By Friedrich Geiger and Eyk Henning

BERLIN--German retailer Metro AG plans to split in two, listing

its wholesale and food and consumer-electronics businesses

separately in the hope of boosting their sales growth and profits,

the company said Wednesday.

Metro said on Wednesday that no final decision has been taken on

a demerger which would require approval from stockholders though

the plan has the support of senior management and the group's main

shareholders.

Investors reacted enthusiastically to the proposal, with shares

in Metro rising more than 13% in early afternoon trading on the

Frankfurt bourse, boosting the group's market capitalization to

around EUR9.09 billion ($10.30 billion).

Metro has been struggling with declining revenues and volatile

profits for the past five years, along with the complexity of its

sprawling operations.

Chief Executive Olaf Koch has attempted to tackle the issue in

recent years by divesting some businesses, including by selling

department-store chain Galeria Kaufhof to Canada's Hudson Bay Co.

in 2015. He has also exited some Asian operations.

But the current plan of splitting the company in two parts,

which requires approval from the supervisory board and

shareholders, is the most dramatic move Metro has undertaken to

simplify its empire of more than 2,000 wholesale food stores,

supermarkets and electronics outlets located throughout Europe,

Asia and Africa.

Annual revenue at the electronics business was EUR21.7 billion

for the 12 months ended September 2015, while revenue at the food

operations exceeded EUR37 billion.

The split could also shield investors in Metro's wholesaling and

supermarket business from a long-running dispute over strategy at

the consumer-electronics unit. The unit, which trades under the

Saturn and Media Markt brands, is part owned by Media Markt's

billionaire founder Erich Kellerhals, who has clashed for years

with management over day-to-day operations and longer-term

strategy.

While Metro plans to retain its 80% stake in the

consumer-electronics unit, held via holding company, the wholesale

business and supermarkets would be spun off as a separate entity

with a new name, the company said. Shareholders would receive

shares in the new company in proportion to their existing stake in

Metro.

"I feel very strongly that a split in two independent and

focused businesses would be in the best interest of all

stakeholders, as it would facilitate a significant opportunity for

faster and more profitable growth," said Jürgen Steinemann,

Chairman of Metro's supervisory board.

The group's three main shareholders--Franz Haniel & Cie.

GmbH, the Schmidt-Ruthenbeck family and the Prof. Otto Beisheim

foundation --support the plans, Metro said.

"We will closely monitor further actions, but don't think the

transaction will affect our rights as a shareholder in the

Media-Saturn holding company," a spokesman for Mr. Kellerhals

said.

Metro's Mr. Koch said Mr. Kellerhals "has no potential to

interfere with this transaction" because the split takes place at

the group level, where Mr. Kellerhals isn't a major

shareholder.

He added that the two businesses--food and electronics--are so

different that they would be easier to steer if they were

independent.

A split could also open new doors to future mergers and

acquisitions, while giving investors a choice of which part of the

existing Metro business they wanted to invest in, Mr. Koch said. A

demerger would likely create new jobs, rather than lead to job

losses because both businesses should experience new growth, he

said.

Some analysts were less sure about the prospects for the

stand-alone businesses. Metro faces tough trading conditions,

notably in important foreign markets like Russia, whose economy is

shrinking, and China, where growth has slowed recently, said

brokerage firm Market Securities.

Mr. Koch, who said the company would like the listings to be

completed by mid-2017, would likely run the wholesale and food

unit. Pieter Haas, chief executive of the Media Markt-Saturn unit

and a management board member of Metro, would likely run the

consumer-electronics business, Metro said.

The company has retained investment bank J.P. Morgan Chase to

advise on the transaction, a person familiar with the matter

said.

Write to Friedrich Geiger at friedrich.geiger@wsj.com

Corrections & Amplifications

Erich Kellerhals is the founder of German consumer-electronics

retailer Media Markt. In a previous article, Mr. Kellerhals was

mistakenly referred to as a founder of its parent company, retail

group Metro AG.

(END) Dow Jones Newswires

March 30, 2016 10:18 ET (14:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

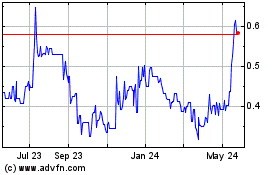

Ceconomy (PK) (USOTC:MTTRY)

Historical Stock Chart

From Jun 2024 to Jul 2024

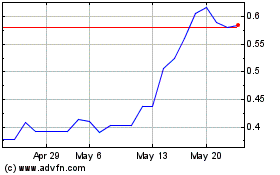

Ceconomy (PK) (USOTC:MTTRY)

Historical Stock Chart

From Jul 2023 to Jul 2024