IC Potash to Advance Ochoa SOP Project on Positive Feasibility

Study Results

TORONTO, ON--(Marketwired - Jan 23, 2014) - IC Potash Corp.

(TSX: ICP) (OTCQX: ICPTF) -- Sidney Himmel, President and Chief

Executive Officer of IC Potash Corp. ("ICP" or the "Company"),

announced today the successful conclusion of an independent

feasibility study ("Study") for its 100%-owned sulphate of potash

("SOP") Ochoa Project ("Project") located in southeast New

Mexico. All dollar amounts in this press release are U.S.

dollars and all tons are short tons.

The Study projects an economically viable mining and processing

facility with the capacity and reserves to produce 714,400 tons of

SOP per year for a minimum of 50 years. The Study recommends

that the Company move to implementation by:

- Commencing engineering, procurement, and construction

management ("EPCM") activities;

- Completing environmental permitting; and

- Arranging Project financing.

The Study was prepared by a group of leading international

independent engineering, process design, and equipment supply

companies led by SNC-Lavalin Inc. ("SNC-Lavalin"). SNC-Lavalin

is a world leader in the consulting, design, engineering, and

construction of mining projects around the world, with specific

expertise in potash mining, processing, and distribution.

Mr. Sidney Himmel stated: "This feasibility study evaluated all

aspects of our plan to produce SOP from our polyhalite Mineral

Reserves. We are pleased with the technical validation of the

mining and processing design, and the resulting economic

characteristics. The Ochoa Project positions ICP to become a

world leader in SOP production and a bottom quartile cost SOP

producer. We intend to begin immediately with the next phases

of engineering and financing."

Financial Results

| |

|

|

|

|

|

Full Equity Basis (i.e. No Debt) |

|

Before Tax |

|

After Tax |

|

Capital Cost |

|

$1,018 million |

|

$1,018 million |

|

Operating Cost Per Ton SOP at Steady State |

|

$195 |

|

$195 |

|

Internal Rate of ReturnA ("IRR") |

|

17.8% |

|

16.0% |

|

Net Present Value ("NPV"), 8% Discount Factor |

|

$1,502.3 |

|

$1,018.9 |

|

NPV, 10% Discount Factor |

|

$942.7 |

|

$612.0 |

|

Payback Period |

|

- |

|

5.4 years |

| |

|

|

|

|

The financial model covers approximately three years of

construction and commissioning beginning in Q2 2014 and continuing

through Q2 2017, followed by 50 years of operation. SOP

production in 2017 is estimated at 48% of annual capacity, with

full capacity expected in 2018. In the financial model, no

inflation or escalation factors were applied to cash inflows and

outflows.

After-tax IRR is sensitive to capital cost, operating cost, and

revenue assumptions. The table below shows the effect of

changing those assumptions to +/-20%.

| |

|

|

|

|

|

|

|

|

|

|

|

Input Variable to Financial Model |

|

- 20% |

|

-10% |

|

Base Case |

|

+10% |

|

+20% |

|

Capital Cost |

|

19.3% |

|

17.5% |

|

16.0% |

|

14.7% |

|

13.6% |

|

Revenue |

|

11.3% |

|

13.8% |

|

16.0% |

|

18.1% |

|

20.1% |

|

Operating Cost |

|

17.8% |

|

16.8% |

|

16.0% |

|

15.1% |

|

14.2% |

| |

|

|

|

|

|

|

|

|

|

|

Capital Cost

The capital cost of the Project is estimated to be $1,018

million, with an accuracy of +/-15%. Preparation of the

capital cost estimate is consistent with standards defined by the

Association for the Advancement of Cost Engineering International

for a Class 3 Estimate.B The table below summarizes the total

estimated capital cost by major area.

| |

| Estimated Capital Cost by Major Area (millions) |

| Mine

Infrastructure and Development |

|

$107 |

|

Process Plant |

|

$527 |

|

Storage and Loading |

|

$37 |

| Total

Direct Costs |

|

$671 |

| EPCM

Services |

|

$99 |

|

Construction Indirect |

|

$22 |

|

Freight, Spares, and First Fills |

|

$34 |

| Total

Indirect Costs |

|

$155 |

| Owner

Costs |

|

$80 |

|

Contingency |

|

$112 |

|

Project Total |

|

$1,018 |

| |

|

|

Operations

Operating costs are based on scheduled production, equipment

requirements, operating hours, equipment operating costs, and

manpower requirements. Steady state has been defined as the

operating years from 2022 through 2065. Steady state years

generally exclude major one-time costs that are included in years

2017 through 2021, such as start-up activities, equipment rentals,

initial receding face expenditures, and inventory adjustments.

