Hong Kong Market Accentuates the Positive After New Security Law

02 July 2020 - 9:32PM

Dow Jones News

By Joanne Chiu and Chong Koh Ping

Investors have overcome initial discomfort at China's tightening

grip on Hong Kong, focusing instead on how a tough new security law

could curb unrest and encourage an influx of mainland money.

On Thursday, the city's benchmark Hang Seng stock index climbed

2.9%, with property and financial stocks leading broad-based gains.

Major advancers included some of the mainland-China-focused stocks

that make up much of the index, as well as local companies such as

Hong Kong Exchanges & Clearing Ltd. and Hang Lung Properties

Ltd. HSBC Holdings PLC rose 3%.

With markets closed Wednesday for a public holiday, this was the

first trading session since Beijing imposed a national-security law

on Hong Kong, giving China's central government a much stronger

hand in policing dissent in the city.

When China's plans for such legislation were first unveiled in

late May, the Hang Seng Index suffered its largest one-day

percentage decline since July 2015, tumbling 5.6%. But the index is

now 3.5% above where it closed May 21, the day before the

selloff.

Christopher Cheung, a pro-Beijing lawmaker in Hong Kong who

represents brokerages in the city, said markets viewed the new law

positively as it made major protests less likely, pointing to

comparatively small demonstrations on Wednesday.

"Investors prefer stability over uncertainty. The July 1 protest

is proof of that," he said. Thousands of demonstrators took to the

streets Wednesday, in defiance of a ban, but the numbers were a far

cry from the biggest crowds of last summer.

Mr. Cheung said many investors also expect Beijing to offer

sweeteners to Hong Kong as the central government seeks to

integrate the city more closely with neighboring areas of southern

China.

Francis Lun, chief executive at Geo Securities Ltd., said,

"There's a disconnect between the financial market and the social

discontent among the general public." He added that "Hong Kong's

financial market has been, and will always be, dependent on China's

support."

Mr. Lun and others said one factor buoying the local market

recently has been secondary listings from U.S.-traded Chinese

companies such as NetEase Inc. and JD.com Inc., as tensions rise

between the two countries. These share sales have drawn a lot of

investor interest and have helped buoy shares of Hong Kong

Exchanges & Clearing, the exchange operator, which is also a

major index constituent.

David Chao, global market strategist for Asia Pacific ex-Japan

at Invesco, said such secondary listings had helped boost the

market, as had bargain-hunting by mainland investors, focusing in

particular on Chinese stocks that trade at a discount to peers

listed in Shenzhen and Shanghai.

"The Hang Seng Index is the cheapest index that I see right now

across Asia," said Mr. Chao. That benchmark trades on a price of

about 11.3 times expected earnings, according to Refinitiv

Datastream.

The rally also signals more investor confidence that Hong Kong

will be able to attract mainland tourists and further investment

from China, he added.

Still, the 50-member Hang Seng Index remains down 10.9% for the

year, lagging behind some peers. In mainland China, the Shanghai

Composite Index rose 2.1% on Thursday, joining its peer the CSI 300

in positive territory for the year. The S&P 500 is down about

3.6% year to date.

Hong Kong also faces challenging economic conditions, after last

year enduring its first full-year recession in a decade.

Adrienne Lui, an economist at Citigroup Global Markets, said in

a note to clients that the new law will likely reduce some risks of

large-scale disruptions to businesses, but that the international

business community would closely watch trends in how the law was

implemented.

"Overall, Hong Kong likely faces a long, winding road to

economic recovery," she said. The bank expects the Hong Kong

economy to shrink 4.6% in 2020.

Write to Joanne Chiu at joanne.chiu@wsj.com and Chong Koh Ping

at chong.kohping@wsj.com

(END) Dow Jones Newswires

July 02, 2020 07:17 ET (11:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

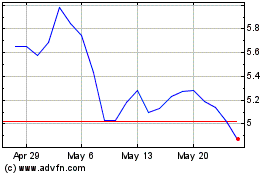

Hang Lung Properties (PK) (USOTC:HLPPY)

Historical Stock Chart

From Feb 2025 to Mar 2025

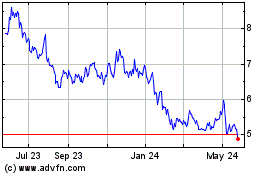

Hang Lung Properties (PK) (USOTC:HLPPY)

Historical Stock Chart

From Mar 2024 to Mar 2025