Julius Baer Assets Lifted by Brexit Trading Boost

26 July 2016 - 1:06AM

Dow Jones News

ZURICH—Swiss bank Julius Baer Group AG said it increased assets

it manages for clients in the first half of this year, as it bulked

up on staff and its overall results were bolstered by the U.K.'s

vote to leave the European Union.

The bank's report Monday managed to offset a relatively gloomy

outlook for the near future issued by its chief executive.

Zurich-based Julius Baer said adjusted net profit rose 5% in the

first half compared with the first six months of 2015, as assets

under management rose 4% from the end of last year to reach 311

billion Swiss francs ($314.9 billion).

Shares of Julius Baer were recently up 4.4%.

The bank said its underlying net trading income fell compared

with the first half of last year, when volatility had risen sharply

due to the Swiss central bank's surprise decision to remove a cap

on the value of the franc. But the figure jumped 26% compared with

the second half of last year, Julius Baer said, as trading volumes

in foreign currency spiked in relation to another dramatic event in

June: the U.K.'s vote to leave the EU.

The Brexit vote "has been a good, broad-based event when it

comes to transaction income," Chief Executive Boris Collardi said

at a media briefing. In a subsequent interview, Mr. Collardi said

the bank continues to benefit from the vote's aftermath, and hopes

to continue seeing clients take up related trading positions "as

long as we can."

Julius Baer is narrowly focused on the business of private

banking for wealthy clients, in which it strives to compete with

bigger, more diversified Swiss players UBS Group AG and Credit

Suisse Group AG. All three wealth managers have been challenged

recently by turbulent markets, which have pushed cautious clients

to let their assets remain dormant—and in turn, starve the banks of

fees.

Julius Baer said net commission and fee income slipped 7% in the

first half of 2016 compared with the same period last year, because

of "reduced client risk appetite." Meanwhile, weakened currencies

cut 4 billion francs from the value of its assets under

management.

Also, like its Swiss peers, Julius Baer is increasingly burdened

by the negative interest rate policy implemented by the country's

central bank. That policy means that lenders keeping cash at the

central bank are being charged 0.75% on deposits above a certain

level. In Julius Baer's case, Mr. Collardi said, those charges

amounted to 20 million francs in the first half of the year.

Mr. Collardi painted a daunting picture for his industry's

near-term future.

He said market volatility should continue this year because of

political events such as the U.S. presidential election. Central

banks, meanwhile, have likely exhausted their ability to ease

troubled markets with further interest rate cuts: "This ongoing

race to the bottom in terms of interest rates has probably now

reached its max impact," the CEO said.

Yet, Julius Baer's investments point to a more upbeat

longer-term outlook.

The bank said it saw a 3.7% gain in net new money to manage in

the first half. That increase came alongside growth in banking

staff. About 50 new relationship managers joined the bank in the

first half of this year, compared with 40 hired in all of last

year. Julius Baer has more than doubled its number of relationship

managers since 2008, to nearly 1,300, amid a series of

acquisitions.

Recent difficulties encountered by Credit Suisse, which is in

the midst of a fitful restructuring effort and has seen its stock

price fall sharply, haven't created opportunities for Julius Baer

to hire Credit Suisse bankers, Mr. Collardi said. "We're not seeing

anything different now than in the past," he said. A veteran of

Credit Suisse who left in 2006, Mr. Collardi said, "I regret to

see" the bank in its current predicament, having embarked on a

turnaround bid last year just as markets were becoming more

challenging. Still, he added, "one has to make his own luck."

Julius Baer's expansion in the first half of the year helped to

offset unwelcome developments in the period, including

"deleveraging" among clients in Asia, or a decline in loans to

clients in that key region secured by assets held at the bank.

The result also comes as Julius Baer said it has now "completed"

the process of European clients pulling assets out as they declare

their Swiss bank accounts to tax authorities in their home

countries—which has long been a drag on Julius Baer's business.

Adjusted net profit was 402 million francs in the first half, a

5% increase from the same period in 2015, when excluding a

provision of $350 million the bank made in the first half of last

year to help it settle a longstanding U.S. Justice Department probe

of its aiding of tax evasion among American clients.

Julius Baer later admitted to helping American clients evade

taxes, and settled the matter by agreeing to pay $547 million.

Write to John Letzing at john.letzing@wsj.com

(END) Dow Jones Newswires

July 25, 2016 10:51 ET (14:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

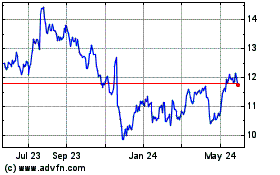

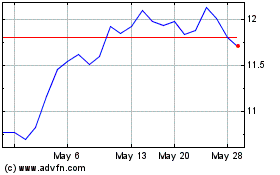

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Feb 2024 to Feb 2025