First Acceptance Corporation (NYSE:FAC) today reported its

financial results for the quarter and year ended December 31,

2017.

Operating Results

Income before income taxes for the three months ended December

31, 2017 was $3.1 million, compared with loss before income taxes

of $5.8 million for the three months ended December 31, 2016. Net

loss for the three months ended December 31, 2017 was $10.4

million, compared with net loss of $3.5 million for the three

months ended December 31, 2016. For the three months ended

December 31, 2017, we recognized $4.3 million of favorable

prior period loss development, compared with unfavorable

development of $2.6 million for the three months ended December 31,

2016.

Income before income taxes for the year ended December 31, 2017

was $6.6 million, compared with loss before income taxes of $45.1

million for the year ended December 31, 2016. Net loss for the year

ended December 31, 2017 was $8.6 million, compared with net loss of

$29.2 million for the year ended December 31, 2016. For the year

ended December 31, 2017, we recognized $2.3 million of favorable

prior period loss development, compared with unfavorable

development of $30.6 million for the year ended December 31, 2016.

The year ended December 31, 2017 was also unfavorably impacted by

$2.4 million in catastrophic claims losses during the third

quarter. Conversely, the year ended December 31, 2016 was favorably

impacted by a $1.2 million gain on the sale of foreclosed real

estate along with net realized gains on investments of $4.8 million

from the sales of fixed maturities that were sold to increase the

statutory capital and surplus of our insurance company

subsidiaries.

The provision for income taxes for the three months and year

ended December 31, 2017 includes a reduction in the deferred tax

asset of $12.5 million as a result of the enactment of legislation

to reduce the corporate income tax rate.

President and Chief Executive Officer, Ken Russell, commented,

“Following the unprecedented underwriting losses in 2016 that

impacted the automobile insurance industry, over the last 18

months, the Company held its focus on returning to profitability by

improving pricing and risk management and strengthening its core

business fundamentals. While higher rates and stricter underwriting

meant less revenues, our 14% decline in policies-in-force since the

beginning of the year, was partially offset by a 10% increase in

our average in-force premium. Bolstered by improved

claims-handling, these changes contributed to a 2017 accident year

loss ratio of 80.2% (79.3% adjusted for the September catastrophic

claims losses) which marked a significant improvement from 91.8% in

2016. All said, these efforts resulted in the Company exceeding its

profitability goals set for 2017.”

Mr. Russell further added “2017 was also a year for the Company

to evaluate and better leverage the strengths of its retail

operations. In doing so, we began to expand the offerings in our

stores of additional commissionable products written through other

carriers for both personal automobile and non-personal automobile

coverages, including homeowners, renters, motorcycle, life and

commercial automobile. Now, as we become better equipped as both an

insurer and an agency, I look towards 2018 with great optimism and

thank all of our stockholders for their patience and support

through this transitionary time.”

Loss Ratio. The loss ratio was 73.9% for the

three months ended December 31, 2017, compared with 91.9% for the

three months ended December 31, 2016. The loss ratio was 79.4% for

the year ended December 31, 2017, compared with 101.9% for the

year ended December 31, 2016. We recognized favorable

development related to prior periods of $4.3 million for the three

months ended December 31, 2017, compared with unfavorable

development related to prior periods of $2.6 million for the three

months ended December 31, 2016. For the year ended December 31,

2017, we recognized $2.3 million of favorable prior period loss

development, compared with unfavorable development of $30.6 million

for the year ended December 31, 2016.

Excluding the development related to prior periods for the three

months ended December 31, 2017 and 2016, the loss ratios were 80.5%

and 88.2%, respectively. Excluding the development related to prior

fiscal years and the impact of the September 2017 hurricanes, the

loss ratios for the years ended December 31, 2017 and 2016 were

79.3% and 91.8%, respectively. We believe that the improvement in

the loss ratio was the result of our aggressive rate and

underwriting actions in addition to a moderate reduction in claims

frequency.

