UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934 |

For the quarterly period ended June 30, 2015

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934 |

For the transaction period from _____________

to _____________

Commission file number 333-62216

HEALTH DISCOVERY CORPORATION

(Exact name of registrant as specified in its

charter)

Georgia

(State or other jurisdiction of incorporation or organization) |

74-3002154

(IRS Employer Identification No.) |

4243 Dunwoody Club Drive

Suite 202

Atlanta, Georgia 30350

(Address of principal

executive offices)

(678) 336-5300

(Registrant's telephone number, including area

code)

(Former name,

former address and former fiscal year,

if changed since the last report)

Indicate by check mark whether the registrant: (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at least

the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes x No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (check one):

| |

Large Accelerated Filer ¨ |

Non-Accelerated Filer ¨ |

| |

|

|

| |

|

(do not check if a smaller reporting company) |

| |

|

|

| |

Accelerated Filer ¨ |

Smaller Reporting Company x |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of

each of the issuer's classes of common stock, as of the latest practicable date:

| Class: |

Outstanding as of August 14, 2015 |

| |

|

| Common Stock, no par value |

264,718,989 |

| |

|

| Series A Preferred Stock |

0 |

| |

|

| Series B Preferred Stock |

0 |

| |

|

| Series C Preferred Stock |

30,000,000 |

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

HEALTH DISCOVERY CORPORATION

Balance Sheets

(unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 30,325 | | |

$ | 7,642 | |

| Accounts Receivable | |

| - | | |

| 1,969 | |

| Investment in Available For Sale Securities (Note G) | |

| 129,564 | | |

| 362,373 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 159,889 | | |

| 371,984 | |

| | |

| | | |

| | |

| Equipment, Less Accumulated Depreciation of $60,301 and $59,765 as of June 30, 2015 and December 31, 2014, respectively | |

| 584 | | |

| 1,120 | |

| | |

| | | |

| | |

| Other Assets | |

| | | |

| | |

| Patents, Less Accumulated Amortization of $2,913,369 and $2,782,009 as of June 30, 2015 and December 31, 2014, respectively | |

| 1,072,425 | | |

| 1,203,785 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 1,232,898 | | |

$ | 1,576,889 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts Payable - Trade | |

$ | 274,993 | | |

$ | 239,910 | |

| Dividends Payable | |

| 206,637 | | |

| 373,346 | |

| Deferred Revenue | |

| 43,388 | | |

| 43,388 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 525,018 | | |

| 656,644 | |

| | |

| | | |

| | |

| Long Term Liabilities | |

| | | |

| | |

| Deferred Revenue | |

| 126,547 | | |

| 148,240 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 651,565 | | |

| 804,884 | |

| | |

| | | |

| | |

| Stockholders' Equity | |

| | | |

| | |

| Series C Preferred Stock, Convertible, 30,000,000 Shares Authorized, 11,066,667 Issued and Outstanding at June 30, 2015 6,640,000 Issued and Outstanding at December 31, 2014 | |

| 332,000 | | |

| 332,000 | |

| Common Stock, No Par Value, 300,000,000 Shares Authorized 264,718,989 Shares Issued and Outstanding at June 30, 2015 261,384,810 Shares Issued and Outstanding at December 31, 2014 | |

| 27,256,787 | | |

| 27,055,938 | |

| Accumulated Deficit | |

| (27,007,454 | ) | |

| (26,615,933 | ) |

| | |

| | | |

| | |

| Total Stockholders' Equity | |

| 581,333 | | |

| 772,005 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 1,232,898 | | |

$ | 1,576,889 | |

See accompanying notes to financial statements.

HEALTH DISCOVERY CORPORATION

Statements of Operations

(unaudited)

For the Three and Six Months Ended June 30,

2015 and 2014

| | |

Three Months | | |

Three Months | | |

Six Months | | |

Six Months | |

| | |

Ended | | |

Ended | | |

Ended | | |

Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Licensing & Development | |

$ | 10,857 | | |

$ | 256,295 | | |

$ | 21,704 | | |

$ | 517,654 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Amortization | |

| 65,680 | | |

| 65,680 | | |

| 131,360 | | |

| 131,360 | |

| Professional and Consulting Fees | |

| 30,778 | | |

| 25,798 | | |

| 98,411 | | |

| 117,715 | |

| Legal Fees | |

| 10,040 | | |

| 17,698 | | |

| 28,357 | | |

| 34,379 | |

| Research & Development Fees | |

| 9,000 | | |

| 23,887 | | |

| 22,813 | | |

| 47,325 | |

| Compensation | |

| 47,582 | | |

| 60,826 | | |

| 94,337 | | |

| 139,356 | |

| Other General and Administrative Expenses | |

| 51,230 | | |

| 50,556 | | |

| 83,210 | | |

| 94,241 | |

| Total Operating Expenses | |

| 214,310 | | |

| 244,445 | | |

| 458,488 | | |

| 564,376 | |

| | |

| | | |

| | | |

| | | |

| | |

| (Loss) Income From Operations | |

| (203,453 | ) | |

| 11,850 | | |

| (436,784 | ) | |

| (46,722 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| Unrealized Loss on Available for Sale Securities (Note G) | |

| (40,763 | ) | |

| (74,250 | ) | |

| (142,789 | ) | |

| (145,050 | ) |

| Realized Gain on Available for Sale Securities (Note G) | |

| 71,788 | | |

| 49,486 | | |

| 205,745 | | |

| 102,566 | |

| Settlement Expense (Note H) | |

| - | | |

| - | | |

| (17,693 | ) | |

| - | |

| Total Other Income (Expense) | |

| 31,025 | | |

| (24,764 | ) | |

| 45,263 | | |

| (42,484 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (172,428 | ) | |

| (12,914 | ) | |

| (391,521 | ) | |

| (89,206 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Preferred Stock Dividends | |

| - | | |

| 17,607 | | |

| - | | |

| 35,020 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Attributable to Common Stockholders | |

$ | (172,428 | ) | |

$ | (30,521 | ) | |

$ | (391,521 | ) | |

$ | (124,226 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Outstanding Shares | |

| 264,718,989 | | |

| 252,557,310 | | |

| 264,718,989 | | |

| 252,557,310 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss Per Share (basic and diluted) | |

$ | (0.0007 | ) | |

$ | (0.0001 | ) | |

$ | (0.0015 | ) | |

$ | (0.0005 | ) |

See accompanying notes to financial statements.

