SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event)

May 19, 2014; (May 15, 2014)

GUIDED THERAPEUTICS, INC.

(Exact Name of Registrant as Specified

in Its Charter)

| |

|

|

| Delaware |

0-22179 |

58-2029543 |

| (State or Other Jurisdiction of |

(Commission File Number) |

(IRS Employer Identification No.) |

| Incorporation) |

|

|

| |

|

|

5835 Peachtree Corners East, Suite D

Norcross, Georgia

(Address of Principal Executive Offices) |

30092

(Zip Code) |

Registrant's Telephone Number, Including Area

Code: (770) 242-8723

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

|

Section 2.02 Results of Operations and Financial

Condition

On May 15, 2014, the registrant publicly released

its financial results for the first quarter ended March 31, 2014, as more fully described in the press release, a copy of which

is furnished as Exhibit 99.1 hereto and which information is incorporated herein by reference.

Section 7.01 (Regulation FD Disclosure)

On May 16, 2014, the registrant conducted a conference

call discussing its financial results for the first quarter ended March 31, 2014, and other matters concerning the operation of

the company, as more fully described in the prepared transcript of the call, a copy of which is furnished as Exhibit 99.2

hereto and which information is incorporated herein by reference.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits.

| |

|

| Number |

Exhibit |

| |

|

| 99.1 |

Press Release dated May 15, 2014 |

| 99.2 |

Transcript of Conference Call on May 16, 2014 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

|

GUIDED THERAPEUTICS, INC. |

|

| |

|

|

|

| |

By: |

/s/ Gene Cartwright |

|

| |

|

Gene Cartwright |

|

| |

|

Chief Executive Officer |

|

| Date: May 19, 2014 |

|

|

|

Exhibit

99.1

|

|

| |

5835

Peachtree Corners East, Suite D |

| |

Norcross, GA

30092 |

Contacts

Bill

Wells, Guided Therapeutics – 770-242-8723

Investors:

Alison Ziegler, Cameron Associates – 212-554-5469

Guided

Therapeutics Reports First Quarter 2014 Results

Key

Highlights:

| • | Productive

meeting held with FDA, plan to submit amended PMA within 45 days |

| • | Completed

$3.0 million private placement |

| • | Sales

momentum building for LuViva® Advanced Cervical Scan outside U.S. |

| • | Affirming

projected sales of $1 million to $3 million for 2014 |

Norcross,

GA (May 15, 2014) -- Guided Therapeutics, Inc. (OTCBB: GTHP) (OTCQB: GTHP) today announced its operating results for the first

quarter ended March 31, 2014.

Revenue

and other income for the first quarter ended March 31, 2014 was approximately $141,000, including approximately $122,000 in sales

of LuViva® devices and disposables, NIH grants totaling approximately $13,000, as well as other income from royalties of approximately

$5,000. Revenue for the three months ended March 31, 2013 was comprised of product sales of approximately $132,000, grants with

NIH and NCI totaling approximately $97,000, as well as other income from royalty and miscellaneous receipts of approximately $70,000.

The

net loss attributable to common stockholders for the first quarter of 2014 was approximately $1.6 million, or $0.02 per share,

compared to approximately $1.8 million, or $0.03 per share, in the comparable quarter of 2013. Cash on hand at March 31, 2014

was approximately $50,000, as compared to approximately $613,000 at December 31, 2013. Net inventory on hand at the end of the

quarter was approximately $1.3 million.

In

April 2014, the Company agreed to sell, in a private placement to Hanover Holdings I, LLC, an affiliate of Magna Group, up to

$3 million in aggregate principal amount of 6% Senior Convertible Notes, due 18 months from the date of issuance, for which the

Company has received an initial $1 million and expects to receive the remaining $2 million in May 2014. Management believes that

this financing, along with the Company’s anticipated future sales, should be sufficient to support existing operations through

the third quarter of 2014. The Company will be required to raise additional funds through public or private financing, additional

collaborative relationships or other relationships.

“We

are pleased to see LuViva revenue begin to build, with an increase of 130% sequentially from the fourth quarter on the shipment

of units and disposables to France, the U.K., Turkey, Nigeria, the United Arab Emirates and Indonesia,” said Gene Cartwright,

Chief Executive Officer of Guided Therapeutics. “We believe we are on track to report product sales of $1 million to $3

million for 2014, in line with our previous revenue guidance.”

