UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of

1934

(Amendment No. )*

Buildablock

Corp.

Name of Issuer

COMMON

STOCK, $0.00001 Par Value

(Title of Class of Securities)

12008D108

(CUSIP Number)

Jeffrey N. Ostrager

Curtis, Mallet-Prevost, Colt & Mosle

LLP

101 Park Avenue, New York, NY 10178-0061

(212) 696-6918

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 7, 2012

(Date of Event which Requires Filing of

this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies

are to be sent.

*

The remainder of this cover page shall be filled

out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“

Act

”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

|

SCHEDULE 13D

|

|

|

CUSIP

No.

12008D108

|

|

Page 2 of 7

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

Bartek Bulzak

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A

GROUP

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

Not Applicable

|

|

6

|

CITIZEN OR PLACE OF ORGANIZATION

Canada

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

4,457,742

|

|

|

8

|

SHARED VOTING POWER

0 (See Item 3)

|

|

|

9

|

SOLE DISPOSITIVE POWER

4,457,742

|

|

|

10

|

SHARED DISPOSITIVE POWER

0 (See Item 3)

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,457,742

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

Not Applicable

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

20.7%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

|

CUSIP

No.

12008D108

|

|

Page 3 of 7

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

8040397 Canada Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

Not Applicable

|

|

6

|

CITIZEN OR PLACE OF ORGANIZATION

Canada

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

4,377,742

|

|

|

8

|

SHARED VOTING POWER

0 (See Item 3)

|

|

|

9

|

SOLE DISPOSITIVE POWER

4,377,742

|

|

|

10

|

SHARED DISPOSITIVE POWER

0 (See Item 3)

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,377,742

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

Not Applicable

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

20.3%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

Item 1. Security and Issuer

This statement on Schedule 13D relates to

the Common Stock, $0.00001 par value per share (the “

Common Stock

”), of Buildablock Corp., a Florida corporation

(the “

Company

”). The Company's principal executive office is located at: 759 Square Victoria, Suite 200, Montreal,

H2Y 2J7, Quebec, Canada.

Item 2. Identity and Background

(a) This Schedule 13D is jointly

filed on behalf of Bartek Bulzak and

8040397 Canada Inc.

(the “

Reporting Persons

”).

Mr. Bulzak is the sole owner of

8040397

Canada Inc. The Reporting Persons have entered into a

Joint Filing Agreement, a copy of which is filed with this Schedule 13D as Exhibit 99.1, pursuant to which they have agreed to

file this Schedule 13D jointly.

(b) Both Reporting Persons’ business address is: 42 Seville

Street, Candiac, Quebec, J5R 6Y6, Canada.

(c) Mr. Bulzak is the Chief Technical Officer of the Company.

The Company's principal executive office is located at: 759 Square Victoria, Suite 200, Montreal, Quebec, H2Y 2J7, Canada.

(d) During the last five years, Mr. Bulzak has not been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, the Reporting Persons have not

been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws, or finding any violation with respect to such laws.

(f) Mr. Bulzak is a citizen of Canada. 8040397 Canada Inc. is

a Canadian Corporation.

Item 3. Source and Amount of Funds or Other Consideration

On November 30, 2011, 8040397 Canada Inc.,

a Canadian corporation owned by Bartek Bulzak and 3324109 Canada Inc., a Canadian corporation, owned by Gary Oberman, collectively,

the “

Sellers

”, entered into an Asset Purchase Agreement (the "

Asset Purchase Agreement

") with

the Company providing for the acquisition by the Company from the Sellers of intellectual property rights comprised of an Internet

and mobile service platform whose purpose is to empower or capitalize on the growth of the neighborhood local economy (the “

Buildablock

Assets

”).

On March 7, 2012, the Company completed the acquisition of the Buildablock Assets

from the Sellers, and in consideration of the transfer of the Reporting Persons’ share of the Buildablock Assets to the Company,

the Company issued 4,377,742 shares of the Company’s Common Stock to each of the Sellers, representing 50% of the Company’s

outstanding shares after giving effect to a one-for-eight reverse stock split.

The shares issued to the Sellers were issued

in a transaction exempt from the registration requirements of the Securities Act of 1933 pursuant to Section 4(2) of the Act. Upon

the closing of the transaction, Messrs. Bulzak and Oberman were elected to the Company’s Board, Mr. Bulzak was appointed

Chief Technical Officer, and Mr. Oberman was appointed President and Chief Executive Officer.

