Fandom

Sports

Releases Wagering and Actionable Predictions Across Entire

Esports

Platform as

"Peer

Analysis" Report

Illustrates

Its

Upside

Potential

June

23, 2021 - By Chris

Thompson, Director of Equity Research, eResearch

eResearch

| As Esports

continues

to grow and fans

search

for ways

to interact with friends and fans in real-time as games

are streaming,

Fandom

Sports Media Corp. (CSE: FDM | OTC: FDMSF | FSE: TQ43) progresses

with an all-ages

app and

website

to

interact with the

Esports

community

and reward users

for

engagement and activity.

The

Fandom

Sports platform

encompasses

free-to-play

actionable

predictions, a wagering

marketplace (P2P), and now

includes

odds-line

wagering.

Free-to-play

is

available

to all users,

while the

wagering features are

geofenced and limited to countries where permissible

by Fandom

Sports'

Curacao iGaming

Wagering License that was received in August 2020.

For investors

searching for an Esports-focused

public company, Fandom

Sports provides a

low

CapEx option

with

near-term revenue catalysts.

Its

recently

published "Gaming Industry

& Peer Analysis" report highlights the Esports

industry

and growth, and a peer comparison

shows Fandom

Sports' upside

potential.

Esports

Odds-line

Wagering

Last week,

Fandom

Sports released odds-line

wagering across the entire Fandom

Sports

platform

that includes game titles such as Call of Duty,

Counterstrike:GO,

Dota 2, FIFA, King of Glory, League of Legends, Overwatch, Rainbow

Six, Rocket League, StarCraft 2, StarCraft BroodWar,

Valorant, Warcraft 3, and

World of Warcraft.

With this

feature, Fandom

Sports utilizes its

web-based

machine learning betting platform to

set

the

gambling

odds and determine the favorites and

underdogs. The

fan

can then

bet on

which

player

or team

will

win

a game or

tournament.

Fandom

Sports'

odds-line

wagering adds another feature to its platform

for

fan

engagement as wagerers will be able to place bets even if

P2P betting

is

unavailable. The Company will

now have another revenue

stream by acting as the

house on the

other

side

of

the

wagers.

Fandom

Sports'

Robust

Platform

Fandom

Sports'

platform

is available on web browsers, Android and iOS devices,

and

multiple languages are now

supported, including Chinese,

English, French, German, Japanese, Russian, and Spanish.

The platform

provides

Esports fans

with

the

ability to watch live streams

and offers a diverse

range of products, from wagering to peer interaction,

including:

-

Odds-line

and P2P wagering

-

All-ages

free-to-play

Prediction

module with an easy to use,

swipe-capable interface

-

Multicast

streaming - watch live

events

while

making predictions or wagers

-

Authenticated

messaging and sharing of

predictions or wagers on

social media

platforms

such as

Facebook, Google, Pinterest,

Reddit,

Telegram,

Twitch,

Twitter,

Viber,

WeChat,

and WhatsApp

-

Esports news

and

social invitations for

interaction, promotion,

and

rewards

-

Users

will

be

rewarded with points, prizes,

fancoins, and Non-Fungible

Tokens ("NFTs").

Capturing

Part of a Billion Dollar Market

In June,

Fandom

Sports

released

a "Gaming

Industry Overview & Fandom Sports Peer

Analysis" report.

In that report,

market data provided by RnR

Market Research pegged

the

global Esports

gambling

market

at US$12.0 billion in 2020

and predicted it

to reach

US$20.5 billion by 2026, growing annually at 14.2%

The

COVID-19

pandemic had a substantial positive

impact on

the video game industry as the pandemic

forced governments to issue stay-at-home

orders.

Although

limiting in-person Esports

events,

more people turned to video games and Esport

online

events.

Fandom

Sports

plans to

capture this growing market by expanding its revenue

streams and

partnerships

including

advertising, product

sponsorship, white-label,

Esports

leagues,

betting commissions, and betting

subscriptions.

As an example of a

revenue stream, Fandom

Sports

and

Elite

Duels signed

a mutual

revenue sharing agreement under which

Elite

Duels will be

promoting Fandom

Sports wagering platform

and Fandom

Sports will drive traffic

to Elite

Duels' Esports

fantasy

platform.

