Net Profit Rises on Strong Loan Growth

The Freedom Bank of Virginia (OTCQX: FDVA) showed strong

performance in terms of profits, asset growth and capital

generation through September 30, 2014.

Financial Highlights

Operations

- Net profit increased $70,355 or 5.7%

over the prior year to $1,300,449 at September 30, 2014.

- Total interest income grew $1,693,345

or 20.3% to $10,031,375 through September 30, 2014 versus the prior

year.

- Interest expense increased 11.7% to

$1,647,259 at September 30, 2014, compared with $1,474,723 at

September 30, 2014.

- The provision for loan losses rose from

$158,500 at September 30, 2013 to $327,000 at September 30, 2014.

The increase was attributable primarily to faster loan growth but

also included some loan write offs in 2014.

- Net income after provision was

$8,057,116 at September 30, 2014, up $1,352,309 or 20.2% from the

prior year.

- Expenses through September 30, 2014

were $7,138,661, up $875,482 or 14% from September 30, 2013. Most

of the increase was a $459,899 or 11.9% rise in salaries

attributable to lenders and support staff responsible for increased

loan volume.

Condition

- Loans Receivable increased 29.2% from

$198,698,833 at September 30, 2013 to $256,760,042 at September 30,

2014.

- Total Assets increased 13.1% from

$270,175,474 at September 30, 2013 to $305,265,372 at September 30,

2014.

- Asset quality remains strong with

non-performing assets comprising 0.68% of total assets at September

30, 2014. This was a slight increase from 0.50% of total assets at

September 30, 2013.

- Non-Interest Bearing Deposits increased

$3,421,690 (7.5%) to $49,044,170 between September 30, 2013 and

September 30, 2014.

- Interest Checking Deposits grew

$5,256,268 (12.1%) to $48,833,260 between September 30, 2013 and

September 30, 2014.

- Total deposits increased $32,656,934

(13.4%) to $276,207,160 between September 30, 2013 and September

30, 2014.

- Total capital rose $1,707,217 (6.6%)

over the past year to $27,639,426 at September 30, 2014, up from

$25,932,209 at September 30, 2013. The book value per share was

$7.25 at September 30, 2014 up from $6.85 at September 30,

2013.

Capital continues to be strong, but the bank is starting to

fully lever it in line with sound banking principles. Regulatory

capital minimums for Tier 1 Leverage Ratio, Risk Based Capital Tier

1, and Risk Based Capital Tier 2 were 5.0%, 6.0% and 10.0%

respectively. At September 30, 2014 the ratios for the bank were

9.21%, 11.20%, 12.22%. However, these were down from 10.03%, 12.90%

and 14.11% at September 30, 2013. The bank recently announced a

capital campaign to provide equity for continued growth. New

capital will fund increased lending, branch expansion and mortgage

banking activities.

According to CEO Craig Underhill, “The bank successfully

invested in growth the past three years and these results reflect

strong performance. These accomplishments have been rewarded by the

market through the share price more than doubling during the past

three years. New capital will allow Freedom to grow present

business lines while expanding its footprint and emphasizing

business lines with strong upside potential.”

Freedom Bank is a community-oriented, locally-owned bank with

locations in Fairfax, Reston and Vienna, Virginia. For information

about Freedom Bank’s deposit and loan services, visit the Bank’s

website at www.freedombankva.com.

This release contains forward-looking statements, including our

expectations with respect to future events that are subject to

various risks and uncertainties. Factors that could cause actual

results to differ materially from management's projections,

forecasts, estimates and expectations include: fluctuation in

market rates of interest and loan and deposit pricing, adverse

changes in the overall national economy as well as adverse economic

conditions in our specific market areas, maintenance and

development of well-established and valued client relationships and

referral source relationships, and acquisition or loss of key

production personnel. Other risks that can affect the Bank are

detailed from time to time in our quarterly and annual reports

filed with the Board of Governors of the Federal Reserve System. We

caution readers that the list of factors above is not exclusive.

The forward-looking statements are made as of the date of this

release, and we may not undertake steps to update the

forward-looking statements to reflect the impact of any

circumstances or events that arise after the date the

forward-looking statements are made. In addition, our past results

of operations are not necessarily indicative of future

performance.

