false

0001439264

0001439264

2024-07-05

2024-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 5, 2024

MARVION

INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-53612 |

|

26-2723015 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 21st Floor, Centennial Tower, |

|

|

| 3 Temasek Avenue, |

|

|

| Singapore |

|

039190 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code +65 6829 7029

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a - 12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13d-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common |

MVNC |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item - 1.01 Entry into a Material Definitive

Agreement.

Effective July 3, 2024,

Marvion Inc., a Nevada corporation (the “Company”) and LEE Ying Chiu Herbert and Young Chi Kin Eric entered into a Stock

Purchase Agreement (the “SPA”) pursuant to which Mr. Lee agreed to sell to Mr. Young 10,000,000 shares of Series A

Preferred Stock of the Company, par value $0.0001 (the “Series A Preferred Stock”), constituting all of the issued and

outstanding shares of the Series A Preferred Stock. In consideration, Mr. Young agreed to assume approximately $288,089 in

liabilities which will be paid in installments in accordance with the terms of the SPA. In connection with the transactions

contemplated in the SPA, the parties agreed to cause Chan Sze Yu to be appointed as the Chief Executive Officer, Chief Financial

Officer, Secretary and Director of the Company.

The Company is in active discussions

with Mr. Young regarding the acquisition of one or more operating businesses. The parties expect the acquisition of any such operating

businesses to take place after the consummation of the transactions contemplated by the SPA.

The foregoing description

of the SPA is qualified in its entirety by reference to the SPA, which is filed as Exhibit 10.1 and incorporated herein by reference.

Item - 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Marvion Inc. |

| Dated: July 5, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Man Chung CHAN |

| |

|

Man Chung CHAN |

| |

|

Chief Executive Officer |

Exhibit 10.1

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY OTHER FEDERAL OR STATE REGULATORY AUTHORITY. THE SHARES BEING SOLD HEREBY

ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. THE SALE PRICE WAS DETERMINED ARBITRARILY BY THE SELLERS AND BEARS NO RELATIONSHIP

TO THE ASSETS, EARNINGS, BOOK VALUE, CURRENT OR FUTURE TRADING PRICE OF THE SHARES, OR ANY OTHER CRITERIA.

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT

is made and entered into this 3rd day of July, 2024, by and among Marvion Inc., a Nevada corporation (the “Company”),

the Sellers set forth on the signature pages hereto (each, a “Seller” and collectively, the “Sellers”), and the

purchasers set forth on Exhibit A, attached hereto and incorporated herein (each, a “Purchaser”, and collectively,

the “Purchasers”). Sellers own, or shall own on the date of the Closing Date (as defined in Section 2 below), an aggregate

of, 10,000,000 shares of Series A Preferred Stock of the Company, par value $0.0001,. Purchasers desire to purchase from Sellers, and

Sellers are willing to sell securities, subject to the terms and conditions contained in this Agreement.

NOW THEREFORE, in consideration

of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties agree as follows:

1.

Purchase and Sale. The Sellers hereby agree

to sell to the Purchasers and the Purchasers, in reliance on the representations and warranties contained herein, and subject to the terms

and conditions of this Agreement, agree to purchase from the Sellers the following securities (the “Company

Shares”) for a total purchase price of Two Hundred and Eighty-Eight

Thousand and Eighty-Nine United States Dollars ($288,089) (the “Purchase

Price”), payable in immediately available funds in United States currency.

| · | 10,000,000 shares of Series A Preferred Stock

of the Company, par value $0.0001. |

Purchasers

and Sellers acknowledge and accept that the trading price of the Company Shares may decrease or increase subsequent to the sale of the

Company Shares. Purchaser and Sellers waive claims to any losses as a result of the sale of the Company Shares. 10,000,000 shares of the

Company’s common stock shall equal approximately 97.35% of the voting

power of all securities of the Company.

2.

Closing. The Closing of the purchase and sale of the Company Shares shall occur upon

the satisfaction or waiver of all conditions set forth below, but no later than 5 PM PST on the June 30, 2024, or such other date as may

be determined by the parties (the “Closing Date”).

2.1. Condition

Precedent. As a condition precedent to the obligations of the Purchasers to purchase the Company Shares, the Purchasers shall have

conducted a due diligence review of the Company and its books and records to its full satisfaction and shall have delivered written confirmation

of the same as set forth in Section 2.3 hereof.