| |

| Estimated Operating Cost Per Ton of SOP |

|

Steady State Production |

|

714,400 Tons Per Year of SOP |

|

Mining Cost Per Ton |

|

$78 |

|

Processing Cost Per Ton |

|

$108 |

|

General and Administrative Cost Per Ton |

|

$9 |

|

Total Operating Cost Per Ton |

|

$195 |

|

% of Operating Cost - Labor |

|

24.8% |

|

% of Operating Cost - Electricity |

|

24.5% |

|

% of Operating Cost - Natural Gas |

|

20.7% |

|

Sustaining Capital Per Ton Per Year |

|

$40 |

| |

|

|

The plant is designed to operate 7,912 hours annually and employ

approximately 400 people at full production. The plant model

projects a K2OC process recovery of 82.2% based on the pilot test

work carried out by independent consultants and equipment

providers. As a result of the pilot test work, the Study

projects an SOP product with potassium content, or K2O equivalent,

between 50.3% and 53.7%.

Energy costs for the Project were obtained from public domain

sources. Xcel Energy, the local electricity supplier, provided

rates under regulated tariffs for transmission and sub-transmission

voltages. Transmission power costs were estimated at $0.0346

per kWh and sub-transmission rates at $0.0348 per kWh, plus

associated demand charges.

Natural gas pricing was estimated at $3.69 per MMBTU based on

the El Paso hub, which is the appropriate index given its proximity

to the Project. Also, the hub's natural gas characteristics,

such as heat value and moisture content, are the same as those of

the natural gas that will be used at the plant. Diesel fuel

pricing was based on the Rocky Mountain Index for No. 2 Diesel,

estimated at $3.95 per gallon.

Revenue Assumptions

SOP prices, based on projected grades, are FOB Jal, New Mexico

("FOB Jal") and net of other sales-related expenses. A.J. Roth

and Associates, a U.S. fertilizer consulting company with

international expertise in potash and phosphates, provided pricing

estimates by grades and receiving locations for the Study. The

relevant SOP grades are standard, granular, and soluble. Upon

full production of the estimated 714,400 tons per year, the product

mix is projected to be 229,400 tons of standard SOP, 385,000 tons

of granular SOP, and 100,000 tons of soluble SOP. The weighted

average FOB Jal SOP price used in the financial model was $636 per

ton. As reported in Green Markets, the average Q4

2013 granular SOP price was $680 per ton for California

Delivery. Granular SOP prices historically receive an average

premium of approximately $50 per ton above standard

SOP. During Q4 2013, ICP estimates the soluble SOP price was

$740 per ton for Florida Delivery.

Mineral Resources and Mineral Reserves

The Study identified Measured and Indicated Resources of 1,017.8

million tons at an average grade of 83.9% by weight

polyhalite. The Resource was constrained by a minimum

polyhalite thickness of 4 feet and a minimum resource grade of 65%

polyhalite. Mineral Resources that are not Mineral Reserves do

not have demonstrated economic viability. Mineral Resources

are summarized in the table below.

| |

| Mineral Resources (effective date May 31, 2013) |

|

Category |

|

Average Thickness (ft) |

|

Resource Area (acres) |

|

In-Place Tons1,2,3 (millions) |

|

Polyhalite (wt %) |

|

Equivalent K2SO4 (wt %)7 |

|

Anhydrite (wt %) |

|

Halite (wt %) |

|

Magnesite (wt %) |

|

Measured4 |

|

5.2 |

|

26,166 |

|

511.7 |

|

84.5 |

|

24.4 |

|

4.02 |

|

3.27 |

|

7.94 |

|

Indicated5 |

|

5.0 |

|

26,698 |

|

506.0 |

|

83.3 |

|

24.1 |

|

4.00 |

|

3.30 |

|

8.61 |

|

Total M&I |

|

5.1 |

|

52,865 |

|

1,017.8 |

|

83.9 |

|

24.2 |

|

4.01 |

|

3.28 |

|

8.27 |

|

Inferred6 |

|

4.8 |

|

15,634 |

|

284.0 |

|

82.6 |

|

23.9 |

|

4.11 |

|

3.37 |

|

8.82 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Average in-situ bulk density of 173.5 pounds per cubic foot.