Revenues. Premiums earned decreased by $3.5

million, or 5.1%, to $65.8 million for the three months ended

December 31, 2017, from $69.3 million for the three months ended

December 31, 2016. For the year ended December 31, 2017 premiums

earned decreased by $25.1 million, or 13.6%, to $278.2 million from

$303.3 million for the year ended December 31, 2016. These

decreases were the result of a targeted decline in new policies

written through the closing of 53 poorly performing stores,

increasing rates and the tightening of underwriting standards.

These actions resulted in a 14% decrease in our year-over-year

policies in force which was partially offset by a 10%

year-over-year increase in our average in-force premium that was

driven by our recent rate actions. The estimated effective rate

increases attained over the last 18 and 12 months were 16% and 2%,

respectively.

Commission and fee income decreased by $2.5 million, or 14.3%,

to $15.0 million for the three months ended December 31, 2017, from

$17.5 million for the three months ended December 31, 2016.

Commission and fee income decreased by $11.0 million, or 14.6%, to

$64.6 million for the year ended December 31, 2017, from $75.6

million for the year ended December 31, 2016. These decreases

were primarily the result of a decrease in monthly billing fees as

a result of the previously-mentioned decline in the number of

policies in force. Additionally, we earned less commission as a

result of a decline in the renewals of automobile insurance

policies sold in California on behalf of third-party carriers.

Expense Ratio. The expense ratio was 20.9% for

the three months ended December 31, 2017, compared with 15.7% for

the three months ended December 31, 2016. The expense ratio was

17.8% for the year ended December 31, 2017, compared with

14.6% for the year ended December 31, 2016. These

year-over-year increases in the expense ratio were primarily due to

the decrease in premiums earned which resulted in a higher

percentage of fixed expenses and the previously-mentioned decline

in commission and fee income, which is a component of the expense

ratio.

Combined Ratio. The combined ratio decreased to

94.8% for the three months ended December 31, 2017 from 107.6% for

the three months ended December 31, 2016. For the year ended

December 31, 2017, the combined ratio decreased to 97.2% from

116.5% for the year ended December 31, 2016.

About First Acceptance Corporation

We are principally a retailer, servicer and underwriter of

non-standard personal automobile insurance based in Nashville,

Tennessee. Our insurance operations generate revenue from selling

non-standard personal automobile insurance products and related

products in 16 states. We currently conduct our insurance servicing

and underwriting operations in 13 states and operate only as an

insurance agency in three states. We are also licensed as an

insurance company in 13 states where we do not conduct any

business. Non-standard personal automobile insurance is sought

after by individuals because of their inability or unwillingness to

obtain standard insurance coverage due to various factors,

including payment history, payment preference, failure in the past

to maintain continuous insurance coverage or driving record and/or

vehicle type.

At December 31, 2017, we leased and operated 350 retail

locations and a call center staffed with employee-agents. Our

employee-agents primarily sell non-standard personal automobile

insurance products underwritten by us and through third-party

carriers for which we receive a commission. We also offer a variety

of additional commissionable products, and, in most states, our

employee-agents also sell an insurance product providing personal

property and liability coverage for renters that is underwritten by

us. In addition to our retail locations, we are able to complete

the entire sales process over the phone via our call center or

through the internet via our consumer-based website or mobile

platform. On a limited basis, we also sell our products through

selected retail locations operated by independent agents.

Additional information about First Acceptance Corporation can be

found online at www.acceptance.com.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements about the expected effects of the recently

completed acquisition. These statements, which have been included

in reliance on the “safe harbor” provisions of the federal

securities laws, involve risks and uncertainties. Investors are

hereby cautioned that these statements may be affected by important

factors, including, among others, the factors set forth under the

caption “Risk Factors” in Item 1A. of our Annual Report on

Form 10-K for the year ended December 31, 2017 and in our

other filings with the Securities and Exchange Commission. Actual

operations and results may differ materially from the results

discussed in the forward-looking statements. Except as required by

law, we undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise.