“We

continue to work closely with our distributors to further penetrate our existing markets. Towards this end, we granted our Turkish

distributor, I.T.E.M. Medical Technologies Group, additional territories in North Africa and have agreed to begin the shipment

of orders to the Turkish Ministry of Health starting this month. This important order is valued at nearly $3 million and is projected

to ship over the next 18 months. We also look forward to welcoming members of the I.T.E.M. service team in Atlanta in a few weeks

for more in depth installation and service training on LuViva, in preparation for their expanding rollout,” Mr. Cartwright

said.

“LuViva

continues to be very well received and we believe that we have a great opportunity in developing markets including Turkey, Nigeria,

Kenya and Mexico, due to cervical cancer remaining a leading cause of cancer deaths in women in these countries. We continue to

make inroads in Canada and a number of European countries and the results of these evaluations have been favorable. We expect

to increase the number of customers who have gone live with our product in these areas over the next few months.”

“In

the U.S., we recently met face-to-face with the FDA to discuss our PMA application. We presented the agency with our proposed

answers to questions in the September not-approvable letter to help clarify our final responses. The meeting was constructive

and we were able to put forward our logic and arguments and have a good, detailed discussion with the FDA. We will incorporate

what was discussed into our formal response, which we hope to file within the next 45 days.”

“I

am extremely optimistic about the future of LuViva,” Cartwright concluded. “It is clear to us that there is a need

for our product, both as a triage test in more developed countries to address the significant and growing number of false positives

with current Pap and HPV screening, and as a primary screening test for cervical cancer in developing markets, where the Pap and

HPV test are not readily available. LuViva Screening trials are ongoing in Turkey and Nigeria and are soon to begin in Kenya and

Mexico, greatly expanding our addressable market. We look forward to continuing to work closely with our experienced distributors

to ensure the ultimate success of our product launch.”

Conference

Call

Guided

Therapeutics will hold a conference call at 11:00 a.m. EDT Friday, May 16, 2014, to discuss its financial results and corporate

developments. Interested parties are invited to listen to the call live over the Internet at http://www.guidedinc.com/investors.htm.

The live call is also available by dialing (888) 510-1785 or for international callers (719) 325-2354 and referencing Conference

ID 2913976.

A

replay of the teleconference will be available on http://www.guidedinc.com/investors.htm. A replay will also be available until

May 23, 2014 by dialing (877) 870-5176 or for international callers (858) 384-5517 and using pin number 2913976.

About

Guided Therapeutics

Guided

Therapeutics, Inc. (OTCBB: GTHP) (OTCQB: GTHP) is the maker of a rapid and painless testing platform based on its patented biophotonic

technology that utilizes light for the early detection of disease at the cellular level. The Company’s first product is

the LuViva® Advanced Cervical Scan, a non-invasive device used to detect cervical disease instantly and at the

point of care. In a multi-center clinical trial, with women at risk for cervical disease, the technology was able to detect cervical

cancer up to two years earlier than conventional modalities, according to published reports. Guided Therapeutics is also developing

a non-invasive test for the early detection of esophageal cancer using the technology platform. For more information, visit: www.guidedinc.com.

The

Guided Therapeutics LuViva® Advanced Cervical Scan is an investigational device and is limited by federal law to

investigational use. LuViva, the wave logo and "Early detection, better outcomes" are registered trademarks owned by

Guided Therapeutics, Inc.

Forward-Looking

Statements Disclaimer: A number of the matters and subject areas discussed in this news release that is not historical or current

facts deal with potential future circumstances and developments. The discussion of such matters and subject areas is qualified

by the inherent risks and uncertainties surrounding future expectations

generally

and also may materially differ from Guided Therapeutics’ actual future experience involving any of or more of such matters

and subject areas. Such risks and uncertainties include those related to the early stage of products in development, the uncertainty

of market acceptance of products, the uncertainty of development or effectiveness of distribution channels, the intense competition

in the medical device industry, the sufficiency of capital raised in our prior financings and our ability to realize their expected

benefits, the uncertainty of future capital to develop products or continue as a going concern, the uncertainty of regulatory

approval of products, and the dependence on licensed intellectual property, as well as those that are more fully described from

time to time under the heading “Risk Factors” in Guided Therapeutics’ reports filed with the SEC, including

Guided Therapeutics’ Annual Report on Form 10-K for the fiscal year ended December 31, 2013, and subsequent quarterly reports.

