Airbus, Engine Suppliers at Odds Over Plane Production

20 June 2019 - 8:06PM

Dow Jones News

By Robert Wall

LE BOURGET, France - Airbus SE (AIR.FR) and suppliers of engines

for its A320neo single-aisle family of planes are at odds over

future production needs.

Airbus used the Paris Air Show, which is taking place this week,

to reinforce the message that it may boost output beyond 63 planes

a month in 2021 to new industry highs. It currently builds around

60 of the planes monthly.

In an interview, Airbus Chief Operating Officer Michael

Schoellhorn said: "We can sustain from a commercial point of view a

higher rate and it not being a spike."

Mr. Schoellhorn said a small increase in production should be

possible without high capital expenditure demands on suppliers.

Taking A320 build-rates above 70 aircraft a month--a figure Airbus

is considering--would be more financially challenging, he said.

The plane's engine suppliers--which at times have struggled to

keep up with current production levels--aren't sold on the

idea.

Gael Meheust, chief executive of CFM International, a joint

venture between General Electric Co. (GE) and France's Safran SA

(SAF.FR), on the eve of the show said he was not sure the supply

chain is capable of doing more than it is doing currently. Another

concern is the sustainability of higher output levels, Mr. Meheust

said, adding that if the company invests in producing more engines

for Airbus, it needs to know the market is strong enough to warrant

those production rates for several years.

That view is echoed at the rival engine group. Michael

Schreyoegg, program head at MTU Aero Engines AG (MTX.XE), a key

partner to United Technologies Corp. (UTX) on the geared turbofan

engine that powers some A320neo planes, said Airbus should hold off

on setting more ambitious production targets for a year or two. Mr.

Schreyoegg said he has doubts the market is strong enough to

warrant the higher output amid concerns airline profitability may

have peaked.

Mr. Schoellhorn said he doesn't share the engine makers'

concerns. The plane maker aims to finalize its plans on where to

take A320 production this year.

Mr. Schoellhorn, who joined the company just a few months ago,

said Airbus is also assessing what plane-parts production assets

the company may want to keep. The sale of PFW Aerospace is ongoing,

and the executive said he is optimistic it will be completed "at

some point in time." Airbus bought the business in 2011 when it was

struggling to avoid disruptions, but the business now has been

turned around and is profitable, he said.

Airbus is also assessing the future of two large plane-parts

subsidiaries, Premium AEROTEC in Germany and Stelia Aerospace in

France. Airbus once said it would consider selling the business.

Mr. Schoellhorn said there are parts of aerostructures production

the company doesn't want to give up, and likely options under

review range from a complete sell or a partial sale.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

June 20, 2019 05:51 ET (09:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

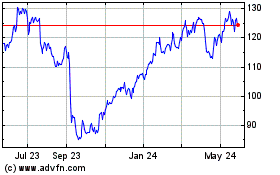

MTU Aero Engines (PK) (USOTC:MTUAY)

Historical Stock Chart

From Dec 2024 to Jan 2025

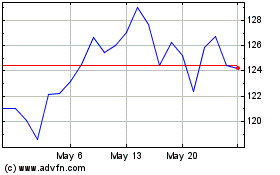

MTU Aero Engines (PK) (USOTC:MTUAY)

Historical Stock Chart

From Jan 2024 to Jan 2025