In the Race for 5G, Africa Lags Far Behind -- Journal Report

12 November 2019 - 2:29PM

Dow Jones News

By Alexandra Wexler

JOHANNESBURG -- While the rest of the world races to deploy

next-generation 5G wireless technology, Africa is lagging behind,

mainly because of poor consumers' inability to pay for fast data

services and devices.

Trade association Groupe Speciale Mobile Association expects

that by 2025, just seven out of 46 countries in sub-Saharan Africa

will have 5G technology. The association estimates 5G will account

for just 3% of mobile connections on the continent that year,

versus 16% of connections world-wide.

That's even though smartphone connections in Africa doubled to

300 million in the three years through 2018, with another 400

million expected to be added by 2025, according to GSMA estimates.

And about 44% of sub-Saharan Africa's population of more than a

billion people is under 15 years old -- a potentially enormous

market for telecommunications companies' services.

But telecom operators on the continent -- including MTN Group

Ltd. and Vodafone International Holdings BV's Vodacom Group Ltd.,

both based in South Africa, and France's Orange SA -- say they want

customers in Africa to graduate to already widely available 4G

networks before sinking billions of dollars into a new technology

that few will be able to use. "Let's fish where the fish are," says

Rob Shuter, chief executive of MTN, which has more mobile-phone

subscribers than AT&T Inc. and Verizon Communications Inc.

combined.

Nearly half of sub-Saharan Africa's population is currently

covered by 4G networks, but 4G accounts for just 10% of total

connections, mostly because users opt for cheaper phones that don't

support the technology, according to executives from telecom

companies.

Focus on 3G and 4G

GSMA estimates that over the past five years, mobile operators

have invested nearly $40 billion in the region, mostly expanding 3G

and 4G networks.

Orange, which has a strong presence in French-speaking areas of

Africa, is investing about $1 billion annually in its network in

Africa and the Middle East, to expand coverage and increase speed.

The mobile-network operator plans to launch 5G in Europe in the

near future but is still rolling 4G out across the African

continent.

Meanwhile, providers are racing to reduce the cost of both their

smartphones and data -- two essential ingredients to get more

Africans to access the internet on their phones.

Of MTN's 240 million subscribers in Africa and the Middle East,

about 160 million still use phones known as feature phones --

devices that can make calls and send texts but don't provide

internet access. Of the 80 million subscribers who use the mobile

internet, about 80% still operate on 3G, Mr. Shuter says.

For now, 5G barely has a toehold on the continent. Vodacom has

established 5G connections for two individual customers -- a bank

and a mining company -- in the tiny landlocked nation of Lesotho,

according to Andries Delport, Vodacom's chief technology

officer.

"It was half a proof of concept to see if it really worked: Can

it provide fiberlike performance?" he says. "The customers'

feedback was that it was more stable than fiber from a

competitor."

Vodacom has no plans to roll out 5G commercially anytime soon.

Mountainous Lesotho is so far the lone country that has allocated

5G spectrum to Vodacom to launch a commercial service, Mr. Delport

says.

The affordability hurdle

Another major hurdle to the advent of 5G in Africa is the cost

of a device that would be capable of running on 5G networks.

Network operators in Africa work with suppliers to bring down the

prices of smartphones, but even prices that are very low by Western

standards can be a burden for most African consumers.

Vodacom sells phones that run 3G for about $18 and 4G-compatible

devices for around $20. Orange sells a very basic 3G-enabled phone

for $20, including a data bundle. MTN launched a very basic

3G-enabled phone last year that retails for about $23, and has

plans to launch an Android entry-level smartphone priced at just

over $20 before the end of the year. But that's still a hefty price

tag for a region where per capita gross domestic product averaged

just $1,574 in 2018, according to the World Bank.

"It's the lack of affordability that is holding us back," Mr.

Shuter says. "It's a real burden for somebody to spend even $30 or

$40 on a handset." Meanwhile, 5G devices can retail for well over

$1,000.

In many developed markets, operators subsidize the cost of a

mobile phone when a customer is on a contract. But in Africa, most

customers use prepaid or pay-as-you-go services. "It's difficult to

subsidize handsets, which is a good way to improve access to a

proper device," says Elisabeth Medou Badang, senior vice president

for Southern Africa and the Indian Ocean at Orange.

About 98% of Orange's customers in Africa are prepaid, as are

about 96% of MTN's subscribers and about 92% of Vodacom's

customers.

The GSMA estimates average revenue per user in the region at

just $4 a month -- the lowest in the world -- which puts additional

strain on operators. Telecoms have boosted revenue in Africa by

branching into other services, such as mobile payments and

microloans.

"There is still a lot to do on 4G before thinking of something

else," says Ms. Medou Badang. "Being a first mover in 5G, does it

give a strong competitive advantage? I don't know, but for sure

lagging behind for some time will be a competitive

disadvantage."

Ms. Wexler is a Wall Street Journal reporter in Johannesburg.

She can be reached at alexandra.wexler@wsj.com.

(END) Dow Jones Newswires

November 11, 2019 22:14 ET (03:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

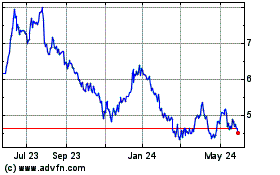

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Dec 2024 to Jan 2025

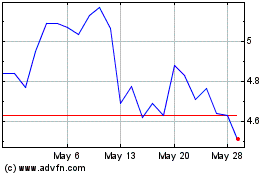

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Jan 2024 to Jan 2025