UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the registrant ☒

Filed by a party other than the registrant ☐

Check the appropriate box:

|

☐

|

Preliminary

proxy statement

|

|

☐

|

Confidential, for use of the Commission only

|

|

|

(as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive

proxy statement

|

|

☐

|

Definitive

additional materials

|

|

☐

|

Soliciting material pursuant to § 240.14a-12

|

First Choice Healthcare Solutions, Inc.

(Name

of Registrant as Specified in Its Charter)

Payment

of filing fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1 I (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 14, 2016

To the Stockholders of First Choice Healthcare Solutions, Inc.:

NOTICE IS HEREBY GIVEN

that the Annual Meeting of Stockholders

(the “Annual Meeting”) of

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

will be held on Wednesday, December 14, 2016

at 709 S. Harbor City Blvd., Melbourne, Florida 32901, at 10:00 a.m. Eastern Time for the following purposes:

|

|

1.

|

To elect two directors to serve until the 2017 Annual Meeting of Stockholders or until their successors are elected and qualified;

|

|

|

2.

|

To consider and act upon the ratification of RBSM LLP as the independent registered public accountants for the fiscal year

ending December 31, 2016;

|

|

|

3.

|

To conduct an advisory vote on the compensation of our Named Executive Officers;

|

|

|

4.

|

To conduct an advisory vote on the frequency of a stockholder advisory vote on the compensation of our Named Executive Officers;

and

|

|

|

5.

|

To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

The Board of Directors has fixed the close of

business on Monday, November 21, 2016 as the record date for the determination of stockholders entitled to receive notice of, and

to vote at, the Annual Meeting and any adjournments or postponements thereof.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 14, 2016 AT 10:00 A.M. ET.

The Notice of Annual Meeting

of Stockholders, our Proxy Statement and our Annual Report to Stockholders on Form 10-K for the fiscal year ended December 31,

2015, are available at: http://ir.myfchs.com/

Your vote

is important. We urge you to review the accompanying materials carefully and to vote by telephone or Internet as promptly as possible.

Alternatively, you may complete, sign, date and promptly return the enclosed proxy card by mail. If you do not specify a choice

on one of the proposals described in this proxy statement, your proxy will be voted as recommended by shares through an

account with a brokerage firm or other nominee or fiduciary to vote your shares.

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

Timothy Skeldon

Corporate Secretary

|

|

|

|

|

|

Dated:

|

Melbourne, Florida

November 23, 2016

|

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

709 S. HARBOR CITY BLVD.

MELBOURNE, FLORIDA 32901

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 14, 2016

SOLICITATION OF PROXIES

Purpose, Place, Date and Time

This proxy statement is furnished to stockholders

of First Choice Healthcare Solutions, Inc., a Delaware corporation, in connection with the solicitation of proxies by the Board

of Directors (our “Board”) for use at the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) to

be held at 709 S. Harbor City Blvd., Melbourne, Florida 32901, on Wednesday, December 14, 2016 at 10:00 a.m., Eastern Time, including

any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

Delivery of Proxy Materials

This Proxy Statement and 2015 Annual Report

to Stockholders on Form 10-K for the fiscal year ended December 31, 2015 (the “Annual Report”) have been mailed to

stockholders on or about November 23, 2016, and are available at http:/www.myfchs.com

Expenses of Solicitation

We will bear the entire cost of soliciting proxies,

including the cost of the preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional

information furnished to our stockholders in connection with the Annual Meeting. In addition to this solicitation by mail, our

directors, officers and other employees may solicit proxies by use of mail, telephone, facsimile, electronic means, in person or

otherwise. These persons will not receive any additional compensation for assisting in the solicitation but may be reimbursed for

reasonable out-of-pocket expenses in connection with the solicitation. We have retained Corporate Stock Transfer and Broadridge

Financial Solutions to aid in the distribution of proxy materials and to provide voting and tabulation services for the Annual

Meeting. In addition, we will reimburse brokerage firms, nominees, fiduciaries, custodians and other agents for their expenses

in distributing proxy material to the beneficial owners of our common stock.

Stockholders Sharing the Same Last Name and Address

We are sending only one copy of our Annual Report

to Stockholders and our proxy statement to stockholders who share the same last name and address, unless they have notified us

that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce

duplicate mailings and save significant printing and postage costs.

If you received a householded mailing this year

and you would like to have additional copies of our Annual Report to Stockholders and our proxy statement mailed to you or you

would like to opt out of this practice for future mailings, we will promptly deliver such additional copes to you if you submit

your request to our Corporate Secretary at First Choice Healthcare Solutions, Inc., 709 S. Harbor City Blvd., Suite 250, Melbourne,

FL 32901. You may also contact us in the same manner if you received multiple copies of the Annual Meeting materials and would

prefer to receive a single copy in the future.

VOTING OF SECURITIES

Record Date; Stockholders Entitled to Vote

At the close of business on November 21, 2016,

the record date (the “Record Date”) for the determination of stockholders entitled to vote at the Annual Meeting, we

had outstanding 24,418,613 shares of common stock, par value $.001 per share. The holders of our common stock are entitled to one

vote for each share held on the Record Date.

Quorum

In order to carry on the business of the Annual

Meeting, a quorum must be present. A quorum requires the presence, in person or by proxy, of the holders of a third of the votes

entitled to be cast at the Annual Meeting.

Abstentions and Broker Non-Votes

Abstentions and broker non-votes are counted

for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions occur when stockholders

are present at the Annual Meeting but choose to withhold their vote for any of the matters upon which the stockholders are voting.

“Broker non-votes” occur when other holders of record (such as banks and brokers) that hold shares on behalf of beneficial

owners do not receive voting instructions from the beneficial owners before the Annual Meeting and do not have discretionary authority

to vote those shares if they do not receive timely instructions from the beneficial owners. At the Annual Meeting, brokers will

not have discretionary authority to vote on Proposal 1 (election of directors), Proposal 3 (advisory vote on the compensation of

our Named Executive Officers) and Proposal 4 (advisory vote on the frequency of an advisory vote on the compensation of our Named

Executive Officers) in the absence of timely instructions from the beneficial owners; however, brokers will have discretionary

authority to vote on Proposal 2 (ratification of the appointment of our independent registered public accounting firm). As a consequence,

there will be no broker non-votes with regard to Proposal 2.

