Mutual Fund Summary Prospectus (497k)

18 March 2014 - 8:28AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY PROSPECTUS

|

|

|

|

|

|

|

|

|

|

Royce Opportunity Select Fund

|

|

|

|

|

|

|

|

|

|

MAY 1, 2013

Investment Class Symbol: ROSFX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before you invest, please review the Fund’s Statutory Prospectus and Statement of Additional Information dated May 1, 2013 and March 18, 2014, respectively. Each is incorporated by reference

(is legally considered part of this Summary Prospectus). Each contains more information about the Fund and its risks. The Fund’s Statutory Prospectus, Statement

of Additional Information, and other information about the Fund are available online at www.roycefunds.com/prospectus. You can also get this information at

no cost by calling Investor Services at (800) 221-4268, sending an e-mail request at www.roycefunds.com/contact, or by contacting your financial intermediary.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.roycefunds.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY PROSPECTUS

|

|

|

|

|

|

|

|

|

|

Royce Opportunity Select Fund

|

|

|

|

|

|

|

|

|

|

MAY 1, 2013

Investment Class Symbol: ROSFX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Goal

The investment goal of Royce Opportunity Select Fund is long-term growth of capital.

Fees and Expenses of the Fund

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

SHAREHOLDER FEES

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum sales charge (load) imposed on purchases

|

|

|

|

|

|

|

|

|

|

|

0.00%

|

|

|

|

|

Maximum deferred sales charge

|

|

|

|

|

|

|

|

|

0.00%

|

|

|

|

|

Maximum sales charge (load) imposed on reinvested dividends

|

|

|

|

|

|

|

|

|

|

|

0.00%

|

|

|

|

|

Redemption fee (as a percentage of amount redeemed on shares held for less than 180 days)

|

|

|

|

1.00%

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Management fees

|

|

|

|

|

|

|

|

|

|

|

1.00%

|

|

|

|

Distribution (12b-1) fees

|

|

|

|

|

|

|

|

|

|

|

0.00%

|

|

|

|

Other expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on securities sold short

|

|

|

|

|

|

|

|

|

|

|

0.14%

|

|

|

|

Other

|

|

|

|

|

|

|

|

|

|

|

1.53%

|

|

|

|

|

Total annual Fund operating expenses

|

|

|

|

|

|

|

|

|

|

|

2.67%

|

|

|

|

|

Fee waivers and/or expense reimbursements

|

|

|

|

|

|

|

|

|

|

|

(1.29)%

|

|

|

|

|

Total annual operating expenses after fee waivers and/or expense reimbursements

|

|

|

|

|

1.38%

|

|

|

|

|

Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Fund’s net annual

operating expenses (excluding dividend expenses relating to short sale activities, brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and

expenses, and other expenses not borne in the ordinary course of business) at or below 1.24% through April 30, 2015 and at or below 1.99% through April 30, 2023.

|

EXAMPLE

|

|

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The example also assumes that your investment has a 5% return each year and that the Fund’s total annual operating expenses (net of fee waivers

and/or expense reimbursements for the periods noted above) remain the same. Although your actual costs may be higher or lower, based on the

assumptions your costs would be:

|

|

|

|

|

|

|

|

1 Year

|

|

|

|

|

|

|

$140

|

|

|

|

|

|

|

|

|

3 Years

|

|

|

|

|

|

|

$436

|

|

|

|

|

|

|

|

|

5 Years

|

|

|

|

|

|

|

$921

|

|

|

|

|

|

|

|

|

10 Years

|

|

|

|

|

|

|

$2,258

|

|

|

|

|

|

|

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These

costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent

fiscal year, the Fund’s portfolio turnover rate was 196% of the average value of its portfolio.

|

|

|

|

|

|

Royce Opportunity Select Fund

|

|

|

Principal Investment Strategy

Royce & Associates, LLC (“Royce”), the Fund’s investment adviser,

may invest the Fund’s assets in both long and short positions in equity

securities. The long portion of the Fund’s portfolio is invested primarily

in a limited number (generally less than 100) of the equity securities of

small-cap and micro-cap companies, those with market capitalizations

up to $2.5 billion, in an attempt to take advantage of what it believes are

opportunistic situations for undervalued securities. Such opportunistic

situations may include turnarounds, emerging growth companies with

interrupted earnings patterns, companies with unrecognized asset

values, or undervalued growth companies.

Normally, the Fund invests at least 65% of its net assets in equity

securities. Although the Fund normally focuses on the securities of

U.S. companies, it may invest up to 25% of its assets in securities of

companies headquartered in foreign countries. The Fund may invest

in other investment companies that invest in equity securities. The

Fund may sell securities to, among other things, secure gains, limit

losses, redeploy assets into what Royce deems to be more promising

opportunities and/or manage cash levels in the Fund’s portfolio. The Fund may engage in active and frequent trading of its portfolio.