The Freedom Bank of Virginia Statements of

Financial Condition (UNAUDITIED) September 30,

2014 September 30, 2013

ASSETS Cash and due from banks $ 7,781,609 $ 14,745,000

Federal funds sold 8,832,000 24,807,000 Interest Bearing Balances

with Banks 1,023,123 1,019,050 Investment securities available for

sale, at fair value 25,500,079 27,458,728 Investment securities

held to maturity 13,603 57,913 Federal Reserve Bank stock 814,100

771,000 Loans held for sale 797,000 - Loans receivable 256,760,042

198,698,833 Allowance for possible loan losses (2,526,807 )

(2,456,325 ) Net Loans 254,233,235 196,242,508 Premises and

equipment, net 508,046 232,061 Accrued interest and other

receivables 728,175 639,818 Other Real Estate Owned

-

-

Other assets 1,893,573 1,330,735 Bank Owned Life Insurance

2,144,829 2,087,182 Deferred Tax Asset 996,000

784,479

Total Assets $ 305,265,372 $

270,175,474

LIABILITIES AND STOCKHOLDERS'

EQUITY Liabilities: Demand deposits: Non-interest bearing

deposits $ 49,044,170 $ 45,622,480 Interest Checking 48,833,260

43,576,993 Savings deposits 1,676,798 1,423,875 Time deposits

176,652,932 152,926,878 Total Deposits

276,207,160 243,550,226 Other accrued expenses 1,322,380

583,912 Accrued interest payable 96,406

109,127

Total Liabilities 277,625,946

244,243,265 Stockholders' Equity: Common

stock, $3.16 par value. (15,000,000 shares authorized: 3,815,029

shares issued and outstanding September 30, 2014 3,787,104 shares

issued and outstanding September 30, 2013) 12,042,431 11,967,248

Additional paid-in capital 16,372,319 16,303,442 Accumulated other

comprehensive income (199,290 ) (320,319 ) Retained earnings

(deficit) (576,034 ) (2,018,162 )

Total

Stockholders' Equity 27,639,426 25,932,209

Total Liabilities and Stockholders' Equity $

305,265,372 $ 270,175,474

The

Freedom Bank of Virginia Statements of Operations

(UNAUDITED) For the three months ended

For the nine months ended September 30, September

30, 2014 2013 2014

2013 Interest Income Interest and fees

on loans $ 3,360,391 $ 2,651,167 $ 9,635,387 $ 7,957,311 Interest

on investment securities 122,361 120,176 378,521 358,181 Interest

on Federal funds sold 4,754 10,433 17,467

22,538 Total Interest Income 3,487,506 2,781,776 10,031,375

8,338,030

Interest Expense Interest on deposits

571,393 514,526 1,647,259 1,474,723

Net Interest Income 2,916,113 2,267,250 8,384,116 6,863,307

Provision for Possible Loan Losses 92,000

- 327,000 158,500

Net Interest Income after Provision for

Possible Loan Losses

2,824,113 2,267,250 8,057,116 6,704,807

Other Income

Service charges and other income 123,002 300,654 338,768 744,458

Increase in cash surrender value of Bank-owned life insurance

15,611 14,318 43,226 44,007 Total Other

Income 138,613 314,972 381,994 788,465

Operating

Expenses Officers and employee compensation and benefits

1,487,218 1,364,101 4,338,065 3,878,166 Occupancy expense 154,875

137,609 440,832 397,401 Equipment and depreciation expense 97,273

61,061 252,233 168,403 Insurance expense 63,881 51,828 173,493

156,264 Professional fees 195,012 147,570 616,050 423,762 Data and

item processing 221,110 188,294 592,914 541,166 Business

development 55,873 42,247 146,899 129,125 Franchise tax 65,915

63,748 194,133 184,432 Other operating expenses 149,712

121,979 384,042 384,459 Total Operating

Expenses 2,490,869 2,178,437 7,138,661

6,263,178 Income before Income Taxes 471,857 403,785

1,300,449 1,230,094

Provision for Income Taxes -

- - -

Net Income $ 471,857 $

403,785 $ 1,300,449 $ 1,230,094

Net Income Per Common

Share $ 0.12 $ 0.11 $ 0.34 $ 0.32

Net Income Per

Diluted Share $ 0.12 $ 0.11 $ 0.33 $ 0.32

Freedom Bank of VirginiaCraig S. Underhill, President &

CEO703-242-5300

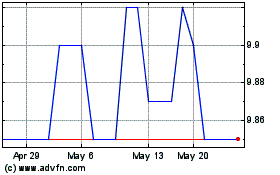

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From May 2024 to Jun 2024

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Jun 2023 to Jun 2024