HEALTH DISCOVERY CORPORATION

Statements of Cash Flows

(unaudited)

For the Six

Months Ended June 30, 2015 and 2014

| | |

2015 | | |

2014 | |

| Cash Flows From Operating Activities | |

| | | |

| | |

| Net Loss | |

$ | (391,521 | ) | |

$ | (89,206 | ) |

| Adjustments to Reconcile Net Loss to Net Cash Used in Operating Activities: | |

| | | |

| | |

| Stock-based Compensation for Employees | |

| 7,674 | | |

| 7,675 | |

| Stock-based Compensation for Directors and Consultants | |

| 26,466 | | |

| 29,756 | |

| Realized Gain on Investments in Available for Sale Securities Measured in Accordance with the Fair Value Option (Note G) | |

| (205,745 | ) | |

| (102,566 | ) |

| Unrealized Loss on Investments in Available for Sale Securities Measured in Accordance with the Fair Value Option (Note G) | |

| 142,789 | | |

| 145,050 | |

| Depreciation and Amortization | |

| 131,896 | | |

| 133,984 | |

| Decrease in Accounts Receivable | |

| 1,969 | | |

| 80 | |

| Decrease in Deferred Revenue | |

| (21,693 | ) | |

| (512,494 | ) |

| Increase in Accounts Payable – Trade | |

| 35,083 | | |

| 23,026 | |

| Net Cash Used in Operating Activities | |

| (273,082 | ) | |

| (364,695 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities: | |

| | | |

| | |

| Proceeds from Sale of Available for Sale Securities (Note G) | |

| 295,765 | | |

| 166,916 | |

| Net Cash Provided by Investing Activity | |

| 295,765 | | |

| 166,916 | |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Proceeds from Series C Preferred Stock Issuance | |

| - | | |

| 147,000 | |

| Net Cash Provided by Financing Activity | |

| - | | |

| 147,000 | |

| | |

| | | |

| | |

| Net Increase (Decrease) in Cash | |

| 22,683 | | |

| (50,779 | ) |

| | |

| | | |

| | |

| Cash, at Beginning of Period | |

| 7,642 | | |

| 71,991 | |

| | |

| | | |

| | |

| Cash, at End of Period | |

$ | 30,325 | | |

$ | 21,212 | |

See accompanying notes to financial statements.

HEALTH DISCOVERY CORPORATION

Notes to Financial Statements (unaudited)

Note A - BASIS OF PRESENTATION

Health Discovery Corporation

(the “Company”) is a biotechnology-oriented company that has acquired patents and has patent pending applications for

certain machine learning tools, primarily pattern recognition techniques using advanced mathematical algorithms to analyze large

amounts of data thereby uncovering patterns that might otherwise be undetectable. Such machine learning tools are currently

in use for diagnostics and drug discovery, but are also marketed for other applications. The Company licenses the use

of its patent protected technology and may provide services to develop specific learning tools under development agreements or

to sell to third parties.

The accounting principles

followed by the Company and the methods of applying these principles conform with accounting principles generally accepted in the

United States of America (GAAP). In preparing financial statements in conformity with GAAP, management is required to make estimates

and assumptions that affect the reported amounts in the financial statements. Actual results could differ significantly from those

estimates.

The interim

financial statements included in this report are unaudited but reflect all adjustments which, in the opinion of management,

are necessary for a fair presentation of the financial position and results of operations for the interim periods presented.

All such adjustments are of a normal recurring nature. The results of operations for the three and six month periods ended

June 30, 2015 are not necessarily indicative of the results of a full year’s operations and should be read in

conjunction with the financial statements and footnotes included in the Company’s annual report on Form 10-K for the

year ended December 31, 2014.

Note B – REVENUE RECOGNITION

Revenue is generated through

the sale or license of patented technology and processes and from services provided through development agreements. These

arrangements are generally governed by contracts that dictate responsibilities and payment terms. The Company recognizes

revenues as they are earned over the duration of a license agreement or upon the sale of any owned patent once all contractual

obligations have been fulfilled. If a license agreement has an undetermined or unlimited life, the revenue is recognized

over the remaining expected life of the patents. Revenue is recognized under development agreements in the period the services

are performed.

The Company treats the

incremental direct cost of revenue arrangements, which consists principally of employee bonuses, as deferred charges and these

incremental direct costs are amortized to expense using the straight-line method over the same term as the related deferred revenue

recognition.

Deferred revenue represents

the unearned portion of payments received in advance for licensing and development agreements. The Company had total unearned revenue

of $169,935 as of June 30, 2015. Unearned revenue of $43,388 is recorded as current and $126,547 is classified as long-term.

Note C - NET LOSS PER SHARE

Basic Earnings Per

Share (“EPS”) includes no dilution and is computed by dividing net loss attributable to common stockholders by the

weighted average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution of

securities that could share in the earnings or losses of the entity. Due to the net loss in all periods presented, the

calculation of diluted per share amounts would create an anti-dilutive result and therefore is not presented.

Note D - STOCK-BASED COMPENSATION and

other EQUITY BASED PAYMENTS

Stock-based expense

included in our net loss for the three months and six months ended June 30, 2015 consisted of $17,071 and $34,140

respectively, for stock options granted to directors, officers and advisors. Stock-based expense included in our net loss for

the three months and six months ended June 30, 2014 was $18,716 and $37,431 respectively.

As of June 30, 2015, there

was $86,033 of unrecognized cost related to stock option and warrant grants. The cost is to be recognized over the remaining

vesting periods that average approximately 1.25 years.