The summary

of the Asset Purchase Agreement contained herein does not purport to be complete and is qualified in its entirety by the full text

of the Asset Purchase Agreement, which is incorporated by reference as Exhibit 1 and incorporated herein by reference.

Pursuant to a Voting Agreement dated as

of November 30, 2011 by and among the Company, the Sellers and René Arbic, Morden C. Lazarus and Peter Varadi, the Sellers

and Messrs. Arbic, Lazarus and Varadi agreed to vote their shares for the election of René Arbic, Alex Kestenbaum,

Gary Oberman and Bartek Bulzak to the Company's Board of Directors effective upon the closing of the Asset Purchase Agreement

and the reverse stock split. This agreement shall continue until the Company's next annual or special meeting or upon a

consent of the Company's stockholders in lieu of a meeting. Mr. Arbic has agreed to resign from the Board within one year

of the closing of the transaction. It is further expected that Mr. Alex Kestenbaum shall continue to serve as Chief Financial

Officer and director until such time as a successor Chief Financial Officer has been appointed.

Item 4. Purpose of the Transaction

Depending upon market conditions, the availability

of funds, an evaluation of alternative investments, and such other factors as may be considered relevant, the Reporting Persons

may purchase or sell shares of Common Stock if deemed appropriate and opportunities to do so are available, in each case, on such

terms and at such times as the Reporting Persons consider desirable. Subject to the foregoing, the Reporting Persons do not

have any present plan or proposal which relates to or would result in any of the actions or events enumerated in clauses (a) through

(j) of Item 4 of Schedule 13D. In addition, the Reporting Persons disclaim any obligation to report any plan or

proposal known to such Reporting Persons solely as a result of Mr. Bulzak’s position as Chief Technical Officer

and director of the Company and his participation in such capacity in decisions involving an action or event described in

clauses (a) through (j) in Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer

(a) The Reporting

Persons beneficially own

4,457,742

shares of Common Stock, or approximately

20.7

%

of the outstanding Common Stock (of which

4,377,742

are held by

8040397 Canada Inc., a

company solely owned by Mr. Bulzak)

. The beneficial ownership percentages reported herein are based

upon:

(i) 17,510,968 shares of Common Stock, outstanding as of March 30, 2012, as reported in the Form 10-Q filed April

20, 2012 and (ii) an aggregate of 4,027,000 shares issued in private transactions, as reported in the Company’s Form 8-K

filed on April 26, 2012.

(b) Mr. Bulzak

has the power to vote or to direct the vote and dispose or to direct the disposition of

4,457,742

shares of Common Stock, of which

4,377,742

are held by

8040397 Canada Inc., a company

solely owned by Mr. Bulzak

.

(c) Mr. Bulzak entered into a Debt Settlement

Agreement on April 12, 2012 pursuant to which he was issued 80,000 shares of common stock, par value $0.00001 per share, of the

Company, to extinguish a debt owed to him in the amount of $20,000.

(d) None.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

See Item 3.

Item 7. Material to Be Filed as Exhibits

|

|

1.

|

Asset Purchase Agreement, dated November 30, 2011 (incorporated by reference to Exhibit 10.19 to Buildablock Corp.’s

Form 8-K, filed with the Securities and Exchange Commission on December 6, 2011).

|

|

|

2.

|

Voting Agreement, dated November 30, 2011 (incorporated by reference to Exhibit 10.2 to Buildablock Corp.’s Form 10-Q,

filed with the Securities and Exchange Commission on April 20, 2012 ).

|

|

|

3.

|

Joint Filing Agreement, filed herewith as Exhibit 99.1.

|

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: May 10, 2012

|

|

/s/

Bartek Bulzak

|

|

|

Bartek Bulzak

|

|

|

|

8040397 Canada Inc.

|

|

|

|

|

|

|

By:

|

/s/

Bartek Bulzak

|

|

|

Name:

|

Bartek Bulzak

|

|

|

Title:

|

President

|

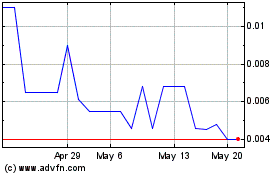

Buildablock (PK) (USOTC:BABL)

Historical Stock Chart

From Apr 2024 to May 2024

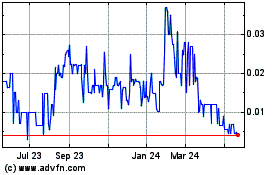

Buildablock (PK) (USOTC:BABL)

Historical Stock Chart

From May 2023 to May 2024