respects.

We do not expect future compliance with environmental laws to have a material adverse effect on our business.

We may not be able to obtain regulatory

approvals for our services

At this time the Company is not subject to any laws or regulations

relating to a business model. However, our future business may be subject to laws and regulations. The Company believes acquisition of

already established corporations will mitigate this risk.

We may face a number of risks associated

with implementing a business plan, including the possibility that we may incur substantial debt or convertible debt, which could adversely

affect our financial condition

We intend to use reasonable efforts to

complete a business plan. The risks commonly encountered in implementing a business plan is insufficient revenues to offset increased

expenses associated with finding a merger candidate. Failure to raise sufficient capital to carry out our business plan. Additionally,

we have no operations at this time so our expenses are likely to increase, and it is possible that we may incur substantial debt or convertible

debt in order to complete our business plan which can adversely affect our financial condition. Incurring a substantial amount of

debt or convertible debt may require us to use a significant portion of our cash flow to pay principal and interest on the debt, which

will reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may negatively

impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing costs, and impact

the terms, conditions, and restrictions contained in possible future debt agreements, including the addition of more restrictive covenants;

impact our flexibility in planning for and reacting to changes in our business as covenants and restrictions contained in possible future

debt arrangements may require that we meet certain financial tests and place restrictions on the incurrence of additional indebtedness

and place us at a disadvantage compared to similar companies in our industry that have less debt.

Our future success is highly dependent

on the ability of management to locate and attract suitable business opportunities and our stockholders will not know what business we

will enter into until we consummate a transaction with the approval of our then existing directors and officers

At this time, we have no operations and

future implementation of a business plan is highly speculative, there is a consequent risk of loss of an investment in the Company.

The success of our plan of operations will depend to a great extent on the operations, financial condition and management of future business

and internal development. While management intends to seek businesses opportunities with entities having established operating histories,

we cannot provide any assurance that we will be successful in locating opportunities meeting that criterion. In the event we complete

a business plan, the success of our operations will be dependent upon management, its financial position and numerous other factors

beyond our control.

There can be no assurance that we will

successfully consummate a business plan or internally develop a successful business

We are a blank check company and can give

no assurance that we will successfully identify and evaluate suitable business opportunities or that we will successfully implement our

business plan. We cannot guarantee that we will be able to negotiate contracts on favorable terms. No assurances can be given that we

will successfully identify and evaluate suitable business opportunities, that we will conclude a business plan or that we will be able

to develop a successful business. Our management and affiliates will play an integral role in establishing the terms for any future business.

We will incur increased costs as a result

of becoming a reporting company, and given our limited capital resources, such additional costs may have an adverse impact on our profitability.

Following the effectiveness of this Form 10,

we will be an SEC reporting company. The Company currently has no business and no revenue. However, the rules and regulations under the

Exchange Act require a public company to provide periodic reports with interactive data files which will require the Company to engage

legal, accounting and auditing services, and XBRL and EDGAR service providers. The engagement of such services can be costly, and the

Company is likely to incur losses, which may adversely affect the Company’s ability to continue as a going concern. In addition,

the Sarbanes-Oxley Act of 2002, as well as a variety of related rules implemented by the SEC, have required changes in corporate governance

practices and generally increased the disclosure requirements of public companies. For example, as a result of becoming a reporting company,

we will be required to file periodic and current reports and other information with the SEC and we must adopt policies regarding disclosure

controls and procedures and regularly evaluate those controls and process.

The additional costs we will incur in connection

with becoming a reporting company will serve to further stretch our limited capital resources. The expenses incurred for filing periodic

reports and implementing disclosure controls and procedures may be as high as $70,000 USD annually. In other words, due to our limited

resources, we may have to allocate resources away from other productive uses in order to pay any expenses we incur in order to comply

with our obligations as an SEC reporting company. Further, there is no guarantee that we will have sufficient resources to meet our reporting

and filing obligations with the SEC as they come due.