2Bed thickness cutoff of 4.0 feet, composite grade cutoff of 65.0%,

excluding out-of-seam dilution. 3Mineral Reserves are included in

Mineral Resources. 4Measured resource located within 0.75-mile

radius from an exploration core hole. 5Indicated resource located

between 0.75-mile and 1.5-mile radius from an exploration core

hole. 6Inferred resource located between 1.5-mile and 3.0-mile

radius from an exploration core hole. 7Pure polyhalite grades 28.9%

by weight K2SO4. This also equates to 15.6% by weight K2O.

Note: Gypsum weight percent negligible for all resource

classifications.

In addition to defining the Mineral Resources and Mineral

Reserves, the Study specified a 50-year mine plan. Contained

within the mine plan are approximately 182.4 million recoverable

tons of Proven and Probable Reserves grading 78.05% by weight

polyhalite. Mining was constrained to a minimum polyhalite

grade of 66%, as well as a minimum polyhalite thickness of 4

feet. A summary of these Mineral Reserves is listed in the

table below.

| |

| Mineral Reserves1 (effective date January 9,

2014) |

|

Category |

|

Average Mined Thickness2 (ft) |

|

50 Year Mine Plan Mined Area (million sq ft) |

|

ROM Mine Tons3,4 (millions) |

|

Mining Recovery5 (%) |

|

Polyhalite (wt %) |

|

Equivalent K2SO4 (wt %)6 |

|

Anhydrite (wt %) |

|

Halite (wt %) |

|

Magnesite (wt %) |

|

Proven |

|

5.9 |

|

246 |

|

125.0 |

|

47.1 |

|

78.42 |

|

22.66 |

|

11.29 |

|

3.66 |

|

7.79 |

|

Probable |

|

5.9 |

|

113 |

|

57.4 |

|

64.8 |

|

77.20 |

|

22.31 |

|

11.60 |

|

3.65 |

|

8.30 |

|

Total P&P |

|

5.9 |

|

359 |

|

182.4 |

|

51.5 |

|

78.05 |

|

22.55 |

|

11.39 |

|

3.66 |

|

8.08 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Mineral Reserves are included in Mineral Resources. 2Bed

thickness cutoff of 4.0 feet, composite grade cutoff of 66.0%,

including out-of-seam dilution. 3Average in-situ bulk density of

173.5 pounds per cubic foot. 4No inferred tons mined. 5Areal

recovery (mined area) inside 50 year mine plan boundary. 6Pure

polyhalite grades 28.9% by weight K2SO4. This also equates to

15.6% by weight K2O. Note: Gypsum weight percent negligible for all

resource classifications.

Updates to the Mineral Resources and Mineral Reserves estimates

are based on the results from the completion of ICP's Phase 3A

exploration drilling program, a continuation of the exploration

program included in the report dated December 30, 2011, and titled

National Instrument 43-101 Technical Report Prefeasibility

Study ("PFS") for the Ochoa Project in Lea County, New

Mexico. Industry best practices were followed for the

exploration program. The investigations, interpretation of

exploration information, and the quality assurance and quality

control measures for the Phase 3A program were as reported in the

PFS.

Over 70,000 feet of exploration drilling has been completed to

date. Additionally, 855 petroleum wells were incorporated into

the model (for stratigraphy correlation and bed thickness only)

through geophysical logging. A higher minimum polyhalite grade

(66%) was defined for the Mineral Reserves to ensure compliance

with the Mineral Resource cutoff grade (65%) when developing mine

projections.

As compared to the PFS, Mineral Reserves increased over 30% from

139.5 million tons to 182.4 million tons while maintaining similar

polyhalite grades (79.39% in the PFS to 78.05% in the

Study). Measured and Indicated Resources (4-foot minimum

thickness) increased from 983.8 million tons to 1,017.8 million

tons. The Study is based on a mine life of 50 years.

