0001746119

false

FY

No

0001746119

2022-08-01

2023-07-31

0001746119

2023-01-31

0001746119

2023-07-31

0001746119

2022-07-31

0001746119

us-gaap:RelatedPartyMember

2023-07-31

0001746119

us-gaap:RelatedPartyMember

2022-07-31

0001746119

MUGH:ThirdPartyMember

2023-07-31

0001746119

MUGH:ThirdPartyMember

2022-07-31

0001746119

2021-08-01

2022-07-31

0001746119

us-gaap:CommonStockMember

2021-07-31

0001746119

us-gaap:AdditionalPaidInCapitalMember

2021-07-31

0001746119

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-07-31

0001746119

us-gaap:RetainedEarningsMember

2021-07-31

0001746119

2021-07-31

0001746119

us-gaap:CommonStockMember

2022-07-31

0001746119

us-gaap:AdditionalPaidInCapitalMember

2022-07-31

0001746119

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-31

0001746119

us-gaap:RetainedEarningsMember

2022-07-31

0001746119

us-gaap:CommonStockMember

2021-08-01

2022-07-31

0001746119

us-gaap:AdditionalPaidInCapitalMember

2021-08-01

2022-07-31

0001746119

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-08-01

2022-07-31

0001746119

us-gaap:RetainedEarningsMember

2021-08-01

2022-07-31

0001746119

us-gaap:CommonStockMember

2022-08-01

2023-07-31

0001746119

us-gaap:AdditionalPaidInCapitalMember

2022-08-01

2023-07-31

0001746119

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-08-01

2023-07-31

0001746119

us-gaap:RetainedEarningsMember

2022-08-01

2023-07-31

0001746119

us-gaap:CommonStockMember

2023-07-31

0001746119

us-gaap:AdditionalPaidInCapitalMember

2023-07-31

0001746119

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-31

0001746119

us-gaap:RetainedEarningsMember

2023-07-31

0001746119

MUGH:MUWorldwideGroupLimitedMember

2018-06-28

2018-06-29

0001746119

MUGH:CovidNineteenMember

2019-08-01

2020-07-31

0001746119

MUGH:CovidNineteenMember

2021-04-07

2021-04-08

0001746119

MUGH:MUWorldwideGroupLimitedMember

2022-08-01

2023-07-31

0001746119

MUGH:MUWorldwideGroupLimitedMember

2023-07-31

0001746119

MUGH:MUGlobalHoldingLimitedMember

2022-08-01

2023-07-31

0001746119

MUGH:MUGlobalHoldingLimitedMember

2023-07-31

0001746119

MUGH:MUGlobalHealthManagementShanghaiLimitedMember

2022-08-01

2023-07-31

0001746119

MUGH:MUGlobalHealthManagementShanghaiLimitedMember

2023-07-31

0001746119

MUGH:LeasableEquipmentMember

2023-07-31

0001746119

us-gaap:ComputerEquipmentMember

2023-07-31

0001746119

MUGH:OutletEquipmentMember

2023-07-31

0001746119

MUGH:OutletDesignFeeAndEquipmentMember

2023-07-31

0001746119

MUGH:ApplicationDevelopmentFeeMember

2023-07-31

0001746119

MUGH:YearEndRMBUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearEndRMBUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:YearAverageRMBUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearAverageRMBUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:YearEndHKUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearEndHKUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:YearAverageHKUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearAverageHKUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:YearEndTWDUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearEndTWDUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:YearAverageTWDUSDollarExchangeRateMember