2.2. Sellers/Company

Deliverables: Unless waived in writing by Purchasers, the Sellers and the Company shall on or prior to the Closing:

| 2.2.1. | Deliver to the Escrow Agent the Company books and records up to the date of the Closing, unless otherwise

agreed to in writing by the parties; |

| | | |

| 2.2.2. | Deliver to Purchasers copies of all Company Contracts, if any; |

| | | |

| 2.2.3. | Written confirmation of termination of all Company Contracts and performance or payment in full of all

obligations and liabilities of the Company, including without limitation: (i) payment in full of all loans of the Company, including without

limitation, those made by Sellers or affiliates of the Company; (ii) payment in full of all amounts due under the Company Contracts; and

(iii) payment in full of all outstanding invoices or invoices that will become outstanding as of Closing or within fourteen (14) days

thereafter. |

| | | |

| 2.2.4. | Executed Pay-off Letter or Waiver Letter from the Sellers identified on the

signature page hereof regarding full repayment of and or cancellation and release of any and all liabilities of the Company owed to such

affiliates; |

| | | |

| 2.2.5. | Signed resignation letters of all existing officers and directors of the Company; |

| | | |

| 2.2.6. | Executed Board consents appointing designees of the Purchasers as directors and officers of the Company; |

| | | |

| 2.2.7. | All Edgar and other codes of the Company necessary to make filings with the Securities and Exchange Commission

and OTC Markets Group; |

| | | |

| 2.2.8. | Contact information of all service providers of the Company necessary or desirable to comply with SEC

rules and regulations and to maintain listing on a national securities exchange or over the counter bulletin board, which shall include

without limitation, independent auditors, legal counsel, transfer agent, registered agent, market maker and edgarizer; |

| | | |

| 2.2.9. | Written confirmation from the Company’s

stock transfer agent that it has received all documentation necessary to effectuate the transfer of stock certificates representing the

shares of common stock included in the Company Shares to the Purchasers, including the issuance of stock certificates representing the

Company Shares to the Purchasers or her designee. (The Company acts as its own transfer agent as to the shares of Preferred Stock. |

2.3. Purchaser

Deliverables: On or prior to the Closing, the Purchasers shall deliver: (i) the $110,000 to the Escrow Agent; and (ii) upon the satisfaction

of the terms set forth in Section 2.2 hereof as determined by Purchasers in their discretion, written acknowledgement that Purchasers

are satisfied with the results of their due diligence review of the Company and its books and records.

| 2.3.1. | A remaining amount of $178,089 will be distributed to settle the outstanding legal, accounting and audit

fees as follows: |

| 2.3.1.1. | Olayinka Oyebola: $51,375, Law Office of Jenny Chen-Drake: $94,653 and Sirius Venture Management Limited:

32,061 |

3.

Resignation of Old and Appointment of New Board of Directors and Officers. The Company

and the Sellers shall take such corporate action(s) and make such SEC filings on Schedule 14F-1 in compliance with the Exchange Act Rules

(if applicable) and as otherwise required by the Company Articles of Incorporation and/or Bylaws to duly (a) appoint the below named persons,

or other persons who names shall be delivered to the Company, to their respective positions, to be effective as of the Closing Date, and

(b) obtain and submit to the Purchasers, together with all required corporate action(s) the resignation of all members of the board of

directors, and any and all corporate officers as of the Closing Date, all of which actions shall be certified and delivered to the Purchasers

as effective at Closing by the Sellers in such form and substance satisfactory to the Purchasers. Following the execution of this Agreement

and through the date of effectiveness of such resignations, no other officers or directors shall be appointed or elected to serve the

Company except as otherwise expressly provided herein.

| Name |

Position |

| CHAN Sze Yu |

Chief Executive Officer, Chief Financial Officer and Secretary, Director |

| |

|

| |

|

4.

Representations and Warranties of Sellers. Each of the Company and the Sellers hereby

severally represents and warrants to each of the following as of the date hereof and the Closing Date:

4.1.

Corporate Existence and Power. The Company is a corporation duly organized and validly existing and in good standing under

the laws of the jurisdiction of its incorporation or formation. The Company has the requisite corporate power and authority to carry on

its business as presently conducted and as currently proposed to be conducted, to own and operate its properties and assets, to execute

and deliver this Agreement, and to carry out the provisions of this Agreement. The Company is duly qualified to do business and is in

good standing as a foreign company in all jurisdictions in which the nature of its activities and of its properties makes such qualification

necessary, except for those jurisdictions in which failure to do so would not have a material adverse effect on the Company or its business.

