UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________

to ____________

Commission file number: 0-5278

IEH Corporation

(Exact name of registrant as specified in its

charter)

| New York | | 13-5549348 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

140 58th Street, Suite 8E, Brooklyn, NY | | 11220 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including

area code: (718) 492-4440

Securities registered pursuant to Section 12(b)

of the Act: None

Securities registered pursuant to Section 12(g)

of the Act:

| Title of Each Class: | | Trading Symbol(s) | | Name of Each Exchange on

Which Registered: |

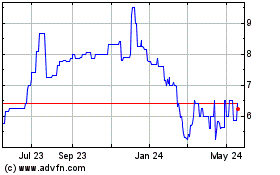

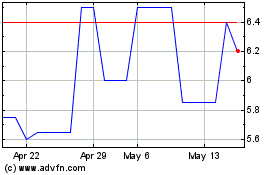

| Shares of common stock, $0.01 par value | | IEHC | | OTC Pink Market |

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large

accelerated filer,” “accelerated filer, “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 30, 2023, the registrant had 2,380,251

shares of its common stock, par value $0.01 per share, outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning

of Section 21E of the Exchange Act and Section 27A of the Securities Act. Any statements contained in this report that are not statements

of historical fact may be forward-looking statements. When we use the words “anticipates,” “plans,” “estimates,”

“expects,” “believes,” “should,” “could,” “may,” “will” and similar

expressions, we are identifying forward-looking statements. We have based these forward-looking statements largely on our current expectations

and projections about future financial events and financial trends that we believe may affect our financial condition, results of operations,

business strategy and financial needs. Forward-looking statements involve risks and uncertainties described under “Risk Factors”

in Part II, Item 1A, and elsewhere in this Quarterly Report on Form 10-Q, and as set forth in Part I, Item 1A, Risk Factors, of our Form

10-K for the fiscal year ended March 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on October 6, 2023,

and may include statements related to, among other things: macroeconomic factors, including inflationary pressures, supply shortages

and recessionary pressures; accounting estimates and assumptions; pricing pressures on our product caused by competition; the risk that

our products will not gain market acceptance; our ability to obtain additional financing; our ability to successfully prevent our registration

with the SEC from being suspended or revoked and to timely file our SEC reports; our ability to operate our accounting system and material

weaknesses identified in connection with our migration to such accounting system; our ability to protect intellectual property; our ability

to integrate our satellite facility into our operations; and our ability to attract and retain key employees. No forward-looking statement

is a guarantee of future performance and you should not place undue reliance on any forward-looking statements. Our actual results may

differ materially from those projected in any forward-looking statements, as they will depend on many factors about which we are unsure,

including many factors beyond our control.

Except as may be required by applicable law, we do not undertake or

intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained

in this report as a result of new information or future events or developments. Thus, you should not assume that our silence over time

means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully review and

consider the various disclosures we make in this report and our other reports filed with the SEC that attempt to advise interested parties

of the risks, uncertainties and other factors that may affect our business.

Important factors that could cause actual results

to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited

to:

| |

● |

changes

in the market acceptance of our products and services; |

| |

|

|

| |

● |

increased

levels of competition; |

| |

|

|

| |

● |

changes

in political, economic or regulatory conditions generally and in the markets in which we operate; |

| |

|

|

| |

● |

our

relationships with our key customers; |

| |

|

|

| |

● |

adverse

conditions in the industries in which our customers operate; |

| |

|

|

| |

● |

our

ability to retain and attract senior management and other key employees; |

| |

|

|

| |

● |

our

ability to quickly and effectively respond to new technological developments; |

| |

|

|

| |

● |

our

ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others

and prevent others from infringing on our proprietary rights; and |

| |

|

|

| |

● |

other risks, including those described in

the “Risk Factors” section of this Quarterly Report on Form 10-Q.

|

PART I: FINANCIAL INFORMATION

Item 1. Financial Statements

IEH CORPORATION

CONDENSED BALANCE SHEETS

| | |

As of | |

| | |

June 30,

2023 | | |

March 31,

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash | |

$ | 6,939,727 | | |

$ | 8,344,706 | |

| Accounts receivable | |

| 2,945,986 | | |

| 2,985,936 | |

| Inventories | |

| 9,483,885 | | |

| 9,446,392 | |

| Corporate income taxes receivable | |

| 1,493,894 | | |

| 1,723,473 | |

| Prepaid expenses and other current assets | |

| 106,871 | | |

| 96,783 | |

| Total current assets | |

| 20,970,363 | | |

| 22,597,290 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

| 3,678,143 | | |

| 3,865,066 | |

| Operating lease right-of-use assets | |

| 2,579,279 | | |

| 2,661,779 | |

| Security deposit | |

| 75,756 | | |

| 75,756 | |

| Total assets | |

$ | 27,303,541 | | |

$ | 29,199,891 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 768,717 | | |

$ | 1,054,078 | |

| Customer advance payments | |

| 44,169 | | |

| 20,639 | |

| Operating lease liabilities | |

| 325,707 | | |

| 317,334 | |

| Other current liabilities | |

| 529,777 | | |

| 902,149 | |

| Total current liabilities | |

| 1,668,370 | | |

| 2,294,200 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| 2,504,903 | | |

| 2,589,121 | |

| Total liabilities | |

| 4,173,273 | | |

| 4,883,321 | |

| | |

| | | |

| | |

| Commitments and Contingencies (Note 9) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock, $0.01 par value; 10,000,000 shares authorized; 2,370,251 shares issued and outstanding at June 30, 2023 and March 31, 2023 | |

| 23,703 | | |

| 23,703 | |

| Additional paid-in capital | |

| 7,695,924 | | |

| 7,566,324 | |

| Retained earnings | |

| 15,410,641 | | |

| 16,726,543 | |

| Total Stockholders’ Equity | |

| 23,130,268 | | |

| 24,316,570 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 27,303,541 | | |

$ | 29,199,891 | |

The accompanying notes are an integral part of

these unaudited condensed financial statements.

IEH CORPORATION

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For the Three Months

Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenue | |

$ | 4,679,845 | | |

$ | 4,078,584 | |

| | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | |

| Cost of products sold | |

| 4,241,432 | | |

| 4,918,939 | |

| Selling, general and administrative | |

| 1,557,569 | | |

| 1,009,007 | |

| Depreciation and amortization | |

| 215,236 | | |

| 248,483 | |

| Total operating expenses | |

| 6,014,237 | | |

| 6,176,429 | |

| | |

| | | |

| | |

| Operating loss | |

| (1,334,392 | ) | |

| (2,097,845 | ) |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| Other income | |

| - | | |

| 76 | |

| Interest income (expense), net | |

| 18,490 | | |

| 373 | |

| Total other income (expense), net | |

| 18,490 | | |

| 449 | |

| | |

| | | |

| | |

| Loss before provision for income taxes | |

| (1,315,902 | ) | |

| (2,097,396 | ) |

| Provision for income taxes | |

| - | | |

| (806,380 | ) |

| Net loss | |

$ | (1,315,902 | ) | |

$ | (2,903,776 | ) |

| | |

| | | |

| | |

| Net loss per common share: | |

| | | |

| | |

| Basic | |

$ | (0.56 | ) | |

$ | (1.23 | ) |

| Diluted | |

$ | (0.56 | ) | |

$ | (1.23 | ) |

| | |

| | | |

| | |

| Weighted-average number of common and common equivalent shares (in thousands): | |

| | | |

| | |

| Basic | |

| 2,370 | | |

| 2,370 | |

| Diluted | |

| 2,370 | | |

| 2,370 | |

The accompanying notes are an integral part of

these unaudited condensed financial statements.

