Africa Internet Group Raises More Funds in Bid to Become Continent's Amazon -- Update

04 March 2016 - 3:29AM

Dow Jones News

By Stu Woo and Friedrich Geiger

Africa has its unicorn.

Africa Internet Group, the startup behind what has been called

the Amazon.com of Africa, said Thursday it raised more than EUR300

million ($327 million) in its latest round of funding, with

investors valuing the company at just over $1.1 billion.

With that fundraising round, the Lagos, Nigeria-based firm

becomes the first in Africa to join the ranks of tech startups

valued at over $1 billion--called unicorns in the lexicon of

Silicon Valley. And it is passing that threshold just as investors

in the U.S. and elsewhere start taking a harder look at some of the

astronomical valuations bestowed on an earlier generation of

unicorns.

Rocket Internet SE, the Berlin-based tech incubator, founded

Africa Internet in 2012. The group's first business was a

Nigeria-based online retailer called Jumia. It is a general

merchandiser that sells electronics, groceries and clothing, though

selling cell phones is one of the biggest parts of its business.

Jumia is now in 11 African countries.

Jumia is the biggest division of Africa Internet, which runs

nine other online businesses on the continent, including

Uber-competitor Easy Taxi and auto-classified site Carmudi.

Investors in the round included Goldman Sachs Group Inc.,

African telecom giant MTN Group Ltd., and French insurer Axa SA.

Rocket Internet also invested in the round. Previously, it had

owned a third of the company, but didn't disclose its current stake

after the most recent round.

Unlike Amazon, which largely uses outside delivery services such

as United Parcel Services Inc. in the U.S., Sacha Poignonnec, one

of Africa Internet's two chief executives, said Jumia delivers 90%

of its orders with drivers in its own network. It has experimented

with delivering goods using drivers from its Easy Taxi service and

plans to further test that strategy.

Africa Internet will use the investment to strengthen its

existing businesses, including the non-Jumia ones, and to

selectively expand to new countries, said Mr. Poignonnec. He said

in an interview Thursday that he wanted all of Africa Internet "to

be in a position of profitability" in two to three years, though

the company might then opt to forgo profitability and instead

invest in future growth, depending on what the market looks

like.

"I often take the example of Amazon, where it's not possible

every quarter to be profitable," Mr. Poignonnec said.

MTN Group Chief Digital Officer Herman Singh said in an

interview last week, before the announcement of the latest

investment round, that Africa Internet was spending about EUR100

million to EUR200 million a year, largely to market to new

customers.

Prior to the latest cash injection, Africa Internet had been

valued at EUR500 million. Africa Internet is the latest business

from Rocket's portfolio to cross the $1 billion valuation

threshold, following Delivery Hero, HelloFresh, Global Fashion

Group, Lazada and Home24.

Write to Stu Woo at Stu.Woo@wsj.com and Friedrich Geiger at

friedrich.geiger@wsj.com

(END) Dow Jones Newswires

March 03, 2016 11:14 ET (16:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

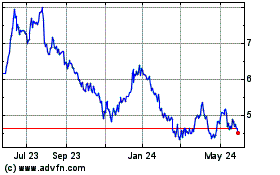

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Dec 2024 to Jan 2025

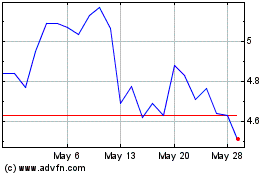

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Jan 2024 to Jan 2025