Freedom Bank of Virginia (Bank) (Bulletin Board:FDVA.OB) earned

a Net profit before taxes of $300,596 for the quarter ending March

31, 2013, its sixteenth consecutive quarterly profit. Net profit at

March 31, 2012 was $308,772. Improving asset quality, allowed less

to be put in the Provision for loan losses, which helped offset

increased salary expense from hiring additional lenders versus the

prior year.

The Bank generated significant loan growth over the trailing

twelve months. Gross loans receivable increased to $183,295,852,

which was up 18.5% from $154,468,808 at March 31, 2012. According

to CEO Craig Underhill, “The Bank significantly increased the size

of its lending staff in the second half of 2012 and is realizing

significant loan growth from that investment.” In addition to the

staff hired in 2012, the Bank hired two more experienced commercial

lenders in the first quarter of 2013 to continue to accelerate loan

growth.

Total assets increased 10.4% to $239,780,059 up from

$217,266,197 at March 31, 2012. Investment securities increased

$8,154,889 (32.2%) to $33,485,453 and Bank Owned Life Insurance

increased $1,058,422 (105.8%) during the same period, which along

with loan growth increased these assets of the Bank by $37,860,355

(20.8%) since March 31, 2012. The growth in assets was partially

funded by $20,670,596 (10.7%) growth in deposits. The Bank also

decreased low yielding Federal Funds by $17,971,000 (-67.1%) to

fund the growth of higher yielding assets compared with March 31,

2012.

Capital continues to be strong, growing $1,558,970 (6.5%) over

the same period in the prior year to $25,555,169. Regulatory

Capital minimums for Tier 1 Leverage Ratio, Risk Based Capital Tier

1, and Risk Based Capital Tier 2 were 5.0%, 6.0% and 10.0%

respectively, to be considered well capitalized. At March 31, 2013

the ratios for the Bank were 10.59%, 13.28 % and 14.49%

respectively, all in the well capitalized category. The Bank

continues its tradition of maintaining a strong capital base to

serve the needs of its customers and stockholders.

About Freedom Bank

Freedom Bank is a community-oriented, locally-owned bank with

locations in Fairfax and Vienna, Virginia. For information about

Freedom Bank’s deposit and loan services, visit

www.freedombankva.com.

This release contains forward-looking statements, including our

expectations with respect to future events that are subject to

various risks and uncertainties. Factors that could cause actual

results to differ materially from management's projections,

forecasts, estimates and expectations include: fluctuation in

market rates of interest and loan and deposit pricing, adverse

changes in the overall national economy as well as adverse economic

conditions in our specific market areas, maintenance and

development of well-established and valued client relationships and

referral source relationships, and acquisition or loss of key

production personnel. Other risks that can affect the Bank are

detailed from time to time in our quarterly and annual reports

filed with the Board of Governors of the Federal Reserve System. We

caution readers that the list of factors above is not exclusive.

The forward-looking statements are made as of the date of this

release, and we may not undertake steps to update the

forward-looking statements to reflect the impact of any

circumstances or events that arise after the date the

forward-looking statements are made. In addition, our past results

of operations are not necessarily indicative of future

performance.

The Freedom Bank of Virginia Statements of

Financial Condition UNAUDITED

March 31, 2013 March 31, 2012

ASSETS Cash and due from banks $ 6,970,034 $

5,034,081 Federal funds sold 8,794,000 26,765,000 Interest Bearing

Balances with Banks 1,017,009 1,010,573

Investment securities available for sale,

at fair value

33,485,453 25,330,564 Investment securities held to maturity

292,997 527,271 Federal Reserve Bank stock 757,950 710,950 Loans

held for sale 2,624,808 1,841,400 Loans receivable 183,295,852

154,648,808 Allowance for possible loan losses (2,305,040 )

(2,303,164 ) Net Loans 180,990,812 152,345,644 Premises and

equipment, net 204,595 203,556 Accrued interest and other

receivables 697,770 583,584 Other assets 1,274,209 1,301,574 Bank

Owned Life Insurance 2,058,422 1,000,000 Deferred Tax Asset

612,000 612,000

Total Assets $

239,780,059 $ 217,266,197

LIABILITIES AND

STOCKHOLDERS' EQUITY Liabilities: Demand deposits: Non-interest

bearing deposits $ 33,195,790 $ 32,768,881 Interest Checking

38,004,367 36,014,310 Savings deposits 1,213,692 1,329,353 Time

deposits 141,008,129 122,638,838

Total Deposits

213,421,978 192,751,382 Other accrued expenses 721,648

444,458 Accrued interest payable 81,265 74,159

Total Liabilities 214,224,891

193,269,999 Stockholders' Equity:

Common stock, $4.17 par value. (5,000,000

shares authorized):

2,866,117 shares issued and outstanding March 31, 2013 2,836,404

shares issued and outstanding March 31, 2012 11,942,228 11,818,325

Additional paid-in capital 16,284,302 16,184,810 Accumulated other

comprehensive income 276,298 124,800 Retained earnings (deficit)

(2,947,659 ) (4,131,737 )

Total

Stockholders' Equity 25,555,169 23,996,198

Total Liabilities and Stockholders' Equity $

239,780,059 $ 217,266,197

The

Freedom Bank of Virginia Statements of Operations

UNAUDITED For the three

months ended March 31, 2013

2012 Interest Income Interest and fees on loans $

2,464,375 $ 2,298,783 Interest on investment securities 101,361

143,640 Interest on Federal funds sold 7,755 13,786

Total Interest Income 2,573,491 2,456,209

Interest

Expense Interest on deposits 482,842 521,929

Net Interest Income 2,090,649 1,934,280

Provision

for Possible Loan Losses 70,000 266,000

Net Interest Income after Provision for Possible Loan Losses

2,020,649 1,668,280

Other Income Service charges and

other income 231,538 203,945 Increase in cash surrender value of

bank-owned life insurance 15,247 - Total Other Income

246,785 203,945

Operating Expenses Officers and

employee compensation and benefits 1,204,421 949,615 Occupancy

expense 124,995 133,051 Equipment and depreciation expense 52,704

48,243 Insurance expense 51,529 41,389 Professional fees 139,537

85,307 Data and item processing 176,641 151,913 Business

development 48,046 34,196 Franchise tax 59,661 50,340 Other

operating expenses 109,304 69,399 Total Operating

Expenses 1,966,838 1,563,453 Income before

Income Taxes 300,596 308,772

Provision for Income Taxes

- -

Net Income $ 300,596 $ 308,772

Net Income Per Common Share $ 0.10 $ 0.11

Net Income Per Diluted Share $ 0.10 $ 0.11

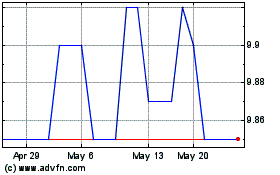

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Jul 2023 to Jul 2024