Ask Thomas J. Herzfeld about Cuba, and the usually low-key money

manager launches into a sermon he has delivered many times.

The 67-year-old Mr. Herzfeld says the country, under a U.S.

trade embargo for 50 years, is the investment opportunity of a

lifetime. And his mutual fund, Herzfeld Caribbean Basin (CUBA), is

ready to capitalize when the restrictions are lifted, focusing on

stocks that he thinks will benefit from Cuba's opening.

Until then, though, the $26 million fund is waiting to pounce,

as it has been since it launched in 1993.

"I've been consistently wrong on when the embargo would be

lifted," he said while sitting in his office on South Beach. "But

it's going to happen." Mr. Herzfeld owns about $1.2 million in

shares of the fund.

Some investors are starting to prepare for the day when the U.S.

resumes trade with Cuba. The Obama administration has loosened

travel restrictions, and the Cuban government has approved economic

overhauls. But for investors, Cuba remains elusive.

"This is an investment theme that's way out of favor," said

Stuart Frankel, founder of New York brokerage firm Stuart Frankel

& Co. Inc., who said he bought shares in Herzfeld Caribbean

Basin after a trip to Cuba a few years ago. Still, "you've got to

be wrong first before you're right," Mr. Frankel said.

On Monday, Pope Benedict XVI, who opposes the trade embargo,

begins a three-day visit to Cuba, the first for a Catholic pope

since 1998. The fund's investors hope the attention will help

hasten the embargo's end, even though similar hopes have been

dashed over the years.

Mr. Herzfeld is mostly known among investors as a closed-end

fund specialist and the publisher of a monthly research report

called the Investor's Guide to Closed-End Funds. Closed-end funds

trade on exchanges and can change hands at prices far above or

below the value of their underlying assets.

Some Cuban-Americans said the country should remain off-limits

to U.S. investors. "It's morally wrong to invest in a country that

treats its people the way the government is treating the Cuban

people," said Ninoska Perez Castellon, director of the Cuban

Liberty Council, a Cuban exile organization that opposes lifting

the embargo until Cuba embraces democracy.

Herzfeld Caribbean Basin is up 10% this year, roughly in line

with the overall U.S. stock market. In the past decade, the fund

posted an average annual return of 9.9%, far above the Standard

& Poor's 500-stock index average annual return of 4%.

Mr. Herzfeld served a stint in the U.S. Army before landing a

job as a stockbroker at New York's Reynolds & Co. in 1968. In

1984, he launched investment-advisory firm Thomas J. Herzfeld

Advisors Inc. in Miami. Though he has never been to Cuba, he said

the many Cuban-American friends and contacts he made in Miami

during the 1980s piqued his interest in starting the fund.

He doesn't flout the U.S. embargo or try to tiptoe around it.

Instead, the fund's portfolio is packed with companies Mr. Herzfeld

thinks would be ready to swoop in if curbs are lifted.

For example, Carnival Corp. (CCL) will establish ports of call

in Cuba after the embargo ends, he predicts. About 5% of the fund's

assets are invested in shares of the cruise operator. Herzfeld

Caribbean Basin also holds food producer and cargo-ship operator

Seaboard Corp. (SEB), which could become a major shipper to Cuba,

he said. Watsco Inc. (WSO, WSOB), an air-conditioning-equipment

distributor, would modernize Cuba's cooling systems, he

predicts.

Some of the fund's securities look more like collectors' items.

Herzfeld Caribbean Basin owns 700 shares of Cuban Electric Co.

(CGAR), which has no assets other than some cash and a 50-year-old,

$270 million claim (plus interest) against the Castro government

for confiscating its power plants. Mr. Herzfeld said he bought all

the shares he could find in 2005. He thinks Cuba will try to settle

confiscation claims if the embargo is lifted. If the government

settled at least the initial judgment, he said, the fund would make

about $74 for each share. The fund's board said the trade embargo

restricts it from selling the shares. So, it values them at

zero.

Herzfeld Caribbean Basin also owns some bonds: pre-Castro

Republic of Cuba issues that would have matured in 1977 had the

Cuban government not defaulted on them in the 1960s. In 1995, Mr.

Herzfeld's fund snapped up $165,000 in face value of the bonds for

$63,038. Later, the New York Stock Exchange halted their trading,

forcing the fund to value the bonds at zero.

Other holdings include shares of publicly traded Fuego

Enterprises Inc. (FUGI), which runs music tours with Cuban artists,

and Cuba Business Development Group, a private company that owns

part of a telecommunications firm with business in Cuba. Both

companies fall under exceptions to the U.S. embargo or have

licenses that allow some entertainment and telecom companies to do

limited business with Cuba.

When Cuba makes headlines, such as on rumors of Mr. Castro's

death, the share price of Mr. Herzfeld's fund usually jumps. It

falls below its net asset value when sentiment darkens. That

happened after Cuba shot down a plane flown by an exile

organization in 1996. On Friday, the fund traded at an 8% discount

to its net asset value, according to Morningstar Inc.

To prepare for an end of the U.S. embargo, Mr. Herzfeld said he

meets frequently with Cuban-American consultants-- his "secret

weapons," he calls them--who feed him news on everything from Mr.

Castro's health to antiembargo movements in Congress.

Ted Williams, a former director of Herzfeld Caribbean Basin,

recalls at least 20 false alarms.

In January, he thought Mr. Castro was dead because several

months had passed without a public appearance by the former Cuban

president. "It will be huge for the [Herzfeld] fund," Mr. Williams

said in an interview at the time. A couple of weeks later, Mr.

Castro gave a six-hour presentation to mark the debut of his

memoirs.

-By Joe Light, The Wall Street Journal

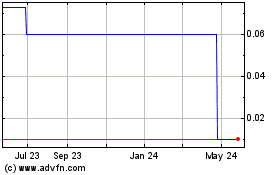

Fuego Enterprises (CE) (USOTC:FUGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

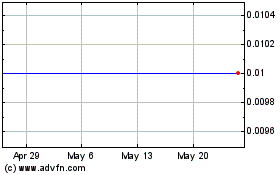

Fuego Enterprises (CE) (USOTC:FUGI)

Historical Stock Chart

From Feb 2024 to Feb 2025