The time and cost of preparing a private

company to become a public reporting company may preclude us from entering into an acquisition or merger with the most attractive private

companies and others

From time to time the Company may come across

target merger companies. These companies may fail to comply with SEC reporting requirements may delay or preclude acquisitions. Sections

13 and 15(d) of the Exchange Act require reporting companies to provide certain information about significant acquisitions, including

certified financial statements for the company acquired, covering one or two years, depending on the relative size of the acquisition.

The time and additional costs that may be incurred by some target entities to prepare these statements may significantly delay or essentially

preclude consummation of an acquisition. Otherwise, suitable acquisition prospects that do not have or are unable to obtain the required

audited statements may be inappropriate for acquisition so long as the reporting requirements of the Exchange Act are applicable.

A Business may result in a change of

control and a change of management.

In conjunction with completion of a business

acquisition, it is anticipated that we may issue an amount of our authorized but unissued common or preferred stock which represents the

majority of the voting power and equity of our capital stock, which would result in stockholders of a target company obtaining a controlling

interest in us. As a condition of the business combination agreement, our current stockholders may agree to sell or transfer all or a

portion of our common stock as to provide the target company with all or majority control. The resulting change in control may result

in removal of our present officers and directors and a corresponding reduction in or elimination of their participation in any future

affairs.

We depend on our officers and the loss of their services would

have an adverse effect on our business

We have officers and directors of the Company that are critical to

our chances for business success. We are dependent on their services to operate our business and the loss of these persons, or any of

them would have an adverse impact on our future operations until such time as he or she could be replaced, if he could be replaced. We

do not have employment contracts or employment agreements with our officers, and we do not carry key man life insurance on their lives.

Because we are significantly smaller than some of our competitors,

we may lack the resources needed to capture market share

We are at a disadvantage as a blank check company, we do not have an

established business. Many of our competitors have an already established their business, more established market presence, and substantially

greater financial, marketing, and other resources than do we. New competitors may emerge and may develop new or innovative products that

compete with our anticipated future production. No assurance can be given that we will be able to compete successfully within the international

education industry.

Our ability to use our net operating loss carry-forwards and

certain other tax attributes may be limited

We have incurred losses during our history. To the extent that we continue

to generate taxable losses, unused losses will carry forward to offset future taxable income, if any, until such unused losses expire.

Under Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change,”

generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability

to use its pre-change net operating loss carry-forwards, or NOLs, and other pre-change tax attributes (such as research tax credits) to

offset its post-change income may be limited. We may experience ownership changes in the future because of subsequent shifts in our stock

ownership. As a result, if we earn net taxable income, our ability to use our pre-change net operating loss carryforwards to offset U.S.

federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In addition,

at the state level, there may be periods during which the use of NOLs is suspended or otherwise limited, which could accelerate or permanently

increase state taxes owed.

Our ability to hire and retain key personnel

will be an important factor in the success of our business and a failure to hire and retain key personnel may result in our inability

to manage and implement our business plan

Our management has extensive experience

when acting in the officer and director capacity, however we will need to hire additional personnel and we may not be able to attract

and retain the necessary qualified personnel. If we are unable to retain or to hire qualified personnel as required, we may not be

able to adequately manage and implement our business plan.

Legal disputes could have an impact on our Company

We plan to engage in business matters that are common to the business

world that can result in disputations of a legal nature. In the event the Company is ever sued or finds it necessary to bring suit

against others, there is the potential that the results of any such litigation could have an adverse impact on the Company.

Our Company is currently listed as Pink Current on the OTC

Markets platform

Our stock quote is currently listed on OTC Markets. The market for

our stock is uncertain at this time. Our securities could be particularly illiquid due to being listed on this market and that if we remain

on the Pink Current market it could impede a potential merger, acquisition, reverse merger or business combination pursuant to which the

company could become an operating company.

Our common stock is not currently quoted on the OTC MARKETS.

