Weakening Oil Takes Some Air Out of Asian Stocks

16 August 2016 - 3:00PM

Dow Jones News

Shares in Asia were mixed on Tuesday, with record gains in the

U.S. market overnight offset by a dip in oil prices and a firmer

yen.

The Nikkei Stock Average was down 0.4% in early morning trade,

flip-flopping between gains and losses. Taiwan's Taiex was down

0.3%, while Australia's S&P/ASX 200 slipped 0.2% as a downswing

in oil hit commodity producers. Elsewhere, markets were rising,

with the Hang Seng Index up 0.3%, the Shanghai Composite Index up

0.3% and Korea's Kospi rising 0.2%.

Late on Monday, the S&P 500, Dow Jones Average and the

Nasdaq Composite all reached record highs—a feat they accomplished

last Thursday for the first time since 1999—on the back of hopes

for production cuts in the oversupplied oil market.

Brent crude oil eased back from a one-month high in Asian trade,

though, and was last down to $48.08 a barrel.

"I don't think that [the U.S. highs are] too significant," said

William Ma, chief investment office at Noah Holdings Ltd. The muted

impact on Asian stocks was due to the small gains involved, he

said.

In Hong Kong and China, stocks were kept afloat by persistent

talk that the Shenzhen-Hong Kong Connect trading link would be

launched before the end of the year.

China Evergrande Group's Hong Kong shares rose 0.9% after it

increased its stake in China Vanke Co. Ltd to 6.8% from 5%.

According to Lucror Analytics, Evergrande's accumulation of Vanke

shares was puzzling, given that the developer is heavily indebted,

having aggressively used debt capital to fund recent expansions and

acquisitions. Vanke was last trading up 2.7%.

The FTSE Bursa Malaysia Index climbed Tuesday morning alongside

positive Asian markets lifted by expectations of more monetary

easing around the globe. The Malaysia 30-stocks benchmark index

increased 0.5% to 1,700.15 points in early trade and was up 0.4%

year-to-date.

Meanwhile, a slightly firmer yen, which typically hurts

exporting businesses, did little damage to Japanese auto makers'

stocks, which rebounded after sustaining yen-related losses in the

previous session. Toyota Motor Corp. was up 0.6%, Nissan Motor Co.

Ltd. was up 1% and Honda Motor Co. Ltd. was 0.6% higher.

The market was attempting to shrug off Japan's disappointing

gross-domestic-product data for the April-June quarter released on

Monday, which weighed in at 0.2%, below an expected 0.7%

expansion.

"On the one hand, the economy is not doing well which doesn't

look good for domestic profits of Japanese firms," said Marcel

Thieliant, senior Japan economist at Capital Economics. However,

the weak figures increase the chance of more easing by the Bank of

Japan, he said.

In other commodities, copper futures edged lower and nickel sank

0.8%, while gold rose 0.4% to $1,344 a troy ounce.

Looking ahead, South Korea is set to release revised trade data

that could dictate momentum for shares.

Dominique Fong and Yantoultra Ngui contributed to this

article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

August 16, 2016 00:45 ET (04:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

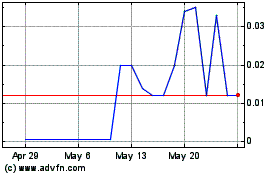

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Oct 2024 to Nov 2024

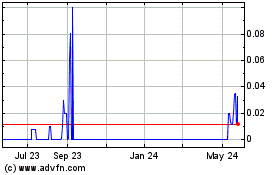

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Nov 2023 to Nov 2024