IEH CORPORATION

CONDENSED STATEMENT OF CHANGES IN STOCKHOLDERS’

EQUITY

(Unaudited)

| | |

Common Stock | | |

Additional

Paid-in | | |

Retained | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Earnings | | |

Equity | |

| Balance at March 31, 2022 | |

| 2,370,251 | | |

$ | 23,703 | | |

$ | 7,566,324 | | |

$ | 23,229,467 | | |

$ | 30,819,494 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (2,903,776 | ) | |

| (2,903,776 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2022 | |

| 2,370,251 | | |

$ | 23,703 | | |

$ | 7,566,324 | | |

$ | 20,325,691 | | |

$ | 27,915,718 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

Balance at March 31, 2023 | |

| 2,370,251 | | |

$ | 23,703 | | |

$ | 7,566,324 | | |

$ | 16,726,543 | | |

$ | 24,316,570 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| - | | |

| - | | |

| 129,600 | | |

| - | | |

| 129,600 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (1,315,902 | ) | |

| (1,315,902 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2023 | |

| 2,370,251 | | |

$ | 23,703 | | |

$ | 7,695,924 | | |

$ | 15,410,641 | | |

$ | 23,130,268 | |

The accompanying notes are an integral part of

these unaudited condensed financial statements.

IEH CORPORATION

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For the Three Months

Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (1,315,902 | ) | |

$ | (2,903,776 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 215,236 | | |

| 248,483 | |

| Stock-based compensation | |

| 129,600 | | |

| - | |

| Inventory obsolescence provision | |

| 54,000 | | |

| 60,000 | |

| Deferred income taxes, net | |

| - | | |

| 806,380 | |

| Operating lease right-of-use assets | |

| 125,719 | | |

| 125,719 | |

| | |

| | | |

| | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 39,950 | | |

| 645,733 | |

| Inventories | |

| (91,493 | ) | |

| 212,807 | |

| Corporate income taxes receivable | |

| 229,579 | | |

| 47,050 | |

| Prepaid expenses and other current assets | |

| (10,088 | ) | |

| (143,743 | ) |

| Accounts payable | |

| (285,361 | ) | |

| (138,888 | ) |

| Customer advance payments | |

| 23,530 | | |

| (88,276 | ) |

| Operating lease liabilities | |

| (119,064 | ) | |

| (115,596 | ) |

| Other current liabilities | |

| (372,372 | ) | |

| 88,862 | |

| Net cash used in operating activities | |

| (1,376,666 | ) | |

| (1,155,245 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of property, plant and equipment | |

| (28,313 | ) | |

| (57,136 | ) |

| Net cash used in investing activities | |

| (28,313 | ) | |

| (57,136 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| (1,404,979 | ) | |

| (1,212,381 | ) |

| Cash - beginning of period | |

| 8,344,706 | | |

| 12,675,271 | |

| Cash - end of period | |

$ | 6,939,727 | | |

$ | 11,462,890 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 28 | | |

$ | 7 | |

| Income taxes | |

$ | 2,251 | | |

$ | - | |

The accompanying notes are an integral part of

these unaudited condensed financial statements.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 1 |

DESCRIPTION OF BUSINESS: |

Overview

IEH Corporation (hereinafter referred to as “IEH”

or the “Company”) began in New York, New York in 1941. IEH was incorporated in New York in March, 1943.

The Company designs and manufactures HYPERBOLOID connectors

that not only accommodate, but exceed military and aerospace specification standards.

| Note 2 |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: |

Basis of Presentation

The accompanying condensed financial statements and the

related disclosures as of June 30, 2023 and for the three months ended June 30, 2023 and 2022 are unaudited and have been prepared in

accordance with accounting principles generally accepted in the United States, or U.S. GAAP, and the rules and regulations of the SEC

for interim financial statements. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete

financial statements. These interim condensed financial statements should be read in conjunction with the March 31, 2023 audited financial

statements and notes included in the Annual Report on Form 10-K filed with the SEC on October 6, 2023. The March 31, 2023 balance sheet

included herein was derived from the audited financial statements as of that date but does not include all disclosures including notes

required by U.S. GAAP for complete financial statements. In the opinion of management, the condensed financial statements reflect all

adjustments, consisting of normal and recurring adjustments, necessary for the fair presentation of the Company’s financial position

and results of operations for the three months ended June 30, 2023 and 2022. The results of operations for the interim periods are not

necessarily indicative of the results to be expected for the fiscal year ended March 31, 2024 or any other interim period or future year

or period.

Revenue Recognition

The core principle underlying Accounting Standards Codification

ASC 606 “Revenue from Contracts with Customers” (“ASC 606”), is to recognize revenue to depict the transfer of

promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange

for those goods or services. ASC 606 sets out the following steps for an entity to follow when applying the core principle to its revenue

generating transactions:

| |

● |

Identify the contract with a customer |

| |

|

|

| |

● |

Identify the performance obligations in the contract

|

| |

|

|

| |

● |

Determine the transaction price |

| |

|

|

| |

● |

Allocate the transaction price to the performance obligations

|

| |

|

|

| |

● |

Recognize revenue when (or as) each performance obligation

is satisfied |

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

|

Note 2 |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued): |

Revenue Recognition, continued

The Company recognizes revenue and the related cost of

products sold when the performance obligations are satisfied. The performance obligations are typically satisfied upon shipment of

physical goods. In addition to the satisfaction of the performance obligations, the following conditions are required for revenue

recognition: an arrangement exists, there is a fixed price, and collectability is reasonably assured.

The Company does not offer any discounts, credits or other

sales incentives. Historically, the Company has not had an issue with uncollectible accounts receivable.

The Company will accept a return of defective products within

one year from shipment for repair or replacement at the Company’s option. If the product is repairable, the Company at its own

cost, will repair and return it to the customer. If unrepairable, the Company will provide a replacement at its own cost. Historically,

returns and repairs have not been material.