2023-07-31

0001746119

MUGH:YearAverageTWDUSDollarExchangeRateMember

2022-07-31

0001746119

MUGH:MsNiuYenYenMember

2018-06-04

2018-06-04

0001746119

MUGH:MsNiuYenYenMember

2018-06-04

0001746119

MUGH:MsNiuYenYenMember

2018-07-06

2018-07-06

0001746119

MUGH:ServerIntlCoLtdMember

2018-07-06

2018-07-06

0001746119

MUGH:MsNiuYenYenMember

2018-07-06

0001746119

MUGH:ServerIntlCoLtdMember

MUGH:MsNiuYenYenMember

2018-07-06

2018-07-06

0001746119

MUGH:ChangChunYingMember

2018-07-07

2018-07-07

0001746119

MUGH:ChangSuFenMember

2018-07-07

2018-07-07

0001746119

MUGH:ChangSuFenMember

2018-07-07

0001746119

MUGH:ChangChunYingAndChangSuFenMember

2018-07-07

2018-07-07

0001746119

MUGH:GreenProAsiaStrategicSPCMember

2018-07-09

2018-07-09

0001746119

MUGH:GreenProVentureCapitalLimitedMember

2018-07-09

2018-07-09

0001746119

MUGH:GreenProVentureCapitalLimitedMember

2018-07-09

0001746119

MUGH:ThreeNonUSResidentsMember

2018-07-09

2018-07-10

0001746119

MUGH:ThreeNonUSResidentsMember

2018-07-10

0001746119

MUGH:EightNonUSResidentsMember

2018-07-09

2018-07-10

0001746119

MUGH:TwoNonUSResidentsMember

2018-07-11

2018-07-11

0001746119

MUGH:TwoNonUSResidentsMember

2018-07-11

0001746119

MUGH:TenNonUSResidentsMember

2018-07-25

2018-07-25

0001746119

MUGH:TenNonUSResidentsMember

2018-07-25

0001746119

MUGH:OneNonUSResidentsMember

2018-07-26

2018-07-26

0001746119

MUGH:OneNonUSResidentsMember

2018-07-26

0001746119

MUGH:DezignFormatPteLtdandChengYoungChienMember

2018-07-31

2018-07-31

0001746119

MUGH:DezignFormatPteLtdandChengYoungChienMember

2018-07-31

0001746119

MUGH:SixteenNonUSResidentsMember

2018-08-01

2018-12-13

0001746119

MUGH:FourtyFiveAccreditedInvestorsMember

2019-05-07

2019-05-07

0001746119

MUGH:FourtyFiveAccreditedInvestorsMember

2019-05-07

0001746119

MUGH:ThirtySixNonUSResidentsMember

us-gaap:IPOMember

2019-05-14

2019-07-31

0001746119

MUGH:ThirtySixNonUSResidentsMember

us-gaap:IPOMember

2019-07-31

0001746119

MUGH:ThreeNonUSResidentsMember

2020-08-01

2021-07-31

0001746119

MUGH:TwentyNonUSResidentsMember

2020-08-01

2021-07-31

0001746119

MUGH:TwoNonUSResidentsMember

2021-08-01

2022-07-31

0001746119

MUGH:ThreeNonUSResidentsMember

2021-08-01

2022-07-31

0001746119

MUGH:ThreeNonUSResidentsMember

2022-08-01

2023-07-31

0001746119

us-gaap:ComputerEquipmentMember

2022-07-31

0001746119

us-gaap:OfficeEquipmentMember

2023-07-31

0001746119

us-gaap:OfficeEquipmentMember

2022-07-31

0001746119

MUGH:LeasableEquipmentMember

2022-07-31

0001746119

MUGH:OutletDesignFeeAndEquipmentMember

2022-07-31

0001746119

MUGH:ApplicationDevelopmentFeeMember

2022-07-31

0001746119

MUGH:LeasableEquipmentMember

2022-08-01

2023-07-31

0001746119

us-gaap:AccountingStandardsUpdate201602Member

2021-11-06

0001746119

MUGH:TienMuInternationalCoLtdMember

2023-07-31

0001746119

MUGH:TienMuInternationalCoLtdMember

2022-07-31

0001746119

MUGH:HongTingNetworkTechnologyXiamenLimitedMember

2023-07-31

0001746119

MUGH:HongTingNetworkTechnologyXiamenLimitedMember

2022-07-31

0001746119

MUGH:ShangHaiShiBaEnterpriseManagementCentreMember

2023-07-31

0001746119

MUGH:ShangHaiShiBaEnterpriseManagementCentreMember

2022-07-31

0001746119

MUGH:HsiehChangChungMember

2023-07-31

0001746119

MUGH:HsiehChangChungMember

2022-07-31

0001746119

country:SC

2022-08-01

2023-07-31

0001746119

country:SC

2021-08-01

2022-07-31

0001746119

country:HK

2022-08-01

2023-07-31

0001746119

country:HK

2021-08-01

2022-07-31

0001746119

country:CN

2022-08-01

2023-07-31

0001746119

country:CN

2021-08-01

2022-07-31

0001746119

country:HK

2022-08-01

2023-07-31

0001746119

country:CN

2022-08-01

2023-07-31

0001746119

MUGH:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-31

0001746119

MUGH:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-31

0001746119

MUGH:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:CustomerBMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-31

0001746119

MUGH:CustomerBMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-31

0001746119

MUGH:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:CustomerCMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-31

0001746119

MUGH:CustomerCMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-31

0001746119

MUGH:CustomersMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:CustomersMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:CustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-31

0001746119

MUGH:CustomersMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-31

0001746119

MUGH:VendorAMember

MUGH:PurchasesMember

MUGH:VendorConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:VendorAMember

MUGH:PurchasesMember

MUGH:VendorConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:VendorAMember

us-gaap:AccountsPayableMember

MUGH:VendorConcentrationRiskMember

2023-07-31

0001746119

MUGH:VendorAMember

us-gaap:AccountsPayableMember

MUGH:VendorConcentrationRiskMember

2022-07-31

0001746119

MUGH:VendorMember

MUGH:PurchasesMember

MUGH:VendorConcentrationRiskMember

2022-08-01

2023-07-31

0001746119

MUGH:VendorMember

MUGH:PurchasesMember

MUGH:VendorConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:VendorMember

us-gaap:AccountsPayableMember

MUGH:VendorConcentrationRiskMember

2023-07-31

0001746119

MUGH:VendorMember

us-gaap:AccountsPayableMember

MUGH:VendorConcentrationRiskMember

2022-07-31

0001746119

MUGH:CustomerMember

us-gaap:PropertyPlantAndEquipmentMember

us-gaap:CustomerConcentrationRiskMember

2021-08-01

2022-07-31

0001746119

MUGH:RentalAgreementMember

2021-11-05

2021-11-06

0001746119

MUGH:RentalAgreementMember

2021-11-06

0001746119

2021-11-05

2021-11-06

0001746119

2022-10-16

2022-10-18

0001746119

MUGH:RelatedPartyAMember

2022-08-01

2023-07-31

0001746119

MUGH:RelatedPartyAMember

2021-08-01

2022-07-31

0001746119

MUGH:RelatedPartyBMember

2022-08-01

2023-07-31

0001746119

MUGH:RelatedPartyBMember

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

MUGH:NVMember

2022-08-01

2023-07-31

0001746119

us-gaap:CorporateMember

country:SC

2022-08-01

2023-07-31

0001746119

us-gaap:CorporateMember

country:HK

2022-08-01

2023-07-31

0001746119

us-gaap:CorporateMember

country:CN

2022-08-01

2023-07-31

0001746119

us-gaap:CorporateMember

2022-08-01

2023-07-31

0001746119

us-gaap:CorporateMember

MUGH:NVMember

2023-07-31

0001746119

us-gaap:CorporateMember

country:SC

2023-07-31

0001746119

us-gaap:CorporateMember

country:HK

2023-07-31

0001746119

us-gaap:CorporateMember

country:CN

2023-07-31

0001746119

us-gaap:CorporateMember

2023-07-31

0001746119

us-gaap:CorporateMember

MUGH:NVMember

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

country:SC

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

country:HK

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

country:CN

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

2021-08-01

2022-07-31

0001746119

us-gaap:CorporateMember

MUGH:NVMember

2022-07-31

0001746119

us-gaap:CorporateMember

country:SC

2022-07-31

0001746119

us-gaap:CorporateMember

country:HK

2022-07-31

0001746119

us-gaap:CorporateMember

country:CN

2022-07-31

0001746119

us-gaap:CorporateMember

2022-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:JPY

iso4217:CNY

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

The Fiscal Year Ended July 31, 2023

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _______________ to _______________

Commission

File Number 333-228847

MU

Global Holding Limited

(Exact

name of registrant issuer as specified in its charter)

| Nevada |

|

30-1089215 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

Rm.