HEALTH DISCOVERY CORPORATION

Notes to Financial Statements (unaudited),

continued

There were no grants,

exercises, forfeitures, or expirations of stock options and warrants for the three and six month period ended June 30,

2015. As of June 30, 2015, there were 23,816,667 option and warrant shares outstanding with a weighted average exercise price

of $0.034.

The following schedule

summarizes combined stock option and warrant information as of June 30, 2015:

| Exercise Prices | |

Number

Outstanding | | |

Weighted-

Average

Remaining

Contractual

Life (years) | | |

Number

Exercisable | | |

Weighted

Average

Remaining

Contractual Life

(years) of

Exercisable

Warrants | |

| $0.027 | |

| 3,000,000 | | |

| 8.00 | | |

| 1,500,000 | | |

| 8.00 | |

| $0.030 | |

| 11,066,667 | | |

| 9.00 | | |

| 11,066,667 | | |

| 9.00 | |

| $0.036 | |

| 7,750,000 | | |

| 8.25 | | |

| 5,000,000 | | |

| 8.25 | |

| $0.040 | |

| 1,000,000 | | |

| 2.50 | | |

| 1,000,000 | | |

| 2.50 | |

| $0.050 | |

| 1,000,000 | | |

| 2.50 | | |

| 1,000,000 | | |

| 2.50 | |

| Total | |

| 23,816,667 | | |

| | | |

| 19,566,667 | | |

| | |

The weighted average remaining

life of all outstanding warrants and options at June 30, 2015 are 8 years. The aggregate intrinsic value of all options and

warrants outstanding and exercisable as of June 30, 2015 was zero, based on the market closing price of $0.02 on June 30, 2015,

less exercise prices.

Note E - PATENTS

The Company has acquired

and developed a group of patents related to biotechnology and certain machine learning tools used for diagnostic and drug discovery.

Legal costs associated with patent acquisitions and the application processes for new patents are also capitalized as patent

assets. The Company has recorded as other assets $1,072,425 in patents and patent related costs, net of $2,913,369 in accumulated

amortization, at June 30, 2015.

Amortization charged to

operations for the three months and six months ended June 30, 2015 and 2014 was $65,680 and $131,360 in both years. Estimated amortization

expense for the next four years is $262,720 per year.

Note F – STOCKHOLDERS’ EQUITY

Series B Preferred Stock

During the first quarter

of 2009, the Board of Directors authorized the designation of Series B Preferred Stock. The number of shares originally constituting

the Series B Preferred Stock was 13,750,000; however, during the fourth quarter of 2009 the Board of Directors authorized the increase

in the number of shares constituting the Series B Preferred Stock to 20,625,000. The Company sold to individual investors a total

of 19,402,675 shares of Series B Preferred Stock for $1,490,015, net of associated expenses, in 2009.

The Series B Preferred

Stock was converted into Common Stock of the Company in the fourth quarter of 2014, which was the fifth anniversary of the date

of issuance as outlined in the original purchase agreement.

The Series B Preferred

Stock accrued dividends at the rate of 10% of the Series B Original Issue Price per year, and was to be satisfied by the fifth

anniversary of the issuance of such shares of the Series B Preferred Stock (the “Original Issue Date”) by the

Company’s issuance of the number of shares of Common Stock equal to such accrued dividends divided by the average closing

price of the Company’s Common Stock as reported on the Over-the-Counter-Bulletin Board or other exchange on which the Company’s

Common Stock trades during the prior ten business days or by the payment of cash, as the Company may determine in its sole discretion.

HEALTH DISCOVERY CORPORATION

Notes to Financial Statements (unaudited),

continued

Note F – STOCKHOLDERS’ EQUITY, continued

No dividend payment will

be made if, after the payment of such dividend, the Company would not be able to pay its debts as they become due in the usual

course of business, or if the Company’s total assets would be less than the sum of its total liabilities plus the amount

that would be needed, if the Company were to be dissolved, to satisfy the preferential rights upon the dissolution to shareholders

whose preferential rights are superior to those receiving the dividend.

Dividends have been accrued

for the Series B Preferred Stock in the amount of $373,346 as of December 31, 2014. The Company gave the Series B holders the choice

of either (1) Common Stock for the amount of the dividend accrued based upon the price of $0.05 per share or (2) to defer payment

of the dividend in cash until the Company is able to pay, at the sole discretion of the Company. During the first quarter of 2015,

$166,709 in dividends were paid with the issuance of 3,334,179 shares of Common Stock. The remaining accrued dividend is recorded

as a current liability in the amount of $206,637 as of June 30, 2015.

Series C Preferred Stock

In the fourth quarter of

2013, the Board of Directors authorized the issuance of Series C Preferred Shares in private placement transactions. As of December

31, 2014 and June 30, 2015, the Company had issued a total of 6,640,000 and 11,066,667 preferred shares respectfully and received

total net proceeds of $332,000. The Series C Preferred Shares are accompanied by $0.03 warrants and $0.03 contingency warrants.

The contingency warrants will be issued only if the Company has not attained profitability by the end of the first quarter 2016.

The holders must exercise fifty percent of the warrants if the market price for the Company’s common stock is $0.20 for a

period of thirty consecutive calendar days. The holders must also exercise fifty percent of the warrants if

the market price for the Company’s common stock is $0.30 for a period of thirty consecutive calendar days. The

warrants were valued at $0.025 each using the Black Scholes Method.

The Series C Preferred

Stock has not been registered under either federal or state securities laws and must be held until a registration statement covering

such securities is declared effective by the Securities and Exchange Commission or an applicable exemption applies.

The Series C Preferred

Stock may be converted into Common Stock of the Company at the option of the holder, without the payment of additional consideration

by the holder, so long as the Company has a sufficient number of authorized shares to allow for the exercise of all of its outstanding

warrants and options. The Shares of Series C Preferred Stock must be converted into Common Stock of the Company either by the demand

by the shareholder or at the fifth anniversary of the date of issuance. If the Company were to be dissolved, the Series C Preferred

Stock receives preferential treatment over Common Stock.

