Encompass Holdings, Inc. Restructures Stock Issue to Meet New Funding Requirements

15 June 2010 - 5:03AM

Encompass Holdings, Inc. (Pink Sheets:ECMH),

www.encompassholdings.com, reported today that it has begun the

process and has received initial approval to restructure its Class

A Common Shares by a factor of 1 new share for every 30 existing

shares.

The Encompass Board of Directors, in order to

meet the requirements for the new funding necessary to meet its

business objectives, unanimously voted to reduce its issued and

outstanding common stock from approximately 740 million shares to

just under 25 million shares; a reduction factor of 1 for 30. The

exact numbers of new shares will be determined when the actual

share adjustment is completed.

The new funding will be used to meet the requirements of the

Encompass subsidiaries, Rotary Engines

Technologies, Inc., (rotary engines) Aqua Xtremes,

Inc., (XBoards) and Quadrant Data Systems,

Inc. (additional virtual platform hardware

purchases) as previously described in the

Encompass press release of May 20, 2010.

Scott Webber, CEO and a Director of Encompass,

stated, "This new funding is an absolute requirement for our

businesses to succeed. Having reached our total Authorized

Shares, we had no other options other than increasing the

authorized shares or decreasing the issued and outstanding

shares. If we would have increased the authorized shares, we

would continue to see 10s of millions of share conversions at

sub-penny prices. However, by reducing the issued and

outstanding shares, the existing convertible debt held by the NIR

Group can be paid down more quickly and with fewer shares and less

dilution by maintaining a lower float and a better share

price. A share reverse, as opposed to an authorized share

increase, results in lower share conversion numbers with each debt

conversion."

Webber continued, "We are just as concerned about the impact of

our actions on our existing shareholders as we are in meeting our

obligations to our creditors. Our future success depends on

receiving these new funds to rapidly complete our business

initiatives. We know the challenges and the importance of

maintaining the new share prices after this action takes

effect. We believe that this new funding will give us the

ability to meet that challenge to support the share price and

values our existing shareholder base deserves. Our new

investors are very positive about our actions and the future of

Encompass."

Forward-looking statements in this news release are made under

the ''Safe Harbor'' provisions of the Private Securities Litigation

Reform Act of 1995. Certain important factors could cause results

to differ materially from those anticipated by the forward-looking

statements, including the impact of changed economic or business

conditions, competition, the success of existing and new product

releases and other risk factors inherent in product development and

other factors discussed from time to time in reports filed by the

company with the Securities and Exchange Commission.

The Encompass Holdings, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=6962

CONTACT: Encompass Holdings, Inc.

J. Scott Webber

InvestorRelations@EncompassHoldings.com

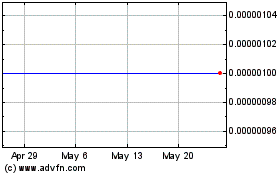

Encompass (CE) (USOTC:ECMH)

Historical Stock Chart

From Jan 2025 to Feb 2025

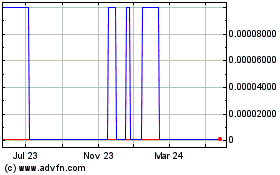

Encompass (CE) (USOTC:ECMH)

Historical Stock Chart

From Feb 2024 to Feb 2025