5, 7F., No. 296, Sec. 4, Xinyi Rd., Da’an Dist.,

Taipei

City 106427, Taiwan (R.O.C.)

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code +886905153139

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities

registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

YES

☐ NO ☒

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large

Accelerated Filer ☐ Accelerated Filer ☐ Non-accelerated Filer ☐ Smaller reporting company ☒ Emerging growth company

☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

If securities are

registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included

in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark

whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received

by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

MUGH |

|

The

OTC Market – Pink Sheets |

The

aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the

Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter:

Not

Applicable

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not

Applicable

APPLICABLE

ONLY TO CORPORATE REGISTRANTS

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

|

Outstanding

at July 31, 2023 |

| Common

Stock, $.0001 par value |

|

59,434,838 |

MU

Global Holding Limited

FORM

10-K

For

the Fiscal Year Ended July 31, 2023

Index

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather

are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,”

“intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these

words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are

subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause

actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| |

● |

The

availability and adequacy of our cash flow to meet our requirements; |

| |

|

|

| |

● |

Economic,

competitive, demographic, business and other conditions in our local and regional markets; |

| |

|

|

| |

● |

Changes

or developments in laws, regulations or taxes in our industry; |

| |

|

|

| |

● |

Actions

taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial

and other governmental authorities; |

| |

|

|

| |

● |

Competition

in our industry; |

| |

|

|

| |

● |

The

loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| |

|

|

| |

● |

Changes

in our business strategy, capital improvements or development plans; |

| |

|

|

| |

● |

The

availability of additional capital to support capital improvements and development; and |

| |

|

|

| |

● |

Other

risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This

report should be read completely and with the understanding that actual future results may be materially different from what we expect.

The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration

of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change

in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events

or otherwise.

Use

of Defined Terms

Except

as otherwise indicated by the context, references in this Report to:

| |

● |

The

“Company,” “we,” “us,” or “our,” “MU Global” are references to MU Global

Holding Limited, a Nevada corporation. |

| |

|

|

| |

● |

“Common

Stock” refers to the common stock, par value $.0001, of the Company; |

| |

|

|

| |

● |

“U.S.

dollar,” “$” and “US$” refer to the legal currency of the United States; |

| |

|

|

| |

● |

“Securities

Act” refers to the Securities Act of 1933, as amended; and |

| |

|

|

| |

● |

“Exchange

Act” refers to the Securities Exchange Act of 1934, as amended. |

PART

I

ITEM

1. BUSINESS

Corporate

History

MU

Global Holding Limited, a Nevada corporation (“the company”) was incorporated under the laws of the State of Nevada on June

4, 2018.

MU

Global Holding Limited, the US Company, operates through its wholly owned subsidiary, MU Worldwide Group Limited, a Seychelles Company;

which operates through its wholly owned subsidiary, MU Global Holding Limited, a Hong Kong Company; which operates through its wholly

owned subsidiary, MU Global Health Management (Shanghai) Limited, a Shanghai Company.

MU

Global Holding Limited is an early-stage wellness and beauty supply services company, which intends to offer customers a wide range of

trusted non-surgical spa services and quality spa care products. All of the previous entities share the same exact business plan with

the goal of developing and providing wellness and beauty services to our future clients. We aim to promote improved overall health and

beauty in our clients through a holistic detoxification method.

The

Company, through its subsidiaries, mainly supplies high quality spa services and spa care products. Details of the Company’s subsidiaries:

| | |

Company name | |

Place and date of incorporation | |

Particulars of issued capital | |

Principal activities | |

Proportional of ownership interest and voting power held | |

| | |

| |

| |

| |

| |

| |

| 1. | |

MU Worldwide Group Limited | |

Seychelles,

June 7, 2018 | |

100 shares of ordinary share of US$1 each | |

Investment holding | |

100 | % |

| 2. | |

MU Global Holding Limited | |

Hong Kong,

January 30, 2018 | |

1 share of ordinary share of HK$1 each | |

Providing SPA and Wellness service in Hong Kong | |

100 | % |

| 3. | |

MU Global Health Management (Shanghai) Limited | |

Shanghai,

August 16, 2018 | |

RMB 7,405,866 | |

Providing SPA and Wellness service in China | |

100 | % |

Business

Overview

MU

Global is a beauty and wellness company, providing SPA and wellness service and also SPA related products to the customers. The services

provided are designed to improve the overall health system and body function.

Since

our establishment, the Company has been focusing to expand in the Chinese market, with other country also under consideration as target

destinations. As an emerging industry in China, the beauty and wellness industry is still in the early stage there is a huge potential

for the industry to growth significantly.

In

year 2020, COVID-19 crisis has resulted the sales of the global beauty and wellness industry weak due to consumers have had limited access

to retail outlets and supply chain bottlenecks have reduced product availability. In China, the industry’s sales fell up to 80

percent compared with 2019. Nevertheless, based on Mckinsey and Company research report on April 8, 2021, shows that consumers care deeply

about wellness—and that their interest is growing and the global wellness market is estimated at more than US$1.5 trillion, with

annual growth of 5 to 10 percent. A rise in both consumer interest and purchasing power presents tremendous opportunities for companies,

particularly as spending on personal wellness rebounds after stagnating or even declining during the COVID-19 crisis.

