China Cosco Is Sole Bidder for Stake in Greece's Piraeus Port

24 December 2015 - 12:40AM

Dow Jones News

China's shipping and port giant China Cosco Holding Co. is so

far the sole bidder for a majority stake in the long-delayed

privatization of Greece's main port of Piraeus, two people with

direct knowledge of the deal said Wednesday.

Two other shortlisted investors—APM Terminals, owned by Danish

shipping conglomerate A.P. Moller-Maersk A/S, and

Philippines-based port operator International Container Terminal

Services Inc.—didn't submit binding bids by Monday's deadline, the

people said.

The privatization is expected to generate hundreds of millions

of euros for cash-strapped Athens. The Hellenic Republic Asset

Development Fund, which handles state asset sales, said it would

disclose the bids for the port on Jan. 12. APM Terminals and ICTS

declined to comment.

"It will be complicated for offers to be accepted after the

deadline, but since the seller has not officially said who put

forward binding bids, it's not unprecedented that a late entry

comes into the fold," one person said.

Regardless of the number of offers, Cosco is considered the

favorite to win the bid as it already operates two container

terminals under a 35-year concession it acquired in 2009.

Piraeus, just a few miles south of the Greek capital of Athens,

is the de facto home of Greece's giant shipping industry and one of

the largest ports in the Mediterranean. As Piraeus is the closest

Western port to the Suez Canal, Cosco already is using it as a

transshipment hub for Asian exports to Europe coming in on

container vessels from China.

"Beyond their existing presence in Piraeus, the Chinese have a

long standing relationship with Greece's shipping sector, including

multibillion credit lines for Greek owners to build ships in

Chinese yards, so I will be surprised if Cosco does not win the

bid," said George Xiradakis, an Athens-based marine-business

consultant and an adviser of China Development Bank.

Stergios Pitsiorlas, head of the Hellenic Republic Asset

Development Fund, told The Wall Street Journal last week that the

fund would consider Cosco's existing investment in Piraeus when

evaluating the bids. However, he said this didn't mean the deal was

sealed.

Greece's leftist government had pushed the privatization back

for a year, upsetting potential investors and the country's

international creditors. The creditors had made the selling of

state assets a condition for a multibillion-euro bailout package to

keep Greece from defaulting on its debts. APM Terminals and ICTS

declined to comment.

The deal involves bids for a 67.7% stake in Piraeus Port

Authority SA. A 51% slice will be transferred to the winning bidder

at once and the remaining 16.7% over the next five years as

required infrastructure investments at the port take shape.

People with knowledge of the deal said the port sale could yield

about €700 million ($768.5 million), including the €300 million

investment the winner must put into Piraeus over the next five

years. Piraeus Port Authority's market capitalization is €357

million.

Greece's Syriza leftist government, which first won power in

January and was re-elected in September, initially opposed

privatizations to which the previous conservative administration

had agreed. It rolled back all potential deals, and no sale

proceeds came in this yeardespite an agreement with the country's

creditors that €2.8 billion worth of state asset sales would be

completed.

For next year, the target is set at €3.5 billion, but Mr.

Pitsiorlas said €2.5 billion is more realistic.

The second-biggest Greek port, in the northern city of

Thessaloniki, will be among the first to be privatized next year,

according to the development fund's schedule. Both APM Terminals

and ICTS are in the running, along with Germany's Deutsche Invest

Equity Partners GmbH and Japan's Mitsui & Co.

Binding bids are expected in April. People familiar with the

matter said APM Terminals is the front-runner to win that

concession.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

December 23, 2015 08:25 ET (13:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

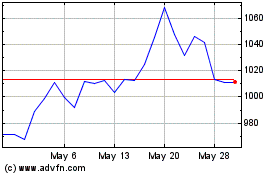

Mitsui (PK) (USOTC:MITSY)

Historical Stock Chart

From Nov 2024 to Dec 2024

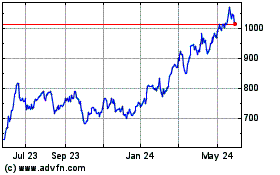

Mitsui (PK) (USOTC:MITSY)

Historical Stock Chart

From Dec 2023 to Dec 2024