An investment in our common stock is risky and there can be no assurance that the price for our stock will not decrease substantially

in the future

Our common stock is not quoted on an exchange. The market for

our stock has been volatile and has been characterized by large swings in the trading price that do not appear to be directly related

to our business or financial condition. As a result, an investment in our common stock is risky and there can be no assurance that the

price for our stock will not decrease substantially in the future.

Our stock trades below $5.00 per share and is subject to special

sales practice requirements that could have an adverse impact on any trading market that may develop for our stock

If our stock trades below $5.00 per share and is subject to special

sales practice requirements applicable to "penny stocks" which are imposed on broker-dealers who sell low-priced securities

of this type. These rules may be anticipated to affect the ability of broker-dealers to sell our stock, which may in turn be anticipated

to have an adverse impact on the market price for our stock if and when an active trading market should develop.

Our officers, directors and principal stockholders own a

large percentage of our stock and other stockholders have little or no ability to elect directors or influence corporate matters

As of December 31, 2021, our officer and director, and principal

stockholders were deemed to be the beneficial owners of approximately 52.6% of our issued and outstanding shares of common stock.

As a result, such persons can determine the outcome of any actions taken by us that require stockholder

approval. For example, they will be able to elect all of our directors and control the policies and practices of the Company.

Offering securities pursuant to a registration statement under

the Rule 419 of the Securities Act of 1933

In the event that we offer securities pursuant to a registration

statement under the Securities Act, such offering will be subject to the provisions of Rule 419 of the Securities Act of 1933. Rule 419

applies to blank check companies and requires that the net offering proceeds, and all securities to be issued (and those sold by a selling

shareholder upon their sale) be promptly deposited by the company into an escrow or trust account pending the execution of an agreement

for an acquisition or merger.

In addition, the registrant is required to file a post-effective

amendment to the registration statement containing the same information as found in a Form 10 registration statement, upon the execution

of an agreement for such acquisition or merger. The rule provides procedures for the release of the offering funds in conjunction with

the post effective acquisition or merger. The obligation to file post-effective amendments are in addition to the obligation to file Forms

8-K to report both the entry into a material non-ordinary course agreement and the completion of the transaction.

Under Rule 419, the funds and securities will be released by the

to the company and to investors, respectively, only after the company has met the following three conditions: first, the company must

execute an agreement for an acquisition; second, the Company must successfully complete a reconfirmation offering which is reconfirmed

by sufficient investors so that the remaining funds are adequate to allow the acquisition to be consummated; and third, the acquisition

meeting the above criteria must be consummated.

If a consummated acquisition meeting the requirements of this section

has not occurred by a date 18 months after the effective date of the initial registration statement, funds held in the escrow or trust

account shall be returned by first class mail or equally prompt means to the purchaser within five business days following that date.

As of this draft, we plan to issue preferred shares in an acquisition

or merger and plan to rely on an exemption from Rule 419. Section 4(a)(2) of the Securities Act of 1933 exempts from registration "transactions

by an issuer not involving any public offering." It is section 4(a)(2) that permits an issuer to sell securities in a "private

placement" without registration under the Act of ’33.

As a blank check company, our shareholders may face significant

restrictions on the resale of our Common Stock due to state "blue sky" laws and due to the applicability of Rule 419 adopted

by the Securities and Exchange Commission.

The resale of Common Stock must meet the blue sky resale requirements

in the states in which the proposed purchasers reside. If we are unable to qualify the Common Stock and there is no exemption from qualification

in certain states, the holders of the Common Stock or the purchasers of the Common Stock may be unable to sell them.

There are state regulations that may adversely affect the transferability

of our Common Stock. We have not registered our Common Stock for resale under the securities or blue sky laws of any state. We may seek

qualification or advise our shareholders of the availability of an exemption. But we are under no obligation to register or qualify our

Common Stock in any state or to advise the shareholders of any exemptions.

Current shareholders, and persons who desire to purchase the Common

Stock in any trading market that may develop in the future, should be aware that there might be significant state restrictions upon the

ability of new investors to purchase the Common Stock.

