0000059860

false

--12-31

2022

FY

P5Y2M26D

P4Y4M6D

P3Y4M6D

0000059860

2022-01-01

2022-12-31

0000059860

2022-06-30

0000059860

2023-07-05

0000059860

2022-12-31

0000059860

2021-12-31

0000059860

us-gaap:SeriesAPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesAPreferredStockMember

2021-12-31

0000059860

us-gaap:SeriesBPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesBPreferredStockMember

2021-12-31

0000059860

us-gaap:SeriesCPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesCPreferredStockMember

2021-12-31

0000059860

us-gaap:SeriesDPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesDPreferredStockMember

2021-12-31

0000059860

us-gaap:SeriesEPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesEPreferredStockMember

2021-12-31

0000059860

us-gaap:SeriesFPreferredStockMember

2022-12-31

0000059860

us-gaap:SeriesFPreferredStockMember

2021-12-31

0000059860

2021-01-01

2021-12-31

0000059860

us-gaap:CommonStockMember

2020-12-31

0000059860

us-gaap:PreferredStockMember

2020-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0000059860

us-gaap:RetainedEarningsMember

2020-12-31

0000059860

2020-12-31

0000059860

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0000059860

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0000059860

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0000059860

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0000059860

us-gaap:CommonStockMember

2021-12-31

0000059860

us-gaap:PreferredStockMember

2021-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000059860

us-gaap:RetainedEarningsMember

2021-12-31

0000059860

us-gaap:CommonStockMember

2022-12-31

0000059860

us-gaap:PreferredStockMember

2022-12-31

0000059860

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000059860

us-gaap:RetainedEarningsMember

2022-12-31

0000059860

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000059860

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2021-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2021-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2020-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0000059860

srt:ChiefExecutiveOfficerMember

2022-12-31

0000059860

srt:ChiefFinancialOfficerMember

2021-12-31

0000059860

srt:ChiefFinancialOfficerMember

2020-12-31

0000059860

srt:ChiefFinancialOfficerMember

2022-01-01

2022-12-31

0000059860

srt:ChiefFinancialOfficerMember

2021-01-01

2021-12-31

0000059860

srt:ChiefFinancialOfficerMember

2022-12-31

0000059860

srt:DirectorMember

2022-01-01

2022-12-31

0000059860

srt:DirectorMember

2022-12-31

0000059860

grmc:NotesPayableInGoldMember

2022-01-01

2022-12-31

0000059860

grmc:NotesPayableInGoldMember

2022-12-31

0000059860

grmc:NotesPayableInGoldMember

2021-01-01

2021-12-31

0000059860

grmc:NotesPayableInGoldMember

2021-12-31

0000059860

us-gaap:EntityLoanModificationProgramMember

2020-04-15

2020-04-15

0000059860

us-gaap:EntityLoanModificationProgramMember

2021-05-01

2021-05-31

0000059860

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesDPreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0000059860

us-gaap:SeriesFPreferredStockMember

2022-01-01

2022-12-31

0000059860

us-gaap:SeriesFPreferredStockMember

2021-01-01

2021-12-31

0000059860

grmc:ClassRWarrantMember

2020-12-31

0000059860

grmc:ClassRWarrantMember

srt:MinimumMember

2021-12-31

0000059860

grmc:ClassRWarrantMember

srt:MaximumMember

2021-12-31

0000059860

grmc:ClassRWarrantMember

2021-01-01

2021-12-31

0000059860

grmc:ClassRWarrantMember

2021-12-31

0000059860

grmc:ClassRWarrantMember

2022-01-01

2022-12-31

0000059860

grmc:ClassRWarrantMember

2022-12-31

0000059860

grmc:ClassSWarrantMember

2020-12-31

0000059860

grmc:ClassSWarrantMember

2021-01-01

2021-12-31

0000059860

grmc:ClassSWarrantMember

2021-12-31

0000059860

grmc:ClassSWarrantMember

2022-12-31

0000059860

grmc:ClassTWarrantMember

2020-12-31

0000059860

grmc:ClassTWarrantMember

2021-01-01

2021-12-31

0000059860

grmc:ClassTWarrantMember

2021-12-31

0000059860

grmc:ClassTWarrantMember

2022-01-01

2022-12-31

0000059860

grmc:ClassTWarrantMember

2022-12-31

0000059860

us-gaap:StockOptionMember

2020-12-31

0000059860

us-gaap:StockOptionMember

2020-01-01

2020-12-31

0000059860

us-gaap:StockOptionMember

2021-01-01

2021-12-31

0000059860

us-gaap:StockOptionMember

2021-12-31

0000059860

us-gaap:StockOptionMember

2022-12-31

0000059860

us-gaap:StockOptionMember

2022-01-01

2022-12-31

0000059860

us-gaap:DomesticCountryMember

2022-12-31

0000059860

us-gaap:StateAndLocalJurisdictionMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| x |

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For

the fiscal year ended December 31, 2022 |

| OR |

| o |

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from to

Commission

file number: 001-06412

Goldrich Mining Company

(Exact

name of registrant as specified in its charter)

| Alaska |

|

91-0742812 |

| (State

of other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

| 2525 E. 29th Ave. Ste. 10B-160 |

|

|

| Spokane,

Washington |

|

99223-4942 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(509)

535-7367

(Registrant’s

Telephone Number, including area code)

SECURITIES

REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

SECURITIES

REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

| Title

of Each Class |

Trading

Symbol(s) |

Name

of Each Exchange on Which Registered |

| Common

Stock, $0.10 par value |

GRMC |

OTC Pink |

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate

by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of

1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate

by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer o |

Accelerated

filer o |

| Non-accelerated filer x |

Smaller reporting company x |

| |

Emerging Growth Company o |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate

by check mark whether the Registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes o No x

As

of June 30, 2022, the aggregate market value of the voting and non-voting shares of common stock of the registrant issued and outstanding

on such date, excluding shares held by affiliates of the registrant as a group, was $4,053,730. This figure is based on the closing sale

price of $0.03 per share of the Registrant’s common stock on June 30, 2022 on the OTC Pink.

Number

of shares of Common Stock outstanding as of July 5, 2023: 195,226,190

GOLDRICH

MINING COMPANY

FORM 10-K

December 31, 2022

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K (this “Annual Report”) and the exhibits attached hereto contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include but are not limited

to:

| ● | estimates

of resources or reserves; |

| ● | our

anticipated results and developments in future periods; |

| ● | statements

regarding our exploration plans at our Chandalar property; |

| ● | statements

regarding our plans to finance our operations; |

| ● | statements

regarding future costs and expenditures; |

| ● | statements

regarding our anticipated plan of operation; and |

| ● | other

matters that may occur in the future. |

These

statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable

and assumptions of management.