Measured and Indicated Mineral Resources exist to the north,

east, and west of the 50-year mine plan boundary and there is a

reasonable expectation that those resources will be economically

mineable, which would allow for an extension of mining operations

beyond 50 years.

Environment and Permitting

The Company remains on schedule to receive a Record of Decision

on its Environmental Impact Statement ("EIS") in early April

2014. That schedule will allow construction to commence as

planned. The Bureau of Land Management ("BLM") and its

retained consultant are currently addressing review comments in

preparation for issuance of the final EIS. Once review

comments are incorporated into the document, the BLM will publish

the final EIS. Notice of availability of the final EIS is

expected to be published in February 2014.

In parallel with the EIS process, ICP also submitted an air

quality permit application for construction to the New Mexico

Environment Department Air Quality Bureau (NMED AQB). This

application was ruled administratively complete by the NMED AQB on

December 13, 2013, and technical review is expected to be completed

on or before June 10, 2014. The assessment included in the

permit application demonstrates that the Project complies with air

quality standards.

As previously announced by the Company there have been two major

permitting milestones to date. First, the Company received a

jurisdictional determination from the U.S. Army Corps of Engineers

("Corps") that concluded no authorization from the Corps is

required for construction. Second, authorization has been

received from the New Mexico Office of the State Engineer that the

Company has full right to appropriate non-potable water from the

Capitan Reef aquifer for mining and industrial use.

Mining

Room-and-pillar mining will be used to extract ore from the

deposit at a nominal rate of 3.7 million tons per

year. Equipment selection includes state-of-the-art,

high-horsepower continuous mining equipment currently in use

throughout the world in the coal, trona, and potash

sectors. During the course of the Study, ICP performed linear

cutting tests on the polyhalite core. A continuous mining

equipment manufacturer reviewed the linear cutting test results,

performed additional testing, and recommended the use of drum-type

continuous miners.

The ore bed will be accessed via a 25-foot diameter, two

compartment mine ventilation and service shaft, and a 12,000-foot

long slope (also referred to as a "ramp" or "decline") inclined at

8.5 degrees. The 1,525-foot deep shaft will have an intake air

compartment, equipped with an emergency escape hoist and cage as

well as electrical high voltage and communication cables. The

second compartment will be used for return air and will contain

fresh water and mine discharge water piping to prevent freezing

during the winter months. General mine ventilation will be

accomplished with dual 11-foot fans installed in parallel on the

return side of the shaft. The slope provides flexibility to

accommodate increased underground production as needed. Ore

will be transported to the surface via a 60-inch slope conveyor

with a capacity of 4,000 tons per hour.

The Study recommends the use of dual split super section

("DSSS") mining methods. Parallel sets of main entries are

developed five to seven entries wide each. Production panels

are developed up to 1000 feet wide to accommodate the DSSS concept

of operating two continuous miners side by side using a centrally

located single belt conveyor. DSSS supports the use of common

equipment such as section scoops, forklifts, and section

conveyors. DSSS keeps both capital and operating costs as low

as possible.

Surface Facilities

The plant will include several key unit operations to process a

continuous stream of polyhalite ore from the mine into finished SOP

products. The main process circuits include crushing and

washing, calcination, leaching, evaporation and crystallization,

and drying and granulation. In conjunction with the crushing

phase, washing removes sodium chloride from the ore and ensures a

high quality, appropriately sized feed to the

calciner. Fluid-bed calciners provide precise temperature

control and cause the ore to become readily soluble in

water. A two-stage counter-current leach circuit produces

brine containing potassium and magnesium sulphates. This brine

is fed to the evaporation and crystallization circuits where SOP is

crystallized. Following crystallization, drying and

granulation of the crystals produces the final products. Pilot

plant operation confirmed that the process is technically and

economically viable on a continuous basis. Portions of this

process are covered by U.S. Patent 8,551,429, with other U.S. and

foreign patents pending.

The SOP products are planned to be trucked 22 miles to the rail

loading and truck distribution facility. From this facility,

ICP will have the ability to reach domestic rail and truck markets,

as well as nearly any international dry bulk port facility in the

Americas. Tailings management will include a variety of

evaporation ponds and injection wells, in addition to a dry-stack

gypsum storage facility. Deep saline water will be sourced

from the Capitan Reef aquifer and treated, where necessary, through

reverse osmosis.