You may vote “FOR” or “WITHHOLD

AUTHORITY” for each director nominee. [If you vote “WITHHOLD AUTHORITY,” your vote will be counted for purposes

of determining the presence or absence of a quorum but will have no legal effect on the election of directors under Delaware law.]

You may vote “FOR,” “AGAINST”

or “ABSTAIN” on our proposal to ratify the selection of our independent registered public accounting firm. [In the

ratification of the appointment of our independent registered public accounting firm, abstentions will have the same effect as

a vote “against” ratification.]

You may vote “FOR,” “AGAINST”

or “ABSTAIN” on our proposal to approve, on an advisory basis, the compensation of our Named Executive Officers. [In

the approval, on an advisory basis, the compensation of our Named Executive Officers, abstentions will have the same effect as

a vote “against” approval. Broker non-votes will have no effect on the outcome of the vote.]

You may vote every “ONE,” “TWO,”

“THREE” years or “ABSTAIN” on our proposal to approve, on an advisory basis, the frequency of an advisory

vote on the compensation of our Named Executive Officers. [In the approval, on an advisory basis, the frequency of an advisory

vote on the compensation of our Named Executive Officers, abstentions and broker non-votes will have no effect on the outcome of

the vote.]

Methods of Voting

If you are a stockholder of record, you may

vote by mailing a completed proxy card, via the Internet or in person at the Annual Meeting. Instructions for voting via the Internet

are set forth on the enclosed proxy card. The Internet voting procedures, including the use of control numbers, are designed to

authenticate your identity, to allow you to vote your shares and to confirm that your instructions have been properly recorded.

If you are a street name holder (meaning that

your shares are held in a brokerage account by a bank, broker or other nominee), you may direct your broker or nominee how to vote

your shares; however, you may not vote in person at the Annual Meeting unless you have obtained a signed proxy from the record

holder giving you the right to vote on your beneficially owned shares. In addition, if you are a street name holder, you may vote

via the Internet if your bank or broker makes those methods available, in which case the bank or broker enclosed the instructions

with the proxy statement.

Vote Required

The election of directors will require a plurality

of the votes cast by the holders of the shares of common stock voting in person or by proxy at the Annual Meeting. The proposal

to ratify selection of the independent registered public accounting firm and the proposal to approve, on an advisory basis, the

compensation of our Named Executive Officers, will require the affirmative vote of the holders of a majority of the shares of common

stock of the Company present in person or by proxy at the Annual Meeting. The proposal, on an advisory basis, regarding the frequency

of future advisory votes on our Named Executive Officer compensation asks that you consider whether such vote should occur once

every one, two or three years. The choice that receives the highest number of votes, even if it receives less than a majority of

the votes cast, will be deemed the choice of the stockholders in the non-binding advisory vote.

Properly executed proxies will be voted as directed.

If no direction is indicated therein, proxies received in response to this solicitation will be voted FOR: (1) the election of

each individual nominated for election as directors; (2) the ratification of the selection of RBSM LLP as our independent registered

public accounting firm for the fiscal year ending December 31, 2016; (3) the approval of the compensation of our Named Executive

Officers, (4) the approval, on an advisory basis, of the option of “One Year” as the frequency of future advisory votes

to approve the compensation of our Named Executive Officers and (5) as recommended by our Board with regard to any other matters

that properly come before the Annual Meeting, or if no recommendation is given, at the discretion of the appointed proxies.

Revocation of Proxies

If you are a registered stockholder (meaning

your shares are registered directly in your name with our transfer agent) you may revoke your proxy at any time prior to the vote

tabulation at the Annual Meeting by: (1) sending in an executed proxy card with a later date, (2) timely submitting a proxy with

new voting instructions via the internet, (3) sending a written notice of revocation by mail to our Corporate Secretary at First

Choice Healthcare Solutions, Inc., 709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901 marked “Proxy. Information Enclosed,

Attention: Corporate Secretary” or (4) attending and voting in person by completing a ballot at the Annual Meeting. Attendance

at the Annual Meeting will not, in itself, constitute revocation of a completed and delivered proxy card.

If you are a street name stockholder and you

vote by proxy, you may change your vote by submitting new voting instructions to your bank, broker or nominee in accordance with

that entity’s procedures.

CORPORATE GOVERNANCE MATTERS

Board of Directors’ Term of Office

Directors are elected at our annual meeting

of shareholders and serve for one year until the next annual meeting of shareholders or until their successors are elected and

qualified.

Family Relationships

There are no family relationships among the

officers and directors, nor are there any arrangements or understanding between any of the Directors or Officers of our Company

or any other person pursuant to which any Officer or Director was or is to be selected as an officer or director.

Involvement in Certain Legal Proceedings

During the last ten years, none of our officers,

directors, promoters or control persons have been involved in any legal proceedings as described in Item 401(f) of Regulation S-K.

Board Meetings; Committee Meetings; and Annual Meeting Attendance

During 2015, the Board of Directors held 25

meetings. Each meeting was attended by all of the members of the Board.

Committees of the Board of Directors

There are currently no committees of the Board

of Directors.

Shareholder Recommendations for Board Nominees

The Board

does not have a Governance or Nominating Committee that is tasked with identifying individuals qualified to become Board members

and recommending to the Board the director nominees for the next annual meeting of shareholders. Until such committee is formed,

the shareholder recommendations for Board nominees would be directed to the entire Board, who will consider the qualifications

of the person recommended based on a variety of factors, including:

|

|

●

|

the appropriate size and the diversity of our Board;

|

|

|

●

|

our needs with respect to the particular talents and experience of our directors;

|

|

|

●

|

the knowledge, skills and experience of nominees, including experience in technology, business, finance, administration or

public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other

members of the Board;

|

|

|

●

|

experience with accounting rules and practices;

|

|

|

●

|

whether such person qualifies as an “audit committee financial expert” pursuant to the SEC Rules;

|

|

|

●

|

appreciation of the relationship of our business to the changing needs of society; and

|

|

|

●

|

the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided

by new members.

|

Compliance with Section 16(A) of the Exchange Act

Section 16(a) of the Exchange Act requires the

Company’s directors, officers and stockholders who beneficially own more than 10% of any class of equity securities of the

Company registered pursuant to Section 12 of the Exchange Act, collectively referred to herein as the “Reporting Persons,”

to file initial statements of beneficial ownership of securities and statements of changes in beneficial ownership of securities

with respect to the Company’s equity securities with the SEC. All Reporting Persons are required by SEC regulation to furnish

us with copies of all reports that such Reporting Persons file with the SEC pursuant to Section 16(a). Based solely on our review

of the copies of such reports and upon written representations of the Reporting Persons received by us, we believe that all Section

16(a) filing requirements applicable to such Reporting Persons have been timely met.