Any

statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates”

or “intends”, or stating that certain actions, events or results “may”, “could”, “would”,

“might”, “should” or “will” be taken, occur or be achieved) are not statements of historical fact

and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties

and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements,

including, without limitation:

| ● | risks

related to our ability to continue as a going concern being in doubt; |

| ● | risks

related to our history of losses; |

| ● | risks

related to our outstanding gold forward sales contracts and notes; |

| ● | risks

related to need to raise additional capital to fund our exploration and, if warranted, development

and production programs; |

| ● | risks

related to our property not having any proven or probable reserves; |

| ● | risk

related to our limited history of commercial production; |

| ● | risk

related to operating a mine; |

| ● | risk

related to accurately forecasting, extraction and production; |

| ● | risks

related to our dependence on a single property – the Chandalar property; |

| ● | risks

related to climate and location restricting our exploration and, if warranted, development

and production activities; |

| ● | risks

related to our mineralization estimates being based on limited drilling data; |

| ● | risks

related to our exploration activities not being commercially successful; |

| ● | risks

related to actual capital costs, production or economic return being different than projected; |

| ● | risks

related to mineral exploration; |

| ● | risks

related to increased costs; |

| ● | risks

related to a shortage of equipment and supplies; |

| ● | risk

related to fluctuations in gold prices; |

| ● | risks

related to title to our properties being defective; |

| ● | risks

related to title to our properties being subject to claims; |

| ● | risks

related to estimates of resources or reserves; |

| ● | risks

related to government regulation; |

| ● | risks

related to environmental laws and regulation; |

| ● | risks

related to land reclamation requirements; |

| ● | risks

related to future legislation regarding mining laws; |

| ● | risks

related to future legislation regarding climate change; |

| ● | risks

related to our lack of insurance coverage for all risks; |

| ● | risks

related to competition in the mining industry; |

| ● | risks

related to our dependence on key personnel; |

| ● | risks

related to our executive offices not dedicating 100% of their time to our company; |

| ● | risks

related to potential conflicts of interest with our directors and executive officers; |

| ● | risks

related to the deed of trust held by our secured debt holders; |

| ● | risks

related to market conditions; |

| ● | risks

related to our disclosure controls and procedures; and |

| ● | risks

related to our shares of common stock. |

This

list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties

that could affect forward-looking statements are described further under “Item 1. Business,” “Item 1A. Risk Factors,”

and “Item 7. Management’s Discussion and Analysis of Results of Operation” of this Annual Report. Should one or more

of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from

those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements,

which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events

or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required

by law.

We

qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

PART

I

As

used in herein, the terms “Goldrich,” the “Company,” “we,” “us,” and “our”

refer to Goldrich Mining Company.

ITEM

1. BUSINESS

Overview

and History

We

are a minerals company in the business of acquiring and advancing mineral properties to the discovery point, where we believe maximum

shareholder returns can be realized. Although we have conducted limited extraction of gold on one of our gold prospects, Goldrich is

an exploration stage company as defined by the U.S. Securities and Exchange Commission (“SEC”) under Subpart 1300 of Regulation

S-K under the Securities Exchange Act of 1934, as amended “Subpart 1300”), although over $50 million in revenue from gold

has been extracted from its claims since 2015.

Incorporated

in 1959, Goldrich Mining Company (OTC Pink trading symbol “GRMC”) has been a publicly traded company since October 9, 1970.

Our executive office address is 2525 E. 29th Ave. Ste. 10B-160, Spokane, WA 99223, and our phone number is (509) 535-7367.

Our website address is www.goldrichmining.com. Information contained on our website is not part of this annual report.

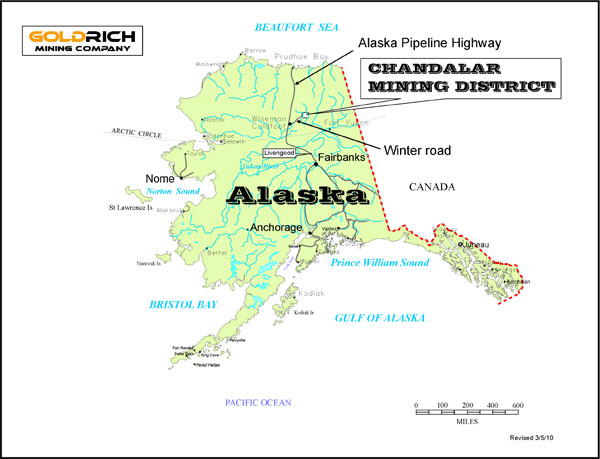

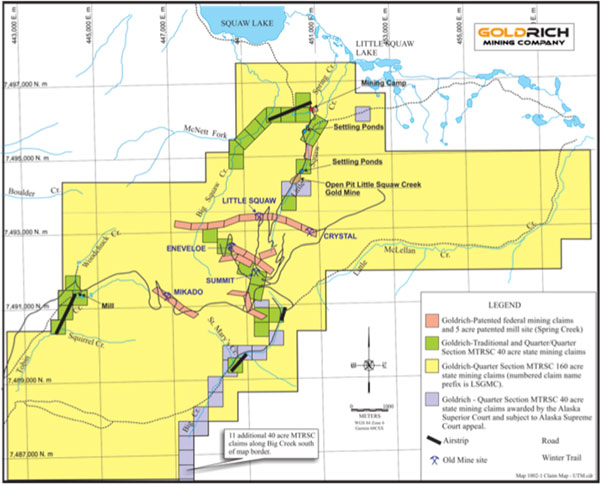

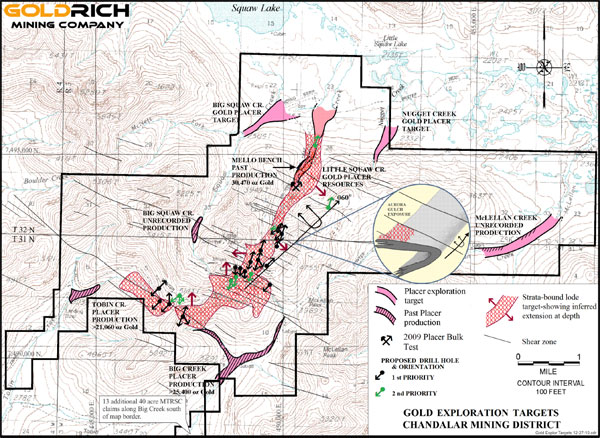

At

this time, our major mineral exploration prospects are contained within our wholly-owned Chandalar property, located approximately 190

air miles north of Fairbanks, Alaska. The property is largely on land owned by the State of Alaska, which is one of the active and highly

ranked mining jurisdictions in the world. Both patented federal mining claims and Alaska state mining claims provide exploration and

mining rights to lode and placer mineral deposits. A more detailed description of our Chandalar property is set forth in “Item

2 – Properties” of this Annual Report.