Engineering Consultants and Client Engineers

"We extend our heartfelt thanks for the stellar performances of

those contributing to this Study," said Randy Foote, Chief

Operating Officer. "During the course of our work, ICP and the

engineering consultants identified further opportunities with the

potential to increase processing efficiencies and lower both

capital and operating costs. We intend to implement these

enhancements."

In addition to SNC-Lavalin, other primary consulting engineering

groups, process design, and equipment supply groups include:

- Agapito Associates Inc. ("AAI"), a Colorado-based company

providing services in geology and mining engineering. AAI was

responsible for reviewing and auditing the exploration program,

developing the resource geologic model and the resources and

reserves estimates, providing mine design and mine engineering, and

developing the operating and capital costs for the mine.

- Veolia Water Solutions and Technologies ("Veolia"), a worldwide

process and technology equipment supplier, providing services in

water treatment and evaporation, as well as crystallization

technologies. Veolia was responsible for developing the

evaporation and crystallization circuits, and for pilot

testing.

- Novopro Projects Inc. ("Novopro"), a Canadian-based company

providing services in engineering, project development, and project

management, with particular expertise in potash mineral processing.

Novopro acted in the role of the owner's engineer, providing

project management, process development, testing, and contract

development services.

- Resource Development Inc. ("RDi"), a Colorado-based company

providing international services in mineral processing, leaching,

and circuit recovery. RDi provided overall technical reviews of

processing technology and surface facilities.

- Upstream Resources, a Washington, D.C.-based geosciences

company providing services in the design and execution of

exploration programs, data analysis, and geologic and resource

modeling, and with substantial international experience in potash

exploration and development. Upstream Resources carried out the

substantial portion of the exploration programs and subsequent data

analysis, and interpretation and geological modeling.

- Hazen Research Inc. ("Hazen"), a Colorado-based company

providing services encompassing research and development in the

adaptation of known technology to new situations, pilot plant

testing, preliminary engineering, and cost analysis. Hazen

designed numerous process testing procedures, provided laboratories

and facilities for bench-scale testing, and fabricated parts of the

pilot plant. Hazen also validated all phases of the ICP

process to optimize conversion of polyhalite into SOP.

- INTERA Incorporated ("INTERA"), a New Mexico-based company

providing services in water resources planning, development and

management. INTERA managed and coordinated environmental

permitting and hydrogeological modeling.

- Walsh Environmental Scientists and Engineers ("Walsh"), a

Colorado-based company with expertise in environmental consulting

services, ecological investigations and surveys, site assessment,

and National Environmental Policy Act regulations. Walsh

contributed to environmental permitting and related

activities.

In addition to the consultants mentioned above, several other

highly regarded professional companies contributed to the

completion of the Study. These include:

- AB Engineering Inc.

- Chastain Consulting

- Chemfelt Engineers

- FEECO International

- Fakatselis Consulting Inc.

- Gundlach Equipment Corporation

- Harrison Western Construction Corp.

- Metso Minerals Industries Inc.

- SGS Lakefield Research Limited

- Sage Earth Sciences

- Western Technologies Inc.

Qualified Persons

Gary Skaggs, P.E., P.Eng., AAI vice president/principal, is the

independent Qualified Person for the mine plan and Mineral

Reserves; Leo Gilbride, P.E, AAI vice president, is the independent

Qualified Person for Mineral Resources; Tom Vandergrift, P.E., AAI

vice president/principal, is the independent Qualified Person for

the mine geotechnical analysis; Susan Patton, Ph.D., P.E., AAI

senior associate, is the independent Qualified Person for mine

capital and operating cost; Vanessa Santos, CPG, AAI chief

geologist, is the independent Qualified Person for the geology and

exploration sections of the Study, each within the meaning of

National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101").

Lawrence Berthelet, P.Eng., MBA, VP Potash, SNC-Lavalin, is the

independent Qualified Person for mineral processing and

metallurgical testing, recovery, and project infrastructure;

Phillipe Poirer, P.Eng., VP Finance, SNC-Lavalin, is the

independent Qualified Person for the economic analysis, both within

the meaning of the NI 43-101.