###MORE###

GUIDED

THERAPEUTICS, INC. AND SUBSIDIARY

Unaudited

Condensed Consolidated Statements of Operations

| | |

Quarter Ended

March 31, |

| In thousands, except per share data | |

2014 | |

2013 |

| Revenue | |

| | | |

| | |

| Contract and grant revenue | |

$ | 19 | | |

$ | 167 | |

Sales – devices and disposables | |

| 122 | | |

| 132 | |

| Cost of goods sold (recovery) | |

| 192 | | |

| 158 | |

| Gross loss | |

| (70 | ) | |

| (26 | ) |

Cost and Expenses | |

| | | |

| | |

| Research and development | |

$ | 607 | | |

$ | 813 | |

| Sales and marketing | |

| 283 | | |

| 164 | |

| General and administration | |

| 1,138 | | |

| 1,039 | |

| Total operating expense | |

$ | 2,028 | | |

$ | 2,016 | |

| Operating Loss | |

$ | (2,079 | ) | |

$ | (1,875 | ) |

| Other income | |

| 2 | | |

| 75 | |

| Interest expense | |

| (27 | ) | |

| (15 | ) |

| Change in fair value of warrants | |

| 542 | | |

| — | |

| Total other income | |

| 517 | | |

| 60 | |

| Net loss | |

| (1,562 | ) | |

| (1,815 | ) |

| Preferred Stock Dividends | |

| 48 | | |

| — | |

| Net Loss Attributable to Common Stockholders | |

$ | (1,610 | ) | |

$ | (1,815 | ) |

| Basic and Diluted Net Loss per Share | |

$ | (0.02 | ) | |

$ | (0.03 | ) |

Basic and Diluted

Weighted Average Shares Outstanding | |

| 71,451 | | |

| 63.671 | |

| Selected Balance Sheet Data (Unaudited) |

| (In thousands) | |

March 31, 2014 | |

December 31, 2013 |

| Cash & Cash Equivalents | |

$ | 50 | | |

$ | 613 | |

Inventory Working Capital | |

| 1,254 (1,286) | | |

| 1,193 268 | |

| Total Assets | |

| 2,596 | | |

| 3,316 | |

| Accumulated Deficit | |

| (104,635 | ) | |

| (103,025 | ) |

| Stockholders’ Equity(Deficit) | |

| (1,270 | ) | |

| 107 | |

###END###

1Q2014 Conference

Call Script - Final

May 16 - 11:00

a.m.

Opening – Alison Ziegler

Good morning

and welcome to the Guided Therapeutics conference call and webcast to discuss first quarter 2014 results.

For today's call

we have: Guided Therapeutics’ CEO Gene Cartwright and company controller Charles Rufai (Roof-eye) Certified Public Accountant.

During this

call the Company will be making forward-looking statements. These statements can obviously differ from actual results, so to rely

on them is subject to risk. Factors that could cause forward-looking statements in this call to differ materially from actual results

are discussed in the company's Form 10-K for the year ended December 31, 2013, and any subsequent filings with the Securities and

Exchange Commission

So at this time

I will turn the conference call over to Gene.

GENE

Good Morning and welcome.

While it has only been a month and a half since our fourth

quarter call -- we have made significant progress in key areas.

Before I provide a review of our international markets

for the LuViva Advanced Cervical Scan, let me start by updating you all on where we stand with the FDA.

As we stated in the press release issued earlier this

week, we held what we believe to be a very productive face-to-face meeting with FDA on May 8th regarding our premarket

approval application for LuViva. The purpose of the meeting was to present the agency with our proposed answers to questions raised

by the agency in the September 2013 not-approvable letter, and to help clarify our final responses. The meeting was constructive

and we were able to put forward our logic - and arguments - and engage in a detailed discussion. We will incorporate our responses

and FDA feedback into our formal response, which we plan to file within the next 45 days. The FDA will then have 180 days to respond

to our submission. We also anticipate additional dialogue with FDA as we proceed toward PMA approval. As I stated in our last call,

it is important to keep you updated on where we are in the FDA approval process and our plans and schedule going forward.

Next I would just like to comment briefly on the financing

we completed. In late April we successfully closed a private placement with Hanover Holdings, an affiliate of Magna Group, for

thee million dollars in 6% Senior Convertible Notes due 18 months from the date of issuance. These funds

will help to support manufacturing and marketing of the

LuViva and should last through the third quarter of 2014. We are pleased to have this behind us so we can return our focus to the

LuViva roll out.