China

has large territory, population, diverse ethnicity and cultural background. As such, it has resulted in different consumer orientations

in different cities and townships across the country, therefore, it is particularly challenging to tackle the consumer market with a

single business model.

The

advance in technological development and rise in use of technology in marketing has also intensified the competition, probing the Company

to develop the business models that allow quick penetration and huge coverage of different markets, and also being able to cope with

the swift changes in the consumer market. Thus, the Company is focusing on three key areas as part of the Company’s early development

in the Chinese market.

The

first and most key focus is to enter the regional market through the adoption of franchisee and agent model, which the other parties

are familiar and have deep understanding in the local market, hence its operating strategy is effective and best suited the targeted

region.

Second,

the key strategy is to ensure rapid development of the Omni channel marketing plan which targets to lease out at least ten thousand Stone

Spa Bed (Hot Stone Bath equipment), reducing the time cost for the development of project, and most importantly, working on to spur sales

and revenue growth.

Lastly,

the essential requirement for business success in the Chinese market is to ensure and maintain a clear and transparent business model,

which would result in effective collaboration between the company and its agent/franchisee, and consequently leads to efficient market

operation and a win-win situation between the two parties.

Currently,

the Company operates in the Chinese market with three business models:

| 1. |

Tripartite

co-operation and profit sharing model (deployment of stone spa bed & franchise) |

| |

|

| 2. |

Large-scale

chain agent model (deployment of stone spa bed) |

| |

|

| 3.

|

Direct-

service store model |

Our

Service

DAY

MORE STONE THERAPHY

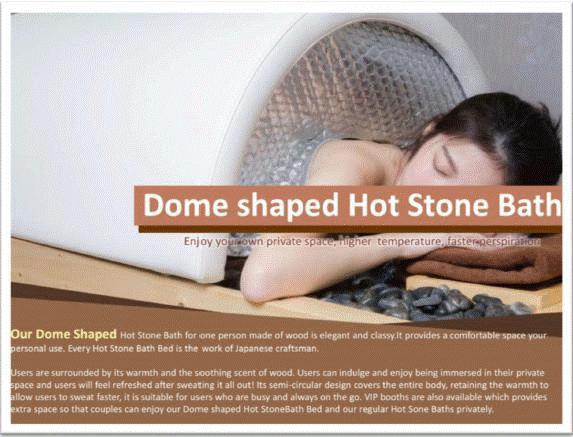

1.

Bedrock Bathing/ Hot Stone Bath

Bedrock

Bathing is a method of keeping the body in shape that involves bathers lying down on a heated slab of rocks embedded on a spa treatment

bed without using hot water wearing indoor clothing. The original name for this hot stone bathing is ‘Ganban’yoku’,

and it is originated from Japan as the term for a popular form of hot stone or bedrock spa. It is also referred to as “stone-bathing”,

but there is no actual bathing or water involved.

It

is our belief that the effects of bedrock bathing are numerous and both aesthetic and metabolic. Furthermore, the rocks selected for

this treatment are believed to provide many health benefits when they are heated. The five stones we intend to use are: Black Silica

Stone, Radium Stone, Far Infrared Stone, Negative Ion Stone and Beitou Stone. The average time taken for each therapy is approximately

30 minutes.

The

Company believes that bedrock bathing treatments will assist in the elimination of suboptimal health conditions caused by polluted environments,

unhealthy dietary intake, and unhealthy lifestyles. The detoxification process will improve general bodily function and immune system,

promote blood circulation, and yield visible skin improvement. The treatment is also believed to improve basal metabolism, resulting

in more efficient energy utilization within the body, hence sustainable weight loss to a desirable level. Prolonged proper treatments

have also been linked to miscellaneous anti-aging benefits.

Our

pricing strategy offers great flexibility to our customers to opt for the service they desire which is also within their budget. In order

to ensure flexibility, the Company has divided the service into three different tiers, each with different pricing strategy: Flagship,

Luxury and Refined. Under the three tiers model, Flagship branch and will be the top tier and will target high-end segment with premium

pricing packages. Luxury branch is designed to attract middle class individuals. Refined branch on the other side, will aim to attract

customer with lower budget, but would still like to enjoy the service.

The

Company started offering bedrock bathing services in the Shanghai outlet in January 2019. Different service packages are designed for

each tier of service, which include option for subscription-based treatments, and pay per services. The packages offer customers either

the option of purchasing our treatments at a discounted price if they purchase in bundle, or they can pay for the service every time

they use at normal price. The bundle comprises of 3 different number of visits per bundle i.e., 10 times visit package, 20 times visit

package, and 30 times visit package. We have also implemented a member database for our bedrock bathing centre. Customers can join our

membership at an attracting fee to enjoy the services provided at member price. In addition to that, the Company also allows customers

to purchase the services package via online and WeChat.

2.

Quartz Therapy

Chakras

is within and parts of the human body that connects with the environment. If chakra is blocked or overactive, we lose balance of our

physical and mental balance and in turn, it affects the physical and mental well-being.

Quarts

have the therapeutic effect of enabling Chakras to regain its balance. Thus, the therapy has the benefit of body cleansing, restoring

good health and also spirit.

Our

Product

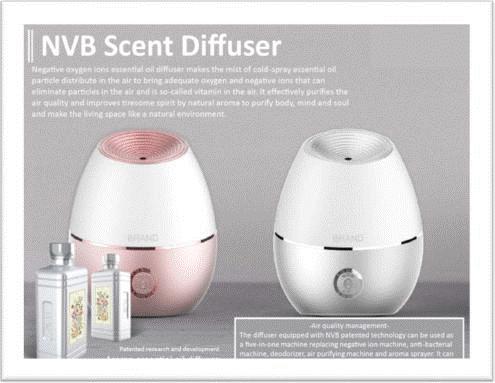

NVB

Scent Diffuser

The

negative oxygen ions essential oil diffuser distributes cold-sprayed essential oil particle to balance oxygen and negative ions in the

air. The negative ions eliminate particles, and it’s called the vitamin in the air. The essential oil diffuser can purify air quality,

and provide a natural aroma that relax the body. The essential oil diffuser has integrated the technology of “Never BAC anti-bacterial”

that provides the effect of purification, anti-bacterial, second-hand smoke elimination, and deodorization.