The independent Qualified Persons within the meaning of the NI

43-101 for the evaporation and crystallization processes are John

DiMonte, P.E., VP Operations; Tony Banasiak, P.E., Electrical

Manager; Jean Claude Gallot, MS, Process Engineer; John Pitts,

CHMM-Engineering; Harry Parker, P.E., Technical Manager, Piping and

Facilities; David Gamache, CHE, Director of Research and

Development; Shawn Thornton, MS, Research and Development;

Charlotte Bessiere, Ph.D., Research and Development; all of Veolia

Water Solutions & Technologies.

Pursuant to NI 43-101, ICP will file a compliant technical

report on SEDAR addressing the applicable sections of this press

release within 45 days of the date of this disclosure.

All scientific and technical disclosures in this press release

have been prepared under the supervision of and approved by Deepak

Malhotra, Ph.D. and registered SME member, president of Resource

Development Inc., a Qualified Person within the meaning of NI

43-101 and an advisor to the Company.

Definitions AIRR is a measure used to establish economic

viability of the Project. It is the interest rate that equates

the discounted values of (i) the estimated capital costs to build

the mine and surface facilities with (ii) the projected cash flows

generated during the 50 year mine plan utilized in the

establishment of the Proven and Probable Reserves.

BAssociation for the Advancement of Cost Engineering

International standards define Class 3 estimates to be those

prepared as the basis for budget authorizations, appropriations,

and funding. Class 3 estimates use quotations for all major

items of capital. They include process and utility flow

diagrams, preliminary piping and instrument designs, and complete

equipment lists.

CK2O equivalent refers to the potassium content percentage of a

particular potassium fertilizer mineral. It is based on a

hypothetical potassium oxide percentage by weight of potassium

sulphate. Pure potassium sulphate, i.e. 100% potassium

sulphate by weight, has a K2O equivalent of 54.06%.

About IC Potash Corp. ICP has demonstrated a low-cost method to

produce sulphate of potash ("SOP") from its 100%-owned Ochoa

polyhalite deposit in southeast New Mexico. The Company intends to

become a primary, long-term producer of SOP. The global market for

SOP is 5.5 million tons per year, with producers benefiting from

substantial price premiums over regular potash, known as muriate of

potash ("MOP"). SOP is a non-chloride potash fertilizer widely

used in the horticultural industry and for high value crops, such

as fruits, vegetables, tobacco and potatoes. It is applicable

for soils where there are substantial agricultural activity, high

soil salinity, and in arid regions. The Ochoa Project has access to

excellent local labor resources, low-cost electricity and natural

gas, water, rail lines, and the Port of Galveston, Texas. ICP's

land holdings consist of nearly 90,000 acres of federal subsurface

potassium prospecting permits and State of New Mexico potassium

mining leases. For more information, please visit

www.icpotash.com.

Forward-Looking Statements Certain information set forth in this

news release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties and other

factors which may cause the actual results, performance or

achievements of ICP to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements include

statements that use forward-looking terminology such as "may",

"will", "expect", "anticipate", "believe", "continue", "potential"

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements include, without

limitation, reserve estimates, ICP's expected position as one of

the lowest cost producers of SOP in the world, the timing of

receipt and publication of ICP's environmental permits, the

sufficiency of ICP's cash balances, the timing of production, and

other statements that are not historical facts. These

forward-looking statements are subject to numerous risks and

uncertainties, certain of which are beyond the control of ICP,

including, but not limited to, risks associated with mineral

exploration and mining activities, the impact of general economic

conditions, industry conditions, dependence upon regulatory

approvals, the uncertainty of obtaining additional financing, and

risks associated with turning reserves into product. Readers

are cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements.

FOR MORE INFORMATION, PLEASE CONTACT: Mr. Mehdi Azodi Investor

Relations Director Phone: 416-779-3268 Email: Email Contact

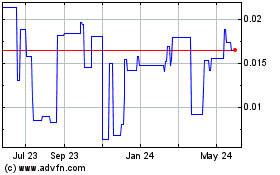

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Feb 2025 to Mar 2025

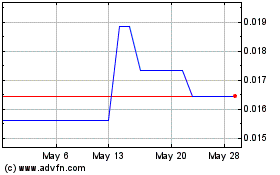

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Mar 2024 to Mar 2025