Current Report Filing (8-k)

12 December 2022 - 10:02PM

Edgar (US Regulatory)

0001068689

false

0001068689

2022-12-07

2022-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 7, 2022

DATA443

RISK MITIGATION, INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

000-30542 |

|

86-0914051 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

4000

Park Drive, Suite 400

Research

Triangle Park, NC 27709

(Address

of Principal Executive Offices)

Registrant’s

telephone number, including area code: (919) 858-6542

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| none |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| ITEM 1.01 |

Entry Into a Material

Definitive Agreement. |

On

December 7, 2022, Data443 Risk Mitigation, Inc. (the “Company”) entered into a Securities Purchase Agreement (the

“Purchase Agreement”) with a certain accredited investor as purchaser (the “Investor”). Pursuant

to the Securities Purchase Agreement, the Company sold, and the Investor purchased, $750,000.00 in principal amount of unsecured convertible

notes (the “Notes”) and warrants (the “Warrants”).

The

Notes are convertible into shares of the Company’s common stock, par value $0.01 per share (“Common Stock”),

at a conversion price per share of $0.50, subject to adjustment under certain circumstances described in the Notes. The Notes were issued

with an original issue discount of 20%, do not bear interest, and mature on the earlier of (i) twelve months from the date of issuance

or (ii) the date that the Common Stock is listed for trading on any of The New York Stock Exchange, The Nasdaq Global Market, The Nasdaq

Global Select Market, The Nasdaq Capital Market or the NYSE American (such date, the “Uplisting Date”).

The

Warrants are exercisable on or after the date that is four months after the Uplisting Date (the “Initial Exercise Date)

and on or prior to the close of business on the five-year anniversary of the Initial Exercise Date. The Warrant entitles the Investor

to purchase up to 100% of that number of shares of Common Stock into which the Note may be converted, subject to adjustment under certain

circumstances described in the Warrants, and has an exercise price of $1.155.

The

Investor will have “piggyback” registration rights that will allow the Investor to elect to have the Common Stock underlying

the Notes and the Warrants included in any underwritten public offering of equity securities subsequently initiated by the Company. The

Common Stock included in any underwritten public offering initiated by us will be subject to limitation based on the discretion of the

underwriter of such offering.

The

Notes and Warrants sold were not registered under the Securities Act of 1933, as amended (the “Securities Act”) or

the securities laws of any state, and were offered and sold in reliance upon the exemption from registration afforded by Section 4(a)(2)

under the Securities Act and Regulation D promulgated thereunder and corresponding provisions of state securities laws, which exempt

transactions by an issuer not involving any public offering. The Investor is an “accredited investor” as such term is defined

in Regulation D promulgated under the Securities Act. This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption

from the registration requirements and certificates evidencing such shares contain a legend stating the same.

The

foregoing descriptions of the Notes, the Warrants and the Purchase Agreement do not purport to be complete descriptions of the rights

and obligations of the parties thereunder and are qualified in their entirety by reference to the full text of such agreements, copies

of which are attached hereto as Exhibits 4.1, 4.2 and 10.1, respectively.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation Under an Off Balance Sheet Arrangement of a Registrant |

The

information set forth in “Item 1.01 Entry into a Material Definitive Agreement” relating to the issuance of the Notes pursuant

to the Purchase Agreement is incorporated by reference herein in its entirety.

| Item

3.02 |

Unregistered

Sales of Equity Securities |

The

information set forth in “Item 1.01 Entry into a Material Definitive Agreement” relating to the issuance of the Notes and

Warrants pursuant to the Purchase Agreement is incorporated by reference herein in its entirety. The Company issued the Notes and Warrants

in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act.

| ITEM 9.01 |

Financial Statements

and Exhibits. |

The

following exhibits are furnished with this report:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

December 9, 2022 |

DATA443

RISK MITIGATION, INC. |

| |

|

| |

By: |

/s/

Jason Remillard |

| |

|

Jason

Remillard |

| |

|

Chief

Executive Officer |

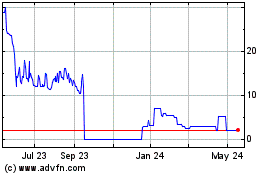

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Jan 2025 to Feb 2025

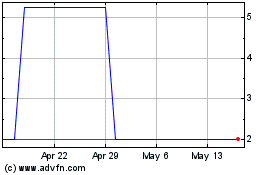

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Feb 2024 to Feb 2025