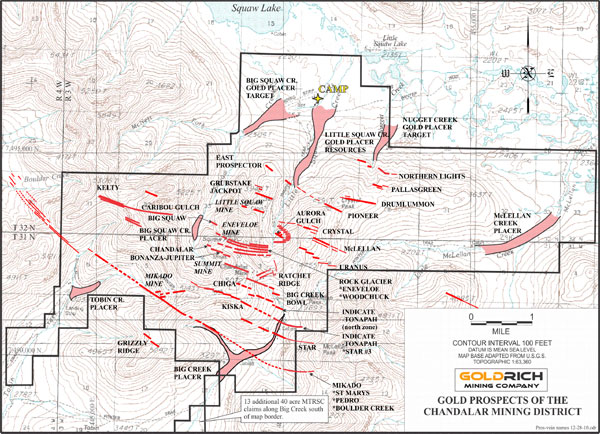

The

Chandalar property contains both our Chandalar hard-rock (lode) gold project, our primary target, and the Chandalar alluvial (placer)

gold mine. The area has a long prospecting and mining history dating to the discovery of placer gold deposits in 1905, soon followed

by the discovery of more than 30 separate high-grade lode gold mineralization prospects. Over the next 80 years the lode gold mineralization

occurrences were intermittently explored or mined by various small operators, but because of the district’s remote location the

readily mineable alluvial gold deposits received the most attention.

Although

there is a history of past lode and alluvial extraction on our Chandalar property, it currently does not contain any known proven or

probable ore reserves as defined in Subpart 1300 but, as detailed in Item 2. Properties below, it does contain alluvial resources

of 119,000 ounces measured and indicated ounces and 16,000 indicated ounces of fine gold. The probability that ore reserves that meet

SEC Subpart 1300 guidelines will be discovered on an individual hard rock prospect at Chandalar cannot be determined at this time. We

commissioned an independent engineering firm to complete a mining plan and initial assessment for the Company’s Chandalar placer

mine, completed in June 2021, according to the new amendments adopted by the SEC to modernize the property disclosure requirements for

mining registrants as codified in Subpart 1300. The new disclosure requirements under Subpart 1300 replaced the SEC Industry Guide 7,

and mining registrants on January 1, 2021. The new disclosure requirements under Subpart 1300 allow issuers to disclose inferred, indicated

and measured resources as defined therein. The Company has yet to decide if a preliminary feasibility study should also be prepared for

the Chandalar placer mine. A preliminary feasibility study allows an issuer to disclose any proven or probable mineral reserves on a

mineral property.

The

ownership and management of Goldrich changed in 2003. Beginning in 2004, we ended a twenty-year hiatus of hard-rock exploration on the

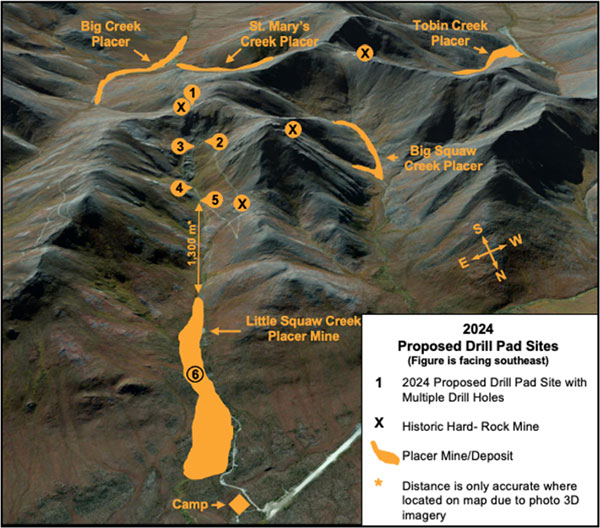

property and began employing modern exploration techniques. Our focus is two-fold:

| (1) | Continue

exploration of our Chandalar property where we have discovered and identified drilling targets for a potentially large bulk tonnage hard-rock

intrusion-related gold deposit. |

| (2) | Continue

gold extraction from the Chandalar placer gold deposit discovered on the property. |

We

have spent many millions of dollars in exploration and mining activities at our Chandalar property. Some of the highlights include (see

details of highlights in the Properties section below):

2012:

As described below in Joint Venture Agreement, we signed an agreement with NyacAU to form a joint venture, Goldrich NyacAU

Placer, LLC (“GNP”) for the purpose of mining the alluvial gold deposits within the bounds of our Chandalar property.

2013:

Achievements included GNP’s mobilization of drilling equipment and plant setup, approval of permits to expand mining operations,

significant infrastructure improvements and extraction of 680 ounces of fine gold.

2014:

We conducted a property-wide airborne radiometric and magnetic survey to generate and further refine exploration targets for bulk-tonnage

low-grade mineralization and possible deeper sources of intrusion-related mineralization. We also completed advanced petrographic studies

of drill core samples from the Chandalar gold property. The new data refined the orogenic model that has historically guided exploration

at Chandalar and redirected our future exploration for intrusion-related mineralization.

2015:

We completed reclamation of a mine waste road built in 2010 and received a confirmation of completion and satisfaction from the Army

Corps of Engineers. GNP extracted approximately 3,600 ounces of fine gold.

2016:

GNP extracted approximately 8,200 ounces of fine gold.

2017:

We performed additional oxygen isotope studies to

further confirm intrusion-related mineralization. In addition, GNP completed a sonic drill program and

drilled 231 holes totaling 14,271 feet to further define the Chandalar placer deposit. GNP extracted approximately 12,300 ounces of fine

gold.

2018:

GNP extracted approximately 17,100 ounces of fine

gold.

2019

– 2022: GNP was dissolved in 2019 due to its inability to reach commercial production, and no mining activities were undertaken

from 2019 through 2022.

Although

GNP extracted over 42,000 ounces of fine gold from 2013 to 2018, GNP failed to meet the minimum production requirements under the GNP

Operating Agreement. Goldrich began arbitration proceedings against NyacAU and certain NyacAU related parties in 2017 (see Joint

Venture Agreement and Arbitration below). GNP was dissolved in June 2019. Except for equipment needed

for reclamation, most of the heavy equipment and the wash plant were removed in March through mid-April 2019. There was no gold

extracted in the years 2019 through 2022. NyacAU is the operator of the mine permits and began reclamation of the mine in 2019, which

is still ongoing.

