Wayland Group Enters into a Letter of Intent to Sell 49.9% of International Business to International Cannabis Corp.

15 January 2019 - 11:16PM

InvestorsHub NewsWire

Wayland Group Enters into a Letter of

Intent to Sell 49.9% of International Business to International

Cannabis Corp.

Toronto, ON -- January 15, 2019 --

InvestorsHub NewsWire -- Wayland Group (CSE:WAYL) (FRANKFURT: 75M) (OTCQB:MRRCF) (“Wayland” or the

“Company”) is pleased to announce that, pursuant to the Company’s

previously announced strategic review, it has entered into a Letter of Intent to sell

49.9% of the Company’s international portfolio of assets to

International Cannabis Corp (“ICC”). Wayland will receive

300,000,000 shares of ICC that trade under the symbol WRLD.U on the

Canadian Securities Exchange, at a deemed price of USD $0.43 per

share (the “Issue Price”). Based on the Issue Price, once complete

this transaction will value Wayland’s international business at

approximately

USD$258,000,000.

Additional Transaction

Details

Upon consummation of

the proposed

transaction:

-

Wayland will sign a

three-year supply agreement with ICC that will supply ICC with

10,000kg of EU-GMP certified product per year, for a total of

30,000kg during the

term

-

ICC will gain access to

Wayland’s German advisory board to help with production and

distribution strategies, branding campaigns, as well as the

continued penetration of new cannabis and CBD markets and verticals

through Cosmos

Holdings

-

Wayland’s international

business will be held in a subsidiary which will be jointly owned

by Wayland and ICC

-

ICC shares will not be

distributed to Wayland shareholders for a period of not less than

six months from the closing date of the

transaction.

This transformational event

for Wayland shareholders affords them the opportunity to unlock the

value in the Company’s international portfolio and to gain exposure

to ICC’s international business. Based on yesterday’s closing price

of Wayland, this transaction will value the international assets at

a 13.3% premium to the current market value of Wayland’s entire

global business and a 32.6% premium to the 20-day VWAP

(volume-weighted average price). The current intention is to spin

out the 300,000,000 ICC shares to WAYL shareholders at the

appropriate time after the six-month holding

period.

Subject to

developments in the strategic review, the Company will continue to

operate its Canadian business supplying its current medical patient

base and the Canadian Provinces. Wayland’s state-of-the-art,

purpose-built cannabis production facility in Langton, Ontario will

be fully operational in

2019.

“The proposed

transaction would provide Wayland and our shareholders with

exposure to an unparalleled portfolio of international assets to

address the ever-expanding global legalization of medical cannabis

with operations in countries with a total population of just over

390 million people and access to international markets that exceed

a billion people. This transaction ascribes value to our

international assets that is in line with our expectations as the

value of our international assets is now greater than the entire

company’s present market capitalization. The transaction also

provides an opportunity at the appropriate time to fully integrate

our international operations with ICC’s to cover all aspects of the

value chain, including medical plant production, extraction, active

pharmaceutical ingredient isolation, finished dose manufacturing,

and distribution.” Stated Wayland CEO, Ben Ward.

The transaction is

expected to close on or around March 1, 2019 and is subject to a

number of conditions including certain regulatory, stock exchange

and securityholder approvals and other conditions, completion of

satisfactory due diligence by ICC and Wayland, Wayland and ICC each

receiving fairness opinions, the completion of a reorganization of

Wayland’s international assets and the entering into a definitive

agreement.

This Transaction is subject to a finder's

fee.

About Wayland

Group

Wayland is a vertically integrated cultivator

and processor of cannabis. The Company was founded in 2013 and is

based in Burlington, Ontario, Canada and Munich, Germany, with

production facilities in Langton, Ontario where it operates a

cannabis cultivation, extraction, formulation, and distribution

business under federal licenses from the Government of Canada. The

Company also has production operations in Dresden, Saxony, Germany,

Regensdorf, Switzerland, Allesandria, Piedmont, Italy and Ibague,

Colombia. Wayland will continue to pursue new opportunities

globally, including the consummation of its previously announced

transactions in the United Kingdom, Australia and Argentina, in its

effort to enhance lives through

cannabis.