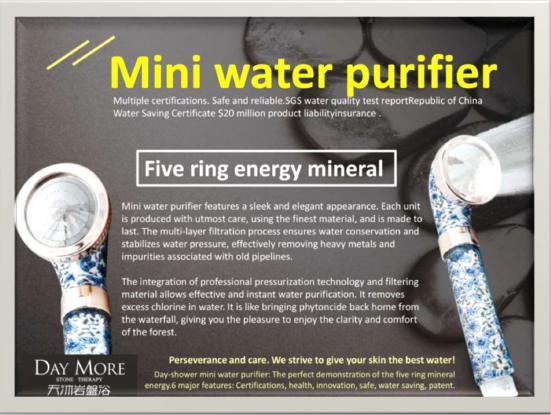

Mini

Water Purifier

The

mini water purifier integrates advanced pressurization technology and filtering materials, which allow instant purification of water

and the removal of excess chlorine in water. The multi-layer filtration process of the purifier ensures water conservation and also stabilizes

water pressure at the same time. Most importantly, the purifier can effectively remove heavy metals and impurity associated with old

pipelines.

Trademarks

The

Company owned several trademarks registered under its subsidiaries in respective jurisdictions of which the subsidiaries operate in.

Currently, the Company is also applying for trademarks in other jurisdictions it intends to expand its operation into.

| Category |

|

Registration

Number |

|

Trade

Marks Logo |

|

Ownership |

|

Country |

|

Effective

Date and Duration |

| Trademark |

|

304770982 |

|

[Class

35] |

|

MU

Global Holding Limited |

|

Hong

Kong |

|

July

12, 2019

For

10

Years |

| Trademark |

|

304770991 |

|

[Class

11,44] |

|

MU

Global Holding Limited |

|

Hong

Kong |

|

June

20, 2019

For

10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

14311788 |

|

|

|

MU

Global Health Management |

|

China |

|

May

14, 2015

For

10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

3] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

14311839 |

|

|

|

MU

Global Health Management |

|

China |

|

May

14, 2015

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

3] |

|

|

|

|

|

|

| Trademark |

|

34828880 |

|

|

|

MU

Global Health Management |

|

China |

|

July

14, 2019

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

32] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

35094440 |

|

|

|

MU

Global Health Management |

|

China |

|

July

28, 2019

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

35] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

34814157 |

|

|

|

MU

Global Health Management |

|

China |

|

July

21, 2019

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

35] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

34821472 |

|

|

|

MU

Global Health Management |

|

China |

|

July

14, 2019

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

44] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

34810654 |

|

|

|

MU

Global Health Management |

|

China |

|

July

21, 2019

For 10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

10] |

|

|

|

|

|

|

| Trademark |

|

38223024 |

|

|

|

MU

Global Health Management |

|

China |

|

February

7, 2020

For

10 Years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

10] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

38234836 |

|

|

|

MU

Global Health Management |

|

China |

|

January

14, 2020

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

20] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

38229731 |

|

|

|

MU

Global Health Management |

|

China |

|

January

14, 2020

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

20] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

38246309 |

|

|

|

MU

Global Health Management |

|

China |

|

February

21, 2020

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

35] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

38238457 |

|

|

|

MU

Global Health Management |

|

China |

|

January

14, 2020

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

44] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

38244932 |

|

|

|

MU

Global Health Management |

|

China |

|

January

14, 2020

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

03] |

|

|

|

|

|

|

| Trademark |

|

40201907290T |

|

|

|

MU

Global Holding Limited |

|

Singapore |

|

April

4, 2019

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

03] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

1440029207 |

|

|

|

MU

Global Holding Limited |

|

Saudi

Arabia |

|

July

31, 2019 to April 11, 2029 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

44] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

1440029205 |

|

|

|

MU

Global Holding Limited |

|

Saudi

Arabia |

|

July

30, 2019 to April 10, 2029 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

11] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

1440029204 |

|

|

|

MU

Global Holding Limited |

|

Saudi

Arabia |

|

July

30, 2019 to April 10, 2029 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

03] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

314481 |

|

|

|

MU

Global Holding Limited |

|

United

Arab Emirates |

|

July

25, 2019

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

44] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

314479 |

|

|

|

MU

Global Holding Limited |

|

United

Arab Emirates |

|

July

25, 2019

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

11] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

314480 |

|

|

|

MU

Global Holding Limited |

|

United

Arab Emirates |

|

July

25, 2019

For

10 years |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

[Class

35] |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Trademark |

|

304770982 |

|

|

|

MU

Global Holding Limited |

|

Hong

Kong |

|

December

14, 2018

For

10 years |

Patent

On

September 4, 2019, our subsidiary, MU Global Health Management (Shanghai) Limited made 5 patent applications to China National Intellectual

Property Administration (CNIPA) in regards to stone spa bed thermostatic control setting. On May 5, 2020, CNIPA officially granted one

patent to MU Global Health Management (Shanghai) Limited for a duration period of 10 years, with an effective date from September 4,

2019. In the year ended July 31, 2021, CNIPA officially granted another four patents to MU Global Health Management (Shanghai) Limited

for a duration period of 10 years, with an effective date from September 4, 2019. On June 22 2021, Intellectual Property Office of Singapore

officially granted one invention patent to MU Global Holding Limited (HK) for a duration period of 20 years, with an effective date from

September 11, 2019.