Goldrich

hired an independent mining engineering firm in 2019 to formulate a mine plan and complete an initial assessment under Subpart 1300 to

determine if Goldrich should pursue production at the placer mine. The mine plan and initial assessment were completed in June 2021 and

supplemented as of December 31, 2022 for full disclosures required by Subpart 1300. Any plan to continue future mining is contingent

upon our success in raising sufficient capital to fund these activities or any portion of them.

On

March 31, 2023, we entered into a settlement agreement concerning the arbitration proceedings with NyacAU, our former joint venture partner,

and its related parties, whereunder we remitted a total of $105,000 to NyacAU and those related entities in consideration of all claims

by both parties to the arbitration and legal proceedings being dismissed and all claims withdrawn. Concurrent with that settlement agreement,

we entered into an option agreement with NyacAU whereunder, at our option, we would become the operator of the mining permit and would

assume the remaining reclamation responsibilities for the Chandalar Mine. The exercise of the option agreement must be done by April

30, 2024, and requires a payment of $1,000,000 to NyacAU for the equipment, facilities, supplies and any other assets remaining at the

Chandalar Mine site, which remain in place for the continuing reclamation work being performed by NyacAU under the mining permit and

reclamation plan previously approved by the Army Corps of Engineers.

Concerning

hard-rock exploration, although we are pleased with the progress that has been made, weak financial markets and the Company’s illiquidity

during the last several years have been an important factor affecting the level of our exploration activities. If the placer mine enters

into commercial production (by Goldrich or a third-party operator), we look forward to potential internal cash flow and additional opportunities

for financing that will give us a unique advantage for growth over other junior mining exploration companies; however, finances must

be obtained before we can continue mining activities.

We

also intend to list our shares on a recognized stock exchange in Canada in addition to maintaining our quotation on the OTC Pink Market

in the United States. We believe these factors will increase our access to financial markets and positively affect our ability to raise

the funds necessary to add value to our property and increase shareholder value. Our

main focus in the future will continue to be the exploration of the hard-rock targets of our Chandalar property as funds become available.

Competition

There

is aggressive competition within the minerals industry to discover and acquire mineral properties considered to have commercial potential.

We compete for the opportunity to participate in promising exploration projects with other entities. In addition, we compete with others

in efforts to obtain financing to acquire and explore mineral properties, acquire and utilize mineral exploration equipment and hire

qualified mineral exploration personnel.

We

may compete with other junior mining companies for mining claims in regions adjacent to our existing claims, or in other parts of the

world should we dedicate resources to doing so in the future. These companies may be better capitalized than us and we may have difficulty

in expanding our holdings through additional mining claims.

In

competing for qualified mineral exploration personnel, we may be required to pay compensation or benefits relatively higher than those

paid in the past, and the availability of qualified personnel may be limited in high-demand mining periods, such as have been experienced

during the increased price of gold in recent years.

Employees

In

October 2009, William Schara began employment as our President and Chief Executive Officer (“CEO”). We rely on consulting

contracts for some of our management and administrative personnel needs, including for our Chief Financial Officer (“CFO”),

Mr. Ted Sharp. The contract for Mr. Sharp expired on December 31, 2009; however, Mr. Sharp continues to provide services to the Company

under the terms of that contract. We employ individuals and contractors on a seasonal basis to conduct exploration, mining and other

required company activities, mostly during the late spring through early fall months. We currently have 2 full-time employees; our CEO

and Controller.

Seasons

We

conduct exploration activities at Chandalar between late spring and early autumn. Access during that time is exclusively by airplane.

All fuel is supplied to the campsite by air transport. Access during winter months is by ice road, snowmobile and ski-plane. All heavy

supplies and equipment are brought in by trucking over the ice road from Coldfoot. Snow melt generally occurs toward the end of May,

followed by an intensive, though short, 90-day growing season with 24 hours of daylight and daytime temperatures that range from 60°

to 80° Fahrenheit. Freezing temperatures return in late August and freeze-up typically occurs by early October. Winter temperatures,

particularly in the lower elevations, can drop to -50° F or colder for extended periods. Annual precipitation is 15 to 20 inches,

coming mostly in late summer as rain and during the first half of the winter as snow. Winter snow accumulations are modest. The area

is essentially an arctic desert.

Regulation

Our

mineral exploration activities are subject to various federal, state, and local laws and regulations governing prospecting, exploration,

production, labor standards, occupational health and mine safety, control of toxic substances, land use, water use, land claims of local

people and other matters involving environmental protection and taxation. New rules and regulations may be enacted, or existing rules

and regulations may be applied in a manner that could limit or curtail exploration at our property. It is possible that future changes

in these rules or regulations could have a significant impact on our business, causing those activities to be economically re-evaluated

at that time.

Taxes

Pertaining to Mining

Alaska’s

tax and regulatory policy is widely viewed by the mining industry as offering the most favorable environment for establishing new mines

in the United States. The mining taxation regimes in Alaska have been stable for many years. There is regular discussion of taxation

issues in the legislatures but no changes have been proposed that would significantly alter their current state mining taxation structures.

The economics of any potential mining operation on our properties would be particularly sensitive to changes in the State of Alaska’s

tax regimes. Amendments to current laws, regulations and permits governing our operations and the general activities of mining and exploration

companies, or more stringent implementation thereof, could cause unanticipated increases in our exploration expenses, capital expenditures

or future production costs, or could result in abandonment or delays in establishing operations at our Chandalar property. Although management

has no reason to believe that new mining taxation laws that could adversely impact our Chandalar property will materialize, such an event

could and may happen in the future.

At

present, Alaska has a 7% net profits mining license tax on all mineral production (AS 43.65), a 3% net profits royalty on minerals from

state lands (AS 38.05.212) (where we hold unpatented state mining claims), and a graduated annual mining claim rental beginning at $1.03/acre.

Alaska state corporate income tax is 9.4% if net profit is more than a set threshold amount. Alaska has an exploration incentive credit

program (AS 27.30.010) whereby up to $20 million in approved accrued exploration credits can be deducted from the state mining license

tax, the state corporate income tax, and the state mining royalty. All qualified new mining operations are exempt from the mining license

tax for 3½ years after production begins.

Environmental

Regulations

Our

Chandalar property contains an inactive small mining mill site on Tobin Creek with tailings impoundments, last used in 1983. The mill

was capable of processing 100 tons of ore per day. A total of 11,884 tons were put through the mill, and into two small adjacent tailings

impoundments. A December 19, 1990 letter from the Alaska Department of Environmental Conservation (the “Alaska DEC”) to the

Alaska Division of Mining of the Department of Natural Resources (the “Alaska DNR”) states: “Our samples indicate the

tailings impoundments meet Alaska DEC standards requirements and are acceptable for abandonment and reclamation.” The Alaska DNR

conveyed acknowledgement of receipt of this report to us in a letter dated December 24, 1990. We subsequently reclaimed the tailings

impoundments and expect that no further remedial action will be required. Vegetation has established itself on the tailings impoundments,

thereby mitigating erosional forces.

