Tesla Makes First Voluntary Recall of Model S - Analyst Blog

22 June 2013 - 2:00AM

Zacks

Hardly any automaker has apologized for safety recall of

vehicles and rarely any automaker has decided to recall vehicles on

its own before receiving any customer complaints, regulatory

warning or reports of accidents or injuries related to their

defective vehicles. But it is Tesla Motors Inc.

(TSLA), which made these smart moves and, as a result, its shares

rose 1.2% to $104.68 yesterday despite announcing its first recall

of Model S sedans in the U.S.

In an official filing with the National Highway Traffic Safety

Administration, Tesla revealed that it would recall 1,228 Model S

sedans due to a defect in the mounting bracket of their rear seat.

The vehicles were manufactured between May 10 and June 8.

The company’s chief executive Elon Musk stated that that the

company has discovered weakened bracket in some cars due to

body-side alignment adjustments. A worker at the California

assembly plant first noticed the problem.

The company suspected that about 20% of the recalled vehicles could

have weakened welded section that may not hold in the event of a

crash and lead to injury to passengers. According to the company

spokeswoman Shanna Hendriks, the recall would cost roughly $150,000

to TSLA in the second quarter of the year.

Tesla made another modest move while announcing the recall. Musk

tweeted that the company will itself contact the Model S owners and

will undertake the entire responsibility of picking up as well as

returning the vehicles at their convenience. He said that fixing

the vehicle would only take a few hours.

Model S received a clean chit from the influential Consumer Reports

magazine, which awarded the electric car a test score of 99 out of

100. Although the latest recall may put to doubt the scores given

by the magazine, the smart handling of the recall by Tesla is bound

to make customers happy. Previously, the automaker twice recalled

its Roadster sports cars, its first model.

In this regard, if we consider what Chrysler did a few days back in

making a voluntary recall, things would really look disappointing.

The Detroit automaker, majority-owned by Italy’s Fiat

SpA (FIATY), refused to recall about 2.7 million units of

its Jeep vehicles even when National Highway Traffic Safety

Administration sent a letter asking the company for a voluntarily

recall.

Chrysler denied on the ground that the letter is based on

“incomplete analysis of the underlying data” and the vehicles are

completely safe. The company revealed that it has met all federal

safety standards when the vehicles were manufactured. The company

thus claimed the Jeeps were “among the safest vehicles of their

era”. However, later Chrysler agreed to make a recall of 1.56

million Jeeps due to the problem.

Automotive safety recalls were brought into focus by media after

Toyota Motor’s (TM) announcement of the

largest-ever global recall of 3.8 million vehicles in Sep 2009,

triggered by a high-speed crash that killed 4 members of a family.

Later on, a string of recalls led Toyota to face numerous personal

injury and wrongful death lawsuits in federal courts.

A few months ago, the Transportation Department of U.S. slapped a

fine of $17.35 million on Toyota due to late response regarding a

defect in its vehicles to safety regulators as well as delayed

recall of those vehicles. According to the department, it was the

maximum allowable fine under the law for not initiating a recall in

a timely manner.

Tesla’s shares started soaring following the reports of its

first-ever quarterly profit on May 8 and early loan repayment. They

have more than tripled in the past six months.

Tesla reported a profit of $15.4 million, or 12 cents per share (on

an adjusted basis) in the first quarter of 2013 compared with a

loss of $79.3 million or 76 cents in the corresponding quarter of

2012. This indicated a whopping positive earnings surprise of

271.4% given the Zacks Consensus Estimate of a loss of 7 cents for

the quarter.

Revenues jumped manifold to $561.8 million from $30.2 million in

the first quarter of 2012, thanks to the impressive 5,000 units of

Model S electric car sales during the quarter.

Shares of TSLA retain a Zacks Rank #3, which implies a short-term

(one to three months) Hold rating. Currently, Toyota Motor and

Fuji Heavy Industries Ltd. (FUJHY) are doing well

in the broader industry with a Zacks Rank #1 (Strong Buy).

FIAT SPA (FIATY): Get Free Report

FUJI HEAVY ADR (FUJHY): Get Free Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

TESLA MOTORS (TSLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

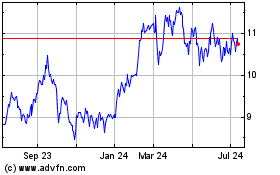

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Subaru Corporation (PK) (OTCMarkets): 0 recent articles

More Fuji Heavy Industries, Ltd. (PC) News Articles