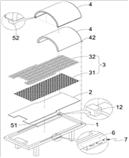

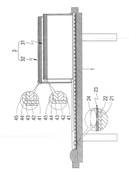

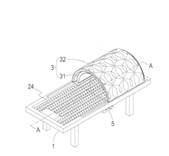

| Category |

|

Registration

Number |

|

Thermostatic

Control Setting Plan |

|

Ownership |

|

Country |

|

Effective

Date and Duration |

| |

|

|

|

|

|

|

|

|

|

|

| Patent |

|

ZL

2019 2 1458259.5 |

|

|

|

MU

Global Health Management |

|

China |

|

May

5, 2020

For

10

Years |

| Patent |

|

ZL

2019 2 1474367.1 |

|

|

|

MU

Global Health Management |

|

China |

|

August

21, 2020

For

10

Years |

| Patent |

|

ZL

2019 2 1462066. 7 |

|

|

|

MU

Global Health Management |

|

China |

|

August

28, 2020

For

10

Years |

| Patent |

|

ZL

2019 2 1458272.0 |

|

|

|

MU

Global Health Management |

|

China |

|

September

29, 2020

For

10

Years |

| Patent |

|

ZL

2019 2 1458071.0 |

|

|

|

MU

Global Health Management |

|

China |

|

December

15, 2020

For

10

Years |

| Patent |

|

10201908402Q |

|

|

|

MU

Global Holding Limited (HK) |

|

Singapore |

|

June

22, 2021

For

20

Years (from September 11, 2019) |

The

setting displays a concept of thermostatic control for a stone spa bed, which includes a bed, a bed heating element, an energy part,

a cover cabin, cover cabin’s opening/closing assembly, a thermostatic control device, and a thermostatic temperature adjustment

device. Once the thermostatic temperature adjustment device sets the default temperature, the user can activate the bed heating element

after lying down on the stone spa bed. Following the closure of the cover cabin, the bed heating element will start heating from the

default temperature to the user’s ideal degree of temperature. Once the session completes, the thermostatic control device will

reduce the heating efficiency to the default temperature in order to maintain the heat for the next session, which can largely reduce

the heating time and electricity cost-saving.

Future

Plan

Marketing

Campaign and Publicity Enhancement

Under

the group’s marketing development plan, the Company will implement actively the major projects launched by the group, including

Omni channel marketing project and nationwide franchised program, which the Company aims to attract at least 1,000 franchised stores.

Since

the opening of outlet shop in Shanghai, the shop has initiated the Omni-channel marketing projects, aiming to penetrate the market, and

it has built a stronghold with the franchised stores and agents in multiple provinces across the country, including Shanghai, Zhejiang,

Jiangsu, Sichuan, Shandong, Shanxi, Henan and Guangdong province. The initial expansion of operation is based on the business model of

profit sharing, and through this model, the Company has managed to expand the Hot Stone Bath therapy service into different health and

wellness service provider outlets in different cities. The outlets span across different sub-segment of the health and wellness industry,

which include beauty centre, post-maternity care centre, as well as high-end beauty salon. The Company targets to achieve the Omni-channel

marketing projects by 2021, and the nationwide franchised program is expected to be achieved by 2023.

Intelligent

Marketing

The

IT team in China has recently completed the development of “Intelligent Health Evaluation Application System” to provide

support for the operation of Hot Stone Bath Therapy. Customers are now able to compare their health indicator through the mobile application

and body fat measure device. The Company aims to build its own health indicator, recommend a personalized Hot Stone Bath therapy to the

customers through the use of big data computation and analysis. By providing personalized service package, the Company believes it can

effectively lead the consumers in making consuming decision, and consequently, the system will be upgraded to be a community marketing

tool aiming to increase new customers flow and also retain existing customers.

Product

Research and Development

While

the Company is seeking to expand the access to the China market, it is also actively promoting the research and development of products

and technology. In addition to the introduction of new products, under the ongoing smart technology trend led by China, the business

model of beauty and health industry has also experienced rapid changes in the emerging environment. Responding to changes in the business

model in this industry, the information and intelligent technology has thus become the core competency in successfully managing large-scale

change industries.

In

MU Global, the Company has numerous experts in information technology, thus equipping the company with the capability to support the

business technology required in this fast-changing business environment, providing the essential tool to manage a large-scale chain remotely,

and also lay the foundation for the success of the Omni-channel marketing project. As such, the Company will continuously strengthen

the capability of information and intelligent technology as it will be the top priority of the Company’s future development plan.

International

Expansion

Currently,

we are actively engaging and negotiating with different parties in the Gulf countries (UAE, Bahrain, Saudi Arabia, Oman, Qatar, and Kuwait).

The Company plans to enter the Middle-East market through the model of national agency and establish a long-term partnership with the

local counterpart to develop and promote the Omni channel marketing project. At the same time, the Company has already established the

national agency network in Malaysia and Singapore, and we are aiming to further expand to other countries in the Association of Southeast

Asian Nations (ASEAN).

Human

Resources and Talent Development

Taking

into consideration of aforementioned development, the Company is well aware that with existing man power is far from sufficient to materialization

of future plan, thus investment in human resources and talent development is inevitable, including but it will not be limited to internal

administrative and operation personnel, but also sales and marketing, accounting and finance, as well as top management personnel.

Competition

The

beauty and wellness industry are highly competitive and fragmented, we might be in disadvantage competing with competitor who has greater

reserve or has higher access to capital than the Company do to deploy in operations, capital expenditure, and marketing activities. We

hope to maintain a competitive advantage by utilizing the knowledge and expertise of the Company in the industry and our beyond satisfactory

customer service.

Customers

For

the year ended July 31, 2023, the Company has generated revenue amounted to $146,252 from customers under the ordinary course of business.

The revenue mainly represented income from wellness and beauty services provided to customers,

sales of products and sharing of revenue from leasable equipment with business alliance and franchisee.

Employees

As

of July 31, 2023, the Company has a total 3 employees. At the moment, the Company has adopted accountability system, hence management

personnel have flexible working hours.

Our

sole director and Chief Executive Officer cum Chief Financial Officer, Niu Yen-Yen currently work full-time and fully committed to the

operation of the company.