Blue sky laws, regulations, orders, or interpretations place limitations

on offerings or sales of securities by blank check companies. These limitations typically provide, in the form of one or more of the following

limitations, that such securities are:

(a) Not

eligible for sale under exemption provisions permitting sales without registration to accredited investors or qualified purchasers;

(b) Not

eligible for the transaction exemption from registration for non-issuer transactions by a registered broker-dealer;

(c) Not

eligible for registration under the simplified small corporate offering registration form available in many states;

(d) Not

eligible for the "solicitations of interest" exception to securities registration requirements available in many states;

(e) Not

permitted to be registered or exempted from registration, and thus not permitted to be sold in the state under any circumstances.

If the company engages in an offering of our

securities, any resales of our securities will require registration in an offering subject to Rule 419. The Securities and Exchange Commission

has adopted Rule 419 which defines a blank-check company as (i) a development stage company, that is (ii) offering penny stock, as defined

by Rule 3a51-1, and (iii) that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger

or acquisition with an unidentified company or companies. Certain jurisdictions may have definitions that are more restrictive than Rule

419. Provisions of Rule 419 apply to every registration statement filed under the Securities Act of 1933, as amended, relating to an offering

by a blank-check company.

Should we conduct an offering of our securities,

before we complete a business combination with an operating company, the Company would be considered a blank check company within the

meaning of Rule 419 and any sales or resales of the stock issued in the offering would require a registration under the Securities Act

of 1933, as amended, in an offering subject to Rule 419, unless there exists a transaction or security exemption for such sale under the

Securities Act of 1933, as amended. Any resales of our Common Stock would require registration under the Securities Act of 1933,

as amended, in an offering subject to Rule 419.

Any transactions in our Common Stock by officers/directors and majority

shareholders will require compliance with the registration requirements under the Securities Act of 1933, as amended.

As of this draft, we plan to issue preferred shares in an acquisition

or merger and plan to rely on an exemption from Rule 419. Section 4(a)(2) of the Securities Act of 1933 exempts from registration "transactions

by an issuer not involving any public offering." It is section 4(a)(2) that permits an issuer to sell securities in a "private

placement" without registration under the Act of ’33.

Risks Related to Our Shareholders and Shares

of Common Stock

There is presently a limited public

market for our securities

Our common stock is currently trading

on the OTC market, however a robust and active trading market may never develop. Because of our current status as a “shell

company,” Rule 144 is not currently available. Future sales of our common stock by existing stockholders pursuant to an effective

registration statement or upon the availability of Rule 144 could adversely affect the market price of our common stock. A shareholder

who decides to sell some, or all, of their shares in a private transaction may be unable to locate persons who are willing to purchase

the shares, given the restrictions. Also, because of the various risk factors described above, the price of the publicly traded common

stock may be highly volatile and not provide the true market price of our common stock.

Our stock is not liquid, so you

may be unable to sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares

Even if our stock increased in liquidity, it is likely that our

common stock will remain thinly traded, meaning that the number of persons interested in purchasing our common shares at or near bid

prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including

the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they

tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our

shares until such time as we became more seasoned and viable. Consequently, there may be periods of several days or more when trading

activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity

that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader

or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

Due to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you

need money or otherwise desire to liquidate your shares.

Our common stock is be considered a

“penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell

A common stock is a “penny stock”

if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on

a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less than

$5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5

million.

The principal result or effect of being designated

a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny

stock” regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed

and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s

account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such

stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information

concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information,

that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be

reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth

the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement

from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment

objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell

their shares to third parties or to otherwise dispose of them in the market or otherwise.