The Company’s disaggregated revenue by geographical

location is as follows:

| | |

For the Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Domestic | |

$ | 4,243,431 | | |

$ | 3,012,794 | |

| International | |

| 436,414 | | |

| 1,065,790 | |

| Total | |

$ | 4,679,845 | | |

$ | 4,078,584 | |

Approximately 11.5% and 64.7% of the international net sales

for the three months ended June 30, 2023 and 2022, respectively represent sales to customers located in China.

The Company’s disaggregated revenue by industry as

a percentage of total revenue is provided below:

| | |

For the Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Industry | |

% | | |

% | |

| Defense | |

| 60.8 | | |

| 55.9 | |

| Commercial Aerospace | |

| 20.2 | | |

| 20.4 | |

| Space | |

| 12.9 | | |

| 17.0 | |

| Other | |

| 6.1 | | |

| 6.7 | |

| | |

| 100.0 | | |

| 100.0 | |

Inventories

Inventories are comprised of raw materials, work-in-process

and finished goods, and are stated at cost, on an average basis, which does not exceed net realizable value. The Company manufactures

products pursuant to specific technical and contractual requirements.

The Company reviews its purchase and usage activity of its

inventory of parts as well as work in process and finished goods to determine which items of inventory have become obsolete within the

framework of current and anticipated orders. The Company estimates which materials may be obsolete and which products in work in process

or finished goods may be sold at less than cost. A periodic adjustment, based upon historical experience is made to inventory in recognition

of this impairment. The Company’s allowance for obsolete inventory was $487,000 and $433,000 as of June 30, 2023 and March 31,

2023, respectively, and was reflected as a reduction of inventory.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 2 |

SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES (Continued): |

Concentration of Credit Risk

Financial instruments which potentially subject the Company

to concentrations of credit risk consist primarily of cash and cash equivalents and accounts receivable.

At times, the Company’s cash in banks was in excess

of the Federal Deposit Insurance Corporation insurance limits. The Company has not experienced any loss as a result of these deposits.

Net Loss Per Share

The Company accounts for earnings per share pursuant to

ASC Topic 260, “Earnings per Share”, which requires disclosure on the financial statements of “basic” and “diluted”

earnings per share. Basic net loss per common share is computed by dividing net loss by the weighted average number of common shares

outstanding for the reporting period. Diluted net loss per common share is computed by dividing net loss by the weighted average number

of common shares outstanding plus common stock equivalents (if dilutive) for the reporting period.

Basic and diluted net loss per common share is calculated

as follows:

| | |

For the Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Net loss | |

$ | (1,315,902 | ) | |

$ | (2,903,776 | ) |

| | |

| | | |

| | |

Net loss per common share, basic and diluted | |

$ | (0.56 | ) | |

$ | (1.23 | ) |

| | |

| | | |

| | |

Weighted average number of common shares outstanding- basic and fully diluted (in thousands) | |

| 2,370 | | |

| 2,370 | |

Potentially dilutive securities outlined in the table below

have been excluded from the computation of diluted net loss per share because the effect of their inclusion would have been anti-dilutive.

| | |

For the Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Potentially dilutive options to purchase common shares | |

| 507,217 | | |

| 472,217 | |

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 2 |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued): |

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments,

consisting of accounts receivable and accounts payable, approximate their fair value due to the relatively short maturity of these instruments.

The Company is exposed to credit risk through its cash but mitigates this risk by keeping these deposits at major financial institutions.

ASC 820, “Fair Value Measurements and Disclosures”,

provides the framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation

techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical

assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements).

Fair value is defined as an exit price, representing the

amount that would be received upon the sale of an asset or payment to transfer a liability in an orderly transaction between market participants.

Fair value is a market-based measurement that is determined

based on assumptions that market participants would use in pricing an asset or liability. A three-tier fair value hierarchy is used to

prioritize the inputs in measuring fair value as follows:

Level 1 - Quoted prices in active markets for identical

assets or liabilities.

Level 2 - Quoted prices for similar assets or liabilities

in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that

are observable, either directly or indirectly.

Level 3 - Significant unobservable inputs that cannot be

corroborated by market data and inputs that are derived principally from or corroborated by observable market data or correlation by

other means.

Use of Estimates

The preparation of financial statements in conformity with

generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, revenues and expenses, and disclosure of contingent assets and liabilities at the date of the financial

statements. The Company utilizes estimates with respect to determining the useful lives of fixed assets, the fair value of stock-based

instruments, an incremental borrowing rate for determining for its leases the present value of lease payments, the calculation of inventory

obsolescence, as well as determining the amount of the valuation allowance for deferred income tax assets, net. Actual amounts could

differ from those estimates.

Segment Information

The Company identifies its operating segments in accordance

with ASC 280, Segment Reporting (“ASC 280”). Operating segments are defined as components of an enterprise about which separate

discrete financial information is available for evaluation by the chief operating decision maker, or decision-making group, in deciding

how to allocate resources and in assessing performance. The Company’s chief operating decision maker, its Chief Executive Officer,

manages the Company’s operations on a combined basis for the purposes of allocating resources. Accordingly, the Company has determined

it operates and manages its business as a single reportable operating segment.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 2 |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued): |

Depreciation and Amortization

The Company provides for depreciation and amortization on

a straight-line basis over the estimated useful lives (5-7 years) of the related assets. Depreciation expense for the three months ended

June 30, 2023 and 2022 was $215,236 and $248,483 respectively.

Stock-Based Compensation

Compensation expense for stock options granted to directors,

officers and key employees is based on the fair value of the award on the measurement date, which is the date of the grant. The expense

is recognized ratably over the service period of the award. The fair value of stock options is estimated using the Black-Scholes valuation

model. The fair value of any other stock awards is generally the market price of the Company’s common stock on the date

of the grant.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13 – Financial

Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which

was subsequently revised by ASU 2018-19 and ASU 2020-02. ASU 2016-13 introduces a new model for assessing impairment on most financial

assets. Entities will be required to use a forward-looking expected loss model, which will replace the current incurred loss model, which

will result in earlier recognition of allowance for losses. ASU 2016-13 was adopted by the Company on April 1, 2023, which is the beginning

of the first interim period of the fiscal year ended March 31, 2024. The Company has evaluated the impact of the adoption of ASU 2016-13,

and related updates, and has determined that the impact was not material to its financial statements and disclosures.

The Company has evaluated other recently issued accounting

pronouncements and has concluded that the impact of recently issued standards that are not yet effective will not have a material impact

on the Company’s financial position or results of operations upon adoption.