We

do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt

plans in the future. There are presently no personal benefits available to our Officers, Directors or employees.

Government

Regulation

At

present, we are subject to the laws and regulations of the jurisdictions in which we operate, which may include business licensing requirements,

income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and supervisory

requirements.

ITEM

1A. RISK FACTORS

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information

under this item.

ITEM

1B. UNRESOLVED STAFF COMMENTS

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information

under this item.

ITEM

2. PROPERTIES

We

had a physical office in Shanghai with address of Room 1510, Building 5, Ark Times Square, 3148 Chengliu Middle Road, Jiading District,

Shanghai. This location has been rented by MU Global Health Management (Shanghai) Limited for a 12-month period from November 6, 2021

to November 5, 2022, for an initial deposit of RMB 7,000 and additional tri-monthly payments in the amount of RMB 3,500 per month over

the course of the lease. The Company has an option to renew after the end of the agreement. On October 18, 2022, the Company has renewed

the tenancy agreement for 12 months with tri-monthly payments in the amount of RMB 3,500 per month over the course of the lease from

November 6, 2022 to November 5, 2023. On August 7, 2023, the Company has further renewed the tenancy agreement for 12 months with tri-monthly

payments in the amount of RMB 3,500 per month over the course of the lease from November 6, 2023 to November 5, 2024, with an option

to renew after the end of the agreement.

ITEM

3. LEGAL PROCEEDINGS

From

time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation

is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

There are currently no pending legal proceedings or claims that we believe will have a material adverse effect on our business, financial

condition or operating results. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or

has a material interest adverse to our business.

ITEM

4. MINE SAFETY DISCLOSURES

Not

applicable.

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Holders

As

of July 31, 2023, we had 59,434,838 shares of our Common Stock par value, $.0001 issued and outstanding. There were 163 beneficial owners

of our Common Stock.

Transfer

Agent and Registrar

The

transfer agent for our capital stock is VStock Transfer, LLC, with an address at 18, Lafayette Place, Woodmere, New York 11598 and telephone

number is +1 (212) 828-8436.

Penny

Stock Regulations

The

Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security

that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition

of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities

to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual

incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For

transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities

and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt

transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated

by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable

to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole

market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly

statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market

in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock

and may affect the ability of investors to sell their Common Stock in the secondary market.

In

addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory

Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced

securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s

financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that

there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements

make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’

ability to buy and sell our stock.

Dividend

Policy

Any

future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our

board of directors out of funds legally available for such purpose. We are under no obligations or restrictions to declare or pay dividends

on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends

to retain all earnings for use in the business for the foreseeable future.

Equity

Compensation Plan Information

Currently,

there is no equity compensation plan in place.

Unregistered

Sales of Equity Securities

Currently,

there is no unregistered sales of equity securities.

Purchases

of Equity Securities by the Registrant and Affiliated Purchasers

We

have not repurchased any shares of our common stock during the fiscal year ended July 31, 2023.

ITEM

6. SELECTED FINANCIAL DATA

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information

under this item.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated

financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain

statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks

and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c)

anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They

are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,”

“estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,”

“expects,” “management believes,” “we believe,” “we intend,” or the negative of these

words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance

that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking

statements.

The

forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities

laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which

the statements are made or to reflect the occurrence of unanticipated events.

Overview

MU

Global Holding Limited, the US Company, operates through its wholly owned subsidiary, MU Worldwide Group Limited, a Seychelles Company;

which operates through its wholly owned subsidiary, MU Global Holding Limited, a Hong Kong Company; which operates through its wholly

owned subsidiary, MU Global Health Management (Shanghai) Limited, a Shanghai Company. The US, Seychelles and Hong Kong Companies act

solely for holding purposes whereas all current and future operations in China are planned to be carried out via MU Global Health Management

(Shanghai) Limited, the Shanghai Company. The purpose of the Hong Kong Company is to function as the current regional hub of the Company.

At

present, we have a physical office in Shanghai with address of Room 1510, Building 5, Ark Times Square, 3148 Chengliu Middle Road, Jiading

District, Shanghai. In the future, we do not have definitive plans for which markets intend to expand to, but we base our operations

in Shanghai, as we prepare for future unidentified expansion efforts.

All

of the previous entities share the same exact business plan with the goal of developing and providing wellness and beauty services to

our future clients. We aim to promote improved overall health and beauty in our clients through a holistic detoxification method. We

will, at least initially, primarily focus our efforts on attracting customers in China. We have intentions, but no definitive plans or

timelines, to expand to Singapore, Malaysia, Hong Kong, and Middle Eastern countries in the coming years, and subsequently we intend

to make efforts to expand throughout Asia. We anticipate spending a substantial amount in marketing and advertising in the coming year.

Results

of Operations

Revenue

The

Company generated revenue of $146,252 and $46,702 for the year ended July 31, 2023 and 2022. The revenue represented income

from wellness and beauty services provided to customers, sales of products and sharing of revenue from leasable equipment with business

alliance and franchisee.

Cost

of Revenue and Gross Margin

For

the year ended July 31, 2023 and 2022, cost incurred in providing wellness and beauty services and

selling of essential oil amounted to $123,088 and $21,891 respectively. The Company generated gross profit of $23,164 and $24,811

for the year ended July 31, 2023 and 2022.

Selling

and Marketing Expenses

Selling

and distribution expenses for the year ended July 31, 2023 and 2022 amounted to $1,531 and $3,470 respectively, comprising advertisement

expenses on WeChat, mobile apps and market public research.

General

and Administrative Expenses

General

and administrative expenses for the year ended July 31, 2023 and 2022 amounted to $163,311 and $428,710 respectively, comprising salary,

allowances, professional fees, consultancy fee for IT and system management, office and outlet operation expenses.

Other

Income

The

Company recorded an amount of $72,851 and $50,036 as other income for the year ended July 31, 2023 and 2022 respectively, being interest

income, foreign exchange gain, gain on disposal, gain on remeasurement of long-term liabilities and waiver of debts.