| |

|

|

|

|

|

|

| FIRST ACCEPTANCE CORPORATION AND

SUBSIDIARIES Consolidated Statements of

Operations (in thousands, except per share

data) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Premiums

earned |

|

$ |

65,775 |

|

|

$ |

69,331 |

|

|

$ |

278,221 |

|

|

$ |

303,328 |

|

|

Commission and fee income |

|

|

14,978 |

|

|

|

17,541 |

|

|

|

64,581 |

|

|

|

75,596 |

|

|

Investment income |

|

|

1,304 |

|

|

|

854 |

|

|

|

4,719 |

|

|

|

4,649 |

|

| Gain on

sale of foreclosed real estate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,237 |

|

| Net

realized (losses) gains on investments, available-for-sale

(includes $4,745 of accumulated other comprehensive loss

reclassification for net unrealized gains in 2016) |

|

|

(3 |

) |

|

|

80 |

|

|

|

(3 |

) |

|

|

4,813 |

|

| |

|

|

82,054 |

|

|

|

87,806 |

|

|

|

347,518 |

|

|

|

389,623 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses

and loss adjustment expenses |

|

|

48,622 |

|

|

|

63,740 |

|

|

|

220,785 |

|

|

|

309,002 |

|

| Insurance

operating expenses |

|

|

28,062 |

|

|

|

27,609 |

|

|

|

111,323 |

|

|

|

116,510 |

|

| Other

operating expenses |

|

|

311 |

|

|

|

287 |

|

|

|

1,133 |

|

|

|

1,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

99 |

|

|

|

43 |

|

|

|

299 |

|

|

|

207 |

|

|

Depreciation |

|

|

465 |

|

|

|

606 |

|

|

|

2,068 |

|

|

|

2,540 |

|

|

Amortization of identifiable intangible assets |

|

|

195 |

|

|

|

239 |

|

|

|

789 |

|

|

|

956 |

|

| Interest

expense |

|

|

1,161 |

|

|

|

1,106 |

|

|

|

4,535 |

|

|

|

4,319 |

|

| |

|

|

78,915 |

|

|

|

93,630 |

|

|

|

340,932 |

|

|

|

434,753 |

|

| Income (loss) before

income taxes |

|

|

3,139 |

|

|

|

(5,824 |

) |

|

|

6,586 |

|

|

|

(45,130 |

) |

| Provision (benefit) for

income taxes |

|

|

13,568 |

|

|

|

(2,277 |

) |

|

|

15,190 |

|

|

|

(15,848 |

) |

| Net loss |

|

$ |

(10,429 |

) |

|

$ |

(3,547 |

) |

|

$ |

(8,604 |

) |

|

$ |

(29,282 |

) |

| Net loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.71 |

) |

|

Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.71 |

) |

| Number of shares used

to calculate net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

41,200 |

|

|

|

41,041 |

|

|

|

41,286 |

|

|

|

41,085 |

|

|

Diluted |

|

|

41,200 |

|

|

|

41,041 |

|

|

|

41,286 |

|

|

|

41,085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST ACCEPTANCE CORPORATION AND