Subsequent Events

The Company evaluated subsequent events and transactions

that occurred after the balance sheet date up to the date that the financial statements were issued. The Company did not identify any

subsequent events that would have required adjustment or disclosure in the financial statements.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

Inventories are comprised of the following:

| | |

As of | |

| | |

June 30,

2023 | | |

March 31,

2023 | |

| Raw materials | |

$ | 8,234,110 | | |

$ | 8,332,522 | |

| Work in progress | |

| 1,300,998 | | |

| 1,048,097 | |

| Finished goods | |

| 435,777 | | |

| 498,773 | |

| Allowance for obsolete inventory | |

| (487,000 | ) | |

| (433,000 | ) |

| | |

$ | 9,483,885 | | |

$ | 9,446,392 | |

| Note 4 |

OTHER CURRENT LIABILITIES: |

Other current liabilities are comprised of the following:

| | |

As of | |

| | |

June 30, | | |

March 31, | |

| | |

2023 | | |

2023 | |

| Payroll and vacation accruals | |

$ | 414,896 | | |

$ | 788,136 | |

| Sales commissions | |

| 51,858 | | |

| 58,685 | |

| Other current liabilities | |

| 63,023 | | |

| 55,328 | |

| | |

$ | 529,777 | | |

$ | 902,149 | |

Operating leases

Leases classified as operating leases are included in operating

lease right-of use, or ROU, assets, operating lease liabilities and operating lease liabilities, non-current, in the Company’s

condensed balance sheets.

Condensed balance sheet information related

to our leases is presented below:

| | |

| |

As of | |

| | |

Condensed Balance

Sheet Location | |

June 30,

2023 | | |

March 31,

2023 | |

| Operating leases: | |

| |

| | |

| |

| | |

| |

| | |

| |

| Right-of-use assets | |

Operating lease right-of-use assets | |

$ | 2,579,279 | | |

$ | 2,661,779 | |

| | |

| |

| | | |

| | |

| Right-of-use liability, current | |

Operating lease liabilities, current | |

$ | 325,707 | | |

$ | 317,334 | |

| | |

| |

| | | |

| | |

| Right-of-use lease liability, long-term | |

Operating lease liabilities, non-current | |

$ | 2,504,903 | | |

$ | 2,589,121 | |

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 5 |

LEASES (Continued): |

The lease expense for the three months ended June 30, 2023

and 2022 was $140,307 and $138,722, respectively, which was included in cost of products sold on the Company’s condensed statement

of operations. In addition to the base rent, the Company pays insurance premiums and utility charges relating to the use of the premises.

The Company considers its present facilities to be adequate for its present and anticipated future needs.

The basic minimum annual rental remaining on these leases

is $3,462,518 as of June 30, 2023.

The weighted-average remaining lease term and the weighted

average discount rate for operating leases were:

| | |

As of | |

| | |

June 30, | | |

March 31, | |

| | |

2023 | | |

2023 | |

| Other information: | |

| | |

| |

| Weighted-average discount rate – operating leases | |

| 6.00 | % | |

| 6.00 | % |

| Weighted-average remaining lease term – operating lease (in years) | |

| 6.6 | | |

| 6.8 | |

The total remaining operating lease payments included in

the measurement of lease liabilities on the Company’s condensed balance sheet as of June 30, 2023 was as follows:

| For the years ended March 31: | |

Operating

Lease

Payments | |

| (Nine months ending) March 31, 2024 | |

$ | 364,119 | |

| 2025 | |

| 497,684 | |

| 2026 | |

| 519,036 | |

| 2027 | |

| 547,460 | |

| 2028 | |

| 563,891 | |

| Thereafter | |

| 970,328 | |

| Total gross operating lease payments | |

| 3,462,518 | |

| Less: imputed interest | |

| (631,908 | ) |

| Total lease liabilities, reflecting present value of future minimum lease payments | |

$ | 2,830,610 | |

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

The effective income tax rates for the three months ended

June 30, 2023 and 2022 were a provision of 0% on a loss before provision for income taxes of $1,315,902 and a provision of 38.4% on a

loss before provision for income taxes of $2,097,396, respectively. The provision for income taxes of $0 for the three months ended June

30, 2023 was attributable to the loss before provision for income taxes incurred for the period and the impact of recording a full valuation

allowance on the Company’s deferred tax assets, net. The provision for income taxes of $806,380 for the three months ended

June 30, 2022 represents a charge to record a full valuation allowance of the Company’s deferred income tax assets, net as of April

1, 2022.

| Note 7 |

EQUITY INCENTIVE PLANS: |

2011 Equity Incentive Plan

On August 31, 2011, the Company’s stockholders approved

the adoption of the Company’s 2011 Equity Incentive Plan (“2011 Plan”) to provide for the grant of stock options and

restricted stock awards to purchase up to 750,000 shares of the Company’s common stock to all employees, consultants and other

eligible participants including senior management and members of the Board of Directors of the Company. The 2011 Equity Incentive Plan

expired on August 31, 2021 after which no further awards will be granted under such plan.

2020 Equity Incentive Plan

On November 18, 2020, the Board of Directors approved the

Company’s 2020 Equity Incentive Plan (the “2020 Plan”) for submission to stockholders at the next annual meeting. On

December 16, 2020, the Company’s stockholders approved the adoption of the 2020 Plan, which provides for options and restricted

stock awards to purchase up to 750,000 shares of common stock to award in the future as incentive compensation to employees,

management and directors of the Company.

Options granted to employees under the 2020 Plan may be

designated as options which qualify for incentive stock option treatment under Section 422A of the Internal Revenue Code, or options

which do not qualify (non-qualified stock options).

Under the 2020 Plan, the exercise price of an option designated

as an incentive stock option shall not be less than the fair market value of the Company’s common stock on the day the option is

granted. In the event an option designated as an incentive stock option is granted to a ten percent (10%) or greater stockholder, such

exercise price shall be at least 110 percent (110%) of the fair market value of the Company’s common stock and the option must

not be exercisable after the expiration of ten years from the day of the grant. The 2020 Plan also provides that holders of options that

wish to pay for the exercise price of their options with shares of the Company’s common stock must have beneficially owned such

stock for at least six months prior to the exercise date.

Exercise prices of stock options may not be less than the

fair market value of the Company’s common stock on the grant date.

The aggregate fair market value of shares subject to options

granted to a participant(s), which are designated as incentive stock options, and which become exercisable in any calendar year, shall

not exceed $100,000.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 7 |

EQUITY INCENTIVE PLANS (Continued): |

Stock-based compensation expense

Stock-based compensation expense is recorded in selling,

general and administrative expenses included in the condensed statements of operations. For the three months ended June 30, 2023 and

2022, stock-based compensation expense was $129,600 and $0, respectively.

As of June 30, 2023 there was no unrecognized compensation

expense related to unamortized stock options. It is the Company’s policy that any unrecognized stock-based compensation cost would

be adjusted for actual forfeitures as they occur.

There were no options granted during the three months ended

June 30, 2022.