Net

Loss

Net

loss for the year ended July 31, 2023 and 2022 amounted to $68,827 and $357,333 respectively. The decrease in net loss of $288,506 due

to management have carried out strict control in expenses to reduce the general and administrative expenses incurred during the year

ended July 31, 2023.

Liquidity

and Capital Resources

As

of July 31, 2023 and 2022, we had working capital of shortage of $382,433 and $339,398, consisting of cash and cash equivalents of $4,425

and $2,909 respectively. During the year ended July 31, 2023 and 2022, we had negative operating cash flows due to revenue is insufficient

to cover the general and administrative expenses.

We

depend substantially on financing activities to provide us with the liquidity and capital resources we need to meet our working capital

requirements and to make capital investments in connection with ongoing operations. During the year ended July 31, 2023, the Company

had met these requirements primarily from the financial support from director and third party company.

Cash

Used in Operating Activities

For

the year ended July 31, 2023 and 2022, net cash used in operating activities was $63,517 and $4,169 respectively. The cash used in operating

activities was mainly for payment of general and administrative expenses.

Cash

Generated from/(Used in) Financing Activities

For

the year ended July 31, 2023 and 2022, net cash generated from and used in financing activities was $46,210 and $14,961 respectively. The

financing cash flow performance primarily reflects loan from director, related company and third party.

Cash

Generated from/(Used in) Investing Activities

For

the year ended July 31, 2023 and 2022, net cash generated from and used in investing activities was $16,930 and $312 respectively. The investing

cash flow performance primarily reflects the purchase of plant, equipment and trademarks and the disposal of plant and equipment.

Credit

Facilities

We

do not have any credit facilities or other access to bank credit.

Critical

Accounting Policies and Estimates

Use

of estimates

Management

uses estimates and assumptions in preparing these financial statements in accordance with US GAAP. Those estimates and assumptions affect

the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities in the balance sheets, and the reported

revenue and expenses during the periods reported. Actual results may differ from these estimates.

Cash

and cash equivalents

Cash

and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions

and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Revenue

recognition

Financial

Accounting Standards Board, or FASB, issued ASC 606. The standard is a comprehensive new revenue recognition model that requires revenue

to be recognized in a manner to depict the transfer of goods or services to a customer at an amount that reflects the consideration expected

to be received in exchange for those goods or services.

Revenue

is measured at the fair value of the consideration received or receivable, net of discounts and taxes applicable to the revenue. The

Company derives its revenue from provision of wellness and beauty services to customers via Company owned outlets, franchised outlets

or distribution of our product to third party wellness and beauty salon.

Cost

of revenues

Cost

of revenue includes the cost of services and product incurred to provide wellness and beauty services and purchase of products.

Cash

and cash equivalents

Cash

and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions

and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Inventories

Inventories

consisting of products available for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the

first-in, first-out (FIFO) method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due

to slow-moving merchandise and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and

promotional environment. The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of

revenues in the Consolidated Statements of Operations and Comprehensive Loss.

Property,

plant and equipment

Property,

plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated

on the straight-line basis over the following expected useful lives from the date on which they become fully operational:

| Classification |

|

Estimated

useful life |

| Leasable

equipment |

|

5

years |

| Computer

hardware and software |

|

3

years |

| Office

equipment |

|

3

years |

| Outlet

design fee and equipment |

|

3

years |

| Application

development fee |

|

3

years |

Expenditures

for maintenance and repairs are expensed as incurred. The gain or loss on the disposal of property, plant and equipment is the difference

between the net sale proceeds and the carrying amount of the relevant assets and is recognized in the Consolidated Statements of Operations

and Comprehensive Loss.

Impairment

of long-live assets

Long-lived

assets primarily include trademark of the Company. In accordance with the provision of ASC Topic 360, Impairment or Disposal of Long-Lived

Assets, the Company generally conducts its annual impairment evaluation to its long-lived assets, usually in the fourth quarter of

each fiscal year, or more frequently if indicators of impairment exist, such as significant sustained change in the business climate.

The recoverability of long-lived assets is measured at the lowest level group. If the total of the expected undiscounted future net cash

flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount

of the asset.

Leases

The

Company recognizes lease payments for its short-term lease on a straight-line basis over the lease term in accordance with ASC 842.

The

right-of-use asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments

made at or before the lease commencement date, plus any initial direct costs incurred less any lease incentives received. Costs associated

with operating lease assets are recognized on a straight-line basis within operating expenses over the term of the lease.

In

determining the present value of the unpaid lease payments, ASC 842 requires a lessee to discount its unpaid lease payments using the

interest rate implicit in the lease or, if that rate cannot be readily determined, its incremental borrowing rate. As most of the Company

leases do not provide an implicit rate, the Company uses its incremental borrowing rate as the discount rate for the lease. The Company

incremental borrowing rate is estimated to approximate the interest rate on a collateralized basis with similar terms and payments.

Income

taxes

Income

taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”).

Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between

the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities

are measured using enacted income tax rates expected to apply to taxable income in the periods in which those temporary differences are

expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income

in the period that includes the enactment date.

ASC

740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements

uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the

financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax

positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of

being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The

Company conducts major businesses in China and is subject to tax in this jurisdiction. As a result of its business activities, the Company

will file tax returns that are subject to examination by the foreign tax authority.

Going

concern

The

accompanying financial statements have been prepared using the going concern basis of accounting, which contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business.

For

the year ended July 31, 2023, the Company has generated revenue of $146,252 and continuously incurred a net loss of $68,827. As of July

31, 2023, the Company suffered an accumulated deficit of $2,458,008, capital deficiency of $583,975 and negative operating cash flow

of $63,517. The Company’s ability to continue as a going concern is dependent upon improving the profitability and the continuing

financial support from its shareholders and director. Management believes the existing shareholders, director or external financing will