SUBSIDIARIES Consolidated Balance Sheets

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Investments,

available-for-sale at fair value (amortized cost of $129,742 and

$117,902, respectively) |

|

$ |

129,945 |

|

|

$ |

117,212 |

|

| Cash, cash equivalents,

and restricted cash |

|

|

115,477 |

|

|

|

118,681 |

|

| Premiums, fees, and

commissions receivable, net of allowance of $275 and $279 |

|

|

69,624 |

|

|

|

66,393 |

|

| Deferred tax assets,

net |

|

|

20,549 |

|

|

|

35,641 |

|

| Other investments |

|

|

9,750 |

|

|

|

9,994 |

|

| Other assets |

|

|

6,438 |

|

|

|

6,078 |

|

| Property and equipment,

net |

|

|

2,888 |

|

|

|

4,213 |

|

| Deferred acquisition

costs |

|

|

4,947 |

|

|

|

4,852 |

|

| Goodwill |

|

|

29,384 |

|

|

|

29,384 |

|

| Identifiable intangible

assets, net |

|

|

6,857 |

|

|

|

7,626 |

|

| TOTAL

ASSETS |

|

$ |

395,859 |

|

|

$ |

400,074 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Loss and loss

adjustment expense reserves |

|

$ |

159,130 |

|

|

$ |

161,079 |

|

| Unearned premiums and

fees |

|

|

82,620 |

|

|

|

78,861 |

|

| Debentures payable |

|

|

40,348 |

|

|

|

40,302 |

|

| Term loan from

principal stockholder |

|

|

29,805 |

|

|

|

29,779 |

|

| Accrued expenses |

|

|

5,975 |

|

|

|

7,089 |

|

| Other liabilities |

|

|

13,224 |

|

|

|

10,476 |

|

| Total

liabilities |

|

|

331,102 |

|

|

|

327,586 |

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $.01

par value, 10,000 shares authorized |

|

|

— |

|

|

|

— |

|

| Common stock, $.01 par

value, 75,000 shares authorized; 41,235 and 41,160 issued and

outstanding, respectively |

|

|

413 |

|

|

|

412 |

|

| Additional paid-in

capital |

|

|

458,124 |

|

|

|

457,750 |

|

| Accumulated other

comprehensive income, net of tax of $(990) and $(1,110),

respectively |

|

|

1,900 |

|

|

|

1,316 |

|

| Accumulated

deficit |

|

|

(395,680 |

) |

|

|

(386,990 |

) |

| Total

stockholders’ equity |

|

|

64,757 |

|

|

|

72,488 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

395,859 |

|

|

$ |

400,074 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST ACCEPTANCE CORPORATION AND

SUBSIDIARIES Supplemental Data

(Unaudited) |

|

|

|

|

|

|

|

|

|

PREMIUMS EARNED BY STATE |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Gross premiums

earned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

|

$ |

16,811 |

|

|

$ |

15,660 |

|

|

$ |

67,313 |

|

|

$ |

63,332 |

|

|

Florida |

|

|

9,025 |

|

|

|

10,571 |

|

|

|

40,058 |

|

|

|

45,880 |

|

|

Alabama |

|

|

8,382 |

|

|

|

6,970 |

|

|

|

32,591 |

|

|

|

28,163 |

|

|

Texas |

|

|

6,697 |

|

|

|

8,869 |

|

|

|

31,057 |

|

|

|

41,154 |

|

| Ohio |

|

|

6,298 |

|

|

|

7,118 |

|

|

|

28,162 |

|

|

|

30,376 |

|

|

Tennessee |

|

|

5,366 |

|

|

|

4,500 |

|

|

|

20,649 |

|

|

|

19,330 |

|

| South

Carolina |

|

|

4,276 |

|

|

|

4,851 |

|

|

|

19,234 |

|

|

|

25,515 |

|

|

Illinois |

|

|

2,613 |

|

|

|

4,495 |

|

|

|

13,978 |

|

|

|

20,733 |

|

|

Indiana |

|

|

2,359 |

|

|

|

2,250 |

|

|

|

9,546 |

|

|

|

9,244 |

|

|

Pennsylvania |

|

|

2,285 |

|

|

|

2,219 |

|

|

|

9,263 |

|

|

|

9,618 |

|

|

Mississippi |

|

|

1,098 |

|

|

|

869 |

|

|

|

4,272 |

|

|

|

3,872 |

|

|

California |

|

|

565 |

|

|

|

217 |

|

|

|

1,795 |

|

|

|

316 |

|

|

Missouri |

|

|

28 |

|

|

|

704 |

|

|

|

368 |

|

|

|

5,397 |

|

|

Virginia |

|

|

72 |

|

|

|

148 |

|

|

|

360 |

|

|

|

848 |

|

| Total gross premiums

earned |

|

|

65,875 |

|

|

|

69,441 |

|

|

|

278,646 |

|

|

|

303,778 |

|

| Premiums

ceded to reinsurer |

|

|

(100 |

) |

|

|

(110 |

) |

|

|

(425 |

) |

|

|

(450 |

) |

| Total net

premiums earned |

|

$ |

65,775 |

|

|

$ |

69,331 |

|

|

$ |

278,221 |

|

|

$ |

303,328 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMBINED RATIOS (INSURANCE OPERATIONS)

