Regulatory News:

LafargeHolcim (Paris:LHN):

PERFORMANCE OVERVIEW

Group (in million CHF) H1 2020 H1 2019 +/-% +/-% LfL

Net sales 10,693 13,059 -18.1 -10.8

Recurring EBIT 1,194 1,667 -28.4 -22.0

Recurring EBIT margin 11.2 12.8

Net income(2) 347 1,009 -65.7

Net income before impairment and

divestments(2) 501 769 -34.8

EPS 0.55 1.68

EPS before impairment and

divestments 0.80 1.28 -37.1

Free cash flow(1) 749 252 +198

Net financial debt 10,652 12,650 -15.8

Jan Jenisch, CEO: "I'm very proud of our teams' rapid and agile

response to the crisis since the beginning of January. We were

quick to respond and take all necessary measures to protect the

health of our people while supporting our communities, from

donating materials to build emergency field hospitals all the way

to supplying essential goods, touching the lives of over four

million people around the world.

"Our half-year results demonstrate the great resilience of our

business. I'm encouraged by our team's agility to weather the storm

with the rapid execution of our "HEALTH, COST & CASH" action

plan, effectively driving cost savings ahead of expectations,

improving net working capital and delivering record free cash

flow(1) .

"The peak of the crisis is behind us. We expect a solid second

half of the year based on June's full recovery, the trend of our

order book and upcoming government stimulus packages.

"As an essential sector to keep society running, we look forward

to playing our part in driving the recovery. We are accelerating

our sustainability efforts to ensure our green solutions are fully

part of the recovery. I am confident LafargeHolcim will emerge

stronger from this crisis."

RESILIENT PERFORMANCE AND RECORD FREE CASH FLOW(1)

Net sales of CHF 10,693 million decreased by 18.1% compared to

the prior year, of which 10.8% was on a like-for-like basis,

reflecting the severe impact of the implementation of strict

lockdowns of construction sites in several major operating

countries. The strong appreciation of the CHF against all

currencies accounted for 6.2% of the absolute decrease. Following

the easing of the lockdowns, net sales in all five regions resumed

prior-year levels by the end of June.

Recurring EBIT reached CHF 1,194 million, a decrease of 22.0%

like-for-like for the half year. Swift implementation of the

"HEALTH, COST & CASH" action plan helped to offset the earnings

impact of the crisis.

Tax and financial expenses have continued to reduce, allowing

net income(2,3) to reach CHF 501 million.

Earnings per share(3) were CHF 0.80 for the first half of 2020

compared to CHF 1.28 in the prior-year period.

Free cash flow(1) reached a record CHF 749 million in the

six-month period, up 198% compared to CHF 252 million in the first

half of 2019.

Net debt amounted to CHF 10.7 billion as at 30 June 2020, down

by 15.8% compared to CHF 12.7 billion as at 30 June 2019.

BUILDING A HEALTHIER WORLD TOGETHER

Since the beginning of the crisis, LafargeHolcim teams around

the world have undertaken extraordinary measures to fight COVID-19

across their communities, touching the lives of more than four

million people. Advancing access to health infrastructure for all,

LafargeHolcim donated five million kilograms of material to build

emergency field hospitals from Wuhan to Boston. Furthermore, the

Group donated over two million relief and emergency kits, including

personal protective equipment, food and water.

In the first half of 2020 LafargeHolcim achieved a number-one

Environmental, Social and Governance (ESG) ranking in the

construction materials sector out of more than one-hundred peer

companies, according to ESG research and ratings agency

Sustainalytics. Playing its part in a green recovery, LafargeHolcim

is advancing its leadership in sustainable and circular

construction, notably with the worldwide rollout of ECOPact, its

green concrete. Further accelerating the transition to renewable

energy, LafargeHolcim leveraged 3D printing in an innovative

partnership with GE Renewable Energy and COBOD to build more

powerful wind turbines.