Note G – INVESTMENT IN AVAILABLE FOR SALE SECURITIES

The Company has elected

the fair value option in accordance with ASC 825, Financial Instruments, as it relates to its shares held in NeoGenomics’

common stock that were acquired resulting from the NeoGenomics Master License Agreement executed on January 6, 2012. Management

made the election for the fair value option related to this investment because it believes the fair value option for the NeoGenomics

common stock provides a better measurement from which to compare financial statements from reporting period to reporting period.

No other financial assets or liabilities are measured at fair value using the fair value option.

The Company’s investment in

NeoGenomics’ common stock is recorded on the accompanying balance sheets under the caption Investment in Available for

Sale Securities. The carrying value of this investment on the date of acquisition approximated $1,945,000. The change in fair

value from December 31, 2014 to June 30, 2015 was a net gain of $62,956 for the remaining 23,949 shares held and is

classified as other income (expense) under the captions Realized and Unrealized (Loss) Gain on Available for Sale Securities

in the accompanying statements of operations. The change in fair value from December 31, 2013 to June 30, 2014 was a loss of

$42,484 and is classified as other income (expense) under the captions Realized and Unrealized (Loss) Gain on Available for

Sale Securities for the six months ended June 30, 2014 in the accompanying statements of operations. The Company classifies

its investment as an available for sale security and the fair value is considered a Level 1 investment in the fair value

hierarchy. The June 30, 2015 fair value of the investment of $129,564 is for the remaining shares held and is calculated

using the closing stock price of the NeoGenomics common stock at the end of the reporting period. As of June 30, 2015, the

Company held 23,949 shares of NeoGenomics stock as compared to 86,900 shares as of December 31, 2014.

HEALTH DISCOVERY CORPORATION

Notes to Financial Statements (unaudited),

continued

Note H – COMMITMENTS AND CONTINGENCIES

On July 17, 2013, the Company

received a Civil Investigative Demand (the "Demand") from the Federal Trade Commission of the United States of America

(the "FTC") relating to the Company's MelApp software application. In the Demand, the FTC has requested information relating

to potentially unfair or deceptive acts or practices related to (i) false advertising and (ii) consumer privacy and data security,

in violation of Trade Commission Act, 15 U.S.C. Sections 45 and 42.

On February 23, 2015, the

FTC notified the Company of its approval, by a vote of 4-1, to accept an Agreement Containing Consent Order (“Agreement”).

This Agreement is for settlement purposes only. The Company neither admits nor denies any of the allegations, except as specifically

stated in the Agreement. The Company believes the effort to contest this matter with the FTC would require funds greater than the

Company has at its disposal.

The

Agreement does, among other things, bar the Company from claiming that any device detects or diagnoses melanoma or its risk

factors, or increases users’ chances of early detection, unless the representation is not misleading and supported by

competent and reliable scientific evidence in the form of human clinical testing of the device. The Agreement also prohibits

the Company from making any other misleading or unsubstantiated claims about a device’s health benefits or efficacy,

unless the representation is not misleading and supported by competent and reliable scientific evidence in the form of human

clinical testing of the device. Finally, the Company was required to pay $17,963 to the FTC, which was accrued during the

three month period ended March 31, 2015. This amount is included as Settlement Expense in the accompanying statements

of operations.

The Company is subject

to various claims primarily arising in the normal course of business. Although the outcome of these matters cannot be

determined, the Company does not believe it is probable that any such claims will result in material costs and expenses.

Note I – FINANCIAL CONDITION

We have prepared our financial statements on a "going concern" basis, which presumes that we will be able to realize our assets and discharge our liabilities in the normal course of business for the foreseeable future.

Our ability to continue as a going concern is dependent upon our licensing arrangements with third parties, achieving profitable operations, obtaining additional financing and successfully bringing our technologies to the market. The successful outcome of these matters cannot be predicted at this time. Our financial statements have been prepared on a going concern basis and do not include any adjustments to the amounts and classifications of the assets and liabilities that might be necessary should we be unable to continue in business.

At June 30, 2015, we had $30,325 cash on hand along with NeoGenomics Stock available for sale worth $129,564. The Company's plan to have sufficient cash to support operations is comprised of selling its NeoGenomics Stock, generating revenue through its relationship with NeoGenomics, providing services related to those patents, and obtaining additional equity or debt financing.

As a result, the

Company is focusing its efforts to secure funds via licensing activity or other forms of fund raising either in the debt or

equity markets. In addition, prior to the beginning of this year, the Company began raising capital through the Series C

Preferred Stock offering. The Series C Preferred offering was subsequently completed in August 2015, as discussed below in

Note J. Therefore, the Company believes we have sufficient cash to continue operations through 2016.

The Company believes the

Series C Preferred Stock offering, along with disciplined expense management, will allow the Company to maintain operations through

2016. While the Company believes these efforts will create a profitable future, there is no guarantee the Company will be successful

in these efforts.

Note J – SUBSEQUENT EVENTS

The Series C Preferred Stock offering was fully subscribed and completed in August 2015. As a result, the Company received $568,000 in addition to the $332,000 received previously in 2015 for a total of $900,000.

HEALTH DISCOVERY CORPORATION

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Corporate Overview

Our Company is a pattern

recognition company that uses advanced mathematical techniques to analyze large amounts of data to uncover patterns that might

otherwise be undetectable. The Company operates primarily in the field of molecular diagnostics where such tools are critical to

scientific discovery. The terms artificial intelligence and machine learning are sometimes used to describe pattern recognition

tools.

HDC’s mission is

to use its patents, intellectual prowess, and clinical partnerships principally to identify patterns that can advance the science

of medicine, as well as to advance the effective use of our technology in other diverse business disciplines, including the high-tech,

financial, and healthcare technology markets.

Our historical foundation

lies in the molecular diagnostics field where we have made a number of discoveries that play a role in developing more personalized

approaches to the diagnosis and treatment of certain diseases. However, our Support Vector Machine (“SVM”) assets in

particular have broad applicability in many other fields. Intelligently applied, HDC’s pattern recognition technology can

be a portal between enormous amounts of otherwise undecipherable data and truly meaningful discovery.

