Honda to Invest $215M in Ohio Facility - Analyst Blog

10 August 2013 - 3:01AM

Zacks

Honda Motor Co. (HMC) will invest $215 million

on infrastructural development for its Ohio plant. With this money,

the automaker will expand its engine plant and build two training

centers in the state.

Reportedly, the investment will create 60 jobs, of which 50 will

be from Honda’s other operations in North America. We believe these

investments would not only add operational efficiency, but will

also help revenue growth over the long-term.

According to reports, the company will spend around $180 million

on its engine plant in Anna, Ohio, and the rest will go in making

two training centers at its assembly plant in Marysville, Ohio. The

training facility will be for auto assembly workers and engineers,

and will have an office space and heritage centre to showcase

Honda's historical achievements in North America.

Over the years, Honda has been increasingly focusing on its

infrastructural developments. This year in May, Honda announced

plans to manufacture the new version of its Acura NSX sports car at

a new plant in Ohio. The company will invest $70 million for

building the plant known as Performance Manufacturing Center,

located inside the former North American Logistics facility and

adjacent to Honda’s existing facility in Marysville.

According to reports, the company has invested nearly $2.7

billion across North America. Among these investments, a notable

move for the company has been its partnership with General

Motors Company (GM) on developing next-generation fuel

cell vehicles in order to meet the fuel economy standard set in the

U.S.

Both these companies aim to develop the vehicles by 2020.

Alongside experimental vehicle fleet, Honda and General Motors

already share more than 1,200 fuel cell patents between them, filed

between 2002 and 2012. We believe the alliance will bring down

their costs in building this expensive technology by sharing each

other’s expertise and suppliers.

Honda retains a Zacks Rank #4 (Sell). Other stocks worth

considering in the auto sector include Nissan Motor Co.

Ltd. (NSANY) and Fuji Heavy Industries

Ltd. (FUJHY), both having a Zacks Rank #1 (Strong

Buy).

FUJI HEAVY ADR (FUJHY): Get Free Report

GENERAL MOTORS (GM): Free Stock Analysis Report

HONDA MOTOR (HMC): Free Stock Analysis Report

NISSAN ADR (NSANY): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

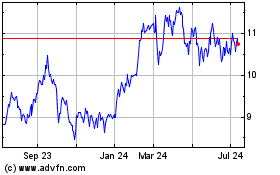

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Dec 2023 to Dec 2024