Code of Ethics

The Company has adopted a Code of Ethics for

adherence by its Chief Executive Officer and Chief Financial Officer to ensure honest and ethical conduct; full, fair and proper

disclosure of financial information in the Company’s periodic reports filed pursuant to the Securities Exchange Act of 1934;

and compliance with applicable laws, rules, and regulations. Any person may obtain a copy of our Code of Ethics, without charge,

by mailing a request to the Company at the address appearing on the front page of this Annual Report on Form 10-K or by viewing

it on our website found at www.myfchs.com.

Employment Agreements

The Company entered a formal five-year employment

agreement (the “Employment. Agreement”) with Christian “Chris” Romandetti, dated March 20, 2014 and effective

January 1, 2014, to serve as the Company’s President and Chief Executive Officer. Pursuant to the terms and conditions set

forth in the Employment Agreement, Mr. Romandetti is entitled to receive an annual base salary of $250,000, which shall increase

no less than 5% per annum for the term of the Employment Agreement. Mr. Romandetti is entitled to (i) five weeks of vacation per

year that if not used in any given one year will accrue and (ii) participate in all benefit plans the Company provides to its senior

executives and the Company will pay 100% of all costs associated with such plans and will reimburse Mr. Romandetti for all reasonable

out-of-pocket expenses and $1,000 per month for auto expenses.

Mr. Romandetti, upon successfully achieving

annual revenue milestones, is entitled to receive a bonus equal to 10% of his salary when $7.1 million in total annual revenue

is reported in a fiscal year scaling up to a bonus equal to 800% of his salary if and when $100 million in total annual revenue

is reported in a fiscal year. If the Company is unable to pay any portion of the bonus compensation when due because of insufficient

liquidity or applicable restrictions under prevailing debt financing agreements, then, as an accommodation to the Company, Mr.

Romandetti shall be able to convert bonus compensation into shares of the Company’s Common Stock at a 30% discount to the

average closing price during the first calendar month after the end of the fiscal year. Mr. Romandetti will also be entitled to

receive a strategic bonus of $100,000, payable in cash, on the sixth month anniversary of opening each new center of excellence.

Pursuant to the Company achieving specific financial

performance benchmarks established by the Board of Directors, Mr. Romandetti will also be entitled to receive a cashless option

to purchase up to 1 million shares of Common Stock per year. The exercise price of the options will be the fair market value of

the average closing price of the stock during the first calendar month after the end of the fiscal year. Mr. Romandetti shall have

up to five years from the date of the annual option grant to exercise the option. In addition to the above compensation consideration,

Mr. Romandetti will be entitled to receive annual restricted stock compensation equal to 100% of the total base salary and bonus

compensation. The fair market value of the restricted stock grant shall be determined using the average closing price of the Common

Stock during the first calendar month after the end of the fiscal year.

Upon the expiration of the initial five-year

term, the Employment Agreement shall automatically be extended for additional terms of one year each unless either party gives

90-day prior written notice of non-renewal. In addition, Mr. Romandetti’s Employment Agreement provides that, upon Mr. Romandetti’s

death, disability, termination for any reason other than “Cause” (as such term is defined in the Employment Agreement)

or resignation for “Good Reason” (as such term is defined in the Employment Agreement), the Company will pay to Mr.

Romandetti 12 months of his annual base salary at the time of separation in accordance with the Corporation’s usual payroll

practices and in case of disability additionally the payment on a prorated basis of any bonus or other payments earned in connection

with the Company’s then-existing bonus plan in place at the time of such termination. Finally, Mr. Romandetti is subject

to standard non-compete and non-solicit covenants during the course of his employment and for a period of 12 months after the date

that he is no longer employed by the Company.

Compensation of Directors

The following

table sets forth the compensation paid our Board of Directors for fiscal 2015:

|

N

ame

|

|

Shares

(#)

|

|

Shares

($)

|

|

Donald

A. Bittar

|

|

|

60,000

|

|

|

$

|

52,200

|

|

|

Christian

C. Romandetti

|

|

|

60,000

|

|

|

|

52,200

|

|

|

Total

|

|

|

|

|

|

$

|

104,400

|

|

Outstanding Equity Awards at 2015 Fiscal Year-End

On March 14, 2012, we adopted our 2011 Incentive

Stock Plan (the “2011 Plan”), pursuant to which 500,000 shares of our Common Stock are reserved for issuance as awards

to employees, directors, officers, consultants, and other service providers of the Company and its subsidiaries (an “Optionee”).

The term of the 2011 Plan is ten years from January 6, 2012, its effective date. No grants have been made to date under the 2011

Plan.

Terms and Conditions of Options Pursuant to the 2011 Incentive

Stock Plan

Options granted under the 2011 Plan shall be

subject to the following conditions and shall contain such additional terms and conditions, not inconsistent with the terms of

the Plan, as the Plan committee shall deem desirable:

|

|

●

|

Option Price.

The purchase price of each share of Stock purchasable under an incentive option shall be determined by

the Plan committee at the time of grant, but shall not be less than 100% of the Fair Market Value (as defined below) of such share

of Stock on the date the option is granted; provided , however , that with respect to an Optionee who, at the time such incentive

option is granted, owns (within the meaning of Section 424(d) of the United States Internal Revenue Code of 1986 (the “Code))

more than 10% of the total combined voting p6wer of all classes of stock of the Company or of any subsidiary, the purchase price

per share of Stock shall be at least 110% of the Fair Market Value per share of Stock on the date of grant. The purchase price

of each share of Stock purchasable under a nonqualified option shall not be less than 100% of the Fair Market Value of such share

of Stock on the date the option is granted. The exercise price for each option shall be subject to adjustment as provided in the

Plan. “Fair Market Value” means the fair market value of the Company’s issued and outstanding Stock as determined

in good faith by the Plan committee. In no event shall the purchase price of a share of Stock be less than the minimum price permitted

under the rules and policies of any national securities exchange on which the shares of Stock are listed.

|

|

|

●

|

Option Term.

The term of each option shall be fixed by the 2011 Plan committee, but no option shall be exercisable more

than ten years after the date such option is granted and in the case of an Incentive Option granted to an Optionee who, at the

time such incentive option is granted, owns (within the meaning of Section 424(d) of the Code) more than 10% of the total combined

voting power of all classes of stock of the Company or of any subsidiary, no such incentive option shall be exercisable more than

five years after the date such incentive option is granted.

|

|

|

●

|

Exercisability.