Forward Looking

Information

This news release

includes forward-looking information and statements, which may

generally be identified by the use of the words “will”,

“intention”, “expects”, “is expected to”, “subject to”, and

variations or similar expressions and which include, but are not

limited to, information and statements regarding or inferring the

future business, operations, financial performance, prospects, and

other plans, intentions, expectations, estimates, and beliefs of

the Company. Such statements include those relating to the terms of

the proposed transaction, the value of Wayland’s international

business, its entering into a supply agreement with ICC and the

terms thereof, the combined presence of the companies, and the

integration of Wayland’s operations team into ICC’s existing

operations, certain expected effects of the transaction, the

anticipated date for entering into a definitive agreement and

closing the transaction, the nature and satisfaction of certain

conditions to completion, the Company’s expectations regarding the

operation of its Canadian business going forward and the

anticipated timeline for the completion of the Company’s Langton

facility. Forward-looking information and statements involve and

are subject to assumptions and known and unknown risks,

uncertainties, and other factors which may cause actual events,

results, performance, or achievements of the Company to be

materially different from future events, results, performance, and

achievements expressed or implied by forward-looking information

and statements herein. Such assumptions, risks, uncertainties and

other factors include, but are not limited to, that the proposed

transaction will be completed on the terms and timelines

anticipated by the Company or at all, that the consummation of the

proposed transaction will help to unlock the value of the Company’s

international portfolio in the manner anticipated or at all, that

the value of the ICC common shares received by the Company in

connection with the transaction will not decrease in value, that

all necessary stock exchange, securityholder regulatory and other

approvals will be received in connection with the proposed

transaction on the timelines anticipated or at all, that all other

conditions to closing will be satisfied in the manner and on the

timelines anticipated, that the integration of Wayland’s existing

operations team into ICC and ICC’s access to Wayland’s German

advisory board will have the anticipated benefits for both

companies, that Wayland will be able to distribute the ICC common

shares received pursuant to the proposed transaction to Wayland’s

shareholders in a cost effective manner and on the timelines

anticipated and that the Company will be able to continue to

operate its existing Canadian business as planned and certain

matters relating to the conduct and outcome of the Company’s

ongoing strategic review. Although the Company believes that any

forward-looking information and statements herein are reasonable,

in light of the use of assumptions and the significant risks and

uncertainties inherent in such information and statements

(including the risk that some or all of the assumptions made by the

Company may prove to have been incorrect), there can be no

assurance that any such forward-looking information and statements

will prove to be accurate, and accordingly readers are advised to

rely on their own evaluation of such risks and uncertainties and

should not place undue reliance upon such forward-looking

information and statements. In particular, the completion of the

proposed transaction is subject to the satisfaction of a number of

conditions and uncertainties (including the completion of

satisfactory due diligence, and the negotiation of definitive

agreements) and the Company can offer no assurance that the

proposed transaction will be completed on the terms, conditioned

and timelines anticipated or at all, nor can any assurance be

offered that the Company’s strategic review will result in any

other transaction in respect of the Company’s international assets

or otherwise being identified or successfully completed. Any

forward-looking information and statements herein are made as of

the date hereof, and except as required by applicable laws, the

Company assumes no obligation and disclaims any intention to update

or revise any forward-looking information and statements herein or

to update the reasons that actual events or results could or do

differ from those projected in any forward looking information and

statements herein, whether as a result of new information, future

events or results, or otherwise, except as required by applicable

laws.

The Canadian

Securities Exchange has not reviewed, approved or disapproved the

content of this news release

For more information

about Wayland, please visit our website at www.waylandgroup.com

Contact

Information:

Investor

Relations

Graham

Farrell

VP,

Communications

Graham.Farrell@waylandgroup.com

647-643-7665

Media

Inquiries: media@waylandgroup.com

Corporate Headquarters

(Canada)

Wayland Group Corp.

(Toronto)

845 Harrington Court,

Unit 3

Burlington Ontario L7N

3P3

Canada

289-288-6274

European Headquarters

(Germany)

Maricann

GmbH

Thierschstrasse 3,

80538 Munchen,

Deutschland

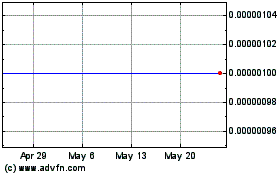

Wayland (CE) (USOTC:MRRCF)

Historical Stock Chart

From Feb 2025 to Mar 2025

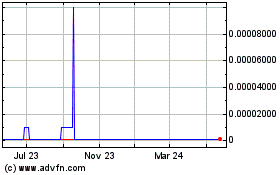

Wayland (CE) (USOTC:MRRCF)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Wayland Group Corporation (CE) (OTCMarkets): 0 recent articles

More Wayland Group Corp. News Articles