OUTLOOK 2020

Based on the speed of June's rebound, the company expects a

solid second half of the year and anticipates for full year 2020(4)

:

-- Fast demand recovery with an encouraging outlook for the second half of

2020

-- Execution of action plan "HEALTH, COST & CASH" to continue ahead of

targets

-- Free cash flow1 generation above CHF 2 billion

-- Debt leverage below 2x

-- Solid second half of the year expected

KEY GROUP FIGURES

Group Q2 2020 2019 +/-% +/-% LfL

Net sales (CHFm) 5,400 7,099 -23.9 -17.0

Recurring EBIT (CHFm) 932 1,362 -31.6 -26.1

Recurring EBIT margin (%) 17.3 19.2

Group H1 2020 2019 +/-% +/-% LfL

Net sales (CHFm) 10,693 13,059 -18.1 -10.8

Recurring EBIT (CHFm) 1,194 1,667 -28.4 -22.0

Recurring EBIT margin (%) 11.2 12.8

Operating profit (EBIT) 1,005 1,581 -36.4

Net income2 347 1,009 -65.7

Net Income before impairment and

divestments(2) 501 769 -34.8

EPS before impairment and

divestments 0.80 1.28 -37.1

Cash flow from operating activities 1,330 1,067 24.7

Free cash flow(1) 749 252 198

Net financial debt 10,652 12,650 -15.8

Group results by segment H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 87.2 103.8 -16.0 -13.1

Net sales of cement (CHFm) 7,029 8,783 -20.0 -11.6

Recurring EBIT of cement (CHFm) 1,131 1,441 -21.5 -14.0

Recurring EBIT margin of cement (%) 16.1 16.4

Sales of Aggregates (mt) 113.8 121.7 -6.5 -6.0

Net sales of Aggregates (CHFm) 1,699 1,907 -10.9 -5.5

Recurring EBIT of Aggregates (CHFm) 101 174 -42.0 -40.1

Recurring EBIT margin of Aggregates (%) 5.9 9.1

Sales of Ready-Mix Concrete (m m(3) ) 19.2 23.6 -18.6 -15.8

Net sales of Ready-Mix Concrete (CHFm) 2,103 2,595 -19.0 -12.3

Recurring EBIT of Ready-Mix Concrete

(CHFm) -47 13 -475.6 -617.4

Recurring EBIT margin of Ready-Mix

Concrete (%) -2.2 0.5

Net sales of Solutions & Products (CHFm) 819 996 -17.8 -13.9

Recurring EBIT of Solutions & Products

(CHFm) 6 39 -84.0 -94.9

Recurring EBIT margin of Solutions &

Products (%) 0.8 3.9

REGIONAL PERFORMANCE H1

Asia Pacific

The Asia Pacific region experienced the most severe COVID-19

related disruption yet delivered a resilient Recurring EBIT margin,

led by India and supported by effective cost and price management

as well as lower input costs. China delivered a full recovery over

the second quarter with volumes closing at higher levels than in

the prior-year period and activity was also resilient in

Australia.

Asia Pacific H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 28.0 38.9 -28.0 -21.0

Sales of aggregates (mt) 13.1 13.3 -1.4 2.2

Sales of ready-mix concrete (m m(3) ) 3.6 5.2 -31.0 -16.4

Net sales to external customers (CHFm) 2,413 3,417 -29.4 -18.0

Recurring EBIT (CHFm) 437 682 -35.9 -29.6

Recurring EBIT margin (%) 18.1 19.9

Europe

Results for the Europe region were impacted by COVID-19 with

full recovery in June. Markets in Germany, Central and Eastern

Europe were resilient. Strict lockdown measures in the UK and

France impacted the performance of the region. Volumes suggest a

V-shaped recovery in June for the majority of markets, except in

the UK.

Europe H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 20.9 22.5 -7.0 -7.0

Sales of aggregates (mt) 51.9 57.2 -9.3 -9.2

Sales of ready-mix concrete (m m(3) ) 8.3 9.6 -14.2 -14.6

Net sales to external customers (CHFm) 3,274 3,796 -13.8 -9.4

Recurring EBIT (CHFm) 288 408 -29.4 -26.2

Recurring EBIT margin (%) 8.7 10.6

Latin America

The Latin America region showed an expanding Recurring EBIT

margin amid COVID-19, with an especially strong contribution from

Mexico. Performances in Ecuador, Colombia and El Salvador were

significantly impacted by the pandemic. Most markets experienced a

strong recovery in June.