In

1990, the Alaska DEC notified us that soil samples taken from a gravel pad adjacent to our Tobin Creek mill site contained elevated levels

of mercury. In response to the notification, we engaged a professional mineral engineer to evaluate procedures for remediating contamination

at the site. In 1994, the engineer evaluated the contamination and determined that it consists of approximately 160 cubic yards of earthen

material that could be cleansed by processing it through a simple gravity washing plant. This plan was subsequently approved by the state.

In 2000, the site was listed in the Alaska DEC’s contaminated sites database as a “medium” priority contaminated site.

We Are not aware of any changes in state environmental laws that would affect our state approved cleanup plan or impose a timetable for

it to be done. During 2008, our employees took a suite of samples at the contamination site to update the readings taken in 1990 or prior.

The results of this sampling reconfirmed the earlier findings, and also suggest that some attenuation of the mercury contamination has

occurred. An independent technical consultant assessed those results and believes that proper procedures for sampling and testing were

followed. During 2011, 2013 and 2014, we took additional samples that showed an overall reduction of mercury in the previously sampled

area. However, one sample on the margin of the sampled area yielded high mercury content, and that may necessitate continued expansion

of the area to be sampled in the future. The 2011, 2013 and 2014 sample results were submitted to the State for analysis and determination

of what additional sampling the State may require on the area around the mill. In 2013, we received a letter request from the Alaska

DEC to update our plan for remediating the contaminated site and in 2014, 2015, and 2016 continued communication with the Alaska DEC

to determine what remediation is necessary. We have engaged an independent environmental engineering company to perform an evaluation

of the remediation requirements based on locality, latitude, altitude, permafrost and other factors. During 2017, the environmental engineering

company performed an eco-scoping study on the site. The Alaska DEC has notified us that further sampling will need to be performed in

and around the streambed from the mine site to the stream’s confluence into Chandalar Lake. At December 31, 2022, we have an accrued

liability of $100,000 in our financial statements for sampling and remediation costs.

ITEM

1A. RISK FACTORS

The

following sets forth certain risks and uncertainties that could have a material adverse effect on our business, financial condition and/or

results of operations, and the trading price of our common stock which may decline and investors may lose all or part of their investment.

These risk factors should be considered along with the forward-looking statements contained in this Annual Report on Form 10-K because

these factors could cause our actual results or financial condition to differ materially from those projected in forward-looking statements.

Additional risks and uncertainties that we do not presently know or that we currently deem immaterial also may impair our business operations.

We cannot assure you that we will successfully address these risks or that other unknown risks exist that may affect our business.

Risks

Related to Our Operations

Our

ability to operate as a going concern is in doubt.

The

audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2022, disclose a ‘going

concern’ qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared

under the assumption that we will continue as a going concern. We are an exploration stage company and we have incurred losses since

our inception. We do not have sufficient cash to fund normal operations and meet debt obligations for the next 12 months without deferring

payment on certain current liabilities and raising additional funds. During the year ended December 31, 2022, we raised $278,840 net

cash from senior secured notes payable to third-party and related-party persons, as described elsewhere, $133,157 in warrant exercises,

as described elsewhere, and $30,000 from private placements, as described elsewhere. We believe that the going concern condition cannot

be removed with confidence until the Company has entered into a business climate where funding of its activities is more assured.

We

currently have no historical recurring source of revenue and our ability to continue as a going concern is dependent on our ability to

raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan.

Our plans for the long-term return to and continuation as a going concern include financing our future operations through sales of our

common stock and/or debt and the eventual profitable exploitation of our mining properties. Additionally, the current capital markets

and general economic conditions in the United States are significant obstacles to raising the required funds. These factors raise substantial

doubt about our ability to continue as a going concern.

GNP

was dissolved in 2019. We are seeking to raise sufficient capital to continue profitably operating the mine. The current plant has been

disassembled and it, as well as most of the equipment used by GNP, has been demobilized from the mine site. While we are working to replace

the dissolved GNP operations with commensurate gold extraction by us or a qualified third-party operator, we cannot assure you we will

have sufficient capital to implement our plan of operation, that we will be successful in beginning gold extraction operations in the

future, the timing for any such operations or that the extraction results in future years will be similar to past results.

The

consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as

a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the

carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

We

have a history of losses and expect to continue to incur losses in the future.

We

have incurred losses since inception and expect to continue to incur losses in the future. We had net income of $50,163 in the year ended

2015, but we incurred net losses during each of the following more recent periods:

| ● | $1,055,630

for the year ended December 31, 2022; |

| ● | $1,759,159

for the year ended December 31, 2021; |

| ● | $2,169,540

for the year ended December 31, 2020; and |

| ● | $2,603,065

for the year ended December 31, 2019. |

We

had an accumulated deficit of approximately $40.48 million as of December 31, 2022. We expect to continue to incur losses unless and

until such time as the Chandalar Mine or one of our properties enters into commercial production and generates sufficient revenues to

fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions

of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to

face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business

development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could

have a materially adverse effect on our financial condition.

We

may be unable to timely pay our obligations under our outstanding note payable in gold or our secured senior secured notes, which may

result in us losing some of our rights to gold from Chandalar alluvial extraction operations and may adversely affect our assets, results

of operations and future prospects.

At

December 31, 2022, a portion of the Company’s notes payable in gold outstanding, with a net liability of $483,514, obligate the

Company to deliver 266.788 ounces of fine gold on demand. To date, the gold notes have not been paid and the note holders have not demanded

payment or delivery of gold. These notes were secured against our right to future distributions of gold extracted from subsequent gold

mining operations by GNP, the former joint venture. At December 31, 2022, we owed secured senior notes to related parties totaling $4,195,979

and outstanding notes payable to unrelated parties of $1,250,169, payable within 10 days of a demand notice of the holders. There has

been no notice of default or demand issued by any holder. These notes are secured against all of the assets and property of each of Goldrich

Mining Company and Goldrich Placer, LLC, whether real, personal or mixed, in which the holders of any Notes (or their Collateral Agent)

hold a security interest at such time, including any property subject to liens or security interest granted by the Deed of Trust.