FIGURE

1: Fandom

Sports'

Product & Opportunity Milestone

Source:

Company presentation (June 2021)

Hitting

the Milestones

for

Product

Rollout in 2021

Earlier this

year, Fandom

Sports

launched

the Free-to-Play Esports

prediction platform

at

www.fandomeSports.gg.

The platform initially allowed for real-time predictive

capabilities from completed integrations with Counter

Strike:GO, DOTA 2, and

League of Legends but now has expanded integration

to over 14 game titles.

The Company

also

entered

into the Non-Fungible Token (NFT) space and

minted its first "Fancoin" NFT in

March.

In June,

Fandom

Sports deployed

odd-line

wagering, P2P

wagering, and actionable

predictions

features

after

setting up its payment gateways and

private cloud infrastructure with its own

data

center and first two remote nodes. A Far East data

center is planned for the fourth quarter this year.

Public

Comps – Room to Grow for Fandom

Sports

Also conveyed

in Fandom

Sports'

June industry report was a peer

comparison

with some

publicly-traded competitors including Enthusiast

Gaming (TSX: EGLX, NASDAQ-GS: EGLX),

Esports

Technologies (NASDAQ-GS:

EBET),

Esports

Entertainment Group (NASDAQ:

GMBL),

ESE

Entertainment (TSXV: ESE, OTCQB: ENTEF),

Allied

Esports Entertainment (NASDAQ: AESE),

FansUnite

Entertainment (CSE:

FANS, OTCQB: FUNFF), and

Real

Luck Group (TSXV:

LUCK, OTCQB: LUKEF).

As illustrated in

Figure 2, Fandom

Sports has a specific focus

on Esports

and

iGaming wagering with a diverse revenue model but trades at

a

fraction

of the market cap of its peers.

As the

Fandom

Sports platform is fully

launched by the end of the year and revenue starts to be recorded,

the stock could see a re-rating

to be more in-line with its industry peers.

Fully

Funded for 2021

Fandom

Sports closed a C$5.1

million financing in April when it issued 21.1 million units at

C$0.24 per unit that included a common share and one common share

purchase warrant at an exercise price of C$0.36 for a period of 2

years.

With the recent

financing, the Company is fully funded for 2021 and plans for the

proceeds

include

enhancing the technology

and

business

development with a focus

on North America

and Asia.

Fandom

Sports currently trades

around C$0.28, up almost 70% year-to-date, but still with a

Market Cap of less than C$23 million.

FIGURE

2: Fandom

Sports'

Public Peers

Source:

Gaming Industry Overview & Fandom Sports Peer Analysis (June

2021)

//

Notes:

All numbers in USD unless otherwise stated. The author of this

report may own stock positions in companies mentioned in this

article and may have been paid by a company mentioned in the

article. The author offers no representations or warranties that

any of the information contained in this article is accurate or

complete. The article is provided for general informational

purposes only and does not constitute financial, investment, tax,

legal, or accounting advice nor does it constitute an offer or

solicitation to buy or sell any securities referred to. Individual

circumstances and current events are critical to sound investment

planning; anyone wishing to act on this information should consult

with a financial advisor. The article may contain "forward-looking

statements" within the meaning of applicable securities

legislation. Forward-looking statements are based on the opinions

and assumptions of the Company's management as of the date made.

They are inherently susceptible to uncertainty and other factors

that could cause actual events/results to differ materially from

these forward-looking statements. Additional risks and

uncertainties, including those that the Company does not know about

now or that it currently deems immaterial, may also adversely

affect the Company's business or any investment therein. Any

projections given are principally intended for use as objectives

and are not intended, and should not be taken, as assurances that

the projected

results will be obtained by the Company. The assumptions used may

not prove to be accurate and a potential decline in the Company's

financial condition or results of operations may negatively impact

the value of its securities.

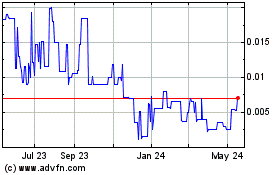

Fandifi Technology (PK) (USOTC:FDMSF)

Historical Stock Chart

From Dec 2024 to Jan 2025

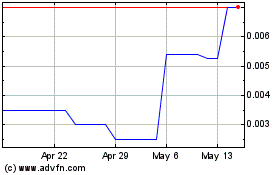

Fandifi Technology (PK) (USOTC:FDMSF)

Historical Stock Chart

From Jan 2024 to Jan 2025