We may issue more shares in an acquisition

or merger, which will result in substantial dilution

Our Articles of Incorporation, as amended, authorize the Company to

issue an aggregate of 90,000,000 shares of common stock of which 77,698,333 shares are currently

outstanding and 10,000,000 shares of Preferred Stock are authorized, of which 0 shares are outstanding. Any acquisition or merger effected

by the Company may result in the issuance of additional securities without stockholder approval and may result in substantial dilution

in the percentage of our common stock held by our then existing stockholders. Moreover, shares of our common stock issued in any such

merger or acquisition transaction may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional

reduction in the percentage of common stock held by our then existing stockholders. In an acquisition type transaction, our Board of

Directors has the power to issue any, or all, of such authorized but unissued shares without stockholder approval. To the extent that

additional shares of common stock are issued in connection with a business combination or otherwise, dilution to the interests of our

stockholders will occur and the rights of the holders of common stock might be materially adversely affected.

Obtaining additional capital though

the sale of common stock will result in dilution of stockholder interests

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock. Additionally, the existing conversion rights may hinder future equity

offerings, and the exercise of those conversion rights may have an adverse effect on the value of our stock. If any such conversion rights

are exercised at a price below the then current market price of our shares, then the market price of our stock could decrease upon the

sale of such additional securities. Further, if any such conversion rights are exercised at a price below the price at which any stockholder

purchased shares, then that particular stockholder will experience dilution in his or her investment.

Our directors have the authority to

authorize the issuance of preferred stock

Our Articles of Incorporation, as amended,

authorize the Company to issue an aggregate of 10,000,000 shares of Preferred Stock. Our directors, without further action by our stockholders,

have the authority to issue shares to be determined by our board of directors of Preferred Stock with the relative rights, conversion

rights, voting rights, preferences, special rights, and qualifications as determined by the board without approval by the shareholders.

Any issuance of Preferred Stock could adversely affect the rights of holders of common stock. Additionally, any future issuance of preferred

stock may have the effect of delaying, deferring, or preventing a change in control of the Company without further action by the shareholders

and may adversely affect the voting and other rights of the holders of common stock. Our Board does not intend to seek shareholder approval

prior to any issuance of currently authorized stock, unless otherwise required by law or stock exchange rules.

We have never paid dividends on our

common stock, nor are we likely to pay dividends in the foreseeable future. Therefore, you may not derive any income solely from ownership

of our stock

We have never declared or paid dividends on

our common stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for

payment of dividends will be re-invested into the Company to further our business strategy. This means that your potential for economic

gain from ownership of our stock depends on appreciation of our stock price and will only be realized by a sale of the stock at a price

higher than your purchase price.

|

Item 2. |

Financial Information |

Management’s Discussion and Analysis

or Plan of Operation

Upon effectiveness of this Registration Statement,

we will file with the SEC annual and quarterly information and other reports that are specified in the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and SEC regulations. Thus, we will need to ensure that we will have the ability to prepare,

on a timely basis, financial statements that comply with SEC reporting requirements following the effectiveness of this registration statement.

We will also become subject to other reporting and corporate governance requirements, including the listing standards of any securities

exchange upon which we may list our Common Stock, and the provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”),

and the regulations promulgated hereunder, which impose significant compliance obligations upon us. As a public company, we will be required,

among other things, to:

| |

· |

Prepare and distribute reports and other stockholder communications in compliance with our obligations under the federal securities laws and the applicable national securities exchange listing rules; |

| |

· |

Define and expand the roles and the duties of our Board of Directors and its committees; |

| |

· |

Institute more comprehensive compliance, investor relations and internal audit functions; |

| |

· |

Involve and retain outside legal counsel and accountants in connection with the activities listed above. |

Management for each year commencing with the

year ending December 31, 2021 must assess the adequacy of our internal control over financial reporting. Our internal control over financial

reporting will be required to meet the standards required by Section 404 of the Sarbanes-Oxley Act. We will incur additional costs in

order to improve our internal control over financial reporting and comply with Section 404, including increased auditing and legal fees

and costs associated with hiring additional accounting and administrative staff. Ultimately, our efforts may not be adequate to comply

with the requirements of Section 404. If we are unable to implement and maintain adequate internal control over financial reporting or

otherwise to comply with Section 404, we may be unable to report financial information on a timely basis, may suffer adverse regulatory

consequences, may have violations of the applicable national securities exchange listing rules, and may breach covenants under our credit

facilities.