The Fund may seek to capitalize on declines in the market

prices of equity securities or declines in securities indices by taking

short positions in the equity securities of a specific company or

through short sales in passively managed, exchange traded funds

(“ETFs”) that track performance of a market index. The Fund may

establish such short positions when Royce anticipates a decline

in the market price of a security because Royce believes that (i)

it is issued by a company with a highly leveraged balance sheet

or limited growth prospects and/or that is poorly managed or (ii)

a company’s securities, or an ETF, are otherwise over-priced. The

short portion of the Fund’s portfolio is not subject to any market

capitalization restrictions, and the Fund may short the securities of

larger capitalization companies and market indices. The Fund will

not sell short securities representing more than 35% of its net assets.

The Fund may borrow for the purpose of purchasing portfolio

securities and other instruments. The Fund may borrow from banks

in an amount not to exceed one-third of the value of its total assets

and may borrow for temporary purposes from entities other than

banks in an amount not to exceed 5% of the value of its total assets.

Primary Risks for Fund Investors

As with any mutual fund that invests in common stocks, Royce

Opportunity Select Fund is subject to market risk—the possibility

that common stock prices will decline, or that the prices of securities

sold short will increase, over short or extended periods of time. As

a result, the value of your investment in the Fund will fluctuate,

sometimes sharply and unpredictably, and you could lose money

over short or long periods of time.

The prices of small-cap and micro-cap securities are generally

more volatile and their markets are less liquid relative to larger-cap

securities. Therefore, the Fund may involve considerably more

risk of loss and its returns may differ significantly from funds

investing in larger-cap companies or other asset classes. The Fund’s

investment in a limited number of issuers and its potential industry

and sector overweights may also involve more risk to investors

than a more broadly diversified portfolio of small-cap and micro-cap

securities because it may be more susceptible to any single

corporate, economic, political, regulatory, or market event.

The Fund’s use of short sales involves additional investment risks

and transaction costs. A short sale is a transaction in which the Fund

sells a security it does not own in anticipation that the market price

of that security will decline. The Fund must borrow the security sold

short to make delivery to the buyer and is then obligated to replace

the security borrowed by purchasing it at the market price at the time

of replacement. The price at such time may be more or less than the

price at which the security was sold short by the Fund. The Fund

may have to pay a premium to borrow the security and is obligated

to pay the lender amounts equal to any dividends declared or interest

that accrues during the period of the loan. Under certain market

conditions, short sales can increase the volatility of the Fund and may

lower the Fund’s return or result in losses, which potentially may be

unlimited. The Fund may not be able to close out a short position at

an acceptable time or price because it has to borrow the securities to

effect the short sale and, if the lender demands that the securities be

returned, the Fund must deliver them promptly, either by borrowing

from another lender or buying the securities in the open market. If

this occurs at the same time other short sellers are trying to borrow or

buy in the securities, or the price of the security is otherwise rising, a

“short squeeze” could occur, causing the stock price to rise and making

it more likely that the Fund will have to cover its short position at an

unfavorable price. The risk of a “short squeeze” is significantly higher

when the Fund is seeking to close out a short position in a micro-cap,

small-cap or mid-cap security than it would be for a larger-cap security

because of such securities’ lower trading volumes.

Short sales are subject to special tax rules that will impact the

character of gains and losses realized and affect the timing of income

recognition. Short sales entered into by the Fund may increase the

amount of ordinary income dividends received by shareholders and

may impact the amount of qualified dividend income and income

eligible for the dividends received deduction that it is able to pass

through to shareholders.

Investment in foreign securities involves risks that may not be

encountered in U.S. investments, including adverse political, social,

economic, or other developments that are unique to a particular

region or country. Prices of foreign securities in particular countries

|

2 | The Royce Fund

Summary Prospectus 2013

|

|

|

|

Royce Opportunity Select Fund

|

|

|

or regions may, at times, move in a different direction and/or be

more volatile than those of U.S. securities. Because the Fund does

not intend to hedge its foreign currency exposure, the U.S. dollar

value of the Fund’s investments may be harmed by declines in the

value of foreign currencies in relation to the U.S. dollar.

The Fund’s borrowing for investment purposes may increase its

volatility and magnify its losses. Interest and other borrowing costs

may exceed the gain on securities purchased with borrowed funds.

In addition, the Fund’s high portfolio turnover rate may result

in increased brokerage fees or other transaction costs, reduced

investment performance, and higher taxes.

The Fund’s opportunistic approach may not be successful and

could result in portfolio losses.

Investments in the Fund are not bank deposits and are not insured

or guaranteed by the Federal Deposit Insurance Corporation or any

other government agency.

Performance

The following performance information provides an indication

of the risks of investing in the Fund. Past performance does not

indicate how the Fund will perform in the future. The Calendar

Year Total Returns chart shows performance year by year since the

Fund’s inception. The Annualized Total Returns table shows how

the Fund’s average annual total returns for various periods compare

with those of the Russell 2000 Index, the Fund’s benchmark index.