Latin America H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 10.4 12.1 -14.3 -14.3

Sales of aggregates (mt) 2.2 2.0 7.8 7.8

Sales of ready-mix concrete (m m(3) ) 1.6 2.5 -34.7 -34.7

Net sales to external customers (CHFm) 980 1,331 -26.4 -12.1

Recurring EBIT (CHFm) 275 358 -23.0 -12.0

Recurring EBIT margin (%) 27.9 26.7

Middle East Africa

The Middle East Africa region showed resilient margins and

recovery from the impact of COVID-19 by June. Volumes declined in

Algeria, Egypt, Iraq and South Africa due to government

restrictions and curfews. Ramadan in May slowed down the recovery

in the respective countries. Nigeria delivered a resilient

performance.

Middle East Africa H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 15.6 17.6 -11.6 -11.6

Sales of aggregates (mt) 1.4 3.4 -60.1 -60.1

Sales of ready-mix concrete (m m(3) ) 1.2 1.9 -35.7 -35.7

Net sales to external customers (CHFm) 1,177 1,476 -20.3 -14.8

Recurring EBIT (CHFm) 137 193 -29.3 -27.0

Recurring EBIT margin (%) 11.5 13.0

North America

The North America region delivered a remarkable performance with

a Recurring EBIT up 20 percent for the first half of 2020 over the

prior-year period on a like-for-like basis. This leading

performance amid COVID-19 was largely due to fast and effective

cost management in the US, partly offset by the impact of lockdowns

in Eastern Canada and the economic challenges facing Western Canada

due to a slowdown in the oil & gas industry.

North America H1 2020 H1 2019 +/-% +/-% LfL

Sales of cement (mt) 8.9 9.0 -1.4 -1.4

Sales of aggregates (mt) 45.2 45.7 -1.1 -0.6

Sales of ready-mix concrete (m m(3) ) 4.5 4.4 2.7 1.5

Net sales to external customers (CHFm) 2,566 2,645 -3.0 0.8

Recurring EBIT (CHFm) 260 225 15.6 19.7

Recurring EBIT margin (%) 10.1 8.5

RECONCILIATION TO GROUP ACCOUNTS

Reconciling measures of profit and loss to the LafargeHolcim

Group's consolidated statement of income

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Net sales 10,693 13,059

Recurring operating costs (8,717) (10,658)

Share of profit of joint ventures 176 272

Recurring EBITDA after leases 2,152 2,673

Depreciation and amortization of property, plant

and equipment, intangible and long-term assets (958) (1,007)

Recurring EBIT 1,194 1,667

Restructuring, litigation and other non-recurring

costs (39) (71)

Impairment of operating assets (151) (14)

Operating profit 1,005 1,581

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Recurring EBITDA after leases 2,152 2,673

Depreciation of right-of-use assets 185 205

Recurring EBITDA 2,337 2,878

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Recurring fixed costs (2,922) (3,436)

Recurring variable costs (5,795) (7,222)

Recurring operating costs (8,717) (10,658)

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Net income 447 1,128

Impairment (143) (23)

Profit/(loss) on divestments (11) 265

Net income before impairment and divestments 601 886

Net income before impairment and divestments Group

share 501 769

Reconciliation of the Free Cash Flow after leases to the

consolidated cash flows of the LafargeHolcim Group

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Cash flow from operating activities 1,330 1,067

Purchase of property, plant and equipment (442) (647)

Disposal of property, plant and equipment 30 41

Repayment of long-term lease liabilities (169) (209)

Free cash flow after leases 749 252

Reconciliation of Net financial debt to the consolidated

statement of financial position of the LafargeHolcim Group

H1 2020 H1 2019

Million CHF (Unaudited) (Unaudited)

Current financial liabilities 2,736 2,862

Long-term financial liabilities 11,697 12,886

Cash and cash equivalents 3,736 3,045

Short-term derivative assets 14 29

Long-term derivative assets 31 25

Net financial debt 10,652 12,650

NON-GAAP DEFINITIONS

Some non-GAAP measures are used in this release to help describe

the performance of LafargeHolcim. A full set of these non-GAAP

definitions can be found on our website.