Options shall be exercisable at such time or times and subject to such terms and conditions as shall

be determined by the Plan committee at the time of grant; provided, however, that in the absence of any option vesting periods

designated by the Plan committee at the time of grant, options shall vest and become exercisable as to one-tenth of the total number

of shares subject to the option on each of the three month anniversary of the date of grant; and provided further that no options

shall be exercisable until such time as any vesting limitation required by Section 16 of the Exchange Act, and related rules, shall

be satisfied if such limitation shall be required for continued validity of the exemption provided under Rule 16b-3(d)(3).

|

Upon the occurrence of a “Change in Control”

(as defined in the 2011 Plan), the 2011 Plan committee may accelerate the vesting and exercisability of outstanding options, in

whole or in part, as determined in its sole discretion. The 2011 Plan committee may also determine that, upon the occurrence of

a Change in Control, each outstanding option shall terminate within a specified number of days after notice to an Optionee thereunder,

and each such Optionee shall receive, with respect to each share of Company common stock subject to an option, an amount equal

to the excess of the Fair Market Value (as defined in the 2011 Plan) of such shares immediately prior to such Change in Control

over the exercise price per share of such option; such amount shall be payable in cash, in one or more kinds of property (including

the property, if any, payable in the transaction) or a combination thereof, as the 2011 Plan committee shall determine in its sole

discretion.

Potential Payments upon Termination or Change in Control

We do not have any contract, agreement, plan

or arrangement that provides for any payment to any of our Named Executive Officers at, following, or in connection with a termination

of the employment of such Named Executive Officer, a change in control of the Company or a change in such Named Executive Officer’s

responsibilities.

PROPOSAL 1 – ELECTION OF DIRECTORS

Our Board currently consists of two members.

The Board has unanimously approved the recommended slate of two directors, both of whom are currently directors.

The following table sets forth certain information,

as of the date of this proxy statement, regarding our director nominees.

|

Directors

|

|

Age

|

|

Position

|

|

Officer and/or Director Since

|

|

|

|

|

|

|

|

|

|

Christian C. Romandetti

|

|

|

55

|

|

|

President, Chief Executive Officer and Director

|

|

December 2010

|

|

Donald Bittar

|

|

|

74

|

|

|

Director

|

|

December 2010

|

Christian “Chris” Romandetti – Chairman,

President and Chief Executive Officer

A serial entrepreneur and proven senior executive

with experience in a broad range of industries, Mr. Romandetti has served as First Choice Healthcare Solution’s Chairman,

President and CEO since December 2010. In this role, he is responsible for articulating the Company’s vision and executing

strategies that place clinically superior, patient-centric care and improved clinical outcomes at the core of the Company’s

corporate mission.

Mr. Romandetti was the Managing Member of Marina

Towers, LLC from July 2003 to September 2010, when it became a wholly owned subsidiary of the Company; and has been for more than

the past five (5) years, the Managing Member of C&K, LLC, a property holding company. Since 2007, he has also lent his business

building expertise to medical practices and MRI centers as a professional business consultant to the healthcare industry. Previously,

he was a founding director of Sunrise Bank, a community bank serving local businesses in Florida’s Space Coast and served

as an executive officer for numerous companies in the real estate, marine, automotive and construction products industries

Donald A. Bittar – Director and Chief Financial Officer

In December 2010, Mr. Bittar was appointed as

the Company’s CFO, Treasurer and Secretary and a member of the Board of Directors. In November 2014, he briefly retired from

his role as the Company CFO, returning in March 2015 and subsequently retiring in July 2016. Mr. Bittar brings our Company more

than 30 years’ experience working with companies as an officer, board member and consultant. Before joining the First Choice

leadership team, he served as President and Chairman of Associated Mortgage of North America and President of DA Bittar and Associates,

Inc., a management and technology consulting firm that he founded in 1980. From 1969 to 1980, he was Chairman, President and CEO

of Marine Telephone, Inc.

At the age of 22, Mr. Bittar was recognized

as one of the youngest individuals in history at that time to earn a broker dealer license, subsequently leading Bittar Securities,

a stock brokerage firm based on Wall Street in New York City. Among other notable career accomplishments, he served as a project

manager at General Electric, tasked with developing and implementing Medinet, the nation’s first shared hospital information

system, which was deployed in New York University Hospital, Bellevue Hospital and Mass General. At Western Union, he succeeded

in introducing the nation’s first barcode application for use at New York University Hospital, and pioneered one of the first

automated medical record management systems to better manage inner city pediatric patients for Bellevue Hospital.

Since 1969, he has also taught finance, management

and information technology at several leading undergraduate and graduate schools. Currently, Mr. Bittar is an Adjunct Professor

at Florida Institute of Technology, College of Business, where he was honored as Teacher of the Year in 2013.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR” CHRISTIAN ROMANDETTI AND DONALD A. BITTAR AS DIRECTORS.

PROPOSAL 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The Board of Directors has selected RBSM LLP

as our independent registered public accounting firm to conduct our audit for the fiscal year ending December 31, 2016.

Although stockholder ratification of the selection

of RBSM LLP is not required, the Board considers it desirable for our stockholders to vote upon this selection. Even if the selection

is ratified, the Board may, in its discretion, direct the appointment of a different independent registered public accounting firm

at any time during the year if it believes that such a change would be in the best interests of our stockholders and us.

RBSM LLP has served as our independent registered

public accountants since May 2011. A representative of RBSM LLP may be present at the Annual Meeting, in which case, will have

the opportunity to make a statement if he or she desires to do so and will be available to answer any appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF RBSM LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE FISCAL

YEAR ENDING DECEMBER 31, 2016.

AUDIT MATTERS

Fees and Expenses of RBSM LLP

The following table sets forth the aggregate

fees billed for the fiscal years ended December 31, 2015 and 2014 by our independent registered public accounting firm, RBSM LLP.

|

|

|

December 31,

|

|

|

|

2015

|

|

2014

|

|

Audit Fees

|

|

$

|

81,001

|

|

|

$

|

53,000

|

|

|

Tax Fees

|

|

|

7,000

|

|

|

|

6,000

|

|

|

All other fees

|

|

|

144,656

|

|

|

|

—

|

|

|

Total

|

|

$

|

232,657

|

|

|

$

|

59,000

|

|

Vote Required and Board Recommendation

If a quorum is present, the affirmative vote

of the holders of a majority of the shares to be voted will be required to approve this proposal. Abstentions will have the same

effect as a vote against this proposal.