4.2.

Subsidiaries. The Company does not own or control any equity security or other interest of any other corporation, partnership,

limited liability company or other business entity. The Company is not a participant in any joint venture, partnership, limited liability

company or similar arrangement.

4.3.

Organizational Documents. True, correct and complete copies of the Organizational Documents of the Company have been made available

to Purchaser, and no action has been taken to amend or repeal such Organizational Documents since the date of delivery. The Company is

not in violation or breach of any of the provisions of its Organizational Documents. “Organizational Documents” means, the

Company’s articles of incorporation and bylaws.

4.4.

Authorization; No Contravention. The execution, delivery and performance by Sellers of this Agreement and the transactions

contemplated hereby (a) have been duly authorized by all necessary action of the Sellers and the Company, (b) do not violate,

conflict with or result in any breach or default of (or with due notice or lapse of time or both would result in any breach, default or

contravention of), or the creation of any lien under, any Organizational Documents, any contractual obligation of the Sellers or the Company

or any requirement of law applicable to the Company, and (d) do not violate any judgment, injunction, writ, award, decree or order

(collectively, “Orders”) of any governmental authority against, or binding upon, the Company. There are no actions,

subpoenas, suits, proceedings, claims, complaints, disputes, arbitrations or investigations (collectively, “Claims”)

pending, initiated, or, to the knowledge of the Sellers, threatened, at law, in equity, in arbitration or before any governmental authority

against the Company.

4.5.

Governmental Authorization; Third Party Consents. No consent, approval, authorization, order, registration or qualification

(each, an “Authorization”) of or with any governmental authority or any other person is required for the execution,

delivery or performance (including, without limitation, the sale of the Company Shares) by, or enforcement against, the Company of this

Agreement or the consummation by the Company of the transactions contemplated by this Agreement, except (i) such Authorizations as

have already been obtained or (ii) as otherwise provided in this Agreement.

4.6.

Capitalization.

4.6.1.

The Company's authorized capital stock consists of 270,000,000,000 shares of common stock, par value $0.0001, of which 54,355,661

shares are issued and outstanding, and 30,000,000 shares of preferred stock, par value $0.0001, 10,000,000 shares of which are designated

Series A Preferred Stock with a par value $0.0001, 1,000,000 of which are designate Series B Preferred Stock with a par value of $0.0001,

1 of which is designated Series C Preferred Stock with a par value of $0.0001, and 18,999,999 of which are undesignated. There are issued

and outstanding 10,000,000 shares of Series A Preferred Stock, 366,345 shares of Series B Preferred Stock and 1 share of Series C Preferred

Stock. All shares of Company stock are owned of record and beneficially by the shareholders in the amounts set forth in the Shareholder’s

list attached hereto as Exhibit B. There are no outstanding dividends, whether current or accumulated, due or payable on any of

the capital stock of the Company, except that the Board has not declared any dividends on any preferred shares, nor have any dividends

been paid on those shares.

4.6.2.

Sellers are the legal owners, and have good and marketable title (beneficially and of record) to all of the Company Shares. The

Company Shares, when issued to the Purchasers pursuant to this Agreement, will be: (i) duly authorized, validly issued, and outstanding;

(ii) fully paid, non-assessable, and free of preemptive rights; and (iii) free and clear of any and all pledges, claims, restrictions,

charges, liens, security interests, encumbrances, or other interests of third parties of any nature whatsoever. As of the date hereof:

(i) there are no outstanding options, warrants, rights, commitments, or agreements of any kind for the issuance or sale of, or outstanding

securities convertible into, any additional shares of capital stock of any class of the Company; (ii) there are no voting trusts, voting

agreements, proxies, or other agreements, instruments, or undertakings with respect to the voting of any Company securities to which the

Company or any of its shareholders is a party; and (iii) there are no restrictions on transfer of any Company securities except for restrictions

imposed by applicable laws or by the express terms of this Agreement. There are no contracts, commitments, understandings or arrangement

by which the Company is bound to issue additional registered capital, share capital or other securities.

4.7.