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Loss |

|

|

73.9 |

% |

|

|

91.9 |

% |

|

|

79.4 |

% |

|

|

101.9 |

% |

| Expense |

|

|

20.9 |

% |

|

|

15.7 |

% |

|

|

17.8 |

% |

|

|

14.6 |

% |

| Combined |

|

|

94.8 |

% |

|

|

107.6 |

% |

|

|

97.2 |

% |

|

|

116.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF RETAIL LOCATIONS

Retail location counts are based upon the date that a location

commenced or ceased writing business.

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Retail locations –

beginning of period |

|

|

350 |

|

|

|

369 |

|

|

|

355 |

|

|

|

440 |

|

|

Opened |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

Acquired |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Closed |

|

|

— |

|

|

|

(14 |

) |

|

|

(5 |

) |

|

|

(89 |

) |

| Retail locations – end

of period |

|

|

350 |

|

|

|

355 |

|

|

|

350 |

|

|

|

355 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST ACCEPTANCE CORPORATION AND

SUBSIDIARIES Supplemental Data

(continued) (Unaudited) |

|

|

|

|

|

|

|

|

|

RETAIL LOCATIONS BY STATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

2017 |

|

|

2016 |

|

| Alabama |

|

|

23 |

|

|

|

23 |

|

|

|

24 |

|

|

|

23 |

|

|

|

23 |

|

| Arizona |

|

|

10 |

|

|

|

10 |

|

|

|

10 |

|

|

|

10 |

|

|

|

10 |

|

| California |

|

|

46 |

|

|

|

47 |

|

|

|

48 |

|

|

|

46 |

|

|

|

47 |

|

| Florida |

|

|

34 |

|

|

|

34 |

|

|

|

39 |

|

|

|

34 |

|

|

|

34 |

|

| Georgia |

|

|

49 |

|

|

|

50 |

|

|

|

60 |

|

|

|

49 |

|

|

|

53 |

|

| Illinois |

|

|

37 |

|

|

|

39 |

|

|

|

61 |

|

|

|

37 |

|

|

|

39 |

|

| Indiana |

|

|

16 |

|

|

|

16 |

|

|

|

17 |

|

|

|

16 |

|

|

|

16 |

|

| Mississippi |

|

|

6 |

|

|

|

6 |

|

|

|

7 |

|

|

|

6 |

|

|

|

6 |

|

| Missouri |

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

6 |

|

| Nevada |

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

| New Mexico |

|

|

5 |

|

|

|

5 |

|

|

|

5 |

|

|

|

5 |

|

|

|

5 |

|

| Ohio |

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

| Pennsylvania |

|

|

11 |

|

|

|

11 |

|

|

|

14 |

|

|

|

11 |

|

|

|

11 |

|

| South Carolina |

|

|

15 |

|

|

|

15 |

|

|

|

24 |

|

|

|

15 |

|

|

|

20 |

|

| Tennessee |

|

|

22 |

|

|

|

23 |

|

|

|

23 |

|

|

|

22 |

|

|

|

23 |

|

| Texas |

|

|

45 |

|

|

|

45 |

|

|

|

68 |

|

|

|

45 |

|

|

|

45 |

|

|

Total |

|

|

350 |

|

|

|

355 |

|

|

|

440 |

|

|

|

350 |

|

|

|

369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTOR RELATIONS CONTACT: Michael J.

Bodayle 615.844.2885

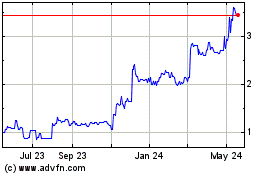

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Jan 2025 to Feb 2025

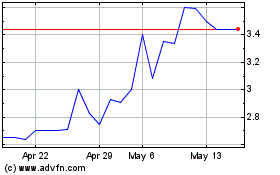

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Feb 2024 to Feb 2025