STOCK OWNERSHIP INFORMATION

Stock Ownership by Management and the Board of Directors

The following table shows the number of shares

of First Choice Healthcare Solutions, Inc. common stock beneficially owned as of the Record Date (i) by each director (ii) the

Named Executive Officers of the Company (hereafter defined in the Summary Compensation Table) and (iii) all directors and executive

officers as a group.

|

Name and Address of Beneficial Owners

|

|

Number of Shares of Common Stock (1) (2)

|

|

Percent of Class

|

|

Christian C. Romandetti (3) (5)

|

|

|

6,706,559

|

|

|

|

27.46

|

%

|

|

Donald Bittar (4) (5)

|

|

|

816,666

|

|

|

|

3.34

|

%

|

|

Timothy Skeldon (5) (6)

|

|

|

150,000

|

|

|

|

—

|

|

|

All Executive Officers and Directors as a Group (3

Individuals)

|

|

|

7,673,225

|

|

|

|

30.81

|

%

|

|

|

(1)

|

Except as otherwise indicated, we believe that the beneficial owners of the common stock

listed above, based on

information furnished by such owners, have sole investment and

voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined

in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of

common stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes

of computing the percentage ownership of the person holding such option or warrants, but are not deemed

outstanding

for purposes of computing the percentage ownership of any other person.

|

|

|

(2)

|

Based on 24,418,613 shares of common stock issued and outstanding.

|

|

|

(3)

|

Of the reported securities, 5,750,000 shares are owned by Romandetti Family Trust. 746,557

shares are owned by Mr. Romandetti and 210,000 shares are owned by Mr. Romandetti’s wife. Mr. Romandetti disclaims beneficial

ownership of the reported securities, except to the extent of his pecuniary interest herein.

|

|

|

(4)

|

Includes 160,000 shares of common stock owned by Mr. Bittar’s wife.

|

|

|

(5)

|

c/o 709 S. Harbor City Blvd., Suite 520, Melbourne, Florida 32901

|

|

|

(6)

|

Includes 150,000 performance-based, restricted stock units vesting

over three years, based on the achievement of certain defined annual financial benchmarks, granted on May 31, 2016.

|

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth the names, ages

and titles, as of the Record Date, of each of our executive officers. There are no family relationships between any of our directors

and executive officers. In addition, there are no arrangements or understandings between any of our executive officers and any

other person pursuant to which any person was selected as an executive officer.

Officers of the Company

The Company’s executive officers are as

follows:

|

Name

|

|

Age

|

|

Positions Held

|

|

Christian Romandetti

|

|

|

55

|

|

|

Chairman of the Board, Chief Executive Officer and President

|

|

Timothy Skeldon

|

|

|

55

|

|

|

Chief Financial Officer and Corporate Secretary

|

Timothy K. Skeldon was appointed Chief Financial

Officer in July, 2016. From 1999 through 2016, Mr. Skeldon served as Chief Financial Officer of Parrish Medical Center,

an award-winning 210-bed medical center serving North Brevard7ounty, Florida. Prior to joining Parrish in 1999, Skeldon served

as Vice President and CFO of Central Florida Regional Hospital, a full service, level II trauma center. Other previous

executive posts have included Controller of Lucerne Medical Center, Controller and Director of Financial Planning of Parrish and

Director of Corporate Accounting for Fawcett Memorial Hospital in Port Charlotte, Florida. He began his career working as a Senior

Audit Accountant for Ernst & Young after graduating from the University of Central Florida with B.S.B.A. and M.S. degrees

in Accounting.

STOCK OWNERSHIP BY CERTAIN STOCKHOLDERS

The following table shows each person or group

who, based upon (i) their most recent filings with the Securities and Exchange Commission, or (ii) known to us, to be the beneficial

owner of more than 5% of the Company’s common stock.

|

Name and Address of Beneficial Owner

|

|

Number of Shares of Common Stock (1) (2)

|

|

Percent of Class

|

|

CT Capital, Ltd. (3)

|

|

|

2,666,667

|

|

|

|

9.85

|

%

|

|

MedTRX Provider Network, LLC (4)

|

|

|

2,075,000

|

|

|

|

7.83

|

%

|

|

Fuse Capital LLC (5)

|

|

|

1,598,735

|

|

|

|

6.55

|

%

|

|

|

(1)

|

Except as otherwise indicated, we believe that the beneficial owners of the common stock

listed above, based on

information furnished by such owners, have sole investment and

voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined

in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of

common stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes

of computing the percentage ownership of the person holding such option or warrants, but are not deemed

outstanding

for purposes of computing the percentage ownership of any other person.

|

|

|

(2)

|

Based on 24,418,613 shares of common stock issued and outstanding.

|

|

|

(3)

|

On June 13, 2013, we entered into a Loan and Security Agreement (the “Loan Agreement”) with CT Capital, Ltd, a

Florida Limited Partnership. Under the Loan Agreement and subsequent amendments, CT Capital committed to make an accounts receivable

line of credit to a maximum aggregate amount of $2,500,000. As of November 1, 2016, $2,500,000 was outstanding under the line of

credit. At any time up and until June 30, 2017 (the “Maturity Date”), CT Capital may convert up to $2,000,000 of the

outstanding principal amount or interest on the loan into our Common Stock at a price equal to $0.75 per share. For purposes of

percent ownership calculation, we have assumed that $2,000,000 was converted into `our common stock at a price of $0.75 per share.