The significant obligations related to being

a public company will continue to require a significant commitment of additional resources and management oversight that will increase

our costs and might place a strain on our systems and resources. As a result, our management’s attention might be diverted from

other business concerns. In addition, we might not be successful in implementing and maintaining controls and procedures that comply with

these requirements. If we fail to maintain an effective internal control environment or to comply with the numerous legal and regulatory

requirements imposed on public companies, we could make material errors in, and be required to restate, our financial statements. Any

such restatement could result in a loss of public confidence in the reliability of our financial statements and sanctions imposed on us

by the SEC.

Asiarim Corporation is a blank check company

and has no operations. Our contemplated business plan includes international education. In summary, ARMC is focused on raising capital

for the educational platform. As of this filing, we have not raised any capital and our business

is not yet operational.

There is no geographic limitation to the location of targets, as

these types of opportunities are not necessarily bound by geography; provided however, we expressly disclaim any intent to and we will

not pursue a business combination with a target company (either directly or through any subsidiaries) with any operations in

China, Hong Kong or Macau nor will we consummate a business combination with any such entity ever.

Results of Operations for Asiarim Corporation

—Comparison of the Years Ended December 31, 2019 and 2020

Revenue

We had no revenues from operations during

either 2019 or 2020.

General and Administrative Expense

General and Administrative Expenses were

5,629 for the year ended December 31, 2020 compared to $2,037 for the year ended December 31, 2019, an increase of $3,592. The expenses

consist primarily of transfer agent fees and annual state filing fees.

Stock compensation expense

During the year ended December 31, 2020,

we incurred Nil on non-cash stock compensation expense from the issuance of common stock for services. There was no stock issued for

services in the prior year.

Net Loss

We had a net loss of $5,629 for the year ended

December 31, 2020 compared to $2,037 for the year ended December 31, 2019.

Liquidity and Capital Resources

As of December 31, 2020, we had $0 of cash,

$7,666 of liabilities and an accumulated deficit of $2,331,376. The Company has working capital deficit of $7,666.

The financial statements accompanying

this Report have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities

and commitments in the normal course of our business. As reflected in the accompanying financial statements, we have not yet

generated any revenue, had a net loss of $5,629 and have an accumulated stockholders’ deficit of $7,666 as of December 31,

2020. These factors raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going

concern is dependent on our ability to raise additional funds and implement our business plan. The financial statements do not

include any adjustments that might be necessary if we are unable to continue as a going concern.

In the next 12 months our expenses could

be as high at $70,000. Expenses include preparing and distributing reports and other stockholder communications in compliance with our

obligations under the federal securities laws and the applicable national securities exchange listing rules. In addition, we will incur

costs associated with retaining outside counsel, accountants, and transfer agent fees. As we have not yet identified a merger candidate

and have not generated revenue, there is an ongoing concern that ARMC will have the ability to fund these expenses without the assistance

of outside funding.

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock.

We used nil of cash in operations for the

year ended December 31, 2020 and used net cash of $2,037 for the year ended December 31, 2019.

We received net advances from related party

of $2,037.

We do not own any property and do not pay

for office space.

|

Item 4. |

Security Ownership of Certain Beneficial Owners and Management |

(a) Security ownership of certain beneficial

owners.

The following table sets forth, as of June 17,

2022, the number of shares of common stock owned of record and beneficially by our executive officer, director and persons who beneficially

own more than 5% of the outstanding shares of our common stock.