The following table provides the stock option activity:

| | |

Shares | | |

Weighted

Avg. Grant

Date Fair

Value | | |

Weighted

Avg. Exercise

Price | | |

Remaining Contractual

Term

(Years) | | |

Aggregate Intrinsic

Value

(in thousands) | |

| Balance as of April 1, 2023 | |

| 467,217 | | |

$ | 7.94 | | |

$ | 14.72 | | |

| 5.51 | | |

$ | 105 | |

| Granted | |

| 40,000 | | |

| 3.24 | | |

| 6.10 | | |

| | | |

| | |

| Exercised | |

| - | | |

| - | | |

| - | | |

| | | |

| | |

| Forfeited or expired | |

| - | | |

| - | | |

| - | | |

| | | |

| | |

| Balance as of June 30, 2023 | |

| 507,217 | | |

$ | 7.57 | | |

$ | 14.04 | | |

| 5.63 | | |

$ | 210 | |

| Exercisable as of June 30, 2023 | |

| 507,217 | | |

$ | 7.57 | | |

$ | 14.04 | | |

| 5.63 | | |

$ | 210 | |

The aggregate intrinsic value in the table above represents

the total pretax intrinsic value (i.e., the difference between the Company’s closing stock price on the last trading day of the

period and the exercise price, times the number of shares) that would have been received by the option holders had all option holders

exercised their in-the-money options on those dates.

In 1987, the Company adopted a cash bonus plan (the “Cash

Bonus Plan”) for non-union, management and administration staff. Unless otherwise approved by the Compensation Committee of the

Board of Directors or the full Board of Directors, the Cash Bonus Plan will only be funded by the Company for payment of bonuses with

respect to any fiscal year, when the Company is profitable for such applicable fiscal year. As of June 30, 2023 and March 31, 2023, the

Company’s accrued bonus was $100,181 and $354,250, respectively. Bonus expense recorded for each of the three months ended June

30, 2023 and 2022 was $100,500.

IEH CORPORATION

Notes to Unaudited Condensed Financial Statements

| Note 9 |

COMMITMENTS AND CONTINGENCIES: |

The Company maintains its operations in facilities located

in both New York and Pennsylvania.

On December 1, 2020, the Company entered into a 120 month

extension of its lease agreement for an industrial building in Brooklyn, NY, expiring December 1, 2030. Monthly rent at inception was

$20,400, and thereafter, such monthly rent escalates annually to a monthly rent of $28,426 for the final year of the lease term. The

Company maintains a security deposit of $40,800, which is included in other assets on the accompanying condensed balance sheet.

On January 29, 2021, the Company entered into an 87 month

lease agreement for an industrial building in Allentown, Pennsylvania, expiring March 30, 2028. Monthly rent at inception was $18,046,

and thereafter such monthly rent escalates annually to a monthly rent of $20,920 for the final year of the lease term. The Company maintains

a security deposit of $35,040, which is included in other assets on the accompanying condensed balance sheet.

The Company has a collective bargaining multi-employer pension

plan (“Multi-Employer Plan”) with the United Auto Workers of America, Local 259 (ID No. 136115077). The Multi-Employer Plan

is covered by a collective bargaining agreement with the Company, which expires on March 31, 2024. Contributions are made in accordance

with a negotiated labor contract and are based on the number of covered employees employed per month. With the passage of the Multi-Employer

Pension Plan Amendments Act of 1990 (the “1990 Act”), the Company may become subject to liabilities in excess of contributions

made under the collective bargaining agreement. Generally, these liabilities are contingent upon the termination, withdrawal, or partial

withdrawal from the Multi-Employer Plan. The risks of participating in a multiemployer plan are different from single-employer plans,

for example, assets contributed to the multiemployer plan by one employer may be used to provide benefits to employees of other participating

employers, if a participating employer stops contributing to the multiemployer plan, the unfunded obligations of the plan may become

the obligation of the remaining participating employers, and if a participating employer chooses to stop participating in these multiemployer

plans, the employer may be required to pay those plans an amount based on the underfunded status of the plan.

The total contributions charged to operations under the

provisions of the Multi-Employer Plan were $14,790 and $9,528 for the three months ended June 30, 2023 and 2022, respectively, and were

reflected within cost of products sold included in the condensed statements of operations.

During the three months ended June 30, 2023 and June 30,

2022, one customer accounted for 12% and 10.8%, respectively, of the Company’s net sales.

As of June 30, 2023, no customer accounted for 10% or more

of accounts receivable. As of March 31, 2023, three customers accounted for 44.5% of accounts receivable, each represented 23.2%, 11.0%

and 10.3%, respectively.

During the three months ended June 30, 2023, two vendors

accounted for 23.4% of the Company’s purchases, each represented 12.7% and 10.7%, respectively. During the three months ended June

30, 2022, one vendor accounted for 15.4% of the Company’s purchases.

As of June 30, 2023 and March 31, 2023, two vendors accounted

for 22.1% of accounts payable and one vendor accounted for 20.9% of accounts payable, respectively.

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

Statements contained in this report, which are not historical

facts, may be considered forward-looking information with respect to plans, projections, or future performance of the Company as defined

under the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, which

could cause actual results to differ materially from those projected. The words “anticipate,” “believe”, “estimate”,

“expect,” “objective,” and think” or similar expressions used herein are intended to identify forward-looking

statements. The forward-looking statements are based on the Company’s current views and assumptions and involve risks and uncertainties

that include, among other things, the performance of the Company’s business, actions of competitors, changes in laws and regulations,

including accounting standards, employee relations, customer demand, prices of purchased raw materials and parts, domestic economic conditions

including inflation and interest rates, foreign economic conditions, including currency rate fluctuations and geopolitical uncertainty.

The following discussion and analysis should be read in

conjunction with our audited financial statements and related footnotes included elsewhere in this report, which provide additional information

concerning the Company’s financial activities and condition.

Overview

The Company designs, develops and manufactures printed circuit

board connectors and custom interconnects for high performance applications.

All of our connectors utilize the HYPERBOLOID contact design,

a rugged, high-reliability contact system ideally suited for high-stress environments. We believe we are the only independent producer

of HYPERBOLOID printed circuit board connectors in the United States.

Our customers consist of Original Equipment Manufacturers

(“OEMs”) and distributors who resell our products to OEMs. We sell our products directly and through 22 independent sales

representatives and distributors located in all regions of the United States, Canada, the European Union, Southeast Asia, Central Asia

and the Middle East.

The customers we service are in the Defense, Aerospace, Space,

Medical, Oil and Gas, Industrial, Test Equipment and Commercial Electronics markets. We appear on the Military Qualified Product Listing

(“QPL”) MIL-DTL-55302 and supply customer requested modifications to this specification.