Our Company’s principal

asset is its intellectual property which includes advanced mathematical algorithms called Support Vector Machines (SVM) and Fractal

Genomic Modeling (FGM), as well as biomarkers that we discovered by applying our SVM and FGM techniques to complex genetic and

proteomic data. Biomarkers are biological indicators or genetic expression signatures of certain disease states. Our intellectual

property is protected by over 60 patents that have been issued or are currently pending around the world.

Our business model has

evolved over time to respond to business trends that intersect with our technological expertise and our capacity to professionally

manage these opportunities. In the beginning, we sought only to use our SVMs internally in order to discover and license our biomarker

signatures to various diagnostic and pharmaceutical companies. Today, our commercialization efforts include: utilization of our

discoveries and knowledge to help develop diagnostic and prognostic predictive tests; licensing of the SVM and FGM technologies

directly to diagnostic companies; and, the potential formation of new ventures with domain experts in other fields where our pattern

recognition technology holds commercial promise.

Operational Activities

The Company markets its

technology and related developmental expertise to prospects in the healthcare, biotech, and life sciences industries. Given

the scope of some of these prospects, the sales cycle can be quite long, but management believes that these marketing efforts may

produce favorable results in the future.

NeoGenomics License

On January 6, 2012, we

entered into a Master License Agreement (the “NeoGenomics License”) with NeoGenomics Laboratories, Inc. (“NeoGenomics

Laboratories”), a wholly owned subsidiary of NeoGenomics, Inc. (“NeoGenomics”). Pursuant to the terms of the

NeoGenomics License, we granted to NeoGenomics Laboratories and its affiliates an exclusive worldwide license to certain of our

patents and know-how to use, develop and sell products in the fields of laboratory testing, molecular diagnostics, clinical pathology,

anatomic pathology and digital image analysis (excluding non-pathology-related radiologic and photographic image analysis) relating

to the development, marketing production or sale of any “Laboratory Developed Tests” or LDTs or other products used

for diagnosing, ruling out, predicting a response to treatment, and/or monitoring treatment of any or all hematopoietic and solid

tumor cancers excluding cancers affecting the retina and breast cancer. We retain all rights to in-vitro diagnostic (IVD) test

kit development.

HEALTH DISCOVERY CORPORATION

Management’s Discussion and Analysis,

continued

Upon execution of the NeoGenomics

License, NeoGenomics paid us $1,000,000 in cash and issued to us 1,360,000 shares of NeoGenomic’s common stock, par value

$0.001 per share, which had a market value of $1,945,000 using the closing price of $1.43 per share for NeoGenomic’s common

stock on the OTC Bulletin Board on January 6, 2012. In addition, the NeoGenomics License provides for milestone payments in cash

or stock, based on sublicensing revenue and revenue generated from products and services developed as a result of the NeoGenomics

License. Milestone payments will be in increments of $500,000 for every $2,000,000 in GAAP revenue recognized by NeoGenomics up

to a total of $5,000,000 in potential milestone payments. After $20,000,000 in cumulative GAAP revenue has been recognized by NeoGenomics,

we will receive a royalty of (i) 6.5% (subject to adjustment under certain circumstances) on net revenue generated from all Licensed

Uses except for the Cytogenetic Interpretation System and the Flow Cytometry Interpretation System and (ii) a royalty of 50% of

net revenue (after the recoupment of certain development and commercialization costs) that NeoGenomics derives from any sublicensing

arrangements it may put in place for the Cytogenetic Interpretation System and the Flow Cytometry Interpretation System.

NeoGenomics agreed to use

its best efforts to commercialize certain products within one year of the date of the license, subject to two one-year extensions

per product if needed, including a “Plasma Prostate Cancer Test”, a “Pancreatic Cancer Test”, a “Colon

Cancer Test”, a “Cytogenetic Interpretation System”, and a “Flow Cytometry Interpretation System.”

NeoGenomics has completed both of its one-year extension terms of the license. While those one-year extension terms are complete,

the Company and NeoGenomics continue to collaborate on efforts to commercialize the licensed technologies.

If NeoGenomics has not

generated $5.0 million of net revenue from products, services and sublicensing arrangements by January 2017, we may, at our option,

revoke the exclusivity with respect to any one or more of the initial licensed products, subject to certain conditions.

The Company believes our

relationship with NeoGenomics is instrumental in our medical and diagnostic testing development. We further believe the majority,

if not all, of our applications in the medical field will be done in conjunction with NeoGenomics.

Plasma Test for Prostate Cancer

NeoGenomics is developing

a Blood Test for Prostate Cancer under the direction of Dr. Maher Albitar using the genes patented by HDC. The test is performed

on blood plasma and urine rather than only prostate tissue biopsies. NeoGenomics completed Phase I of their research and published

the results in 2014. Additionally, NeoGenomics completed Phase II of their prostate test validation in 2014. The results were largely

the same as those published regarding Phase I. NeoGenomics is currently conducting a clinical trial for this test. NeoGenomics

has announced their expectation is to launch this test in 2016.

Cytogenetic Analysis

Cytogenetic analysis is

the science of studying chromosomes. Microscopic evaluation of individual chromosomes remains the first step in the evaluation

of the human genome. Cytogenetic analysis is performed on almost all patients with hematopoietic diseases (blood cancers such as

leukemia and lymphoma) and on a significant number of patients with solid tumors. The collected data is useful for diagnosis, prognosis

and monitoring of diseases. Currently, specially trained technicians perform most of the analysis manually. The work is labor-intensive

and subjective. Computer automation of this work could significantly reduce cost and improve the quality of the test.

NeoGenomics is currently

working on development, validation and commercialization of this new image analysis tool for cytogenetic analysis under the direction

of Dr. Maher Albitar. The Company and NeoGenomics have spent a considerable amount of time using SVM Technology to create significant

improvement in cytogenetic analysis. NeoGenomics is currently beta testing this co-developed technology within their facilities.