The address of CT Capital, Ltd. is 6300 NE First Avenue, Suite 201 Fort Lauderdale, Florida 33334.

|

|

|

(4)

|

1 Kalisa Way, Suite 201, Paramus, New Jersey 652. Comprised of 200,000 shares of common stock; and a cash warrant to purchase

1,875,000 shares of common stock that may be exercised on or prior to the close of business on December 23, 2018 at $3.60 per share,

For purposes of percent ownership calculation, we have assumed that the warrant was exercised at an exercise price of $3.60 per

share.

|

|

|

(5)

|

40 Hemlock Drive, Roslyn, New York 11576. Mark Burnett, as the managing member of Fuse Capital LLC, is deemed to have sole

voting and disposition of these shares. Does not include (i) 42,000 shares held by Jennifer Burnett, Mr. Burnett’s wife,

of which Ms. Burnett maintains sole voting and disposition power of 19,500 shares, and shared voting and disposition power with

Mr. Burnett of 22,500 shares and (ii) 29,500 shares which Mr. Burnett holds, and maintains sole voting and disposition power of.

|

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis describes our executive

compensation program, which is designed to attract, incent and retain the leaders of our organization. The goal of our compensation

program is the same as our goal for operating our Company, to create long-term value for our stockholders. Toward this goal, we

have designed and implemented compensation programs for our executive officers to reward them for sustained financial and operating

performance and leadership excellence, to align their interests with those of our stockholders and to encourage them to remain

with our Company for long and productive careers. Most of our compensation elements simultaneously fulfill more than one of our

performance, alignment and retention objectives. These elements consist of base salary and annual bonuses, equity incentive compensation,

and other employee benefits. In deciding on the type and amount of compensation that may be appropriate for each executive, we

focus on both current pay and the opportunity for future compensation. We combine the compensation elements for each executive

in a manner we believe optimizes the executive’s contribution to our Company.

Our executive compensation policies are intended to provide a comprehensive

picture to you, the stockholder, of both the rationale behind executive compensation decisions and the manner in which those decisions

are made. In developing our disclosure, the Compensation Committee relied upon the principles contained in the regulations governing

public company executive compensation disclosures that were approved by the SEC.

Compensation Objectives

Performance

The executives who are identified in the Summary Compensation Table

(are referred to as our “Named Executive Officers”). The amount of compensation for each current Named Executive Officer

reflects his superior management experience, continued high performance and exceptional career of service over a long period of

time. Key elements of compensation that depend upon each Named Executive Officer’s performance include:

|

|

●

|

a cash bonus that is based on an assessment of his performance against pre-determined quantitative and qualitative measures

within the context of our overall performance; and

|

|

|

●

|

equity incentive compensation in the form of stock options and restricted stock, the value of which is contingent upon the

performance of our share price and subject to vesting schedules that require continued service with us.

|

Base salaries and annual bonuses are designed

to reward annual achievements and be commensurate with the executive’s scope of responsibilities, demonstrated leadership

abilities, and management experience and effectiveness. Our other elements of compensation focus on motivating and challenging

the executive to achieve superior, long-term, sustained results.

Alignment

We seek to align the interests of the Named

Executive Officers with those of our stockholders by evaluating executive performance on the basis of key financial measurements

that we believe closely correlate to long-term stockholder value, including revenue, organic revenue, operating profit, earnings

per share, operating margins, return on total equity or total capital, cash flow from operating activities and total stockholder

return. A key element of compensation that aligns the interests of the Named Executive Officers with stockholders include equity

incentive compensation, which links a significant portion of compensation to stockholder value because the total value of those

awards correspond to stock price appreciation.

Retention

Due to the exceptional management training and

experience offered by careers with us, our senior executives are often presented with other professional opportunities, including

ones at potentially higher compensation levels. We attempt to retain our executives by using continued service as a determinant

of total pay opportunity. A key element of compensation that requires continued service to receive any, or maximum, as applicable,

payouts include the extended vesting terms on elements of equity incentive compensation, including stock options and restricted

stock.

Implementing Our Objectives

Determining Compensation

We rely upon internal factors and the judgment

of our Compensation Committee in making compensation decisions, although the Compensation Committee has the authority to engage

outside consultants and advisors if it feels that our internal information is not sufficient to make compensation decisions. The

Compensation Committee strives to make fully-informed compensation decisions after reviewing our performance and carefully evaluating

an executive’s performance during the year against established goals, leadership qualities, operational performance, business

responsibilities, career with us, current compensation arrangements and long-term potential to enhance stockholder value. Specific

factors affecting compensation decisions for the Named Executive Officers include:

|

|

●

|

key financial measurements such as revenue, organic revenue, operating profit, earnings per share, operating margins, return

on total equity or total capital, cash flow from operating activities and total stockholder return;

|

|

|

●

|

strategic objectives such as acquisitions, dispositions or joint ventures, technological innovation and globalization;

|

|

|

●

|

promoting commercial excellence by launching new or continuously improving products or services, being a leading market player

and attracting and retaining customers;

|

|

|

●

|

achieving specific operational goals for our Company, including improved productivity and risk management; and

|

|

|

●

|

supporting our values by promoting a culture of unyielding integrity through compliance with law and our ethics policies, as

well as commitment to community leadership and diversity.

|

We generally do not adhere to rigid formulas

or necessarily react to short-term changes in business performance in determining the amount and mix of compensation elements.

We consider competitive market compensation paid by other companies, that we consider to be peers, but we do not attempt to maintain

a certain target percentile within a specific peer group or otherwise rely on those data to determine executive compensation. We

incorporate flexibility into our compensation programs and in the assessment process to respond to and adjust for the evolving

business environment.

We strive to achieve an appropriate mix between

equity incentive awards and cash payments in order to meet our objectives. Any apportionment goal is not applied rigidly and does

not control our compensation decisions; we use it as another tool to assess an executive’s total pay opportunities and whether

we have provided the appropriate incentives to accomplish our compensation objectives. Our mix of compensation elements is designed

to reward recent results and motivate long-term performance through a combination of cash and equity incentive awards. We also

seek to balance compensation elements that are based on financial, operational and strategic metrics with others that are based

on the performance of our shares. We believe the most important indicator of whether our compensation objectives are being met

is our ability to motivate our Named Executive Officers to deliver superior performance and retain them to continue their careers

with us on a cost-effective basis.

Tax Deductibility of Compensation

Section 162(m) of the Internal Revenue Code

of 1986, as amended (the “Code”) imposes a $1.0 million limit on the amount that a public company may deduct for compensation

paid to our Chief Executive Officer or any of our three other most highly compensated executive officers (other than the Chief

Financial Officer) who are employed as of the end of the applicable year. This limitation does not apply to compensation that meets

the requirements under Section 162(m) for “qualifying performance-based” compensation (established objective goals

based on performance criteria approved by stockholders). For the fiscal year ended December 31, 2015, the grants of stock options,

restricted stock and the payments of annual bonuses were designed to satisfy the requirements for deductible compensation, although

we have the right to grant non-performance based awards to executives if circumstances or business reasons deem such an award appropriate

or necessary.