Amount and Nature

of Beneficial Ownership Percentage of Class

| Name and Address of Beneficial Owner |

|

Amount and Nature of Beneficial

Ownership |

|

Percentage of Class |

| Mitex Group Ltd* |

|

5,591,533 |

|

7.19% |

| 271 Lockhart Rd, Ste 1601 |

|

|

|

|

| Jie Yang Bldg. |

|

|

|

|

| Wanchai Hong Kong |

|

|

|

|

| |

|

|

|

|

| Reunite Investments Inc. * |

|

7,173,334 |

|

9.23% |

| 24338 El Toro Rd, Unit e |

|

|

|

|

| Laguan Woods, CA 92637 |

|

|

|

|

| |

|

|

|

|

| Di Pan |

|

11,400,000 |

|

14.6% |

| 1005-33 Sheppard Ave |

|

|

|

|

| North York, Ontario |

|

|

|

|

| M2K 3E5 Canada |

|

|

|

|

| |

|

|

|

|

| Bingqiang Xie |

|

11,400,000 |

|

14.6% |

| 1309-8081 Birchmount Rd |

|

|

|

|

| Markham, Ontario |

|

|

|

|

| L6G 0G5 Canada |

|

|

|

|

| |

|

|

|

|

| Ci Zhang |

|

15,200,000 |

|

19.56% |

| 5689 Condor Pl |

|

|

|

|

| Mississauga, ON |

|

|

|

|

| L5V 2J4 Canada |

|

|

|

|

*Ho

Te Hwai is the control person for Mitex Group Ltd and not associated with the Company’s current officers and directors

* David Lovatt is the control person for Reunite Investments,

Inc. and not associated with the Company’s current officers and directors

|

Item 5. |

Directors and Executive Officers |

A. Identification of Directors and Executive Officers.

Our Officers and directors and additional information concerning them

are as follows:

| Name |

|

Age |

|

|

Position |

| Dr. Ci Zhang |

|

|

39 |

|

|

CEO, President, Director, CFO* |

Officer Bios

Ci Zhang, Chief Executive Officer (age 39)

Employment History:

CEO and Director of Un Monde International Ltd. - 10/2018 to Present

CEO of One World International School - 10/2018 to Present

Computer/Network Technician in Multi-Tech Computers - 2/2012 to 7/2018

Ci Zhang was appointed President, CEO, and Director of Asiarim

Corp. on April 2, 2019. Mr. Zhang has more than 15 years of experience in the education and technology sectors. As a Cisco Certified

Network (CCN) Professional, he combines extensive experience in network design and management with strong business management as well

as student management, counselling and instructional skills.

As the CEO of Un Monde International Ltd. he has led the development

of the school’s unique technology platform that integrates all school functions in a single cloud-based system that leverages the

power of Artificial Intelligence and big data.

Mr. Zhang is the CEO and holds 30 percent ownership of One World

International School. One World International School is bilingual (Chinese and English) online education platform, website http://www.oneworldeducation.ca.

Prior to One World, Mr. Zhang Prior to One World, Mr. Zhang held multiple management positions at Multi-Tech Computer Systems in

Hamilton, ON leading the design and implementation of computer and local area networks. Before Multi-tech, he served as an instructor

teaching students Cisco Network CCN certification courses at Xincon College in Toronto, as well as an International Student Counselor

advising on admission and program requirements.

After technical training at Cisco Systems in Beijing, Mr. Zhang obtained

a Bachelor of Science form McMaster University in Hamilton, ON. He also holds certifications as a Cisco Certified Network Associate, Expert,

and Professional as well as a Microsoft Systems Engineer.

|

Item 6. |

Executive Compensation |

For the past two years, no sole officer or director has received any

cash remuneration. No remuneration of any nature has been paid for on account of services rendered by a director in such capacity to date.

Our officer and director intend to devote all of his time to ARMC and its subsidiaries.

The Company for the benefit of its employees has adopted no retirement,

pension, profit sharing, stock option or insurance programs or other similar programs.

|

Item 7. |

Certain Relationship and Related Transactions, and Director Independence |

Regulation S-K, Item 4, Section C require

disclosure of promoters and certain control persons for registrants that are filing a registration statement on Form 10 under the Exchange

Act and that had a promoter at any time during the past five fiscal years shall:

(i) State the names of the promoter(s), the