CALENDAR YEAR TOTAL RETURNS

in Percentages (%)

During the period shown in the bar chart, the highest return for a calendar quarter

was 18.10% (quarter ended 3/31/12) and the lowest return for a calendar quarter

was -26.25% (quarter ended 9/30/11).

The table also presents the impact of taxes on the Fund’s returns.

In calculating these figures, we assumed that the shareholder was in

the highest federal income tax bracket in effect at the time of each

distribution of income or capital gains. We did not consider the impact

of state or local income taxes. Your after-tax returns depend on your tax

situation, so they may differ from the returns shown. This information

does not apply if your investment is in an individual retirement account

(IRA), a 401(k) plan, or is otherwise tax deferred because such accounts are subject to income taxes only upon distribution. Current month-end

performance information may be obtained at www.roycefunds.com or

by calling Investor Services at (800) 221-4268.

|

ANNUALIZED TOTAL RETURNS

(12/31/12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

Since Inception

(8/31/10)

|

|

|

Return Before Taxes

|

|

|

|

|

|

|

35.14

|

%

|

|

|

17.41

|

%

|

|

Return After Taxes on Distributions

|

|

|

|

|

|

|

31.66

|

|

|

|

15.43

|

|

|

Return After Taxes on

Distributions and Sale

of Fund Shares

|

|

|

|

|

|

|

23.11

|

|

|

|

13.83

|

|

|

|

Russell 2000 Index (Reflects no

deductions for fees, expenses, or taxes)

|

|

|

|

|

|

|

16.35

|

|

|

|

17.52

|

|

|

Investment Adviser and Portfolio Management

Royce serves as investment adviser to the Fund. William A. Hench,

Portfolio Manager of Royce, manages the Fund, assisted by Boniface

A. Zaino. Mr. Hench and Mr. Zaino have served as the Fund’s

portfolio manager and assistant portfolio manager, respectively, since

its inception.

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Investment

Class purchased directly from The Royce Fund:

|

Account Type

|

|

Minimum

|

|

|

Regular Account

|

|

$2,000

|

|

|

IRA

|

|

$1,000

|

|

|

Automatic

Investment or Direct Deposit Plan Accounts

|

|

$1,000

|

|

|

401(k) Accounts

|

|

None

|

|

The minimum for subsequent investments is $50, regardless of account type.

You may sell shares in your account at any time and make requests

online, by telephone, and by mail. You may also purchase or sell

Fund shares through a third party, such as a discount or full-service

broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that may be taxable as ordinary

income or capital gains.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial

intermediary (such as a bank), the Fund and its related companies may

pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing the

broker-dealer or other intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your

financial intermediary’s website for more information.

|

The Royce Fund

Summary Prospectus 2013

| 3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

More information on The Royce Fund is available free upon

request, including the following:

Annual/Semiannual Reports

Additional information about a Fund’s investments, together with a discussion

of market conditions and investment strategies that significantly affected the

Fund’s performance, is available in the Funds’ annual and semiannual reports

to shareholders. These reports are also available online at

www.roycefunds.com.

Statement of Additional Information (“SAI”)

Provides more details about The Royce Fund and its policies. A current SAI is

available at

www.roycefunds.com/literature

and by phone. It is also on file

with the Securities and Exchange Commission (“SEC”) and is incorporated by

reference (is legally considered part of this prospectus).

To obtain more information:

By mail:

The Royce Funds,

745 Fifth Avenue, New York, NY 10151

By telephone:

(800) 221-4268

Through the Internet:

Prospectuses, applications, IRA forms, and additional

information are available through our website at

www.roycefunds.com/literature.

Text only versions of the Funds’ prospectus, SAI, and other documents filed

with the SEC can be viewed online or downloaded from

www.sec.gov.

You can also obtain copies of documents filed with the SEC by visiting the SEC’s

Public Reference Room in Washington, DC (telephone (202) 551-8090) or by

sending your request and a duplicating fee to the SEC’s Public Reference

Section, Washington, DC 20549-1520. You may also make your request by

e-mail at publicinfo@sec.gov after paying a duplicating fee.

|

|

|

|

|

|

745 Fifth

Avenue | New York, NY 10151 | P (800) 221-4268 | www.roycefunds.com

|

ROS-ISI-0314

|

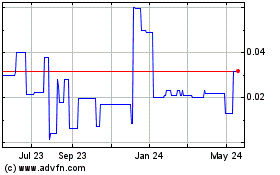

Aristocrat (PK) (USOTC:ASCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

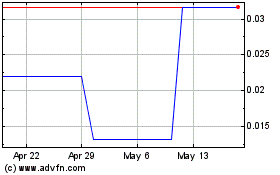

Aristocrat (PK) (USOTC:ASCC)

Historical Stock Chart

From Jul 2023 to Jul 2024