The customers we service by industry as a percentage of total

revenue is provided below:

| | |

For the Three Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| Industry | |

% | | |

% | |

| Defense | |

| 60.8 | | |

| 55.9 | |

| Commercial Aerospace | |

| 20.2 | | |

| 20.4 | |

| Space | |

| 12.9 | | |

| 17.0 | |

| Other | |

| 6.1 | | |

| 6.7 | |

| | |

| 100.0 | | |

| 100.0 | |

Financial Overview

Critical Accounting Policies

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of America (US GAAP) requires management to make estimates and assumptions

about future events that affect the amounts reported in the financial statements and accompanying notes. Future events and their effects

cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results

inevitably will differ from those estimates, and such differences may be material to the financial statements. The most significant accounting

estimates inherent in the preparation of our financial statements include estimates associated with revenue recognition, valuation of

inventories, accounting for income taxes and stock-based compensation expense. Our financial position, results of operations and cash

flows are impacted by the accounting policies we have adopted. In order to get a full understanding of our financial statements, one must

have a clear understanding of the accounting policies employed. It is important that the discussion of our operating results that follow

be read in conjunction with these critical accounting policies which have been disclosed in our Annual Report on Form 10-K for the fiscal

year ended March 31, 2023 filed with the SEC on October 6, 2023.

Results of Operations

Comparison of the Three

Months Ended June 30, 2023 and 2022

The following table summarizes

our results of operations for the three months ended June 30, 2023 and 2022:

| | |

For the Three-Months Ended

June 30, | | |

Period-to-Period | |

| | |

2023 | | |

2022 | | |

Change | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 4,679,845 | | |

$ | 4,078,584 | | |

$ | 601,261 | |

| | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | |

| Cost of products sold | |

| 4,241,432 | | |

| 4,918,939 | | |

| (677,507 | ) |

| Selling, general and administrative | |

| 1,557,569 | | |

| 1,009,007 | | |

| 548,562 | |

| Depreciation and amortization | |

| 215,236 | | |

| 248,483 | | |

| (33,247 | ) |

| Total operating expenses | |

| 6,014,237 | | |

| 6,176,429 | | |

| (162,192 | ) |

| Operating loss | |

| (1,334,392 | ) | |

| (2,097,845 | ) | |

| 763,453 | |

| Other income (expense): | |

| | | |

| | | |

| | |

| Other income | |

| - | | |

| 76 | | |

| (76 | ) |

| Interest income (expense), net | |

| 18,490 | | |

| 373 | | |

| 18,117 | |

| Total other income (expense), net | |

| 18,490 | | |

| 449 | | |

| 18,041 | |

| | |

| | | |

| | | |

| | |

| Loss before provision for income taxes | |

| (1,315,902 | ) | |

| (2,097,396 | ) | |

| 781,494 | |

| Provision for income taxes | |

| - | | |

| (806,380 | ) | |

| 806,380 | |

| Net loss | |

$ | (1,315,902 | ) | |

$ | (2,903,776 | ) | |

$ | 1,587,874 | |

Revenue for the three months ended June 30, 2023 was $4,679,845,

reflecting an increase of $601,261, or 14.7%, as compared to $4,078,584 for the three months ended June 30, 2022.

The increase in revenue for the period was principally on

account of an increase in orders from our defense customers. Our defense revenues have benefitted from increased defense related spending

on programs in which we participate. Our quarter over quarter commercial aerospace revenues have grown steadily, consistent with the post

COVID-19 return of consumer aviation traffic. Our increase in commercial aerospace revenues offset quarter over quarter softness in revenues

from our space customers.

Cost of products sold for the three months ended June 30,

2023 was $4,241,432, reflecting a decrease of $677,507, or 13.8% as compared to $4,918,939 for the three months ended June 30, 2022. The

decrease in our cost of products sold is attributable to a combination of improved margins due to changes in product mix and greater absorption

of production costs into inventory, driven by increases in production volume.

Selling, general and administrative expenses for the three

months ended June 30, 2023 was $1,557,569, reflecting an increase of $548,562, or 54.4%, as compared to $1,009,007 for the three months

ended June 30, 2022. The increase was primarily due to increased consulting and legal fees incurred in connection with bringing our public

filings current.

Depreciation and amortization for the three months

ended June 30, 2023 was $215,236, reflecting a decrease of $33,247, or 13.4%, as compared to $248,483 for the three months ended June

30, 2022. The decrease was principally attributable to reduced amortization in the current period for certain fully amortized assets.

Total other income (expense) for the three months ended June

30, 2023 was income of $18,490, reflecting an increase of $18,041, as compared to income of $449 for the three months ended June 30, 2022.

The increase was principally attributable to interest earned on our cash balances.

Provision for income taxes was $0 and $806,380 for the three

months ended June 30, 2023 and 2022. The provision for income taxes of $0 for the three months ended June 30, 2023 was attributable

to the loss before provision for income taxes incurred for the period and the impact of recording a full valuation allowance on our deferred

tax assets. The tax provision for the three months ended June 30, 2022 of $806,380 represents a charge to record a full valuation

allowance of our deferred income tax assets, net as of April 1, 2022.

Liquidity and Capital Resources:

Our primary requirements for liquidity and capital are working

capital, inventory, capital expenditures, public company costs and general corporate needs. We expect these needs to continue as we further

develop and grow our business. For the three months ended June 30, 2023, our primary sources of liquidity came from existing cash. Based

on our current plans and business conditions, we believe that existing cash, together with cash generated from operations will be sufficient

to satisfy our anticipated cash requirements, and we are not aware of any trends or demands, commitments, events or uncertainties that

are reasonably likely to result in a decrease in liquidity of our assets. We may require additional capital to respond to technological

advancements, competitive dynamics or technologies, business opportunities, challenges, acquisitions or unforeseen circumstances and in

either the short-term or long-term may determine to engage in equity or debt financings or enter into credit facilities for other reasons.

If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to

grow or support our business and to respond to business challenges could be significantly limited. In particular, inflationary pressures

and interest rates, and the conflicts in Eastern Europe and in the Middle East have resulted in, and may continue to result in, significant

disruption and volatility in the global financial markets, reducing our ability to access capital. If we are unable to raise additional

funds when or on the terms desired, our business, financial condition and results of operations could be adversely affected.

As of June 30, 2023 and March 31, 2023, the Company’s

cash on hand was $6,939,727 and $8,344,706, respectively. The Company recorded a net loss of $1,315,902 and $2,903,776 for the three months

ended June 30, 2023 and 2022, respectively. As of June 30, 2023 and March 31, 2023, the Company had working capital of $19,301,993 and

$20,303,090 and stockholders’ equity of $23,130,268 and $24,316,570, respectively.

Our principal source of liquidity has been from cash flows

generated by operating activities and our cash reserves.

Cash Flow Activities for

the Three Months Ended June 30, 2023 Compared to the Three Months Ended June 30, 2022

The following table summarizes our

sources and uses of cash for the three months ended June 30, 2023 and 2022:

| | |

For the Three Months Ended

June 30, | | |

Period-to-Period | |

| | |

2023 | | |

2022 | | |

Change | |

| Cash flows used in: | |

| | | |

| | | |

| | |

| Operating activities | |

$ | (1,376,666 | ) | |

$ | (1,155,245 | ) | |

$ | (221,421 | ) |

| Investing activities | |

| (28,313 | ) | |

| (57,136 | ) | |

| 28,823 | |

| Decrease in cash | |

$ | (1,404,979 | ) | |

$ | (1,212,381 | | |

$ | (192,598 | ) |

Net cash used in operating activities was $1,376,666 for

the three months ended June 30, 2023, compared to $1,155,245 for the three months ended June 30, 2022. The period over period increase

in use of cash of $221,421 was primarily attributable to an increase in the payment of the accrued cash bonus during the current period.