One of the goals with this technology is for NeoGenomics to sub-license this technology after successful internal testing and validation.

Per the license agreement, HDC will receive a portion of the sub-license revenue generated by NeoGenomics.

HEALTH DISCOVERY CORPORATION

Management’s Discussion and Analysis,

continued

Flow Cytometry

Management believes that

our efforts to develop an SVM-based diagnostic test to help interpret flow cell cytometry data for myelodysplastic syndrome (pre-leukemia)

has resulted in a successful proof of concept. The Company, along with NeoGenomics, is now capable of completing development, final

validation and commercialization of the new diagnostic test for the interpretation of flow cytometry data. This test has been licensed

to NeoGenomics for final development and work has begun on the further development of this technology.

SVM Capital, LLC

In January 2007, SVM Capital,

LLC (“SVM Capital”) was formed as a joint venture between HDC and Atlantic Alpha Strategies, LLC (“Atlantic Alpha”)

to explore and exploit the potential applicability of our SVM technology to quantitative investment management techniques. Atlantic

Alpha’s management has over thirty years of experience in commodity and futures trading.

In November 2012, Atlantic

Alpha began auditable formal live trading by applying SVM technology to quarterly fundamental corporate data such as

sales, earnings and projected earnings. The SVM algorithm is utilized to select U.S. stocks which are expected to outperform or

underperform in the next quarter based on current data while at the same time rendering superior portfolio risk metrics. This application

of SVM technology allows the creation of a variety of equity portfolios. SVM Capital has been pleased with the results of

the application of the SVM technology.

On June 16, 2015, SVM Capital

joined Manifold Partners, LLC (“ Manifold Partners”) as a partner. Manifold Partners is

a San Francisco-based multi-strategy portfolio management firm specializing in quantitative investment methodologies. This new

collaboration will be known as Manifold Vector. SVM Capital specializes in the application of an artificial intelligence technique

to investment strategies. SVM Capital has developed mathematical algorithms to rank-order S&P 500 stocks to determine investment

desirability, including long and short equity positions. Importantly, only fundamental corporate data is analyzed, which Manifold

Partners believes to be unique in the quantitative investment field. This technology is an outgrowth of the machine learning techniques

created the Company.

A thorough exposition of SVM Capital may be

found on the appropriate link in HDC's web page.

Intellectual Property Developments

The Company now holds the

exclusive rights to 53 issued U.S. and foreign patents covering uses of SVM and FGM technology for discovery of knowledge from

large data sets. The Company also has 10 pending U.S. and foreign patent applications covering uses of the SVM technology as well

as diagnostic methods that have been discovered using the SVM technology. The reduction in the total number of issued and pending

patents during 2014 resulted from the Company’s decision to allow certain foreign patents issued and/or filed in countries

that were deemed to have lower strategic value to lapse. In addition, a few U.S. patents that were either near the ends of their

terms and/or had parallel applications with broader claims in force were allowed to expire. In addition, significant changes in

the U.S. Patent Laws relating to the eligibility of certain subject matter for patent protection influenced the Company’s

decision to abandon a few of its pending U.S. applications. This in turn reduced the Company’s total expenses for patent

maintenance.

Intel Update

The Company’s patent

application that was submitted to provoke an interference with Intel’s Patent No. 7,685,077 remains pending. The application

file was transferred to the U.S. Patent Office’s Interference Division in December 2014 and is awaiting further action.

HEALTH DISCOVERY CORPORATION

Management’s Discussion and Analysis,

continued

Three Months Ended June 30, 2015 Compared

with Three Months Ended June 30, 2014

Revenue

For the three months ended

June 30, 2015, revenue was $10,857 compared with $256,295 for the three months ended June 30, 2014. The revenue earned during the

second quarter of 2015 is related to the revenue recognition of the Vermillion settlement and the revenue earned during the second

quarter of 2014 is primarily related to the licensing revenue recognition for the NeoGenomics License.

Operating and Other Expenses

Amortization expense was

$65,680 for both the three months ended June 30, 2015 and 2014. Amortization expense relates primarily to the costs associated

with filing patent applications and acquiring rights to the patents.

Professional and consulting

fees totaled $30,778 for the three months ended June 30, 2015, compared with $25,798 for the same 2014 period. These fees consist

primarily of patent filing and maintenance costs, professional fees, and accounting fees. The increase was due to higher patent

filing fees.

Legal fees decreased slightly

with fees totaling $10,040 during the three months ended June 30, 2015 and $17,698 during the same period in 2014. The decrease

was related to elimination of legal costs incurred in the second quarter 2014 related to the Company’s resolution of the

FTC matter.

Research and development

expense was $9,000 for the three months ended June 30, 2015 and $23,887 for the same period in 2014. This expense for research

and development relates primarily to work completed under the NeoGenomics License.

Compensation expense of

$47,582 for the three months ended June 30, 2015 was lower than the $60,826 reported for the comparable 2014 period. The decrease

is attributed to the sacrifices made by current management through reduction, or elimination of, compensation in order to preserve

cash.

Other general and administrative

expense remained flat at $51,230 for the three months ended June 30, 2015, compared to $50,556, for the same period in 2014. This

expense remains much lower than earlier periods principally due to a reduction in all non-essential costs by the new leadership

beginning in August 2013.

Loss / Income from Operations

The loss from operations

for the three months ended June 30, 2015 was $203,453, compared to income of $11,850 for the three months ended June 30, 2014.

The loss was due to the reduction in revenue recognized, specifically the revenue from the NeoGenomics license.

Other Income and Expense

The Company received a

portion of the NeoGenomics license fee in NeoGenomics stock. The Company has chosen to measure the gain or loss on the value of

this asset using the fair value option method. During the three month period ended June 30, 2015, the change in the NeoGenomics

stock fair value increased by $31,025, which is recorded as other income (expense) in the statements of operations. During the

same three month period in 2014, the change in the NeoGenomics stock fair value decreased by $24,764.