We continued to make very good progress in the first

quarter with our international launch. Shipments of LuViva devices and disposables went to France, the United Kingdom, Turkey,

Nigeria, the United Arab Emirates and Indonesia as evaluations of LuViva turned to orders. In total we shipped seven LuViva units

in the quarter and about two-thousand and five-hundred Cervical Guide disposables. This was more than double the revenue from sales

in the fourth quarter. While it is still difficult to have high confidence in exactly how fast sales will grow, we continue to

believe we are on track to report product sales of $1 million to $3 million for 2014, in line with our previous revenue guidance.

We expect sales for 2015 to be significantly higher, and as we move closer to the end of the year we can provide more precise guidance

on 2015 sales projections.

We continue to work closely with our established distributors

to further penetrate our existing markets. Towards this end, we granted our Turkish distributor, I.T.E.M. Medical Technologies

Group, additional territories in North Africa. We have a very good working relationship with I.T.E.M and plan to begin the shipment

of orders to the Turkish Ministry of Health this month.

This important order is valued at nearly three million

dollars and is projected to ship over the next 18 months. We also look forward to welcoming members of the I.T.E.M. service team

to Atlanta in a few weeks for more in-depth installation and service training on LuViva in preparation for their expanding rollout.

LuViva continues to be very well received and we believe

that we have a great opportunity in developing markets including Turkey, Nigeria, Kenya and Mexico due to cervical cancer remaining

a leading cause of cancer deaths in women in these countries. In these markets, LuViva is being evaluated, and used, for primary

screening in addition to its use as a triage device.

In Nigeria positive results are being reported as a result

of two government evaluations. These two evaluations have moved quickly with over 400 patients tested to date. First, the federal

ministry is sponsoring a 100 patient study for the triage use, which is more than 60 percent complete. Orders for additional units

and disposables have been proposed by the principle investigator. Our distributor reports that a second study, a state government

study of 2,000 women has now converted to a sale with reorders of disposables expected when the stock for the clinical trial has

been depleted.

In Kenya, LuViva was launched in late April at an event

in Nairobi and presented at the Kenya Medical Association meeting. In addition to a planned evaluation at a large teaching hospital,

LuViva is under review for inclusion in local government and foundations programs for cervical cancer.

In Mexico, progress has been made with clinical protocols

for trials at two government hospitals. One of these two protocols was approved today to start. Regulatory review continues in

Mexico and we are still within this expected window of time for review. Separately, we are on track to begin a clinical study

for primary screening in Peru later this year.

In developing countries, there is very little Pap smear

or HPV testing done today due to the difficulty and expense of setting up laboratory infrastructure. Additionally, the fact that

LuViva gives an immediate result is important because of the problem of losing patients to follow up if the Pap smear or HPV test

takes days or weeks to complete. Since these LuViva evaluations are typically done in cooperation with the country’s Ministry

of Health, even one large evaluation can lead to very significant ongoing sales for LuViva.

Turning to developed markets such as Canada and Europe,

where LuViva will be used as a triage test on Pap smear positive women to determine which of these women are actually false positives

- we continue to make inroads. Results of ongoing evaluations have been favorable and we look forward to the presentation by Dr.

James Bentley, the Secretary General of the International Federation for Cervical Pathology and Colposcopy (IFCPC) later this month

at the International meeting in London. His experience is expected to mirror the results of our earlier clinical trial where we

demonstrated that LuViva can determine that 35% of the initial Pap smear positives are false positives with 99% confidence.

We are actively working with our distributors in 26

countries on evaluations of LuViva and expect to increase the number of customer evaluations as well as the number of customers

who have gone live with our product in these markets over the next few months, consistent with our sales forecast.

I am confident that there is a clinical need in both

developed and developing markets for LuViva. And in developed markets this need is expected to grow if the use of the HPV test

as a primary screener is adopted. It is a well-documented fact that HPV screening is more sensitive than the Pap test, but it also

generates as many as twice the number of false positives as the Pap test. We plan to prove that LuViva will be able to effectively

reduce the number of false positives generated specifically by the HPV screening test in a clinical study later this year in Europe.

Finally, we often get questioned about the financial

value proposition for LuViva. We have shown that the cost savings from the reduced number of colposcopies and biopsies more than

offsets the added cost of implementing LuViva.

With that I will turn the call over to Charles.

Charles

Thank you Gene.

Total revenue

for the three months ended March 31, 2014 was about 141 thousand dollars. This included 122 thousand dollars in sales of LuViva

devices and disposables. NIH grants totaled approximately $13,000 and other income from royalties was approximately $5,000 for

the three month period. Revenue for the same period in 2013 was comprised of product sales of approximately 132 thousand dollars,

grants with NIH and NCI totaling approximately 97 thousand dollars and other income from royalty and miscellaneous receipts of

approximately 70 thousand dollars.