Agreements. The Company is not a guarantor or indemnitor of any indebtedness of

any other person, party or entity. Except for this Agreement and the Escrow Agreement (as hereinafter defined),

and except as set forth on Exhibit C, there are no agreements, understandings, instruments, contracts or proposed transactions,

or judgments, orders, writs or decrees, to which the Company is a party or by which it is bound. All contracts set forth on Exhibit

C (the “Company Contracts”) are in writing and are valid and binding and enforceable against the Company and, to

the Company’s knowledge, against the other parties thereto in accordance with their respective terms. The Company is not a guarantor

or indemnitor of any indebtedness of any other person, party or entity. The Company has not declared or paid any dividends, or authorized

or made any distribution upon or with respect to any class or series of its equity securities.

4.8. Absence

of Undisclosed Liabilities. As of the dates of the Company's financial statements, the Company had no liabilities, either accrued

or contingent, of a nature required to be reflected in the financial statements in accordance with generally accepted accounting principles,

and whether due or to become due, which individually or in the aggregate are reasonably likely to have an adverse effect on the Company.

4.9. Absence

of All Liabilities.

4.9.1.

Except for debt owed to the Sellers which is being cancelled at closing, the Company has no liabilities, either accrued or contingent,

whether or not of a nature required to be reflected in the financial statements in accordance with generally accepted accounting principles,

and whether due or to become due. The Company has fully paid all creditors, debtors, vendors and service providers for all obligations

that have become due and payable as of the Closing Date; and (ii) all loans, notes payables, and liabilities, either accrued or contingent,

whether or not of a nature required to be reflected in the financial statements in accordance with generally accepted accounting principles,

whether due or to become due or whether or not disclosed in the OTC Markets Reports have been paid in full.

4.9.2.

There are no lawsuits, actions or administrative, arbitration or other proceedings or governmental investigations ongoing, pending

or threatened against or relating to the Company, Sellers or the Company's properties or business. The Company has not entered into or

been subject to any consent decree, compliance order, or administrative order with respect to any property owned, operated, leased, or

used by the Company. The Company has not received any request for information, notice, demand letter, administrative inquiry, or formal

or informal complaint or claim with respect to any property owned, operated, leased, or used by the Company or any facilities or operations

thereon.

4.9.3.

The Company has filed all tax returns required to have been filed for the years 2017 through 2019; the Form 1120 has not yet been

prepared for the 2020 tax year but will be provided to Purchaser for filing prior to the September 15, 2021 extended due date. All such

tax returns were correct and complete in all material respects. All taxes owed by the Company (whether or not shown on any tax return)

have been paid. The Company currently is not the beneficiary of any extension of time within which to file any tax return. To the Company's

knowledge, no claim has ever been made by an authority in a jurisdiction where the Company does not file tax returns that it is or may

be subject to taxation by that jurisdiction. There are no actual, pending or, to the Company's knowledge, threatened liens, encumbrances,

or charges against any of the assets of the Company arising in connection with any failure (or alleged failure) to pay any tax. The Company

has withheld and paid all taxes required to have been withheld and paid in connection with amounts paid or owing to any employee, independent

contractor, creditor, shareholder, or other third party. To the Company's knowledge, there is no dispute or claim concerning any tax liability

of the Company either claimed or raised by any authority in writing. The Company has not waived any statute of limitations in respect

of taxes or agreed to any extension of time with respect to a tax assessment or deficiency.

4.10.

Financial Statements. The Company's financial statements fairly present the financial condition of the Company at the dates

of said statements and the results of its operations for the periods covered thereby and have been prepared in accordance with United

States generally accepted accounting principles and practices consistently applied and consistent with the books and records of the Company.

4.11.

Binding Effect. This Agreement has been duly executed and delivered by the Sellers, and constitutes the legal, valid and

binding obligation of the Sellers, enforceable against the Sellers in accordance with its terms, except as enforceability may be limited

by applicable bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting the enforcement

of creditors' rights generally and by general principles of equity.

4.12.

Private Offering. No registration of the Company Shares, pursuant to the provisions of the Securities Act of 1933, as amended,

or any state securities or “blue sky” laws, will be required by the sale of the Company Shares in the manner contemplated

in Section 1 herein. Sellers agree that neither he or she, nor anyone acting on his or her behalf, shall offer to sell the Company

Shares or any other securities of the Company so as to require the registration of the Company Shares pursuant to the provisions of the

Securities Act of 1933, as amended, or any state securities or “blue sky” laws.

