Deutsche Bank AG is investigating a series of trades that may

have improperly generated millions of dollars in personal profits,

some at the bank's expense, for a handful of current and former

employees, according to people familiar with the matter.

Among those who internal auditors believe profited from the

trades is Colin Fan, these people said. Mr. Fan was co-head of

Deutsche Bank's investment bank when he left as part of a shake-up

in October. The auditors estimate Mr. Fan has made $9 million on a

roughly $1 million investment.

The trades, which started in 2009, were meant to remove some of

the risk that Deutsche Bank had taken when it made a deal with a

large insurance-company client, the people said. Some of the trades

continue.

Led by Mr. Fan's team, Deutsche Bank found a hedge fund to take

over the bulk of the risk-offloading part of the deal, according to

the people. But the fund didn't put up all the cash: Mr. Fan and

five other Deutsche Bank employees chipped in some of their own

money.

Internal bank auditors are examining whether Mr. Fan and other

employees set up the structure to make Deutsche Bank pay an

inflated share of profits and fees to themselves and the hedge

fund, while locking the bank into high fixed costs, the people

said. The internal auditors are also probing whether the compliance

review of the structure was adequate, they said.

"We are reviewing a transaction that may have involved

unacceptable conflicts of interest when structured in 2009," a

Deutsche Bank spokesman said. Following its internal investigation,

he said, the bank "will take disciplinary measures where

appropriate and review further our controls to minimize the chance

of a reoccurrence."

Executives don't believe any clients involved were disadvantaged

by the transaction, the spokesman said. The bank has suspended

bonuses or other pay to the individuals involved.

A spokesman for Mr. Fan said he had "fulfilled all appropriate

compliance procedures, been entirely transparent at all times, and

denied any wrongdoing."

The probe hasn't been previously reported. Details of the trades

also have been referred to European and U.S. regulators, people

familiar with the matter said. The probe's final results are

expected to be delivered to senior management in coming weeks.

A person briefed on the continuing internal investigation said

auditors haven't determined whether the bank lost money overall, in

part because the trades begot other trades that generated

commissions and fees.

On its own—without accounting for the ancillary revenue—the 2009

arrangement might have cost Deutsche Bank more than $60 million,

according to a preliminary auditors' assessment, the person

said.

Mr. Fan left Deutsche Bank in a management overhaul under new

Chief Executive Officer John Cryan. Mr. Fan's role in the

transaction factored into Mr. Cryan's decision to appoint a

different executive to take over his role, according to people

close to the matter.

Mr. Fan, who in 2009 was global head of credit trading, was the

most senior of the six then-employees to invest in the trades under

review and was the one who profited the most, the people said.

The 43-year-old credit trader joined Deutsche Bank in 1998 and

later rose under former co-CEO Anshu Jain, who promoted him in 2012

to oversee all of global securities trading. Mr. Jain left the bank

last year.

Altogether, internal auditors estimate that the six current and

former Deutsche Bank employees have made about $37 million on the

trades, which will close off next year, according to the person

briefed on the audit. The individuals invested about $4.5 million

combined, alongside a small hedge fund based in Monaco, Greengate

SAM, that has made roughly $80 million, at a roughly equal rate of

return, the people said.

Greengate didn't respond to requests to comment.

In years past, employees at Deutsche Bank and other lenders had

more leeway to invest in trades controlled by their employees or

alongside bank clients, compliance specialists and bank executives

said. Those rules have been tightened apace with other restrictions

on behavior.

But banks have long policed their own employees' personal

trading and required disclosure to avoid conflict. Such rules

widely require that employees detail any personal investments that

run counter to clients' or shareholders' interests.

The 2009 trade originated in a roughly $750 million deal between

French insurer AXA SA and Deutsche Bank, through which the bank

would arrange derivatives trades in part using AXA's money,

according to people familiar with the transaction.

Deutsche Bank sought to profit through a strategy known as index

arbitrage—essentially betting on the pricing differences between

credit indexes and the companies that make them up, which will

ultimately come together. But it didn't want the price swings on

its own books, the people said.

Mr. Fan's team and Deutsche Bank salespeople signed up Greengate

to manage the derivative-trading portfolio and to take on the risk

of those swings, the people said. Another former Deutsche Bank

deal-structuring specialist who worked on the arrangement also

invested, one of the people said.

Another participant was Antoine Cornut, who worked for Mr. Fan

at the time, the people said. Mr. Cornut left the bank in 2012. He

didn't respond to requests to comment.

John Pipilis, currently Deutsche Bank's co-head of global credit

trading, and André Muschallik, a senior salesman, also invested,

the people said. Messrs. Pipilis and Muschallik declined to comment

through a bank spokesman.

The index-arbitrage trades were viewed as "free money" for

investors who could stomach the price swings and wait out the

trades.

To amplify what would have been a thin profit margin, Deutsche

Bank lent the investors roughly $30 for every $1 invested, the

people said. The trades generated steady returns.

A senior bank official who in 2009 was operations chief of the

trading unit, Henry Ritchotte, approved the general structure of

the transaction but with certain conditions, including that the

bank would market the offering to clients and that the bank would

earn its fair share of the profits, according to a person familiar

with the matter.

Mr. Ritchotte declined to comment through a bank spokesman.

It is unclear how extensively Deutsche Bank tried to market the

deal. One person briefed on the internal audit said other employees

were told that the offering was oversubscribed. Another person

close to the matter said the investment was too small and

complicated for big clients, and other hedge funds didn't want to

take part in a deal in which they wouldn't be in control of

investment strategy.

Other senior executives became aware of the situation in 2014,

when employees raised issues with auditors about Mr. Fan's and his

colleagues' positions, the people said.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

May 19, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

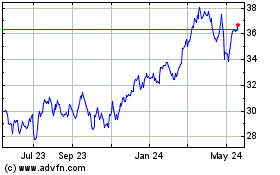

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

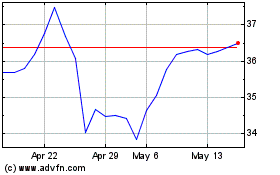

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024