Measures Definition

Like-for-like Like-for-like information is

information factoring out changes in

the scope of consolidation (such as

divestments and acquisitions occurring

in 2020 and 2019) and currency

translation effects (2020 figures are

converted with 2019 exchange rates in

order to calculate the currency

effects).

Recurring fixed costs Recurring fixed costs refer to all

recurring costs not directly related

to volumes such as Maintenance,

Personal costs in Production,

Administration, Marketing and Sales

Expenses, Third party services and

depreciation of right-of-use assets.

Recurring variable costs Recurring variable costs include

recurring operating costs directly

related to volumes such as raw

materials and finished goods

purchases, inventory variation,

energy, quarry outsourcing and

distribution costs. The addition of

variable and fixed recurring costs

equals the total recurring operating

costs.

Recurring operating costs The Recurring operating costs is an

indicator representing all recurring

costs. It is defined as: +/--

Recurring EBITDA after leases; -- net

sales; and -- share of profit of joint

ventures

Recurring EBITDA The Recurring EBITDA (earnings before

interest, tax, depreciation and

amortization) is an indicator to

measure the performance of the group

excluding the impacts of non-recurring

items. It is defined as: +/--

Operating profit (EBIT) -

depreciation, amortization and

impairment of operating assets -

restructuring, litigation and other

non-recurring costs

Recurring EBITDA Margin The Recurring EBITDA margin is an

indicator to measure the profitability

of the Group excluding the impacts of

non-recurring items. It is defined as

the Recurring EBITDA divided by net

sales.

Recurring EBITDA after leases The Recurring EBITDA after leases

(earnings before interest, tax,

depreciation and amortization) is an

indicator to measure the performance

of the Group including the impacts of

lease depreciation and excluding the

impacts of non-recurring items. The

Recurring EBITDA after leases is

defined as the Recurring EBITDA less

the depreciation of right-of-use

assets.

Recurring EBIT The Recurring EBIT is defined as

Operating profit/loss (EBIT) adjusted

for restructuring, litigation and

other non-recurring costs and for

impairment of operating assets.

Restructuring, litigation and other Restructuring, litigation and other

non-recurring costs non-recurring costs comprise

significant items that, because of

their exceptional nature, cannot be

viewed as inherent to the Group's

ongoing performance, such as strategic

restructuring, major items relating to

antitrust fines and other business

related litigation cases.

Profit/loss on disposals and other Profit/loss on disposals and other

non-operating items non-operating items comprise capital

gains or losses on the sale of Group

companies and of material property,

plant and equipment and other

non-operating items that are not

directly related to the Group's normal

operating activities such as

revaluation gains or losses on

previously held equity interests,

disputes with non-controlling interest

and other major lawsuits.

Net income/loss before impairment and Net income/loss before impairment and

divestments divestments excludes impairment

charges and capital gains and losses

arising on disposals of investments

which, because of their exceptional

nature, cannot be viewed as inherent

to the Group's ongoing activities. It

is defined as: +/- Net income/loss -

gains and losses on disposals of Group

companies - impairments of goodwill

and long-term assets

EPS (Earnings Per Share) before The EPS (Earnings Per Share) before

impairment and divestments impairment and divestments is an

indicator that measures the

theoretical profitability per share of

stock outstanding based on a net

income/loss before impairment and

divestments. It is defined as Net

income/loss before impairment and

divestments attributable to the

shareholders of LafargeHolcim divided

by the weighted average number of

shares outstanding.

