Jade Art Group Announces Initiation of Coverage by Murphy Analytics Research Group

03 July 2008 - 10:58PM

Business Wire

Jade Art Group Inc. (OTCBB: JADA), a seller and distributor of raw

jade sourced from the SheTai Jade mine in China, today announced

that Murphy Analytics, a fee-based equity research group, has

initiated coverage on Jade Art Group with an "Outperform" rating.

In the report entitled, "Gold Has a Value; Jade is Invaluable,"

Murphy Analytics discussed such investor highlights as Jade Art

Group�s exclusive distribution right with XiKai Mining, which has

China�s largest high quality jade reserves. The report also

reviewed industry drivers, including the increasing demand for jade

throughout China. According to analyst Patrick J. Murphy, CFA, and

author of the report, much of the Chinese economy�s increasing

demand for jade is driven by the rapidly growing affluence of the

middle and upper classes whose rising incomes make �treasures such

as jade not only desirable but obtainable by an ever-expanding

market.� These are among the factors substantiating the Company�s

2008 guidance of $61- $65 million in revenues, according to the

report. �With favorable production and product cost agreements in

place, JADA has created a highly profitable distribution business

with the potential to generate as much as $40 million in net income

in calendar year 2008, or approximately $0.50 EPS,� the report

stated. �At a price of $4.75 on June 25, 2008 and a price of $3.00

on July 2, 2008 Murphy Analytics sees the potential for significant

price appreciation for JADA and is initiating coverage on JADA with

an Outperform rating.� �We are very pleased with the quality of

Murphy Analytics research coverage,� commented Mr. Hua-Cai Song,

CEO of Jade Art Group. �The report provides serious investors with

an in-depth understanding of our Company and the jade industry in

China.� The report is available for review free of charge at

http://www.murphyanalytics.com/uploads/JADA_Initiation. Jade Art

Group has engaged Murphy Analytics to provide research coverage

under the compensation terms described below. About Jade Art Group

Inc. Jade Art Group Inc., through its wholly owned subsidiary,

Jiangxi SheTai Jade Industrial Co., Ltd., sells and distributes raw

jade sourced from the SheTai Jade mine throughout China, with uses

ranging from decorative construction material to high-end jewelry.

This mine�s operating capacity is estimated to reach 40,000 tons

and it contains one of the largest jade reserves in China. The mine

is owned by XiKai Mining, with which Jade Art Group signed an

agreement to acquire exclusive distribution rights to sell 90% of

the SheTai Jade produced from the mine for the next 50 years.

According to a survey report issued by the Inner Mongolia

Geological Institution, the mine has proven and probable reserves

of approximately 6 million tons, or approximately $16 billion worth

of jade at current market rates of $2,750 per ton. Several national

jade experts have noted the high quality of SheTai Jade as compared

to the other existing varieties of Chinese jade. For more

information, please visit: www.jadeartgroupinc.com About Murphy

Analytics Murphy Analytics provides company-sponsored research

coverage on small-cap stocks in a broad range of sectors. Murphy

Analytics was paid $9,000 by Jade Art Group in advance of the

creation of this report. For additional information, please visit

www.murphyanalytics.com. The views expressed in the report on Jade

Art Group accurately reflect the analyst's personal views. Neither

the analyst's compensation nor the compensation received by Murphy

Analytics is in any way related to the specific ratings or views

contained in this research report. FORWARD-LOOKING STATEMENTS: This

document includes forward-looking statements. Forward-looking

statements include, but are not limited to, statements concerning

estimates of, and increases in, production, projected volume of

customer orders, performance by customers under existing and future

agreements, cash flows and values, statements relating to the

continued advancement of Jade Art Group�s projects and other

statements which are not historical facts. When used in this

document, the words such as "could," "plan," "estimate," "expect,"

"intend," "may," and similar expressions are forward-looking

statements. Although Jade Art Group believes that its expectations

reflected in these forward-looking statements are reasonable, such

statements involve risks and uncertainties and no assurance can be

given that actual results will be consistent with these

forward-looking statements. Important factors that could cause

actual results to differ from these forward-looking statements

include, but are not limited to, those set forth in our reports

filed with the Securities and Exchange Commission, together with

the risks discussed in our press releases and other communications

to shareholders issued by us from time to time, such as our ability

to raise capital as and when required, the availability of raw

products and other supplies, competition, the costs of goods,

government regulations, and political and economic factors in the

People's Republic of China in which our subsidiaries operate.

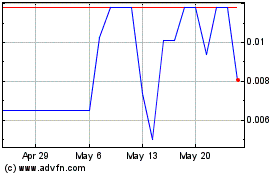

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Jun 2024 to Jul 2024

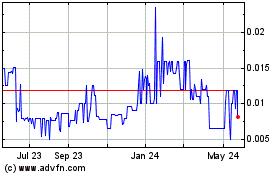

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Jul 2023 to Jul 2024