- Current report filing (8-K)

03 December 2009 - 10:03PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of

report (Date of earliest event reported):

December

2, 2009 (November 25, 2009)

General

Environmental Management, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

Nevada

(State

of Other Jurisdiction of Incorporation)

|

33-55254-38

(Commission File

Number)

|

87-0485313

(IRS Employer

Identification No.)

|

3191

Temple Avenue, Suite 250 Pomona, California 91768

(Address

of Principal Executive Offices) (Zip Code)

(909)

444-9500

(Registrant's

Telephone Number, Including Zip Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously

satisfy the filing obligation of the registrant under any of the

following

provisions:

[

] Written communications pursuant to Rule 425 under the

Securities Act (17

CFR

230.425)

[

] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR

240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b)

under the

Exchange

Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communication pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13c-4(c)

Item

1.01 Entry into a Material Definitive Agreement

On

November 25, 2009, General Environmental Management, Inc., a Nevada corporation

(“Company”) entered into a Stock Purchase Agreement ("Purchase Agreement") with

Luntz Acquisition (Delaware), LLC, ("Luntz") a subsidiary of PSC Environmental

Services, LLC (“PSC”), pursuant to which the Company has agreed to sell General

Environmental Management, Inc. (DE) and its subsidiaries, which include five

service centers, the TSDF of GEM Rancho Cordova LLC, and the Island

Environmental Services business. Consideration for the sale will be cash in the

aggregate amount of $14 million and the assumption by Luntz of approximately

$1.1 million of long term lease obligations. The final purchase price will be

subject to an adjustment based on the computation of net working capital at

closing. PSC is a leading provider of industrial cleaning, environmental,

remediation, and transportation services. GEM Delaware, a subsidiary of the

Company, is a full-service hazardous waste management and environmental services

firm with locations in the western United States.

The

closing ("Closing") of the sale is subject to the approval of shareholders and

other customary closing conditions. The Company’s Board of Directors has

unanimously approved the Purchase Agreement and adopted resolutions recommending

shareholder approval. The Company will hold a shareholder’s meeting to submit

the Purchase Agreement for approval. The Closing will be on or prior

to March 1, 2010.

Luntz

will retain a minimum of $1.0 million for the one year period following the

Closing, to assure payment of certain of the Company’s indemnification

obligations, if any, arising under the Purchase Agreement and the related

ancillary agreements. The net cash proceeds from the transaction will be used by

the Company to retire senior debt and to pursue its strategy in the water

treatment and waste-to-energy markets. Total reduction in indebtedness to the

Company’s senior lender could amount to more than $9 million. The Company does

not currently intend to distribute any proceeds from the transaction to the

Company’s stockholders.

The

Purchase Agreement may be terminated by either Luntz or the Company if the

Closing has not occurred by March 12, 2010 or upon the occurrence of

certain events as set forth in the Purchase Agreement.

The

foregoing description of the sale of GEM Delaware does not purport to be a

complete statement of the parties’ rights under the Purchase Agreement and is

qualified in its entirety by reference to the full text of the Purchase

Agreement, a copy of which is filed with this Current Report as

Exhibit 10.38 and is incorporated by reference

herein.

On

December 2, 2009, the Company issued a press release announcing the signing

of the Purchase Agreement. This press release is filed as Exhibit 99.1 to

this Current Report and is incorporated herein by reference.

Item

2.01 Completion of Acquisition or Disposition of Assets

See Item

1.01

Item

9.01 Financial Statements and Exhibits

Attached

to this report is the Stock Purchase Agreement and the press release issued by

the Company announcing the transaction.

Exhibit

No. Description

10.38 Stock

Purchase Agreement dated November 25, 2009

99.1

Press Release dated December 2, 2009

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

General

Environmental Management, Inc

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy

Koziol

|

|

|

|

|

Timothy

Koziol, Chief Executive Officer

|

|

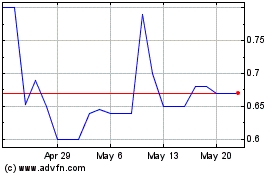

General Enterprise Ventu... (PK) (USOTC:GEVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

General Enterprise Ventu... (PK) (USOTC:GEVI)

Historical Stock Chart

From Jul 2023 to Jul 2024