Net cash used in investing activities was $28,313 for the

three months ended June 30, 2023, a decrease of $28,823, as compared to a use of $57,136 for the three months ended June 30, 2022. The

decrease in cash used in investing activities during the three months ended June 30, 2023 was principally due to decreases in purchase

of property and equipment.

There were no financing activities during the three months

ended June 30, 2023 or 2022.

Backlog of Orders

The backlog of orders for the Company’s products amounted

to approximately $13,837,000 at June 30, 2023 as compared to approximately $9,537,000 at June 30, 2022. The orders in backlog at June

30, 2023 are expected to ship over the next twelve months depending on customer requirements and product availability.

Inflation

In the opinion of management, inflation has continued to

impact the costs of our operations and depending upon the current duration and degree of higher inflation levels, is expected to have

an impact upon our operations in the future. Management will continue to monitor inflation and evaluate the possible future effects of

inflation on our business and operations.

Item 3. Qualitative and Quantitative Disclosures about Market

Risk

Not applicable.

Item 4. Controls and Procedures

Management’s Evaluation of our Disclosure Controls

and Procedures

We maintain disclosure controls and procedures (as defined

in paragraph (e) of Rules 13a-15 and 15d-15 under the Exchange Act) designed to ensure that the information we are required to disclose

in reports that we file or furnish under the Exchange Act is recorded, processed, summarized and reported within the time periods specified

under the rules and forms of the SEC. Disclosure controls and procedures include, without limitation, controls and procedures designed

to ensure that such information is accumulated and communicated to our management, including our Chief Executive Officer and our Chief

Financial Officer, as appropriate to allow timely decisions regarding required disclosures.

As required by paragraph (b) of Rules 13a-15 and 15d-15 under

the Exchange Act, our management, with the participation of our Chief Executive Officer (our principal executive officer) and our Chief

Financial Officer (our principal financial officer) carried out an evaluation of the effectiveness of the design and operation of our

disclosure controls and procedures as of as of the end of the period covered by this Quarterly Report on Form 10-Q. Our management recognizes

that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives,

and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Our principal

executive and principal financial officer have concluded based upon the evaluation described above that, as of June 30, 2023, our disclosure

controls and procedures were not effective at the reasonable assurance level.

Management has used the framework set forth in the report

entitled Internal Control—Integrated Framework published by the Committee of Sponsoring Organizations of the Treadway Commission

(2013 framework), known as COSO, to evaluate the effectiveness of our internal control over financial reporting.

As of June 30, 2023, the following material weaknesses were

identified:

| ● | Certain

of the Company’s controls associated with reconciliations of inventory and cost of products sold were not operating effectively.

These deficiencies, combined with inadequate compensating review controls represent a material weakness in the Company’s internal

control over financial reporting. |

| ● | The

Company has not established an effective control environment due to the ineffective design and implementation of Information Technology

General Controls (“ITGC”). The Company’s ITGC deficiencies included improperly designed controls pertaining to user

access rights over systems that are critical to the Company’s system of financial reporting. The ITGC deficiencies, combined with

a lack of properly designed management review controls to compensate for these deficiencies, represent a material weakness in the Company’s

internal control over financial reporting. |

Management is actively engaged in the planning for and implementation

of remediation efforts to address the identified material weaknesses. The remediation plan includes (i) the engaging of additional experienced

financial resources, (ii) the development and implementation of enhanced controls designed to evaluate the appropriateness of policies

and procedures, (iii) the implementation of review and monitoring of transactions to ensure compliance with the new policies and procedures,

(iv) improvements in the design and implementation of enhanced monitoring of ITGC controls, and (v) the enhanced training of personnel.

Changes in Internal Controls Over Financial Reporting

There were no changes in our internal controls over financial

reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act) identified in connection with the evaluation of our internal

controls that occurred during the fiscal quarter ended June 30, 2023 that materially affected, or are reasonably likely to materially

affect our internal controls over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

There are no legal proceedings that have occurred within

the past year concerning our directors, or control persons which involved a criminal conviction, a criminal proceeding, an administrative

or civil proceeding limiting one’s participation in the securities or banking industries, or a finding of securities or commodities

law violations.

On August 17, 2022, the SEC issued an Order Instituting Administrative

Proceedings and Notice of Hearing pursuant to Section 12(j) of the Exchange Act. The stated purpose of the administrative proceeding is

for the Commission to determine whether it is necessary and appropriate for the protection of investors to suspend for a period not exceeding

twelve months, or revoke the registration of each class of securities registered pursuant to Section 12 of the Exchange Act of the Company.

The Company filed an Answer in the proceeding on October 3, 2022 and on October 13, 2022 we conducted a prehearing conference with SEC

staff in the Division of Enforcement. On March 1, 2023 the SEC’s Division of Enforcement filed a Motion for Summary Disposition,

on March 15, 2023, IEH filed an opposition brief to the SEC Division of Enforcement’s Motion for Summary Disposition, and on March

29, 2023, the SEC’s Division of Enforcement filed a Reply in Support of its Motion for Summary Disposition. The Commission will

issue a decision on the basis of the record in the proceeding.

Item 1A. Risk Factors

Our operations and financial results are subject to various

risks and uncertainties, including those described in Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for

the year ended March 30, 2023 which could adversely affect our business, financial condition, results of operations, cash flows, and the

trading price of our common and capital stock. Except as set forth below, as of the date of this Quarterly Report on Form 10-Q, there

have been no material changes to our risk factors previously disclosed in our Exchange Act Reports.

Item 2. Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information

None.

Item 6. Exhibits

The exhibits filed as part of this Quarterly Report on Form

10-Q are set forth on the Exhibit Index, which Exhibit Index is incorporated herein by reference.