4.13.

Disclosure. Sellers understand and confirm that Purchasers are relying on the representations, warranties and covenants

contained in this Agreement and the disclosures set forth in the reports, forms and other documents filed with FINRA as reflected on the

OTC Markets Group, LLC by the Company (collectively, the “OTC Markets Reports”) in entering into this Agreement. All disclosures

contained in the OTC Markets Reports or otherwise provided to Purchaser(s) regarding the Company, its businesses and the transactions

contemplated hereby, furnished by or on behalf of Sellers or the Company are complete, true and correct and do not contain any untrue

statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the

circumstances under which they were made, not misleading.

5.

Indemnification. The Sellers shall, jointly and severally, notwithstanding any termination

of this Agreement, indemnify and hold harmless each Purchaser, the Company, the officers, directors, agents, investment advisors, partners,

members and employees of each of them, each person who controls any such Purchaser (within the meaning of Section 15 of the Securities

Act or Section 20 of the Exchange Act) and the officers, directors, agents and employees of each such controlling person, to the fullest

extent permitted by applicable law, from and against any and all losses, claims, damages, liabilities, costs (including, without limitation,

reasonable costs of preparation and reasonable attorneys' fees) and expenses (collectively, “Losses”), as incurred,

arising out of or relating to any breach of the representations, warranties and covenants of Sellers or the Company set forth in this

Agreement, up to a maximum amount equal to the portion of the Purchase Price actually received by Sellers.

If any Proceeding shall be brought or asserted

against any person entitled to indemnity hereunder (an “Indemnified Party”), such Indemnified Party shall promptly

notify the Person from whom indemnity is sought (the “Indemnifying Party”) in writing, and the Indemnifying Party shall

assume the defense thereof, including the employment of counsel reasonably satisfactory to the Indemnified Party and the payment of all

fees and expenses incurred in connection with defense thereof; provided, that the failure of any Indemnified Party to give such notice

shall not relieve the Indemnifying Party of its obligations or liabilities pursuant to this Agreement, except (and only) to the extent

that it shall be finally determined by a court of competent jurisdiction (which determination is not subject to appeal or further review)

that such failure shall have proximately and materially adversely prejudiced the Indemnifying Party.

An Indemnified Party shall have the right to employ

separate counsel in any such Proceeding and to participate in the defense thereof, but the fees and expenses of such counsel shall be

at the expense of such Indemnified Party or Parties unless: (1) the Indemnifying Party has agreed in writing to pay such fees and expenses;

(2) the Indemnifying Party shall have failed promptly to assume the defense of such Proceeding and to employ counsel reasonably satisfactory

to such Indemnified Party in any such Proceeding; or (3) the named parties to any such Proceeding (including any impleaded parties) include

both such Indemnified Party and the Indemnifying Party, and such Indemnified Party shall have been advised by counsel that a conflict

of interest is likely to exist if the same counsel were to represent such Indemnified Party and the Indemnifying Party (in which case,

if such Indemnified Party notifies the Indemnifying Party in writing that it elects to employ separate counsel at the expense of the Indemnifying

Party, the Indemnifying Party shall not have the right to assume the defense thereof and such counsel shall be at the expense of the Indemnifying

Party). The Indemnifying Party shall not be liable for any settlement of any such Proceeding effected without its written consent, which

consent shall not be unreasonably withheld or delayed. No Indemnifying Party shall, without the prior written consent of the Indemnified

Party, effect any settlement of any pending Proceeding in respect of which any Indemnified Party is a party, unless such settlement includes

an unconditional release of such Indemnified Party from all liability on claims that are the subject matter of such Proceeding.

All fees and expenses of the Indemnified Party

(including reasonable fees and expenses to the extent incurred in connection with investigating or preparing to defend such Proceeding

in a manner not inconsistent with this Section) shall be paid to the Indemnified Party, as incurred, within ten calendar of written notice

thereof to the Indemnifying Party (regardless of whether it is ultimately determined that an Indemnified Party is not entitled to indemnification

hereunder; provided, that the Indemnifying Party may require such Indemnified Party to undertake to reimburse all such fees and expenses

to the extent it is finally judicially determined that such Indemnified Party is not entitled to indemnification hereunder).

This Section 5 shall expire and terminate one

year after the Closing Date.

