IHS Holding Sets IPO Terms That Could Put Market Cap Near $8 Billion

04 October 2021 - 11:20PM

Dow Jones News

By Colin Kellaher

IHS Holding Ltd. on Monday said it plans to sell 18 million

shares at between $21 and $24 apiece in an initial public offering

that could give the Wireless tower operator a market capitalization

of nearly $8 billion.

At the $22.50 midpoint of the expected price range, IHS said it

expects net proceeds of about $378.8 million, or around $436.5

million if the underwriters exercise an option to buy an additional

2.7 million shares.

IHS said current shareholders, including South Africa-based

telecommunications group MTN Group Ltd. and private-equity firm

Emerging Capital Partners, plan to sell a total of 4.5 million

shares in the offering, bringing the size of the IPO to 22.5

million shares.

MTN would still be IHS's largest shareholder after the IPO, with

a stake topping 25%, while French investment company Wendel SE,

which isn't selling any shares, would hold nearly 23%, according to

a filing with U.S. Securities and Exchange Commission.

In the filing, IHS said it would have about 330.8 million shares

outstanding after the IPO, assuming exercise of the overallotment

option, for a market capitalization of around $7.94 billion at the

$24-a-share high end of the expected price range.

IHS said it has been approved to list its shares on the New York

Stock Exchange under the symbol IHS.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

October 04, 2021 08:05 ET (12:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

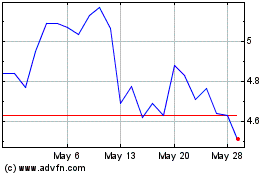

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Dec 2024 to Jan 2025

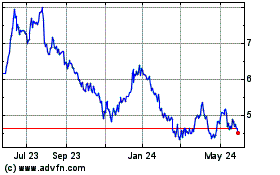

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about MTN Group Ltd (PK) (OTCMarkets): 0 recent articles

More MTN Group Ltd (PK) News Articles