The net

loss available to stockholders for the three months ended March 31, 2014 was about 1.6 million dollars, or two cents per share,

compared to a loss of about 1.8 million dollars, or three cents per share, for the same period last year.

We had a gross loss of about 70 thousand

dollars for the quarter just ended. Total operating expenses were relatively flat, with a decline in research and development expenses

being offset by an increase in both sales and marketing and general and administrative expenses. We also saw a positive impact

of 542 thousand dollars due to warrant valuation in the quarter.

While cash on hand at the end of the first quarter was

about 50 thousand dollars compared to 613 thousand dollars at the end of our fiscal year on December 31, 2013, in April we raised

3 million dollars in a private placement of 6% Senior Convertible Notes due 18 months from the date of issuance. To date we have

received an initial 1 million dollars. Net proceeds from the private placement are intended to be used for general corporate purposes,

including supporting manufacturing and marketing of the LuViva® Advanced Cervical Scan.

With our projected monthly burn rate remaining at about

450 thousand dollars, and future estimated sales, we anticipate cash lasting through the third quarter of 2014. The Company will

be required to raise additional funds through public or private financing, additional collaborative relationships or other new

relationships and we continue to evaluate various options to manage our cash requirements, as well as options to raise additional

funds, including loans.

At March 31, 2014, net account receivables

based on current invoices totaled about 122 thousand dollars, compared to about 133 thousand dollars at the end of our fiscal year

ended December 31, 2013.

The Company had approximately 1.3

million dollars of net inventory on hand at the end of the quarter.

At March 31,

2014, the Company had outstanding warrants exercisable for approximately 11.6 million shares of common stock, with exercise prices

of $0.40, $0.80 and 1.08 per share averaging approximately $0.67. If exercised, these warrants could bring in about 7.8 million

dollars in cash over the next four years.

To provide a

bit more detail on some of the near term warrant expirations, 471,856 warrants with an exercise price of $0.80 come due on July

26, 2014 for a potential 377,485 dollars. On March 1, 2015, 3,590,522 warrants come due with an exercise price of $0.80 for a potential

2.87 million dollars. Additional detail can be seen in our Form 10-Q.

At the end of

the quarter the Company had approximately 71.8 million shares outstanding.

I’ll now

turn the call back over to Gene…….

GENE

Finally,

before we open the call to your questions, I’d like to update everyone on our key goals for 2014:

| · | First, continue to grow international sales of LuViva to reach our

$1 million to $3 million 2014 sales target. We will do this by focusing on customers with the largest potential disposable volume

due to the strong profitability of our cervical guide disposable. |

| · | Second, push forward as quickly as possible with the filing of our

PMA towards achieving ultimate FDA approval for LuViva. |

| · | Third, ensure we have the necessary capital to fund ongoing operations

and carry the company through to breakeven |

And lastly, as we continue to get

more traction in the market and are better able to forecast sales growth, we will increase our investor relations and public relations

efforts to raise the profile of Guided Therapeutics. . We want to create more buyers for our stock and we’ve got a good story

to tell.

There are a number of reasons why

I’m optimistic about the future for our company.

First, the market for our product

is large and the clinical need is significant -- both as a triage test in more developed countries to address the significant and

growing number of false positives with current Pap and HPV screening, and as a primary screening test for cervical cancer in developing

markets where the Pap and HPV test are not readily available. Secondly, we continue to get a very positive reception for our product

in the market. Third, the profitability of our disposable is high. And lastly, our burn rate is low, enabling us to be cash flow

positive on a monthly basis with annual sales of just $7-$10 million dollars.

Launching a new product that changes

doctors’ behavior is never simple but we will continue to work closely with our experienced distributors to ensure the ultimate

success of our product launch.

Thank you for your time. We look

forward to updating you on our progress in the weeks and months to come. I’ll now turn the call over to the operator for

your questions.

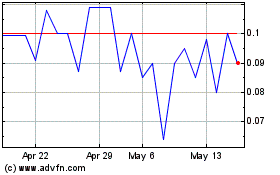

Guided Therapeutics (QB) (USOTC:GTHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

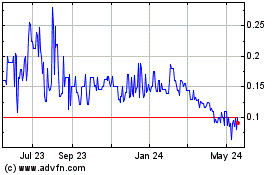

Guided Therapeutics (QB) (USOTC:GTHP)

Historical Stock Chart

From Jul 2023 to Jul 2024