Net Loss

The net loss for the three

months ended June 30, 2015 was $172,428, compared to net loss of $12,914 for the three months ended June 30, 2014. The increase

was due primarily to the expiration of the revenue recognition related to the NeoGenomics license.

HEALTH DISCOVERY CORPORATION

Management’s Discussion and Analysis,

continued

The loss attributable

to common shareholders was $172,428 for the three months ended June 30, 2015 compared to a loss of $30,521 in the three

months ended June 30, 2014. This significant change is related to the expiration of the NeoGenomics license revenue

recognition, which occurred in the three-month period ended June 30, 2014.

Loss per share was $0.0007

for the three-month period ended June 30, 2015 compared to loss per share of $0.0001 for the quarterly period ended June 30, 2014.

Six Months Ended June 30, 2015 Compared

with Six Months Ended June 30, 2014

Revenue

For the six months ended

June 30, 2015, revenue was $21,704 compared with $517,654 for the six months ended June 30, 2014. Revenue is recognized for licensing

and development fees over the period earned. The revenue earned is almost entirely related to the licensing revenue recognition

for the NeoGenomics License. The revenue recognition expired in 2014.

Operating and Other Expenses

Amortization expense was

$131,360 for both the six months ended June 30, 2015 and 2014. Amortization expense relates primarily to the costs associated with

filing patent application and acquiring rights to the patents.

Professional and consulting

fees were $98,411 for the six months ended June 30, 2015 compared with $117,715 for the same 2014 period. The decrease was due

to the elimination or reduction of professional services provided to the Company.

Legal fees totaled $28,357

during the six months ended June 30, 2015 compared to $34,379 during the same period in 2014. The reduction was related to legal

costs in the first half 2014 pertaining to the Company’s matter with the FTC.

Research and Development

fees were $22,813 for the six months ended June 30, 2015 and $47,325 for the same period in 2014. This expense for research and

development relates primarily to work completed under the NeoGenomics License.

Compensation expense of

$94,337 for the six months ended June 30, 2015 was less than the $139,356 reported for the comparable 2014 period. The decrease

is attributed to the sacrifices made by current management through reduction, or elimination of, compensation in order to preserve

cash.

Other

general and administrative expenses decreased to $83,210 for six months ended June 30, 2015 compared to $94,241 in

2014. This decrease was due to the reduction in all non-essential costs by the new leadership beginning in August 2013.

Loss from Operations

The loss from operations

for the six months ended June 30, 2015 was $436,784 compared to $46,722 for the period ended June 30, 2014. The increased loss

was due to the reduction in revenue recognized, specifically the revenue from the NeoGenomics license.

Other Income and Expense

The Company

received a portion of the NeoGenomics license fee in NeoGenomics stock. The Company has chosen to measure the gain or loss on

the value of this asset using the fair value option method. During the six month period ending June 30, 2015, the

NeoGenomics stock fair value increased by $62,956, which is recorded as other income in the statements of operations. During

the same period in 2014, the NeoGenomics stock decreased by $42,484. As a result of the settlement with the FTC over actions

by previous management, the Company recognized a settlement expense of $17,693 during the first quarter 2015.

HEALTH DISCOVERY CORPORATION

Management’s Discussion and Analysis,

continued

Net Loss

The net loss for the six

months ended June 30, 2015 was $391,521 compared to $89,206 for the six months ended June 30, 2014. The increased net loss was

due to the reduction in revenue recognized, specifically the revenue from the NeoGenomics license.

The net loss attributable

to common shareholders was $391,521 for the six months ended June 30, 2015 compared to $124,226 in the six months ended June 30,

2014.

Net loss per share was

$0.0015 for the six-month period ended June 30, 2015 and $0.0005 for the six-month period ended June 30, 2014.

Liquidity and Capital Resources

We have prepared our financial statements on a "going concern" basis, which presumes that we will be able to realize our assets and discharge our liabilities in the normal course of business for the foreseeable future.

Our ability to continue as a going concern is dependent upon our licensing arrangements with third parties, achieving profitable operations, obtaining additional financing and successfully bringing our technologies to the market. The successful outcome of these matters cannot be predicted at this time. Our financial statements have been prepared on a going concern basis and do not include any adjustments to the amounts and classifications of the assets and liabilities that might be necessary should we be unable to continue in business.

At June 30, 2015, we had $30,325 cash on hand along with NeoGenomics Stock available for sale worth $129,564. The Company's plan to have sufficient cash to support operations is comprised of selling its NeoGenomics Stock, generating revenue through its relationship with NeoGenomics, providing services related to those patents, and obtaining additional equity or debt financing.

As a result, the Company is focusing its efforts to secure funds via licensing activity or other forms of fund raising either in the debt or equity markets. In addition, prior to the beginning of this year, the Company began raising capital through the Series C Preferred Stock offering. The Series C Preferred offering was subsequently completed in August 2015. In addition, the Company believes the NeoGenomics relationship will provide revenue to the Company in 2016. Therefore, The Company believes the Series C Preferred Stock offering, along with disciplined expense management, will allow the Company to maintain operations through 2016.

HEALTH DISCOVERY CORPORATION

Off-Balance Sheet Arrangements

The Company has no off-balance

sheet arrangements that provide financing, liquidity, market or credit risk support or involve leasing, hedging or research and

development services for our business or other similar arrangements that may expose us to liability that is not expressly reflected

in the financial statements.

Forward-Looking Statements

This Report contains certain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 12E of the Securities Exchange

Act of 1934, including or related to our future results, certain projections and business trends. Assumptions relating to forward-looking

statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future

business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. When

used in this Report, the words “estimate,” “project,” “intend,” “believe,” “expect”

and similar expressions are intended to identify forward-looking statements. Although we believe that assumptions underlying the

forward-looking statements are reasonable, any of the assumptions could prove inaccurate, and we may not realize the results contemplated

by the forward-looking statement. Management decisions are subjective in many respects and susceptible to interpretations and periodic

revisions based on actual experience and business developments, the impact of which may cause us to alter our business strategy

or capital expenditure plans that may, in turn, affect our results of operations. In light of the significant uncertainties inherent

in the forward-looking information included in this Report, you should not regard the inclusion of such information as our representation

that we will achieve any strategy, objective or other plans. The forward-looking statements contained in this Report speak only

as of the date of this Report as stated on the front cover, and we have no obligation to update publicly or revise any of these

forward-looking statements. These and other statements which are not historical facts are based largely on management’s current

expectations and assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially

from those contemplated by such forward-looking statements. These risks and uncertainties include, among others, the failure to

successfully develop a profitable business, delays in identifying customers, and the inability to retain a significant number of

customers, as well as the risks and uncertainties described in “Risk Factors” section to our Annual Report for the

fiscal year ended December 31, 2014.