6.

Acknowledgement of Escrow Agent as Counsel to Purchaser Representative. The Sellers

and Purchaser hereby acknowledge that they are parties to that certain Escrow Agreement dated June 17, 2024, by and among Chen-Drake Law

(“Escrow Agent”), the Purchasers and the Sellers (the “Escrow Agreement”), pursuant to which the Sellers and Purchasers

established an escrow account and appointed Escrow Agent to serve as the escrow agent thereto in accordance with the terms and conditions

of the Escrow Agreement. The Sellers and Purchasers hereby acknowledge that Escrow Agent: (i) is legal counsel to the representatives

of the Purchasers; (ii) has explained to each of it the potential conflicts arising from having legal counsel to the representatives of

the Purchasers serve as the Escrow Agent; and (iii) has advised each of them to seek independent counsel to review the terms of this Agreement

and the Escrow Agreement. Each of the Company, Sellers and Purchasers hereby acknowledges that it, he or she has had the opportunity to

seek such independent counsel and agrees to waive all potential and actual conflicts arising from having Escrow Agent serve as Escrow

Agent. The parties further acknowledge that the duties, responsibilities and obligations of Escrow Agent shall be limited to those expressly

set forth in the Escrow Agreement and no duties, responsibilities or obligations shall be inferred or implied. Escrow Agent shall not

be subject to, nor required to comply with, any other agreement between or among any or all of the Purchasers, the Company and the Sellers

or to which any of the Purchasers or the Sellers are a party, even though reference thereto may be made herein, or to comply with any

direction or instruction from any of the Purchasers or the Sellers or any entity acting on its behalf. The Purchasers, the Company

and the Sellers hereby expressly acknowledge their appointment of Escrow Agent to serve as the escrow agent in accordance with the terms

and conditions of the Escrow Agreement.

7.

Miscellaneous. This Agreement constitutes the entire agreement between the parties

hereto and supersedes all prior agreements and discussions between Purchasers and Sellers. No waiver of any of the provisions of this

Agreement will be deemed to constitute a waiver of any other provisions hereof. This Agreement may be executed by the parties hereto in

separate counterparts, each of which will be deemed to be one and the same instrument. All claims, disputes and other matters in question

between the parties to this Agreement, arising out of or relating to this Agreement or breach thereof, shall be filed and heard only in

the state courts of Nevada. The Agreement will be government by and construed and enforced in accordance with the internal laws of the

State of Nevada, without regard to the principles of conflicts of law thereof.

[The remainder of this

page has been intentionally left blank.]

IN WITNESS WHEREOF, the parties hereto have executed

this Agreement as of the date set forth in the first paragraph.

|

COMPANY:

Marvion Inc.

a Nevada corporation

By: /s/ Chang Man Chung

Its: Chan Man Chung

Chief Executive Officer

Address:

21/F, Centennial Tower,

3 Temasek Avenue

Singapore 039190

|

|

SELLERS:

Lee Ying Chiu Herbert

By: /s/ Lee Ying Chiu Herbert

Lee Ying Chiu Herbert

(10,000,000 shares of Series A Preferred

Stock)

|

|

PURCHASERS:

/s/ Young Chi Kin Eric

Young Chi Kin Eric

Address:

2/F, 17 Yau Kam Tau Village,

Tsuen Wan, N.T., Hong Kong |

|

EXHIBIT A

PURCHASERS

| |

Amount of Series A Preferred Shares |

Consideration |

| |

|

|

| Young Chi Kin Eric |

10,000,000 |

US$288,089 |

| |

|

|

| |

|

|

| |

|

|

| TOTAL |

10,000,000 |

US$288,089 |

EXHIBIT B

SHAREHOLDERS LIST

[See Attachment]

EXHIBIT C

COMPANY CONTRACTS

None

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

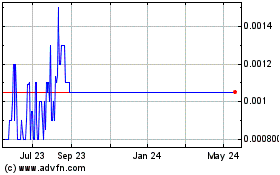

Bonanza Goldfields (PK) (USOTC:BONZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

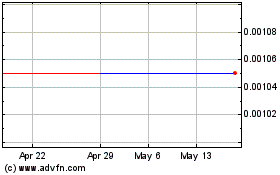

Bonanza Goldfields (PK) (USOTC:BONZ)

Historical Stock Chart

From Jul 2023 to Jul 2024