Under

our gold forward sales contracts, each of the following constitutes an event of default: (a) our failure to perform or observe any term,

covenant or agreement contained in the gold forward sales contract; (b) any warranty made by us in the gold forward sales contract shall

prove to have been incorrect in a material respect when made; or (c) we shall declare bankruptcy. Upon the occurrence of an event of

default, the holders of the gold forward sales contracts may designate a termination date for the contract and upon termination receive

the delivery date index price (as determined in the gold forward sales contract) of any quantities of gold we were deficient in delivering

payable in either (i) cash or (ii) an amount of our shares of common stock equal such value converted into shares at the greater of $0.15

per share or 75% of the current market price per share on the delivery date.

Under

our senior secured notes, each of the following constitutes an event of default: (a) the Company fails to pay (i) any portion of the

principal amount of any Note when due or (ii) any accrued and unpaid Interest when due and such failure continues for three (3)

Business Days or (iii) any other amount that is due and payable under this Amended Agreement, any Note, or the Deed of Trust and

such failure continues for ten (10) Business Days after demand for such payment is made by the Holder; (b) the Company fails to

observe or perform any other obligation, covenant, or agreement applicable to the Company under this Amended Agreement as and when

due and fails to cure such failure within 10 Business Days of notice of such failure by the holder to the Company; (c) the Company

fails to observe or perform any covenant or agreement applicable under the Guaranty and fails to cure such failure within 10

Business Days of notice of such failure by the holder to the Company; (d) an insolvency or liquidation proceeding or assignment is

commenced with respect to the Company or its subsidiary; or (e) any alleged creditor other than the holders seeks to collect any

amount allegedly due and owing to said creditor at that time.

If

we are unable to timely satisfy our obligations under the notes payable in gold or the secured senior notes, including timely payment

of gold on demand or interest when due and payment of the principal amount on demand for the secured senior notes and we are not able

to re-negotiate the terms of such agreements, the holders will have rights against us, including potentially seizing or selling our assets.

The notes payable in gold are specifically secured against our right to future gold distributions from subsequent gold mining operations

by GNP, the former joint venture. The senior secured notes are secured against all our assets. Any failure to timely meet our obligations

under these instruments may adversely affect our assets, results of operations and future prospects or cause us to declare bankruptcy.

We

are required to raise additional capital to fund our exploration and, if warranted, development and production programs on the Chandalar

property.

We

are an exploration stage company and currently do not have sufficient capital to fully fund any long-term plan of operation at the Chandalar

gold property. We will require additional financing in the future to fund exploration of and development and production on our properties,

if warranted, to attain self-sufficient cash flows. We expect to obtain financing through various means including, but not limited to,

private or public placement offerings of debt or our equity securities, the exercise of outstanding warrants, the sale of a production

royalty, the sales of gold from future production, joint venture agreements with other mining companies, or a combination of the above.

The level of additional financing required in the future will depend on the results of our exploration work and recommendations of our

management and consultants. Failure to obtain sufficient financing may result in delaying or indefinite postponement of exploration or

even a loss of some property interest. Additional capital or other types of financing may not be available if needed or, if available,

may not be available on favorable terms or terms acceptable to us. Failure to raise such needed financing could result in us having to

discontinue our mining and exploration business.

We

have only a brief, recent history of gold extraction.

We

have only a brief recent history of gold extraction from 2013-2018 and have carried on our business at a loss. As a result of dissolution

of GNP, the current plant has been disassembled and it, as well as most of the equipment used by GNP, has been demobilized from the mine

site. While we are working to replace the GNP operations with commensurate gold extraction by us or a qualified third-party operator,

we cannot assure you that similar results will be accomplished in future years. At this time, due to the risks and uncertainties described

in this section, we cannot assure you that extraction activities in the future will generate revenues, profits or cash flow to us.

Estimates

of cash flows, extraction costs, profitability and other financial and extraction measurements are subject to the inherent risks related

to accurately forecasting extraction.

Estimates

of future extraction costs and potential extraction profitability are dependent on numerous factors, which could affect the success and

profitability of extraction activities. These risks include volatile gold prices, engineering and construction errors, changes or shortages

in equipment and labor availability and costs, variances in grade, natural disasters and other events outside our control. The occurrence

of such events could make anticipated results differ from actual results and could negatively affect our financial position.

We depend

largely on a single property - the Chandalar property.

Our

major mineral property at this time is the Chandalar property. We are dependent upon making a gold deposit discovery at Chandalar for

the furtherance of the Company at this time. Should we be able to make an economic find at Chandalar, we would then be solely dependent

upon a single mining operation for our revenue and profits, if any.

Chandalar

is located within the remote Arctic Circle region and exploration and, if warranted, development and production activities may be limited

by climate and location.

While

we have conducted test mining and minor gold mining extraction in recent years, our current focus remains on exploration of our Chandalar

property. With our current infrastructure at Chandalar, the arctic climate limits exploration activities to a summer field season that

generally starts in early May and lasts until freeze-up in mid-September. The remote location of the Chandalar property limits access

and increases exploration expenses. Costs associated with such activities are estimated to be between 25% and 50% higher than costs associated

with similar activities in the lower 48 states in the United States. Transportation and availability of qualified personnel is also limited

because of the remote location. Higher costs associated with exploration activities and limitations for the annual periods in which we

can carry on exploration activities will increase the costs and time associated with our planned activities and could negatively affect

the value of our property and securities.

Our

resource estimate at Chandalar is based on a limited amount of drilling completed to date.

We

commissioned an independent engineering firm to complete a mining plan and initial assessment (“IA”) for the Chandalar Alluvial

Gold Deposit on our Chandalar property according to the new amendments adopted by the SEC to modernize the property disclosure requirements

for mining registrants as codified in Subpart 1300. The IA was completed in June 2021 and supplemented as of December 31, 2022 for full

disclosures required by Subpart 1300. The IA is based on a limited amount of drilling completed during 2007, 2013, and 2017. These estimates

have a high degree of uncertainty. While we plan on conducting further drilling programs on the deposit, we cannot guarantee that the

results of future drilling will return similar results or that our current estimate of resources will ever be established as proven and

probable reserves as defined in the new SEC regulations in Subpart 1300. Any gold resources that may be discovered at Chandalar through

our drilling programs may be of insufficient quantities to justify commercial operations.

Our

exploration activities may not result in commercially successful mining operations.

Our

operations are focused on mineral exploration, which is highly speculative in nature, involves many risks and is frequently non-productive.

Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved

in the conduct of exploration programs. The focus of our current exploration plans and activities is conducting mineral exploration and

deposit definition drilling at Chandalar. The success of this gold exploration is determined in part by the following factors:

| ● | identification

of potential gold mineralization based on analysis; |

| ● | availability

of government-granted exploration permits; |

| ● | the

quality of our management and our geological and technical expertise; and |

| ● | capital

available for exploration. |

Substantial

expenditures are required to establish proven and probable reserves through drilling and analysis, to determine metallurgical processes

to extract metal, and to establish commercial mining and processing facilities and infrastructure at any site chosen for mining. Whether

a mineral deposit at Chandalar would be commercially viable depends on a number of factors, which include, without limitation, the particular

attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government

regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting

of minerals and environmental protection. Any gold resources that may be discovered at Chandalar may be of insufficient quantities to

justify commercial operations.