Item

3. Quantitative and Qualitative Disclosures about Market Risk

Not Applicable.

Item 4. Controls and Procedures

As of the end of the period

covered by this report (the “Evaluation Date”), we carried out an evaluation regarding the fiscal quarter ended June

30, 2015, under the supervision and with the participation of our management, including our Interim Chief Executive Officer, who

is also serving as our Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls

and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based

upon this evaluation, our management concluded that, as of the Evaluation Date, our disclosure controls and procedures were effective

to provide reasonable assurance that information required to be disclosed in the reports that are filed or submitted under the

Exchange Act is recorded, processed, summarized, and reported within the time periods specified by the Securities and Exchange

Commission’s rules and forms and that our disclosure controls and procedures are designed to ensure that information required

to be disclosed in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management

including our Chief Executive Officer, as appropriate, to allow timely decisions regarding required disclosure.

Because of the inherent

limitations in all control systems, no evaluation of controls can provide absolute assurance that the Company’s disclosure

controls and procedures will detect or uncover every situation involving the failure of persons within the Company to disclose

material information otherwise required to be set forth in the Company’s periodic reports.

The Company’s management

is also responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles. As of the Evaluation Date, no changes in the Company’s internal

control over financial reporting occurred that have materially affected or are reasonably likely to materially affect, the Company’s

internal control over financial reporting.

Our Annual Report on Form

10-K contains information regarding a material weakness in our internal control over financial reporting as of December 31, 2014

due to an inadequate segregation of duties resulting from our small number of employees.

HEALTH DISCOVERY CORPORATION

PART II — OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

In addition to the other

information set forth in this report, you should carefully consider the risk factors discussed in Part I, “Item 1A. Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014, which could materially affect our business,

financial condition or future results. The risks described in our Annual Report on Form 10-K are not the only risks facing our

Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially

adversely affect our business, financial condition and/or operating results.

Item 2. Unregistered Sales of Equity

Securities and Use of Proceeds

None.

Item 3. Defaults upon Senior Securities

Not applicable.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

HEALTH DISCOVERY CORPORATION

Item 6. Exhibits

The following exhibits

are attached hereto or incorporated by reference herein (numbered to correspond to Item 601(a) of Regulation S-K, as promulgated

by the Securities and Exchange Commission) and are filed as part of this Form 10-Q:

| 31.1 | Rule 13a-14(a)/15(d)-14(a) Certifications of Chief Executive Officer and Principal Financial Offier.

Filed herewith. |

| 32.1 | Section 1350 Certifications of Chief Executive Officer and Principal Financial Officer. Filed herewith. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

|

Health Discovery Corporation |

|

| |

|

Registrant |

|

| |

|

|

|

|

| |

Date: August 14, 2015 |

By: |

/s/ Kevin Kowbel |

|

| |

|

Printed Name: Kevin Kowbel |

|

| |

|

Title: Interim Chief Executive Officer, Principal Financial Officer, and Principal Accounting Officer |

|

EXHIBIT 31.1

CERTIFICATIONS PURSUANT TO SECTION 302 OF THE

SARBANES-OXLEY ACT OF 2002

I, Kevin Kowbel, certify that:

1. I

have reviewed this quarterly report on Form 10-Q of Health Discovery Corporation (the “Registrant”);

2. Based

on my knowledge, this quarterly report does not contain any untrue statement of a material fact or omit to state a material fact

necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with

respect to the period covered by this report;

3. Based

on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented

in this report;

4. The

Registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal controls over financial reporting (as defined in Exchange

Act Rules 13a-15(f)) for the Registrant and have:

a) designed

such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by

others within those entities, particularly during the period in which this report is being prepared;

b) designed

such internal controls over financial reporting, or caused such internal controls over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles;

c) evaluated

the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about

the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

d) disclosed

in this report any change in the Registrant’s internal control over financial reporting that occurred during the Registrant’s

most recent fiscal quarter (the Registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting;

5. The

Registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the Registrant’s auditors and the audit committee of Registrant’s board of directors (or persons

performing the equivalent functions):

a) all

significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which

are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize and report financial information;

and

b) any

fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s

internal control over financial reporting.

| Date: August 14, 2015 |

/s/ Kevin Kowbel |

| |

Kevin Kowbel |

| |

Interim Chief Executive Officer, Principal Financial Officer and Principal Accounting Officer |

EXHIBIT 32.1

CERTIFICATIONS PURSUANT TO 18 U.S.C. SECTION

1350 AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

The undersigned hereby certifies,

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that this Quarterly

Report on Form 10-Q for the period ended June 30, 2015 fully complies with the requirements of Section 13(a) or 15(d) of the

Securities Exchange Act of 1934, as amended, and the information contained in such report fairly presents, in all material

respects, the financial condition and results of operations of the Company.

Date: August 14, 2015

| |

/s/ Kevin Kowbel |

| |

Kevin Kowbel |

| |

Interim Chief Executive Officer, Principal Financial Officer and Principal Accounting Officer |

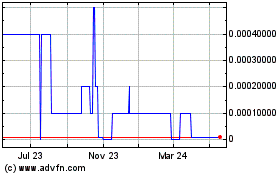

Health Discovery (CE) (USOTC:HDVY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Health Discovery (CE) (USOTC:HDVY)

Historical Stock Chart

From Feb 2024 to Feb 2025