Stock Options and Restricted Stock

Our equity incentive compensation program is

designed to recognize scope of responsibilities, reward demonstrated performance and leadership, motivate future superior performance,

align the interests of the executive with our stockholders and retain the executives through the term of the awards. We consider

the grant size and the appropriate combination of stock options and restricted stock when making award decisions. The amount of

equity incentive compensation granted is based upon the strategic, operational and financial performance and reflects the executive’s

expected contributions to our future success. Existing ownership levels are not a factor in award determination, as we do not want

to discourage executives from holding significant amounts of our common stock. Under the terms of our stock option plans, unvested

stock options and restricted stock are forfeited if the executive voluntarily leaves our Company.

We expense stock option grants under ASC 718-Stock

Compensation. When determining the appropriate combination of stock options and restricted stock, our goal is to weigh the cost

of these grants with their potential benefits as a compensation tool. We believe that providing combined grants of stock options

and restricted stock effectively balances our objective of focusing the Named Executive Officers on delivering long-term value

to our stockholders, with our objective of providing value to the executives with the equity awards. Stock options only have value

to the extent the price of our common stock on the date of the exercise exceeds the exercise price on grant date, and thus are

an effective compensation element only if the stock price grows over the term of the award. In this sense, stock options are a

motivational tool. Unlike stock options, restricted stock offer executives the opportunity to receive shares of our common stock

on the date the restriction lapses. In this regard, restricted stock serve both to reward and retain executives, as the value of

the restricted stock is linked to the price of our common stock on the date the restricted stock vests.

Other Compensation

We provide our Named Executive Officers with

other benefits, which are detailed in the All Other Compensation column of the Summary Compensation Table below, that we believe

are reasonable, competitive and consistent with our overall executive compensation program. The costs of these benefits constitute

only a small percentage of each Named Executive Officers’ total compensation, and include the non-business use of company

automobiles and the cost reimbursement of certain business expenses and computer equipment to the Chief Executive Officer. It is

our belief that such benefits are necessary for the Company to remain competitive and to attract and retain top caliber executive

officers.

Summary

We believe that the compensation levels paid

to Named Executive Officers during the fiscal year ended December 31, 2015 fairly reflected our Company’s performance and

were appropriate. We continually monitor our programs, the marketplace in which we compete for talent and changing trends in compensation

best practices in an effort to maintain an executive compensation program that is performance driven, consistent with stockholder

interests and fair and reasonable overall.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes for the fiscal

years ended December 31, 2015, 2014 and 2013, respectively, the total compensation of the Company’s Chief Executive Officer

and Chief Financial Officer (“Named Executive Officers”).

|

Name and Position(s)

|

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Stock

Awards

($)

|

|

Other

($)(1)

|

|

Total Compensation

($)

|

|

Christian C. Romandetti

|

|

|

2015

|

|

|

|

262,500

|

|

|

|

625,000

|

|

|

|

314,700

|

|

|

|

12,196

|

|

|

|

1,214,396

|

|

|

President, CEO & Director

|

|

|

2014

|

|

|

|

250,000

|

|

|

|

50,000

|

|

|

|

300,000

|

|

|

|

23,076

|

|

|

|

623,076

|

|

|

|

|

|

2013

|

|

|

|

240,000

|

|

|

|

23,750

|

|

|

|

33,000

|

|

|

|

36,347

|

|

|

|

333,097

|

|

|

Donald A. Bittar, CFO(2)

|

|

|

2015

|

|

|

|

73,280

|

|

|

|

—

|

|

|

|

95,700

|

|

|

|

—

|

|

|

|

168,980

|

|

|

Secretary, Treasurer & Director

|

|

|

2014

|

|

|

|

36,750

|

|

|

|

—

|

|

|

|

150,000

|

|

|

|

—

|

|

|

|

186,750

|

|

|

|

|

|

2013

|

|

|

|

26,500

|

|

|

|

—

|

|

|

|

33,300

|

|

|

|

—

|

|

|

|

59,500

|

|

|

|

(1)

|

Consists of provision of an automobile, computer equipment and reimbursement of business expenses.

|

|

|

(2)

|

Mr. Bittar retired as the Company’s CFO and Corporate Secretary in July 2016.

|

PROPOSAL 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer

Protection Act added Section 14A to the Securities Exchange Act of 1934, which requires that we provide our stockholders with the

opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our Named Executive Officers as disclosed

in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission.

As described in greater detail under the heading

“Compensation Discussion and Analysis,” we seek to closely align the interests of our Named Executive Officers with

the interests of our stockholders. Our compensation programs are designed to reward our Named Executive Officers for sustained

financial and operating performance and leadership excellence, and the alignment of their interests with those of our stockholders,

while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

This vote is advisory, which means that the

vote on executive compensation is not binding on the Company, our Board of Directors or the Compensation Committee of the Board

of Directors. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to

the overall compensation of our Named Executive Officers, as described in this proxy statement in accordance with the compensation

disclosure rules of the Securities and Exchange Commission. Although the vote is non-binding, we value your opinions and will consider

the outcome of the vote in establishing compensation philosophy and making future compensation decisions.

The affirmative vote of a majority of the shares

present or represented and entitled to vote either in person or by proxy is required to approve this Proposal 3. Accordingly, we

ask our stockholders to vote on the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders

approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement

for the 2016 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission,

including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosures.”

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT

.

PROPOSAL 4 – ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY

VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section

14A of the Securities Exchange Act of 1934, we are providing stockholders with the opportunity to vote, on a non-binding, advisory

basis, for their preference as to how frequently to vote on future advisory votes on the compensation of our Named Executive Officers

as disclosed in accordance with the compensation disclosure rules of the Securities and Exchange Commission. Stockholders may indicate

whether they would prefer that we conduct future advisory votes on executive compensation once every one, two, or three years.

Stockholders also may abstain from casting a vote on this proposal.

The Board of Directors has determined that an

advisory vote on executive compensation that occurs once every year is the most appropriate alternative for the Company and therefore

the Board of Directors recommends that you vote for a one year frequency for the advisory vote on executive compensation. The Board

of Directors has determined that an annual advisory vote on executive compensation will permit our stockholders to provide direct

input on the Company’s executive compensation philosophy, policies and practices as disclosed in the proxy statement each

year, which is consistent with our efforts to engage in an ongoing dialogue with our stockholders on executive compensation and

corporate governance matters.

This vote is advisory, which means that the

vote on executive compensation is not binding on the Company, our Board of Directors or the Compensation Committee of the Board

of Directors. Notwithstanding the advisory nature of the vote, the Board of Directors values the opinions of stockholders and will

consider the outcome of the vote in determining how frequently the Company conducts an advisory vote on its executive compensation.