Actual

capital costs, operating costs, extraction and economic returns may differ significantly from those anticipated and there are no assurances

that any future development activities will result in profitable mining operations.

We

have limited operating history on which to base any estimates of future operating costs related to any future development of our properties.

Capital and operating costs, extraction and economic returns, and other estimates contained in pre-feasibility or feasibility studies

may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs for any future

development activities will not be higher than anticipated or disclosed.

Mining

and Exploration activities involve a high degree of risk.

Our

operations on our properties will be subject to all the hazards and risks normally encountered in the mining of and exploration for deposits

of gold. These hazards and risks include, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts,

pit-wall failures, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result

in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and legal liability.

Milling operations, if any, are subject to various hazards, including, without limitation, equipment failure and failure of retaining

dams around tailings disposal areas, which may result in environmental pollution and legal liability.

The

parameters that would be used at our properties in estimating possible mining and processing efficiencies would be based on the testing

and experience our management has acquired in operations elsewhere. Various unforeseen conditions can occur that may materially affect

estimates based on those parameters. In particular, past mining operations at Chandalar indicate that care must be taken to ensure that

proper mineral grade control is employed and that proper steps are taken to ensure that the underground mining operations are executed

as planned to avoid mine grade dilution, resulting in uneconomic material being fed to the mill. Other unforeseen and uncontrollable

difficulties may occur in planned operations at our properties that could lead to failure of the operation.

If

we decide to exploit our Chandalar property and build a large gold mining operation based on existing or additional deposits of gold

mineralization that may be discovered and proven, we plan to process the resource using technology that has been demonstrated to be commercially

effective at other geologically similar gold deposits elsewhere in the world. These techniques may not be as efficient or economical

as we project, and we may never achieve profitability.

Increased

costs could affect our financial condition.

We

anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next

due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape

and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber, and electricity. Such

commodities are at times subject to volatile price movements, including increases that could make extraction at certain operations less

profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

A

shortage of equipment and supplies could adversely affect our ability to operate our business.

We

are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development and production operations.

The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and

therefore limit or increase the cost of reaching production.

We

may be adversely affected by a decrease in gold prices.

The

value and price of our securities, our financial results, and our exploration activities may be significantly adversely affected by declines

in the price of gold and other precious metals. Gold prices fluctuate widely and are affected by numerous factors beyond our control

such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against

foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of

gold producing countries throughout the world. The price for gold fluctuates in response to many factors beyond anyone’s ability

to predict. The prices that would be used in making any economic assessment estimates of resources or reserves on our properties would

be disclosed and would probably differ from daily prices quoted in the news media. Percentage changes in the price of gold cannot be

directly related to any estimated resource quantities at any of our properties, as they are affected by a number of additional factors.

For example, a ten percent change in the price of gold may have little impact on any estimated quantities of resources or reserves at

Chandalar and would affect only the resultant cash flow. Because any future mining at Chandalar would occur over a number of years, it

may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons, including

a belief that a low price of gold is temporary and/or that a greater expense would be incurred in temporarily or permanently closing

a mine there. Resource or reserve calculations and life-of-mine plans, if any, using significantly lower gold and precious metal prices

could result in material write-downs of our investments in mining properties and increased reclamation and closure charges.

In

addition to adversely affecting any of our resource or reserve estimates and its financial aspects, declining metal prices may impact

our operations by requiring a reassessment of the commercial feasibility of a particular project. Such a reassessment may be the result

of a management decision related to a particular event, such as a cave-in of a mine tunnel or open pit wall. Even if any of our projects

may ultimately be determined to be economically viable, the need to conduct such a reassessment may cause substantial delays in establishing

operations or may interrupt on-going operations, if any, until the reassessment can be completed.

Title

to our properties may be defective.

We

hold certain interests in our Chandalar property in the form of State of Alaska unpatented mining claims. We hold no interest in any

unpatented U.S. federal mining claims at Chandalar or elsewhere. Alaska state unpatented mining claims are unique property interests,

in that they are subject to the paramount title of the State of Alaska, and rights of third parties to uses of the surface within their

boundaries, and are generally considered to be subject to greater title risk than other real property interests. The rights to deposits

of minerals lying within the boundaries of the unpatented state claims are subject to Alaska Statues 38.05.185 – 38.05.280, and

are governed by Alaska Administrative Code 11 AAC 86.100 – 86.600. The validity of all State of Alaska unpatented mining claims

is dependent upon inherent uncertainties and conditions. These uncertainties relate to matters such as:

| ● | The

existence and sufficiency of a discovery of valuable minerals; |

| ● | Proper

posting and marking of boundaries in accordance with state statutes; |

| ● | Making

timely payments of annual rentals for the right to continue to hold the mining claims in

accordance with state statutes; |

| ● | Whether

sufficient annual assessment work has been timely and properly performed and recorded; and |

| ● | Possible

conflicts with other claims not determinable from descriptions of records. |

The

validity of an unpatented mining claim also depends on: (1) the claim having been located on Alaska state land open to appropriation

by mineral location, which is the act of physically going on the land and making a claim by putting corner stakes in the ground; (2)

compliance with all applicable state statutes in terms of the contents of claim location notices or certificates and the timely filing

and recording of the same; (3) timely payment of annual claim rental fees; and (4) the timely filing and recording of proof of annual

assessment work. In the absence of a discovery of valuable minerals, the ground covered by an unpatented mining claim is open to location

by others unless the owner is in actual possession of and diligently working the claim. We are diligently working and are in actual possession

of all of our mining claims comprising our Chandalar, Alaska property. The unpatented state mining claims we own or control there may

be invalid, or the title to those claims may not be free from defects. In addition, the validity of our claims may be contested by the

Alaska state government or challenged by third parties.

Title

to our property may be subject to other claims.

There

may be valid challenges to the title to properties we own or control that, if successful, could impair our exploration activities on

them. Title to such properties may be challenged or impugned due to unknown prior unrecorded agreements or transfers or undetected defects

in titles.

A

major portion of our mineral rights on our flagship Chandalar property consists of “unpatented” lode mining claims created

and maintained on deeded state lands in accordance with the laws governing Alaska state mining claims. We have no unpatented mining claims

on federal land in the Chandalar mining district, but do have unpatented state mining claims. Unpatented mining claims are unique property

interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of

unpatented mining claims is often uncertain. This uncertainty arises, in part, out of complex federal and state laws and regulations.

