Current Report Filing (8-k)

13 February 2018 - 5:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of report

(Date of earliest event reported): February 13, 2015

MINING

GLOBAL, INC.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

000-53556

|

74-3249571

|

|

(State or Other

Jurisdiction

|

(Commission File

Number)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification

No.)

|

224 Datura St.

Suite 1015

West Palm Beach FL 33401

(Address of Principal

Executive Officers) (Zip Code)

Registrant's telephone number, including

area code:

(561) 259-3009

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

ITEM 1.02 TERMINATION OF A MATERIAL DEFINITIVE

AGREEMENT

On March

17, 2015, Mining Global, Inc., a Nevada corporation (the “Company” or “MNGG”), entered into a

Settlement and Exchange Agreement (the “Agreement”) with Nathan Yoder and Joel Natario. A copy of such Agreement

is attached hereto as Exhibit 10.1.

Yoder etal made

certain representations upon which representations the management relied up that they in fact loaned certain sums of monies

or will loan certain sums of money to the Company. The current management has conducted an exhaustive and forensic search and

can not locate any evidence that any monies were in fact advanced by Yoder as outlined in the aforementioned agreement.

The current management has also made efforts by itself and through

its litigation lawyers demanding proof of such indebtedness. The Yoder representatives are either non responsive or evasive in

production of proof of the monies loaned to the company.

The management is

of the opinion that the Yoder loan document is fraudulent in nature non valid and non binding.

Effective

immediately (February 12, 2018) or retroactive to the date first entered into the agreement as permitted by law, the

current management hereby rescinds the agreement.

ITEM 9.01 FINANCIAL STATEMENTS

AND EXHIBITS

10.1

Settlement and Exchange Agreement

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 12, 2018

|

|

By:

/s/ Sammy Adigun

Name: Sammy Adigun

Title: Chief Executive Officer

|

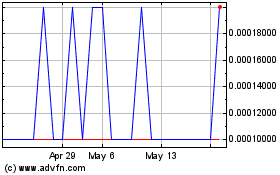

Mining Global (CE) (USOTC:MNGG)

Historical Stock Chart

From Feb 2025 to Mar 2025

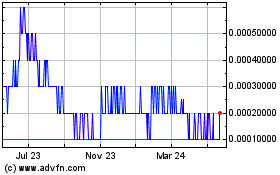

Mining Global (CE) (USOTC:MNGG)

Historical Stock Chart

From Mar 2024 to Mar 2025