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 3.1 |

|

Amended and Restated Certificate of Incorporation of the Company (filed as Exhibit C-4 to Current Report on Form 8-K, dated February 27, 1991). |

| |

|

|

| 3.2 |

|

By-Laws of the Company (filed as Exhibit 3.2 on Annual Report on Form 10-KSB for the fiscal year ended March 27, 1994). |

| |

|

|

| 4.1 |

|

Form of Common Stock Certificate of the Company (filed as Exhibit 4.1 on Annual Report on Form 10-KSB for the fiscal year ended March 27, 1994). |

| |

|

|

| 4.2 |

|

Description of Securities (filed as Exhibit 4.2 on Annual Report on Form 10-K for the fiscal year ended March 31, 2022 on June 22, 2023). |

| |

|

|

| 10.1(†)* |

|

Employment Agreement between the Company and Subrata Purkayastha dated as of June 1, 2023. |

| |

|

|

| 10.2(†) |

|

Employment Agreement between the Company and Subrata Purkayastha made as of October 26, 2023 and effective as of November 1, 2023 (previously filed as Exhibit 10.1 to the Current Report on Form 8-K filed on November 7, 2023) |

| |

|

|

| 31.1* |

|

Certification of Chief Executive Officer pursuant to Section 17 CFR 240.13a-14(a) or 17 CFR 240.15d-14(a) pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

|

|

| 31.2* |

|

Certification of Principal Financial Officer pursuant to Section 17 CFR 240.13a-14(a) or 17 CFR 240.15d-14(a) pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 32.1** |

|

Certifications by Chief Executive Officer and Principal Financial Officer, pursuant to 17 CFR 240.13a-14(b) or 17 CFR 240.15d-14(b) and Section 1350 of Chapter 63 of Title 18 of the United States Code adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

|

|

| 101.1* |

|

The following information from IEH Corporation’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, formatted in Inline XBRL (Extensible Business Reporting language) and filed electronically herewith: (i) the Balance Sheets; (ii) the Statements of Operations; (iii) the Statements of Stockholders’ Equity; (iv) the Statements of Cash Flow; and (v) the Notes to Financial Statements. |

| |

|

|

| 101.INS* |

|

Interactive Data Files pursuant to Rule 405 of Regulation S-T formatted in Inline Extensible Business Reporting Language (“Inline XBRL”) |

| |

|

|

| 101.SCH* |

|

Inline XBRL Taxonomy Extension Schema Document |

| |

|

|

| 101.CAL* |

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| |

|

|

| 101.DEF* |

|

Inline XBRL Taxonomy Extension Definition Linkbase Document |

| |

|

|

| 101.LAB* |

|

Inline XBRL Taxonomy Extension Label Linkbase Document |

| |

|

|

| 101.PRE* |

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

| * |

Exhibits filed herewith. |

| ** |

Exhibits furnished herewith. |

| † |

Indicates management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

IEH CORPORATION |

| |

|

|

| Dated: November 30, 2023 |

By: |

/s/ David Offerman |

| |

|

David Offerman |

| |

|

Chairman of the Board, President and

Chief Executive Officer (Principal Executive Officer) |

| |

|

|

| |

|

/s/ Subrata Purkayastha |

| |

|

Subrata Purkayastha, Chief Financial Officer |

| |

|

(Principal Financial Officer) |

22

--03-31

2024

NONE

0.56

1.23

2370000

2370000

false

Q1

0000050292

0000050292

2023-04-01

2023-06-30

0000050292

2023-11-30

0000050292

2023-06-30

0000050292

2023-03-31

0000050292

2022-04-01

2022-06-30

0000050292

us-gaap:CommonStockMember

2022-03-31

0000050292

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0000050292

us-gaap:RetainedEarningsMember

2022-03-31

0000050292

2022-03-31

0000050292

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0000050292

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0000050292

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0000050292

us-gaap:CommonStockMember

2022-06-30

0000050292

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0000050292

us-gaap:RetainedEarningsMember

2022-06-30

0000050292

2022-06-30

0000050292

us-gaap:CommonStockMember

2023-03-31

0000050292

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000050292

us-gaap:RetainedEarningsMember

2023-03-31

0000050292

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000050292

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000050292

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000050292

us-gaap:CommonStockMember

2023-06-30

0000050292

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000050292

us-gaap:RetainedEarningsMember

2023-06-30

0000050292

country:CN

2023-04-01

2023-06-30

0000050292

country:CN

2022-04-01

2022-06-30

0000050292

srt:MinimumMember

2023-06-30

0000050292

srt:MaximumMember

2023-06-30

0000050292

iehc:DomesticMember

2023-04-01

2023-06-30

0000050292

iehc:DomesticMember

2022-04-01

2022-06-30

0000050292

iehc:InternationalMember

2023-04-01

2023-06-30

0000050292

iehc:InternationalMember

2022-04-01

2022-06-30

0000050292

iehc:DefenseMember

2023-04-01

2023-06-30

0000050292

iehc:DefenseMember

2022-04-01

2022-06-30

0000050292

iehc:CommercialAerospaceMember

2023-04-01

2023-06-30

0000050292

iehc:CommercialAerospaceMember

2022-04-01

2022-06-30

0000050292

iehc:SpaceMember

2023-04-01

2023-06-30

0000050292

iehc:SpaceMember

2022-04-01

2022-06-30

0000050292

iehc:OtherMember

2023-04-01

2023-06-30

0000050292

iehc:OtherMember

2022-04-01

2022-06-30

0000050292

iehc:TwoZeroOneOneEquityIncentivePlanMember

2011-08-31

0000050292

iehc:TwoZeroTwoZeroEquityIncentivePlanMember

2020-12-16

0000050292

iehc:TwoZeroTwoZeroEquityIncentivePlanMember

2023-04-01

2023-06-30

0000050292

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2023-04-01

2023-06-30

0000050292

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2022-04-01

2022-06-30

0000050292

2023-04-01

0000050292

2023-04-01

2023-04-01

0000050292

2020-12-01

2020-12-01

0000050292

srt:ScenarioForecastMember

2030-12-01

2030-12-01

0000050292

us-gaap:OtherAssetsMember

2023-06-30

0000050292

2021-01-29

2021-01-29

0000050292

srt:ScenarioForecastMember

2028-03-30

2028-03-30

0000050292

iehc:OneCustomersMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-04-01

2022-06-30

0000050292

iehc:CustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:CustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-04-01

2023-03-31

0000050292

iehc:OneCustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-04-01

2023-03-31

0000050292

iehc:SecondCustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-04-01

2023-03-31

0000050292

iehc:ThirdCustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-04-01

2023-03-31

0000050292

iehc:VendorMember

iehc:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:OneVendorMember

iehc:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:TwoVendorMember

iehc:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:VendorMember

iehc:PurchaseBenchmarkMember

us-gaap:SupplierConcentrationRiskMember

2022-04-01

2022-06-30

0000050292

iehc:TwoVendorMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0000050292

iehc:OneVendorMember

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

2022-04-01

2023-03-31

xbrli:shares

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:pure

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS AGREEMENT (this “Agreement”)

is made as of the 1st day of June, 2023 (the “Effective Date”) by and between Subrata Purkayastha (the “Employee”)

and IEH Corporation, a New York corporation (the “Company”).

W I T N E S S E T H:

WHEREAS, the Company and its

subsidiaries, if any, are engaged in the business of designing, developing and manufacturing printed circuit and plastic circular connectors

for high performance applications utilizing the HYPERBOLOID contact design; and

WHEREAS, the Employee desires

to be employed by the Company as the Interim Chief Financial Officer and Interim Treasurer of the Company, and the Company desires to