Also, unpatented mining claims are always subject to possible challenges by third parties or validity contests by the federal and state

governments. In addition, there are few public records that definitively determine the issues of validity and ownership of unpatented

state mining claims.

We

have attempted to acquire and maintain satisfactory title to our Chandalar mining property, but we do not normally obtain title opinions

on our properties in the ordinary course of business, with the attendant risk that title to some or all segments our properties, particularly

title to the State of Alaska unpatented mining claims, may be defective. We do not carry title insurance on our patented mining claims.

Estimates

of resources and reserves are subject to evaluation uncertainties that could result in project failure.

Our

exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict

the quantity and quality of resources or reserves within the earth using statistical sampling techniques. Estimates of any resources

or reserves on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground

workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent

to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details

that have not been identified or correctly appreciated at the current level of accumulated knowledge about our Chandalar property. This

could result in uncertainties that cannot be reasonably eliminated from the process of estimating resources or reserves. If these estimates

were to prove to be unreliable, we could implement a plan that may not lead to commercially viable operations in the future.

Government

regulation may adversely affect our business and planned operations.

Our

mineral exploration activities are subject to various laws governing prospecting, mining, development, production, taxes, labor standards

and occupational health, mine safety, toxic substances, land use, water use, land claims of local residents and other matters in the

United States. New rules and regulations may be enacted or existing rules and regulations may be applied in a manner that could limit

or curtail exploration at our Chandalar property. The economics of any potential mining operation on our properties would be particularly

sensitive to changes in the federal and State of Alaska’s tax regimes.

The

generally favorable State of Alaska tax regime could be reduced or eliminated. Such an event could materially hinder our ability to finance

the future exploitation of any gold deposit we might prove-up at Chandalar, or elsewhere on State of Alaska lands. Amendments to current

laws, regulations and permits governing our operations and the general activities of mining and exploration companies, or more stringent

implementation thereof, could cause unanticipated increases in our exploration expenses, capital expenditures or future extraction or

production costs, or could result in abandonment or delays in establishing operations at our Chandalar property.

Our

activities are subject to environmental laws and regulation that may materially adversely affect our future operations, in which case

our operations could be suspended or terminated.

We

are subject to a variety of federal, state and local statutes, rules and regulations in connection with our exploration activities. We

are required to obtain various governmental permits to conduct exploration at and development of our property. Obtaining the necessary

governmental permits is often a complex and time-consuming process involving numerous federal, state and local agencies. The duration

and success of each permitting effort is contingent upon many variables not within our control. In the context of permitting, including

the approval of reclamation plans, we must comply with known standards, existing laws, and regulations that may entail greater or lesser

costs and delays depending on the nature of the activity to be permitted and the interpretation of the laws and regulations implemented

by the permitting authority. The failure to obtain certain permits or the adoption of more stringent permitting requirements could have

a material adverse effect on our business, plans of operation, and property in that we may not be able to proceed with our exploration

programs. Compliance with statutory environmental quality requirements may require significant capital investments, significantly affect

our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or local

governments may be changed or become more stringent in the future, which could materially and adversely affect our proposed activities.

As a result of these matters, our operations could be suspended or cease entirely.

Mineral

exploration and mining are subject to potential risks and liabilities associated with pollution of the environment and the disposal of

waste products occurring as a result of mineral exploration and production. Insurance against environmental risk (including potential

liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is

not generally available to us (or to other companies in the minerals industry) at a reasonable price. To the extent that we become subject

to environmental liabilities, the remediation of any such liabilities would reduce funds otherwise available to us and could have a material

adverse effect on our financial condition. Laws and regulations intended to ensure the protection of the environment are constantly changing

and are generally becoming more restrictive.

Federal

legislation and regulations adopted and administered by the U.S. Environmental Protection Agency, Forest Service, Bureau of Land Management

(“BLM”), Fish and Wildlife Service, Mine Safety and Health Administration, and other federal agencies, and legislation such

as the Federal Clean Water Act, Clean Air Act, National Environmental Policy Act, Endangered Species Act, and Comprehensive Environmental

Response, Compensation, and Liability Act, have a direct bearing on U.S. exploration and mining operations within the United States.

These regulations will make the process for preparing and obtaining approval of a plan of operations much more time-consuming, expensive,

and uncertain. Plans of operation will be required to include detailed baseline environmental information and address how detailed reclamation

performance standards will be met. In addition, all activities for which plans of operation are required will be subject to review by

the BLM, which must make a finding that the conditions, practices or activities do not cause substantial irreparable harm to significant

scientific, cultural, or environmental resource values that cannot be effectively mitigated.

U.S.

federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

Although some mines continue to be approved in the United States, the process is increasingly cumbersome, time-consuming, and expensive,

and the cost and uncertainty associated with the permitting process could have a material effect on exploring and mining our properties.

Compliance with statutory environmental quality requirements described above may require significant capital investments, significantly

affect our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or

local governments may be changed or become more stringent in the future, which could materially and adversely affect our proposed activities.

As a result of these matters, our operations could be suspended or cease entirely.

At

this time, our Chandalar property does not include any federal lands and therefore we do not file plans of operations with the BLM. However,

we are subject to obtaining watercourse diversion permits from the U.S. Army Corp of Engineers.

Land

reclamation requirements for our properties may be burdensome and expensive.

Although

variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration

companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation

may include requirements to:

| ● | control

dispersion of potentially deleterious effluents; and |

| ● | reasonably

re-establish pre-disturbance land forms and vegetation. |

In

order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial

resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation

obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated

reclamation work, our financial position could be adversely affected.

Future

legislation and administrative changes to the mining laws could prevent us from exploring and operating our properties.

New

local, state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing

laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability

to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities

could cause us to cease operations. We are at this time unaware of any proposed Alaska state or U.S. federal laws and regulations that

would have an adverse impact on the future of our Alaska mining properties.

Regulations

and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material

adverse effect on our business.

A

number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change

interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose

significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment,

environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations

could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the political

significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and

regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation,

increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies

in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and

would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns

and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production

and financial performance of our operations.

We

do not insure against all risks.

Our

insurance policies will not cover all the potential risks associated with our operations. We may also be unable to maintain insurance

coverage to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate

to cover any resulting liability. Moreover, insurances against risks such as environmental pollution or other hazards as a result of

exploration and production are not generally available to us or to other companies in the mining industry on acceptable terms. We might

also become subject to liability for pollution or other hazards for which we may not be insured against or for which we may elect not

to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could

have a material adverse effect upon our financial condition and results of operations.

We