Capex or Capex Net (Net Maintenance The Capex or Capex Net (Net

and Expansion Capex) Maintenance and Expansion Capex) is an

indicator to measure the cash spent to

maintain or expand its asset base. It

is defined as: + Expenditure to

increase existing or create additional

capacity to produce, distribute or

provide services for existing products

(expansion) or to diversify into new

products or markets (diversification)

+ Expenditure to sustain the

functional capacity of a particular

component, assembly, equipment,

production line or the whole plant,

which may or may not generate a change

of the resulting cash flow -- Proceeds

from sale of property, plant and

equipment

Free Cash Flow after leases The Free Cash Flow after leases is an

indicator to measure the level of cash

generated by the Group after spending

cash to maintain or expand its asset

base. It is defined as: +/-- Cash flow

from operating activities -- Net

Maintenance and Expansion Capex --

Repayment of long-term lease

liabilities

Net financial debt ("Net debt") The Net financial debt ("net debt") is

an indicator to measure the financial

debt of the Group after deduction of

the cash. It is defined as: +

Financial liabilities (short-term and

long-term) including derivative

liabilities -- Cash and cash

equivalents -- Derivative assets

(short-term and long-term)

Debt Leverage The Net financial debt to Recurring

EBITDA ratio is used as an indicator

of financial risk and shows how many

years it would take the Group to pay

back its debt.

Cash conversion The cash conversion is an indicator

that measures the Group's ability to

convert profits into available cash.

It is defined as Free Cash Flow after

leases divided by Recurring EBITDA

after leases.

ADDITIONAL INFORMATION

The analyst presentation of the results and our 2020 half-year

report are available on our website at www.lafargeholcim.com

The financial statements are based on IFRS can be found on the

LafargeHolcim Group website.

Media conference: 09:00 CET Analyst conference: 10:00 CET

Switzerland: +41 58 310 5000

France: +33 1 7091 8706

UK: +44 207 107 0613

US: +1 631 570 5613

About LafargeHolcim

LafargeHolcim is the global leader in building materials and

solutions and active in four business segments: Cement, Aggregates,

Ready-Mix Concrete and Solutions & Products. Its ambition is to

lead the industry in reducing carbon emissions and shifting towards

low-carbon construction. With the strongest R&D organization in

the industry, the company seeks to constantly introduce and promote

high-quality and sustainable building materials and solutions to

its customers worldwide - whether individual homebuilders or

developers of major infrastructure projects. LafargeHolcim employs

over 70,000 employees in over 70 countries and has a portfolio that

is equally balanced between developing and mature markets.

More information is available on www.lafargeholcim.com

Important disclaimer - forward-looking statements:

This document contains forward-looking statements. Such

forward-looking statements do not constitute forecasts regarding

results or any other performance indicator, but rather trends or

targets, as the case may be, including with respect to plans,

initiatives, events, products, solutions and services, their

development and potential. Although LafargeHolcim believes that the

expectations reflected in such forward-looking statements are based

on reasonable assumptions as at the time of publishing this

document, investors are cautioned that these statements are not

guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are difficult to

predict and generally beyond the control of LafargeHolcim,

including but not limited to the risks described in the

LafargeHolcim's annual report available on its website

(www.lafargeholcim.com) and uncertainties related to the market

conditions and the implementation of our plans. Accordingly, we

caution you against relying on forward-looking statements.

LafargeHolcim does not undertake to provide updates of these

forward-looking statements.

(1) After leases

(2) Group share

(3) Before impairment and divestments

(4) Subject to pandemic-related uncertainties

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200729005862/en/

CONTACT: Media Relations:

media@lafargeholcim.com

+41 (0) 58 858 87 10

Investor Relations:

investor.relations@lafargeholcim.com

+41 (0) 58 858 87 87

SOURCE: LafargeHolcim

Copyright Business Wire 2020

(END) Dow Jones Newswires

July 30, 2020 00:45 ET (04:45 GMT)

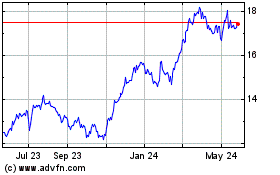

Holcim (PK) (USOTC:HCMLY)

Historical Stock Chart

From Feb 2025 to Mar 2025

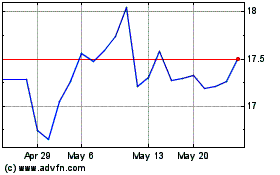

Holcim (PK) (USOTC:HCMLY)

Historical Stock Chart

From Mar 2024 to Mar 2025