The proxy

card provides stockholders with the opportunity to choose among four options (holding the vote every one, two or three years, or

abstain from voting) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the Board of

Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT

YOU VOTE FOR THE OPTION OF ONCE EVERY YEAR AS THE PREFERRED FREQUENCY FOR ADVISORY VOTES ON EXECUTIVE COMPENSATION.

TRANSACTIONS WITH RELATED PERSONS

Policies and Procedures

On an ongoing basis, the Audit Committee is

required by its charter to review all “related party transactions” (those transactions that are required to be disclosed

in this proxy statement by SEC Regulation S-K, Item 404 and under NASDAQ’s rules), if any, for potential conflicts of interest

and all such transactions must be approved by the Audit Committee.

Transactions

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the fiscal year ended December 31, 2015:

|

|

●

|

none of the members of the Compensation Committee was an officer (or former officer) or employee of our Company or any of its

subsidiaries;

|

|

|

●

|

none of the members of the Compensation Committee had a direct or indirect material interest in any transaction in which we

were a participant and the amount involved exceeded $120,000;

|

|

|

●

|

none of our executive officers served on the Compensation Committee (or another board committee with similar functions or,

if none, the entire Board of Directors) of another entity where one of that entity’s executive officers served on our Compensation

Committee;

|

|

|

●

|

none of our executive officers served as a director of another entity where one of that entity’s executive officers served

on our Compensation Committee; and

|

|

|

●

|

none of our executive officers served on the Compensation Committee (or another board committee with similar function or, if

none, the entire Board of Directors) of another entity where one of that entity’s executive officers served as a director

on our Board.

|

OTHER MATTERS

As of the date hereof, our Board knows of no

other business to be presented at the Annual Meeting. If, however, any other matter properly comes before the Annual Meeting, it

is intended that the persons named in the accompanying proxy will vote the proxy in accordance with the discretion and instruction

of our Board.

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 2017 ANNUAL

MEETING

Pursuant

to the SEC’s rules and regulations, stockholders interested in submitting proposals for inclusion in our proxy materials

and for presentation at our 2017 Annual Meeting of Stockholders may do so by following the procedures set forth in Rule 14a-8 under

the Securities Exchange Act of 1934 and present such proposal to the Company’s Corporate Secretary at the Company’s

principal office at 709 S. Harbor City Blvd., Suite 250, Melbourne, Florida 32901. In general, stockholder proposals must be received

by our Corporate Secretary at the address indicated above no later than July 14, 2017 to be eligible for inclusion in our proxy

materials.

In addition, stockholders may present business

at a stockholder meeting without having submitted the proposal pursuant to Rule 14a-8 as discussed above. For business to be properly

brought or nominations of persons for election to our Board to be properly made at the time of our 2017 Annual Meeting of Stockholders,

notice must be received by our Corporate Secretary in compliance with our By-Laws. Our By-Laws provide that a stockholder entitled

to vote for the election of directors may nominate persons for election as directors only at an annual meeting and if written notice

of such stockholder’s intent to make such nomination or nominations has been given to our Corporate Secretary less than sixty

(60) days nor more than ninety (90) days prior to such meeting, provided, however, that if less than seventy (70) days notice or

prior public disclosure of the date of the meeting is given to stockholders, such nomination shall have been provided to the Secretary

not later than the close of business or the 10

th

day following the date on which the notice of meeting was mailed or

such public disclosure was made. The stockholder’s notice must include the following information:

|

|

●

|

the name, age and address of the stockholder intending to make the nomination and of the person or persons to be nominated

and the number of shares beneficially owned;

|

|

|

●

|

a representation that the stockholder is a stockholder of record entitled to vote at the meeting and intends to appear in person

or by proxy at the meeting to nominate the person or persons specified in the notice;

|

|

|

●

|

the name, age and business address and, if known, residence address of each director nominee;

|

|

|

●

|

the principal occupation or employment of each director nominee;

|

|

|

●

|

a description of all arrangements or understandings between the stockholder and each director nominee and any other person(s)

naming such person(s) pursuant to which the nomination is to be made by the stockholder;

|

|

|

●

|

any other information regarding each director nominee proposed by the stockholder as would be required to be disclosed in solicitations

or proxies for election of directors in an election contest, or is otherwise required to be disclosed, pursuant to the proxy rules

of the SEC, had the nominee been nominated, or intended to be nominated, by our Board; and

|

|

|

●

|

the written consent of the nominee to serve as a director if elected.

|

The requirements found in our Certificate of

Incorporation are separate from the requirements a stockholder must meet to have a proposal included in our proxy statement under

Rule 14a-8 of the Securities Exchange Act of 1934.

OTHER MATTERS

A copy of our Annual Report on Form 10-K for

the fiscal year ended December 31, 2015, accompanies this proxy statement. Except for the financial statements included in the

Annual Report on Form 10-K that are specifically incorporated by reference herein, the Annual Report on Form 10-K is not incorporated

in this proxy statement and is not deemed to be part of this proxy soliciting material.

We have filed our Annual Report on Form 10-K

for the fiscal year ended December 31, 2015 with the SEC. It is available free of charge at the SEC’s web site at

www.sec.gov

.

Upon written request by a stockholder, we will mail, without charge, a copy of our Annual Report on Form 10-K, including the financial

statements and financial statements schedules, but excluding exhibits to the Annual Report on Form 10-K. Exhibits to the Annual

Report on Form 10-K are available upon payment of a reasonable fee, which is limited to our expenses in furnishing the requested

exhibit.

As of the date of this proxy statement, the

Board knows of no other business that will be presented at the Annual Meeting. If any other business is properly brought before

the Annual Meeting, it is intended that proxies in the enclosed form will be voted in respect thereof in accordance with the best

judgment and in the discretion of the person voting the proxies.

24

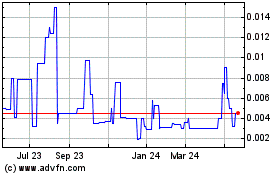

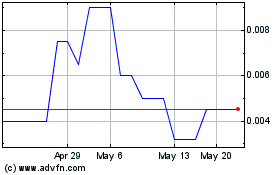

First Choice Healthcare ... (PK) (USOTC:FCHS)

Historical Stock Chart

From Jul 2024 to Jul 2024

First Choice Healthcare ... (PK) (USOTC:FCHS)

Historical Stock Chart

From Jul 2023 to Jul 2024